stoxx index methodology guide (portfolio based indices) - STOXX.com

stoxx index methodology guide (portfolio based indices) - STOXX.com

stoxx index methodology guide (portfolio based indices) - STOXX.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

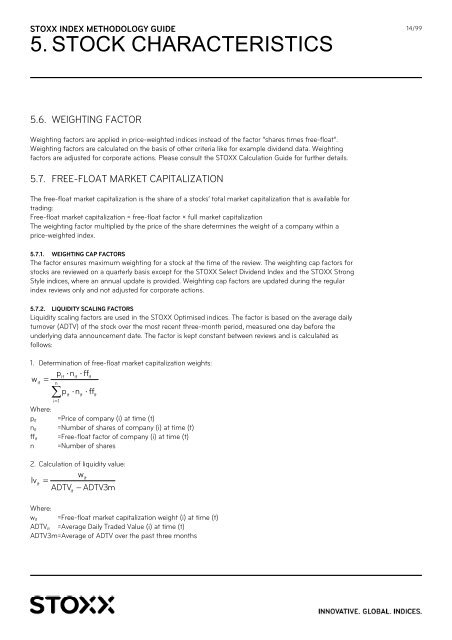

<strong>STOXX</strong> INDEX METHODOLOGY GUIDE<br />

5. STOCK CHARACTERISTICS<br />

5.6. WEIGHTING FACTOR<br />

Weighting factors are applied in price-weighted <strong>indices</strong> instead of the factor “shares times free-float”.<br />

Weighting factors are calculated on the basis of other criteria like for example dividend data. Weighting<br />

factors are adjusted for corporate actions. Please consult the <strong>STOXX</strong> Calculation Guide for further details.<br />

5.7. FREE-FLOAT MARKET CAPITALIZATION<br />

The free-float market capitalization is the share of a stocks’ total market capitalization that is available for<br />

trading:<br />

Free-float market capitalization = free-float factor × full market capitalization<br />

The weighting factor multiplied by the price of the share determines the weight of a <strong>com</strong>pany within a<br />

price-weighted <strong>index</strong>.<br />

5.7.1. WEIGHTING CAP FACTORS<br />

The factor ensures maximum weighting for a stock at the time of the review. The weighting cap factors for<br />

stocks are reviewed on a quarterly basis except for the <strong>STOXX</strong> Select Dividend Index and the <strong>STOXX</strong> Strong<br />

Style <strong>indices</strong>, where an annual update is provided. Weighting cap factors are updated during the regular<br />

<strong>index</strong> reviews only and not adjusted for corporate actions.<br />

5.7.2. LIQUIDITY SCALING FACTORS<br />

Liquidity scaling factors are used in the <strong>STOXX</strong> Optimised <strong>indices</strong>. The factor is <strong>based</strong> on the average daily<br />

turnover (ADTV) of the stock over the most recent three-month period, measured one day before the<br />

underlying data announcement date. The factor is kept constant between reviews and is calculated as<br />

follows:<br />

1. Determination of free-float market capitalization weights:<br />

w it<br />

pit<br />

�nit<br />

� ffit<br />

� n<br />

p �n<br />

� ff<br />

�<br />

i�1<br />

it<br />

it<br />

it<br />

Where:<br />

pit =Price of <strong>com</strong>pany (i) at time (t)<br />

nit =Number of shares of <strong>com</strong>pany (i) at time (t)<br />

ffit =Free-float factor of <strong>com</strong>pany (i) at time (t)<br />

n =Number of shares<br />

2. Calculation of liquidity value:<br />

lv<br />

it<br />

�<br />

ADTV<br />

it<br />

wit<br />

� ADTV3m<br />

Where:<br />

wit =Free-float market capitalization weight (i) at time (t)<br />

ADTVit =Average Daily Traded Value (i) at time (t)<br />

ADTV3m=Average of ADTV over the past three months<br />

14/99