stoxx index methodology guide (portfolio based indices) - STOXX.com

stoxx index methodology guide (portfolio based indices) - STOXX.com

stoxx index methodology guide (portfolio based indices) - STOXX.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

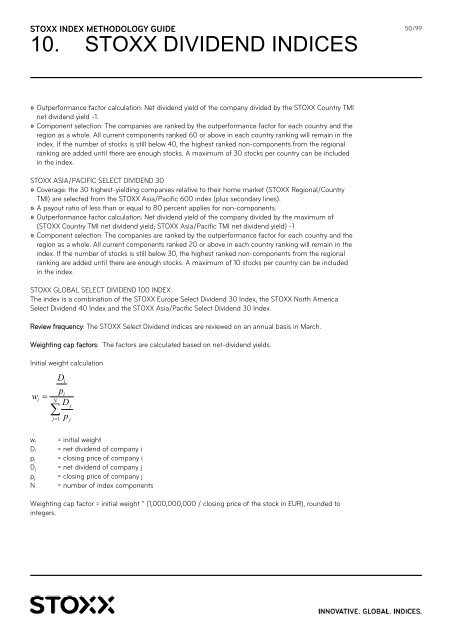

<strong>STOXX</strong> INDEX METHODOLOGY GUIDE<br />

10. <strong>STOXX</strong> DIVIDEND INDICES<br />

» Outperformance factor calculation: Net dividend yield of the <strong>com</strong>pany divided by the <strong>STOXX</strong> Country TMI<br />

net dividend yield -1.<br />

» Component selection: The <strong>com</strong>panies are ranked by the outperformance factor for each country and the<br />

region as a whole. All current <strong>com</strong>ponents ranked 60 or above in each country ranking will remain in the<br />

<strong>index</strong>. If the number of stocks is still below 40, the highest ranked non-<strong>com</strong>ponents from the regional<br />

ranking are added until there are enough stocks. A maximum of 30 stocks per country can be included<br />

in the <strong>index</strong>.<br />

<strong>STOXX</strong> ASIA/PACIFIC SELECT DIVIDEND 30<br />

» Coverage: the 30 highest-yielding <strong>com</strong>panies relative to their home market (<strong>STOXX</strong> Regional/Country<br />

TMI) are selected from the <strong>STOXX</strong> Asia/Pacific 600 <strong>index</strong> (plus secondary lines).<br />

» A payout ratio of less than or equal to 80 percent applies for non-<strong>com</strong>ponents.<br />

» Outperformance factor calculation: Net dividend yield of the <strong>com</strong>pany divided by the maximum of<br />

(<strong>STOXX</strong> Country TMI net dividend yield; <strong>STOXX</strong> Asia/Pacific TMI net dividend yield) -1<br />

» Component selection: The <strong>com</strong>panies are ranked by the outperformance factor for each country and the<br />

region as a whole. All current <strong>com</strong>ponents ranked 20 or above in each country ranking will remain in the<br />

<strong>index</strong>. If the number of stocks is still below 30, the highest ranked non-<strong>com</strong>ponents from the regional<br />

ranking are added until there are enough stocks. A maximum of 10 stocks per country can be included<br />

in the <strong>index</strong>.<br />

<strong>STOXX</strong> GLOBAL SELECT DIVIDEND 100 INDEX<br />

The <strong>index</strong> is a <strong>com</strong>bination of the <strong>STOXX</strong> Europe Select Dividend 30 Index, the <strong>STOXX</strong> North America<br />

Select Dividend 40 Index and the <strong>STOXX</strong> Asia/Pacific Select Dividend 30 Index.<br />

Review frequency: The <strong>STOXX</strong> Select Dividend <strong>indices</strong> are reviewed on an annual basis in March.<br />

Weighting cap factors: The factors are calculated <strong>based</strong> on net-dividend yields.<br />

Initial weight calculation<br />

w<br />

i<br />

Di<br />

p<br />

i � N D j<br />

�<br />

j�1 p j<br />

wi = initial weight<br />

Di = net dividend of <strong>com</strong>pany i<br />

pi = closing price of <strong>com</strong>pany i<br />

Dj = net dividend of <strong>com</strong>pany j<br />

pj = closing price of <strong>com</strong>pany j<br />

N = number of <strong>index</strong> <strong>com</strong>ponents<br />

Weighting cap factor = initial weight * (1,000,000,000 / closing price of the stock in EUR), rounded to<br />

integers.<br />

50/99