stoxx index methodology guide (portfolio based indices) - STOXX.com

stoxx index methodology guide (portfolio based indices) - STOXX.com

stoxx index methodology guide (portfolio based indices) - STOXX.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

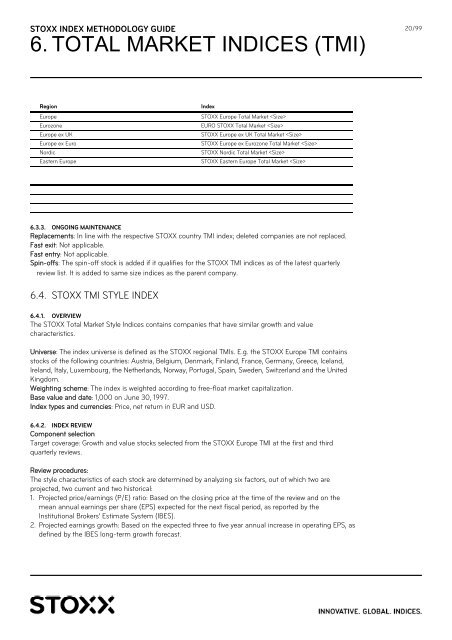

<strong>STOXX</strong> INDEX METHODOLOGY GUIDE<br />

6. TOTAL MARKET INDICES (TMI)<br />

Region Index<br />

Europe <strong>STOXX</strong> Europe Total Market <br />

Eurozone EURO <strong>STOXX</strong> Total Market <br />

Europe ex UK <strong>STOXX</strong> Europe ex UK Total Market <br />

Europe ex Euro <strong>STOXX</strong> Europe ex Eurozone Total Market <br />

Nordic <strong>STOXX</strong> Nordic Total Market <br />

Eastern Europe <strong>STOXX</strong> Eastern Europe Total Market <br />

6.3.3. ONGOING MAINTENANCE<br />

Replacements: In line with the respective <strong>STOXX</strong> country TMI <strong>index</strong>; deleted <strong>com</strong>panies are not replaced.<br />

Fast exit: Not applicable.<br />

Fast entry: Not applicable.<br />

Spin-offs: The spin-off stock is added if it qualifies for the <strong>STOXX</strong> TMI <strong>indices</strong> as of the latest quarterly<br />

review list. It is added to same size <strong>indices</strong> as the parent <strong>com</strong>pany.<br />

6.4. <strong>STOXX</strong> TMI STYLE INDEX<br />

6.4.1. OVERVIEW<br />

The <strong>STOXX</strong> Total Market Style Indices contains <strong>com</strong>panies that have similar growth and value<br />

characteristics.<br />

Universe: The <strong>index</strong> universe is defined as the <strong>STOXX</strong> regional TMIs. E.g. the <strong>STOXX</strong> Europe TMI contains<br />

stocks of the following countries: Austria, Belgium, Denmark, Finland, France, Germany, Greece, Iceland,<br />

Ireland, Italy, Luxembourg, the Netherlands, Norway, Portugal, Spain, Sweden, Switzerland and the United<br />

Kingdom.<br />

Weighting scheme: The <strong>index</strong> is weighted according to free-float market capitalization.<br />

Base value and date: 1,000 on June 30, 1997.<br />

Index types and currencies: Price, net return in EUR and USD.<br />

6.4.2. INDEX REVIEW<br />

Component selection<br />

Target coverage: Growth and value stocks selected from the <strong>STOXX</strong> Europe TMI at the first and third<br />

quarterly reviews.<br />

Review procedures:<br />

The style characteristics of each stock are determined by analyzing six factors, out of which two are<br />

projected, two current and two historical:<br />

1. Projected price/earnings (P/E) ratio: Based on the closing price at the time of the review and on the<br />

mean annual earnings per share (EPS) expected for the next fiscal period, as reported by the<br />

Institutional Brokers’ Estimate System (IBES).<br />

2. Projected earnings growth: Based on the expected three to five year annual increase in operating EPS, as<br />

defined by the IBES long-term growth forecast.<br />

20/99