East and West Africa Cement Companies Report November 2011

East and West Africa Cement Companies Report November 2011

East and West Africa Cement Companies Report November 2011

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Lafarge WAPCO<br />

Reaping ‘first mover’ advantage benefits....<br />

Lafarge WAPCO (WAPCO), commissioned its 2.5mtpa<br />

Ewekoro II integrated cement plant in mid-September <strong>2011</strong>.<br />

The additional capacity brought the total to 4.5mtpa<br />

enabling the company to retain its second position behind<br />

DCP with a 15% share of installed capacity in Nigeria<br />

(including all the planned capacity additions by peers).<br />

Additionally, the plant is supported by a 90MW power plant<br />

which was commissioned in June <strong>2011</strong> <strong>and</strong> is expected to<br />

ensure production bottlenecks emanating from power<br />

outages are eliminated. WAPCO’s story going forward will<br />

be defined by how well it defends its turf in the face of<br />

stiffer competition as installed capacity races ahead of<br />

current consumption levels. We note the completion of its<br />

expansion program, especially ahead of the game changing<br />

DCP’s 12mtpa capacity addition. The company thus has a<br />

‘first mover’ opportunity to help consolidate its market<br />

share.<br />

� WAPCO made significant investments into its<br />

distribution channel, opening 19 new depots <strong>and</strong><br />

installing a hi-tech distribution system with the aim of<br />

improving efficiency in pushing its higher output<br />

volumes.<br />

� Additionally, transport logistics, which are a significant<br />

cost in Nigeria owing to poor road <strong>and</strong> rail networks,<br />

were boosted by a fleet of new trucks <strong>and</strong> a new<br />

business partnership with Nigeria Railway Corporation.<br />

� The company successfully raised NGN 11.8bn at a fixed<br />

interest rate of 11.5% under its NGN 50bn bond issuance<br />

programme. Management plans to apply the funds to<br />

retire its variable rate borrowings on the Ewekoro II<br />

expansion projects. We expect this to bring stability to<br />

earnings while providing cover to higher costs which are<br />

likely given inflationary pressures in Nigeria.<br />

� We value WAPCO at NGN 41.51 which largely indicates<br />

full valuation <strong>and</strong> accordingly downgrade our rating<br />

from buy to Hold.<br />

Millions<br />

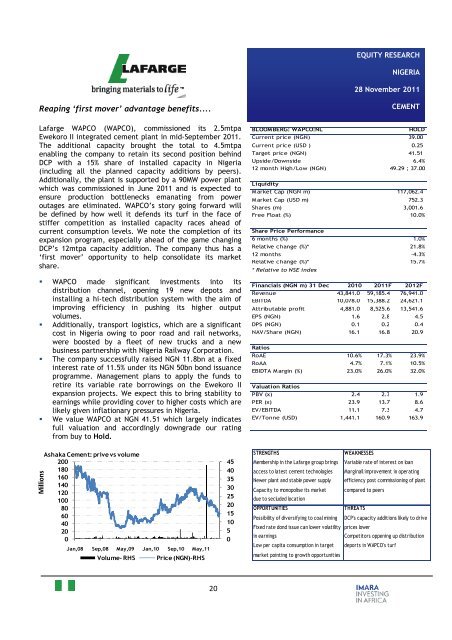

Ashaka <strong>Cement</strong>: prive vs volume<br />

200<br />

180<br />

160<br />

140<br />

120<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0<br />

Jan,08 Sep,08 May,09 Jan,10 Sep,10 May,11<br />

Volume- RHS Price (NGN)-RHS<br />

20<br />

45<br />

40<br />

35<br />

30<br />

25<br />

20<br />

15<br />

10<br />

5<br />

0<br />

STRENGTHS WEAKNESSES<br />

EQUITY RESEARCH<br />

NIGERIA<br />

28 <strong>November</strong> <strong>2011</strong><br />

CEMENT<br />

BLOOMBERG: WAPCO:NL HOLD<br />

Current price (NGN) 39.00<br />

Current price (USD ) 0.25<br />

Target price (NGN) 41.51<br />

Upside/Downside 6.4%<br />

12 month High/Low (NGN) 49.29 ; 37.00<br />

Liquidity<br />

M arket Cap (NGN m) 117,062.4<br />

M arket Cap (USD m) 752.3<br />

Shares (m) 3,001.6<br />

Free Float (%) 10.0%<br />

Share Price Performance<br />

6 months (%) 1.0%<br />

Relative change (%)* 21.8%<br />

12 months -4.3%<br />

Relative change (%)* 15.7%<br />

* Relative to NSE index<br />

Financials (NGN m) 31 Dec 2010 <strong>2011</strong>F 2012F<br />

Revenue 43,841.0<br />

EBITDA 10,078.0<br />

Attributable profit 4,881.0<br />

EPS (NGN) 1.6<br />

DPS (NGN) 0.1<br />

NAV/Share (NGN) 16.1<br />

Ratios<br />

Membership in the Lafarge group brings Variable rate of interest on loan<br />

access to latest cement technologies Marginall improvement in operating<br />

Newer plant <strong>and</strong> stable power supply efficiency post commissioning of plant<br />

Capacity to monopolise its market compared to peers<br />

due to secluded location<br />

OPPORTUNITIES THREATS<br />

Possibility of diversifying to coal mining DCP's capacity additions likely to drive<br />

Fixed rate dond issue can lower volatility prices lower<br />

in earnings Competitors oppening up distribution<br />

Low per capita consumption in target deports in WAPCO's turf<br />

market pointing to growth opportunities<br />

59,185.4<br />

15,388.2<br />

8,525.6<br />

2.8<br />

0.2<br />

16.8<br />

76,941.0<br />

24,621.1<br />

13,541.6<br />

4.5<br />

0.4<br />

20.9<br />

RoAE 10.6% 17.3% 23.9%<br />

RoAA 4.7% 7.1% 10.5%<br />

EBIDTA M argin (%) 23.0% 26.0% 32.0%<br />

Valuation Ratios<br />

PBV (x) 2.4<br />

PER (x) 23.9<br />

EV/EBITDA 11.1<br />

EV/Tonne (USD) 1,441.1<br />

2.3<br />

13.7<br />

7.3<br />

160.9<br />

1.9<br />

8.6<br />

4.7<br />

163.9