East and West Africa Cement Companies Report November 2011

East and West Africa Cement Companies Report November 2011

East and West Africa Cement Companies Report November 2011

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Bamburi <strong>Cement</strong><br />

Still controls a lion’s share of the Kenyan market …<br />

Bamburi is the largest cement company in Kenya as<br />

measured by market cap <strong>and</strong> controls 42% of the Kenyan<br />

cement market. The company’s key attraction lies in its<br />

hold on the inl<strong>and</strong> <strong>East</strong> <strong>Africa</strong> market. The Ug<strong>and</strong>a based<br />

Hima cement plant, with 0.85mtps cement capacity, is<br />

closer to important markets like the DRC. With competition<br />

heating up in Kenya <strong>and</strong> operating costs generally rising with<br />

the depreciation of the KES, the inl<strong>and</strong> markets are h<strong>and</strong>y<br />

due to their generally higher retail prices.<br />

� Bamburi beats competitors in profitability. The<br />

company’s RoAE <strong>and</strong> ROAA of 23.1% <strong>and</strong> 15.1% are both<br />

ahead of its Kenyan peers that average 15.5% <strong>and</strong> 11.8%,<br />

respectively, although lower than CCNN <strong>and</strong> DCP in<br />

Nigeria. Our expectations are that the company will<br />

exploit its lion’s share of the market to maintain<br />

profitability at these high levels.<br />

� Bamburi has a strong portfolio of br<strong>and</strong>s which are sold<br />

at a c5% premium to similar products from competitors,<br />

<strong>and</strong> management remains unmoved on maintaining the<br />

higher prices. With <strong>East</strong> <strong>Africa</strong> likely to see greater<br />

efficiencies <strong>and</strong> newer plants especially from DCP <strong>and</strong><br />

ARM, the company’s market share is at risk of shrinking<br />

further.<br />

� Hima <strong>Cement</strong> in Ug<strong>and</strong>a holds the key to volume growth<br />

for Bamburi in H2 11 <strong>and</strong> for 2012. However, planned<br />

capacity additions by competition in Rw<strong>and</strong>a <strong>and</strong><br />

Ug<strong>and</strong>a places profitability at risk. CIMERWA is<br />

increasing capacity 6x to 0.6mtpa, while Tororo <strong>Cement</strong><br />

of Ug<strong>and</strong>a, has since increased its capacity by more than<br />

double to 2.2mtpa. Bamburi’s <strong>East</strong> <strong>Africa</strong>n competitors<br />

have a habit of beating it on pricing <strong>and</strong> we expect the<br />

fight for inl<strong>and</strong> <strong>East</strong> <strong>Africa</strong> to take the same form <strong>and</strong><br />

hence cut margins.<br />

� Free cash flow generation remains strong <strong>and</strong> the<br />

company still controls the largest market share in<br />

Kenya. We value Bamburi at KES 194.18, pointing to<br />

14.6% upside, <strong>and</strong> hence reiterate our BUY call.<br />

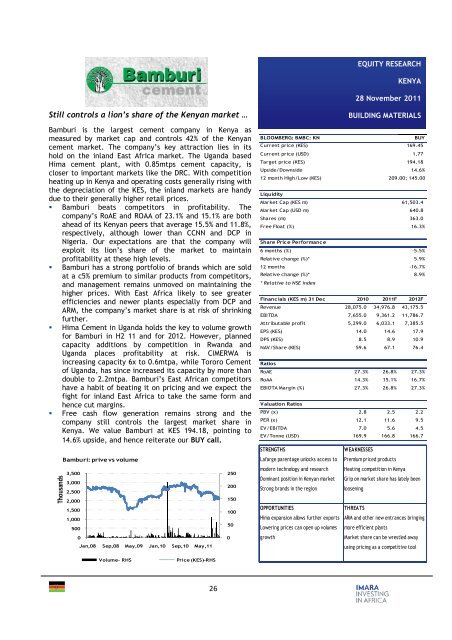

Thous<strong>and</strong>s<br />

Bamburi: prive vs volume<br />

3,500<br />

3,000<br />

2,500<br />

2,000<br />

1,500<br />

1,000<br />

500<br />

0<br />

Jan,08 Sep,08 May,09 Jan,10 Sep,10 May,11<br />

Volume- RHS Price (KES)-RHS<br />

26<br />

250<br />

200<br />

150<br />

100<br />

50<br />

0<br />

EQUITY RESEARCH<br />

KENYA<br />

28 <strong>November</strong> <strong>2011</strong><br />

BUILDING MATERIALS<br />

BLOOMBERG: BMBC: KN BUY<br />

Current price (KES) 169.45<br />

Current price (USD) 1.77<br />

Target price (KES) 194.18<br />

Upside/Downside 14.6%<br />

12 month High/Low (KES) 209.00; 145.00<br />

Liquidity<br />

Market Cap (KES m) 61,503.4<br />

Market Cap (USD m) 640.8<br />

Shares (m) 363.0<br />

Free Float (%) 16.3%<br />

Share Pric e Performanc e<br />

6 months (%) -5.5%<br />

Relative change (%)* 5.9%<br />

12 months -16.7%<br />

Relative change (%)* 8.9%<br />

* Relative to NSE index<br />

Financ ials (KES m) 31 Dec 2010 <strong>2011</strong>F 2012F<br />

Revenue 28,075.0<br />

EBITDA 7,655.0<br />

Attributable profit 5,299.0<br />

EPS (KES) 14.0<br />

DPS (KES) 8.5<br />

NAV/Share (KES) 59.6<br />

Ratios<br />

34,976.8<br />

9,361.2<br />

6,033.1<br />

14.6<br />

8.9<br />

67.1<br />

43,175.5<br />

11,786.7<br />

7,385.5<br />

17.9<br />

10.9<br />

76.4<br />

RoAE 27.3% 26.8% 27.3%<br />

RoAA 14.3% 15.1% 16.7%<br />

EBIDTA Margin (%) 27.3% 26.8% 27.3%<br />

Valuation Ratios<br />

PBV (x) 2.8<br />

PER (x) 12.1<br />

EV/EBITDA 7.0<br />

EV/Tonne (USD) 169.9<br />

STRENGTHS WEAKNESSES<br />

2.5<br />

11.6<br />

5.6<br />

166.8<br />

Lafarge parentage unlocks access to Premium priced products<br />

modern technology <strong>and</strong> research Heating competition in Kenya<br />

2.2<br />

9.5<br />

4.5<br />

166.7<br />

Dominant position in Kenyan market Grip on market share has lately been<br />

Strong br<strong>and</strong>s in the region loosening<br />

OPPORTUNITIES THREATS<br />

Hima expansion allows further exports ARM <strong>and</strong> other new entrances bringing<br />

Lowering prices can open up volumes more efficient plants<br />

growth Market share can be wrestled away<br />

using pricing as a competitive tool