General information - Eureko Sigorta

General information - Eureko Sigorta

General information - Eureko Sigorta

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

88 EUREKO S‹GORTA<br />

EUREKO S‹GORTA A.fi.<br />

Notes to the Financial Statements As at 31 December 2008<br />

(Currency: New Turkish Lira (TRY))<br />

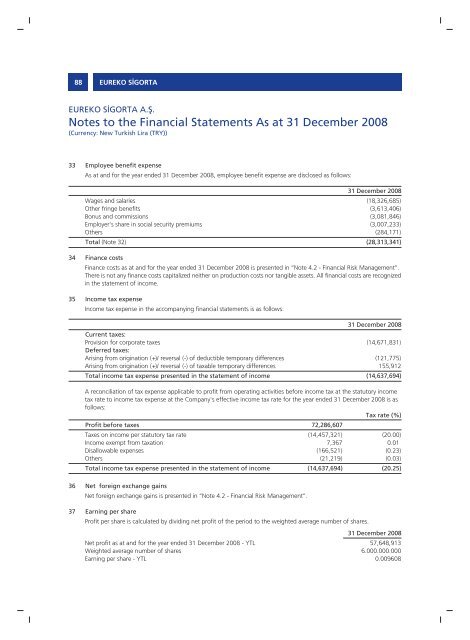

33 Employee benefit expense<br />

As at and for the year ended 31 December 2008, employee benefit expense are disclosed as follows:<br />

Wages and salaries<br />

31 December 2008<br />

(18,326,685)<br />

Other fringe benefits (3,613,406)<br />

Bonus and commissions (3,081,846)<br />

Employer's share in social security premiums (3,007,233)<br />

Others (284,171)<br />

Total (Note 32) (28,313,341)<br />

34 Finance costs<br />

Finance costs as at and for the year ended 31 December 2008 is presented in “Note 4.2 - Financial Risk Management”.<br />

There is not any finance costs capitalized neither on production costs nor tangible assets. All financial costs are recognized<br />

in the statement of income.<br />

35 Income tax expense<br />

Income tax expense in the accompanying financial statements is as follows:<br />

31 December 2008<br />

Current taxes:<br />

Provision for corporate taxes (14,671,831)<br />

Deferred taxes:<br />

Arising from origination (+)/ reversal (-) of deductible temporary differences (121,775)<br />

Arising from origination (+)/ reversal (-) of taxable temporary differences 155,912<br />

Total income tax expense presented in the statement of income (14,637,694)<br />

A reconciliation of tax expense applicable to profit from operating activities before income tax at the statutory income<br />

tax rate to income tax expense at the Company's effective income tax rate for the year ended 31 December 2008 is as<br />

follows:<br />

Tax rate (%)<br />

Profit before taxes 72,286,607<br />

Taxes on income per statutory tax rate (14,457,321) (20.00)<br />

Income exempt from taxation 7,367 0.01<br />

Disallowable expenses (166,521) (0.23)<br />

Others (21,219) (0.03)<br />

Total income tax expense presented in the statement of income (14,637,694) (20.25)<br />

36 Net foreign exchange gains<br />

Net foreign exchange gains is presented in “Note 4.2 - Financial Risk Management”.<br />

37 Earning per share<br />

Profit per share is calculated by dividing net profit of the period to the weighted average number of shares.<br />

Net profit as at and for the year ended 31 December 2008 - YTL<br />

31 December 2008<br />

57,648,913<br />

Weighted average number of shares 6.000.000.000<br />

Earning per share - YTL 0.009608