stoxx index methodology guide (portfolio based indices) - STOXX.com

stoxx index methodology guide (portfolio based indices) - STOXX.com

stoxx index methodology guide (portfolio based indices) - STOXX.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

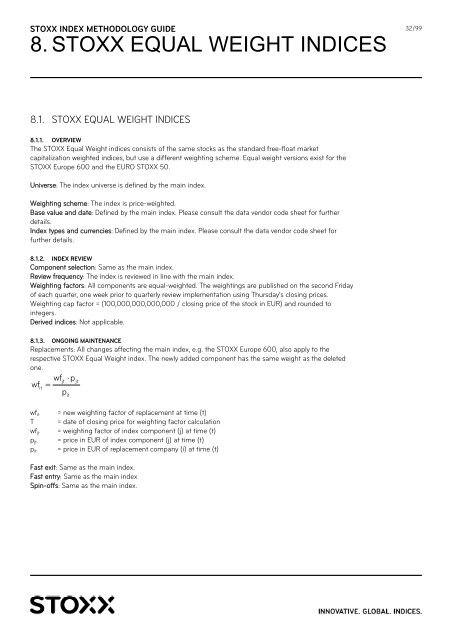

<strong>STOXX</strong> INDEX METHODOLOGY GUIDE<br />

8. <strong>STOXX</strong> EQUAL WEIGHT INDICES<br />

8.1. <strong>STOXX</strong> EQUAL WEIGHT INDICES<br />

8.1.1. OVERVIEW<br />

The <strong>STOXX</strong> Equal Weight <strong>indices</strong> consists of the same stocks as the standard free-float market<br />

capitalization weighted <strong>indices</strong>, but use a different weighting scheme. Equal weight versions exist for the<br />

<strong>STOXX</strong> Europe 600 and the EURO <strong>STOXX</strong> 50.<br />

Universe: The <strong>index</strong> universe is defined by the main <strong>index</strong>.<br />

Weighting scheme: The <strong>index</strong> is price-weighted.<br />

Base value and date: Defined by the main <strong>index</strong>. Please consult the data vendor code sheet for further<br />

details.<br />

Index types and currencies: Defined by the main <strong>index</strong>. Please consult the data vendor code sheet for<br />

further details.<br />

8.1.2. INDEX REVIEW<br />

Component selection: Same as the main <strong>index</strong>.<br />

Review frequency: The <strong>index</strong> is reviewed in line with the main <strong>index</strong>.<br />

Weighting factors: All <strong>com</strong>ponents are equal-weighted. The weightings are published on the second Friday<br />

of each quarter, one week prior to quarterly review implementation using Thursday’s closing prices.<br />

Weighting cap factor = (100,000,000,000,000 / closing price of the stock in EUR) and rounded to<br />

integers.<br />

Derived <strong>indices</strong>: Not applicable.<br />

8.1.3. ONGOING MAINTENANCE<br />

Replacements: All changes affecting the main <strong>index</strong>, e.g. the <strong>STOXX</strong> Europe 600, also apply to the<br />

respective <strong>STOXX</strong> Equal Weight <strong>index</strong>. The newly added <strong>com</strong>ponent has the same weight as the deleted<br />

one.<br />

wf<br />

it<br />

wfjt<br />

�p<br />

�<br />

p<br />

it<br />

jt<br />

wfit = new weighting factor of replacement at time (t)<br />

T = date of closing price for weighting factor calculation<br />

wfjt = weighting factor of <strong>index</strong> <strong>com</strong>ponent (j) at time (t)<br />

pjt = price in EUR of <strong>index</strong> <strong>com</strong>ponent (j) at time (t)<br />

= price in EUR of replacement <strong>com</strong>pany (i) at time (t)<br />

pit<br />

Fast exit: Same as the main <strong>index</strong>.<br />

Fast entry: Same as the main <strong>index</strong><br />

Spin-offs: Same as the main <strong>index</strong>.<br />

32/99