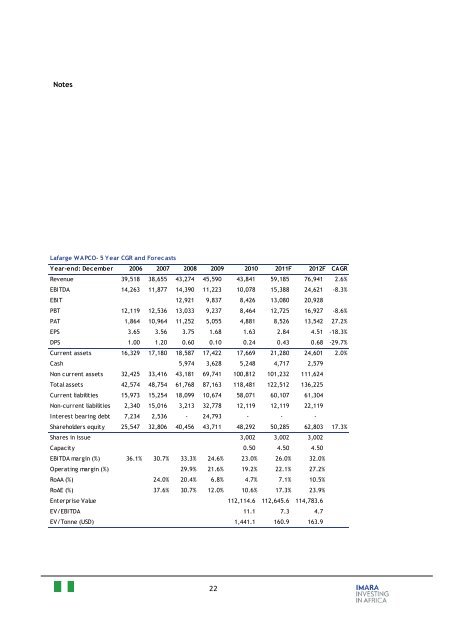

Notes Lafarge WAPCO- 5 Year CGR <strong>and</strong> Forec asts Year-end: December 2006 2007 2008 2009 2010 <strong>2011</strong>F 2012F CAGR Revenue 39,518 EBITDA 14,263 38,655 11,877 43,274 14,390 EBIT 12,921 PBT 12,119 PAT 1,864 EPS 3.65 DPS 1.00 Current assets 16,329 12,536 10,964 3.56 1.20 17,180 13,033 11,252 3.75 0.60 18,587 Cash 5,974 Non current assets 32,425 Total assets 42,574 Current liabilities 15,973 Non-current liabilities 2,340 Interest bearing debt 7,234 33,416 48,754 15,254 15,016 2,536 43,181 61,768 18,099 3,213 - 45,590 11,223 9,837 9,237 5,055 1.68 0.10 17,422 3,628 69,741 87,163 10,674 32,778 24,793 22 43,841 10,078 8,426 8,464 4,881 1.63 0.24 17,669 5,248 100,812 118,481 58,071 12,119 59,185 15,388 13,080 12,725 8,526 2.84 0.43 21,280 4,717 101,232 122,512 60,107 12,119 76,941 24,621 20,928 16,927 13,542 4.51 0.68 24,601 2,579 111,624 136,225 61,304 22,119 2.6% -8.3% -8.6% 27.2% -18.3% -29.7% Shareholders equity 25,547 32,806 40,456 43,711 48,292 50,285 62,803 17.3% Shares in issue 3,002 Capacity 0.50 - - 3,002 - 3,002 EBITDA margin (%) 36.1% 30.7% 33.3% 24.6% 23.0% 26.0% 32.0% Operating margin (%) 29.9% 21.6% 19.2% 22.1% 27.2% RoAA (%) 24.0% 20.4% 6.8% 4.7% 7.1% 10.5% RoAE (%) 37.6% 30.7% 12.0% 10.6% 17.3% 23.9% Enterprise Value 112,114.6 112,645.6 114,783.6 EV/EBITDA 11.1 7.3 4.7 EV/Tonne (USD) 1,441.1 160.9 163.9 4.50 4.50 2.0%

Athi River Banking on efficiency... ARM’s key attraction is the ongoing installation of an additional 1.5mtpa in cement capacity which is the largest expansion among its peers in Kenya. The company will sit on 2.5mtpa within the EAC by the end of 2012, 1.5mtpa of which will be from br<strong>and</strong> new equipment. Lafarge will still maintain pole position with its 3.3mtpa, but the age of its plant will give ARM a competitive advantage. Additionally DCP plans to set up new plants by 2015 with 1.5mtpa each in both Tanzania <strong>and</strong> Ethiopia which should be formidable competition to ARM’s new plant. We however expect that by that time, ARM would have consolidated its position in the market. � ARM is also planning to enter the South <strong>Africa</strong>n market. It is banking on its ability to create capacity cheaper than its peers, while production costs are forecast to be between 15% - 20% lower than the average SA cement plant. The company has achieved construction costs of USD 77/tonne in Kenya <strong>and</strong> USD 84/tonne in Tanzania compared to the USD 250/tonne world average. � A strategic decision to focus on cement <strong>and</strong> wean off noncement operations was taken in 2010, although this is yet to be implemented. Non-cement business contributes between 15% - 20% of total turnover <strong>and</strong> proceeds are largely in foreign currency. � The company has hard currency borrowings (USD 25m) which expose the business to exchange rate risk. However, unlike its peers, ARM has hard currency proceeds from the non-cement business to amortise the loan over time hence we do not expect the exchange losses to be crystallised. � Blending DCF <strong>and</strong> relative valuation methods, we arrive at a target price of KES 137.33 which is 19.0% lower than the current price <strong>and</strong> hence advises taking profits. Sell. Thous<strong>and</strong>s Athi River Mining: prive vs volume 12,000 10,000 8,000 6,000 4,000 2,000 0 Jan,08 Sep,08 May,09 Jan,10 Sep,10 May,11 Volume- RHS Price (KES)-RHS 23 250 200 150 100 50 0 EQUITY RESEARCH KENYA 28 <strong>November</strong> <strong>2011</strong> CEMENT BLOOMBERG: ARML:KN SELL Current price (KES) 169.45 Current price (US$) 1.77 Target price (KES) 137.33 Upside/Downside -19.0% 12 month High/Low (KES) 196.00 ;137.00 Liquidity Market Cap (KESm) 16,784.9 Market Cap (US$m) 174.9 Shares (m) 99.1 Free Float (%) 31.1% Share Price Performance 6 months (%) 1.2% Relative change (%)* 13.4% 12 months 2.4% Relative change (%)* 33.9% * Relative to NSE 20 FINANCIALS 2010 <strong>2011</strong>F 2012F Revenue 5,964.7 EBITDA 1,339.2 Attributable profit 792.0 EPS (KES) 8.1 DPS (KES) 1.3 NAV/Share (KES) 46.9 Ratios 8,313.8 1,836.4 598.4 6.0 3.5 52.4 11,473.0 2,579.5 1,582.8 16.0 4.1 80.9 RoAE 18.0% 12.2% 24.0% RoAA 5.6% 3.2% 7.0% EBIDTA M argin (%) 22.5% 22.1% 22.5% Valuation Ratios PBV (x) 3.6 PER (x) 21.0 EV/EBITDA 18.7 EV/Tonne (USD) 261.4 STRENGTHS WEAKNESSES 3.2 28.0 13.7 284.0 Ability to exp<strong>and</strong> capacity cheaply Debt brings volatility to earnings 2.1 10.6 9.7 109.3 Comparatively newer plants Management focus shrowded by non Deiversified portifolio of products cement operations Closer to two big markets it the EAC block OPPORTUNITIES THREATS Expectations of fast growth in Imports especially in Tanzania consumption Poor road infrastrusure can hamper Entarence into the SA market with exports from Tanzania cheaply manufactured cement