General information - Eureko Sigorta

General information - Eureko Sigorta

General information - Eureko Sigorta

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

2008 ANNUAL REPORT<br />

EUREKO S‹GORTA A.fi.<br />

Notes to the Financial Statements As at 31 December 2008<br />

(Currency: New Turkish Lira (TRY))<br />

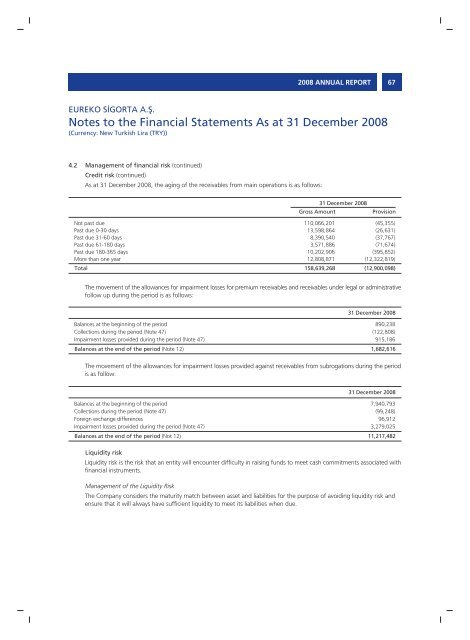

4.2 Management of financial risk (continued)<br />

Credit risk (continued)<br />

As at 31 December 2008, the aging of the receivables from main operations is as follows:<br />

Not past due<br />

Past due 0-30 days<br />

Past due 31-60 days<br />

Past due 61-180 days<br />

Past due 180-365 days<br />

More than one year<br />

Total<br />

31 December 2008<br />

The movement of the allowances for impairment losses for premium receivables and receivables under legal or administrative<br />

follow up during the period is as follows:<br />

Balances at the beginning of the period<br />

Collections during the period (Note 47)<br />

Impairment losses provided during the period (Note 47)<br />

Balances at the end of the period (Note 12)<br />

Gross Amount<br />

110,066,201<br />

13,598,864<br />

8,390,540<br />

3,571,886<br />

10,202,906<br />

12,808,871<br />

158,639,268<br />

The movement of the allowances for impairment losses provided against receivables from subrogations during the period<br />

is as follow:<br />

Balances at the beginning of the period<br />

Collections during the period (Note 47)<br />

Foreign exchange differences<br />

Impairment losses provided during the period (Note 47)<br />

Balances at the end of the period (Not 12)<br />

Liquidity risk<br />

Liquidity risk is the risk that an entity will encounter difficulty in raising funds to meet cash commitments associated with<br />

financial instruments.<br />

Management of the Liquidity Risk<br />

The Company considers the maturity match between asset and liabilities for the purpose of avoiding liquidity risk and<br />

ensure that it will always have sufficient liquidity to meet its liabilities when due.<br />

67<br />

Provision<br />

(45,355)<br />

(26,631)<br />

(37,767)<br />

(71,674)<br />

(395,852)<br />

(12,322,819)<br />

(12,900,098)<br />

31 December 2008<br />

890,238<br />

(122,808)<br />

915,186<br />

1,682,616<br />

31 December 2008<br />

7,940,793<br />

(99,248)<br />

96,912<br />

3,279,025<br />

11,217,482