General information - Eureko Sigorta

General information - Eureko Sigorta

General information - Eureko Sigorta

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

74 EUREKO S‹GORTA<br />

EUREKO S‹GORTA A.fi.<br />

Notes to the Financial Statements As at 31 December 2008<br />

(Currency: New Turkish Lira (TRY))<br />

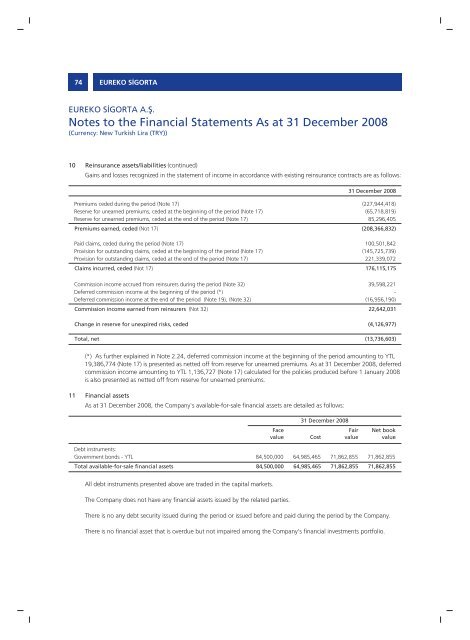

10 Reinsurance assets/liabilities (continued)<br />

Gains and losses recognized in the statement of income in accordance with existing reinsurance contracts are as follows:<br />

Premiums ceded during the period (Note 17)<br />

Reserve for unearned premiums, ceded at the beginning of the period (Note 17)<br />

Reserve for unearned premiums, ceded at the end of the period (Note 17)<br />

Premiums earned, ceded (Not 17)<br />

Paid claims, ceded during the period (Note 17)<br />

Provision for outstanding claims, ceded at the beginning of the period (Note 17)<br />

Provision for outstanding claims, ceded at the end of the period (Note 17)<br />

Claims incurred, ceded (Not 17)<br />

Commission income accrued from reinsurers during the period (Note 32)<br />

Deferred commission income at the beginning of the period (*)<br />

Deferred commission income at the end of the period (Note 19), (Note 32)<br />

Commission income earned from reinsurers (Not 32)<br />

Change in reserve for unexpired risks, ceded<br />

(*) As further explained in Note 2.24, deferred commission income at the beginning of the period amounting to YTL<br />

19,386,774 (Note 17) is presented as netted off from reserve for unearned premiums. As at 31 December 2008, deferred<br />

commission income amounting to YTL 1,136,727 (Note 17) calculated for the policies produced before 1 January 2008<br />

is also presented as netted off from reserve for unearned premiums.<br />

11 Financial assets<br />

As at 31 December 2008, the Company's available-for-sale financial assets are detailed as follows:<br />

All debt instruments presented above are traded in the capital markets.<br />

The Company does not have any financial assets issued by the related parties.<br />

31 December 2008<br />

(227,944,418)<br />

(65,718,819)<br />

85,296,405<br />

(208,366,832)<br />

100,501,842<br />

(145,725,739)<br />

221,339,072<br />

176,115,175<br />

39,598,221<br />

-<br />

(16,956,190)<br />

22,642,031<br />

(4,126,977)<br />

Total, net (13,736,603)<br />

Debt instruments:<br />

Government bonds - YTL<br />

Total available-for-sale financial assets<br />

Face<br />

value<br />

84,500,000<br />

84,500,000<br />

31 December 2008<br />

Fair<br />

Cost value<br />

64,985,465<br />

64,985,465<br />

71,862,855<br />

71,862,855<br />

There is no any debt security issued during the period or issued before and paid during the period by the Company.<br />

There is no financial asset that is overdue but not impaired among the Company's financial investments portfolio.<br />

Net book<br />

value<br />

71,862,855<br />

71,862,855