East and West Africa Cement Companies Report November 2011

East and West Africa Cement Companies Report November 2011

East and West Africa Cement Companies Report November 2011

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

� Secondly, cement prices in SSA, then ranging between USD 100 - USD 300 per tonne were clearly<br />

the highest the world over. While production costs are also relatively high, improvements in<br />

efficiencies will guarantee wider margins <strong>and</strong> as such cement manufacturers have been making<br />

huge capital investments to install newer <strong>and</strong> more efficient plants capable of unlocking cost<br />

savings <strong>and</strong> economies of scale benefits.<br />

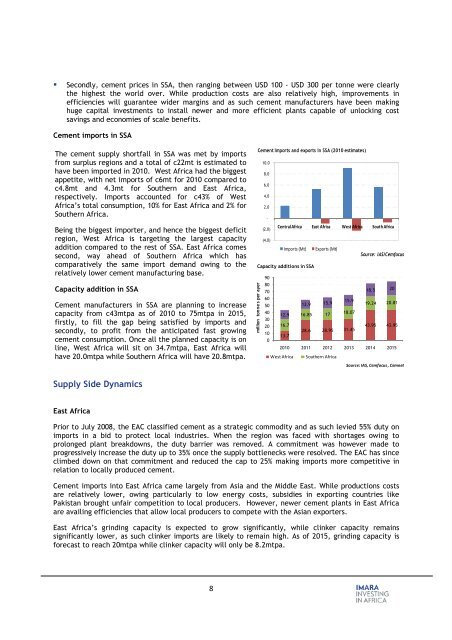

<strong>Cement</strong> imports in SSA<br />

The cement supply shortfall in SSA was met by imports<br />

from surplus regions <strong>and</strong> a total of c22mt is estimated to<br />

have been imported in 2010. <strong>West</strong> <strong>Africa</strong> had the biggest<br />

appetite, with net imports of c6mt for 2010 compared to<br />

c4.8mt <strong>and</strong> 4.3mt for Southern <strong>and</strong> <strong>East</strong> <strong>Africa</strong>,<br />

respectively. Imports accounted for c43% of <strong>West</strong><br />

<strong>Africa</strong>’s total consumption, 10% for <strong>East</strong> <strong>Africa</strong> <strong>and</strong> 2% for<br />

Southern <strong>Africa</strong>.<br />

Being the biggest importer, <strong>and</strong> hence the biggest deficit<br />

region, <strong>West</strong> <strong>Africa</strong> is targeting the largest capacity<br />

addition compared to the rest of SSA. <strong>East</strong> <strong>Africa</strong> comes<br />

second, way ahead of Southern <strong>Africa</strong> which has<br />

comparatively the same import dem<strong>and</strong> owing to the<br />

relatively lower cement manufacturing base.<br />

Capacity addition in SSA<br />

<strong>Cement</strong> manufacturers in SSA are planning to increase<br />

capacity from c43mtpa as of 2010 to 75mtpa in 2015,<br />

firstly, to fill the gap being satisfied by imports <strong>and</strong><br />

secondly, to profit from the anticipated fast growing<br />

cement consumption. Once all the planned capacity is on<br />

line, <strong>West</strong> <strong>Africa</strong> will sit on 34.7mtpa, <strong>East</strong> <strong>Africa</strong> will<br />

have 20.0mtpa while Southern <strong>Africa</strong> will have 20.8mtpa.<br />

Supply Side Dynamics<br />

<strong>East</strong> <strong>Africa</strong><br />

Prior to July 2008, the EAC classified cement as a strategic commodity <strong>and</strong> as such levied 55% duty on<br />

imports in a bid to protect local industries. When the region was faced with shortages owing to<br />

prolonged plant breakdowns, the duty barrier was removed. A commitment was however made to<br />

progressively increase the duty up to 35% once the supply bottlenecks were resolved. The EAC has since<br />

climbed down on that commitment <strong>and</strong> reduced the cap to 25% making imports more competitive in<br />

relation to locally produced cement.<br />

<strong>Cement</strong> imports into <strong>East</strong> <strong>Africa</strong> came largely from Asia <strong>and</strong> the Middle <strong>East</strong>. While productions costs<br />

are relatively lower, owing particularly to low energy costs, subsidies in exporting countries like<br />

Pakistan brought unfair competition to local producers. However, newer cement plants in <strong>East</strong> <strong>Africa</strong><br />

are availing efficiencies that allow local producers to compete with the Asian exporters.<br />

<strong>East</strong> <strong>Africa</strong>’s grinding capacity is expected to grow significantly, while clinker capacity remains<br />

significantly lower, as such clinker imports are likely to remain high. As of 2015, grinding capacity is<br />

forecast to reach 20mtpa while clinker capacity will only be 8.2mtpa.<br />

8<br />

million tonne s per ayer<br />

<strong>Cement</strong> Imports <strong>and</strong> exports in SSA (2010 estimates)<br />

10.0<br />

8.0<br />

6.0<br />

4.0<br />

2.0<br />

-<br />

(2.0)<br />

(4.0)<br />

Central <strong>Africa</strong> <strong>East</strong> <strong>Africa</strong> <strong>West</strong> <strong>Africa</strong> South <strong>Africa</strong><br />

Imports (Mt) Exports (Mt)<br />

Capacity additions in SSA<br />

90<br />

80<br />

70<br />

60<br />

50<br />

40<br />

30<br />

20<br />

10<br />

0<br />

12.9<br />

16.7<br />

13.7<br />

12.9<br />

15.9<br />

16.85 17<br />

15.9<br />

18.07<br />

28.6 28.95 31.45<br />

Source: IAS/Cemfocus<br />

18.5<br />

19.24<br />

20<br />

20.81<br />

43.95 43.95<br />

2010 <strong>2011</strong> 2012 2013 2014 2015<br />

<strong>West</strong> <strong>Africa</strong> Southern <strong>Africa</strong><br />

Source: IAS, Cemfocus , Cemnet