germany - AHK - AHKs

germany - AHK - AHKs

germany - AHK - AHKs

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

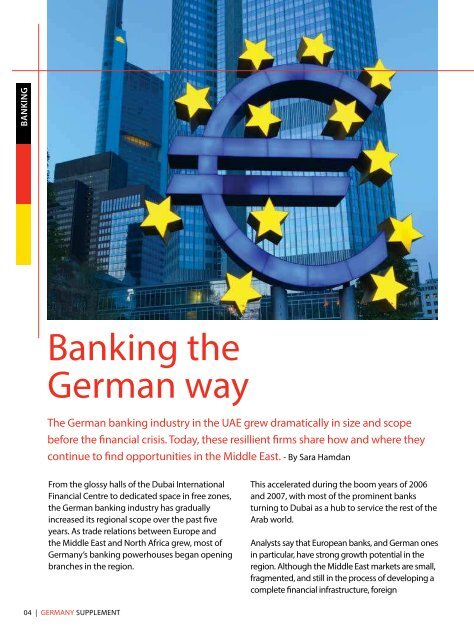

BANKING<br />

Banking the<br />

German way<br />

The German banking industry in the UAE grew dramatically in size and scope<br />

before the financial crisis. Today, these resillient firms share how and where they<br />

continue to find opportunities in the Middle East. - By Sara Hamdan<br />

From the glossy halls of the Dubai International<br />

Financial Centre to dedicated space in free zones,<br />

the German banking industry has gradually<br />

increased its regional scope over the past five<br />

years. As trade relations between Europe and<br />

the Middle East and North Africa grew, most of<br />

Germany’s banking powerhouses began opening<br />

branches in the region.<br />

This accelerated during the boom years of 2006<br />

and 2007, with most of the prominent banks<br />

turning to Dubai as a hub to service the rest of the<br />

Arab world.<br />

Analysts say that European banks, and German ones<br />

in particular, have strong growth potential in the<br />

region. Although the Middle East markets are small,<br />

fragmented, and still in the process of developing a<br />

complete financial infrastructure, foreign<br />

The Middle East has been<br />

developing significantly over<br />

the past few years and is now a<br />

key market for the international<br />

banking industry.<br />

- Micheal Cohrs, Head of Global<br />

Banking, Deutsche Bank<br />

institutions were intrigued by lucrative opportunities<br />

in frontier markets characterised by young<br />

populations, oil revenues and strong fundamentals.<br />

German banks that were among the first to open<br />

local branches, including Commerzbank and<br />

Deutsche Bank, showed that it was possible to<br />

provide the right services for local clients and<br />

navigate through financial difficulty during the<br />

crisis of 2008.<br />

Deutsche Bank, which has had an office in Dubai<br />

since 2001, opened another branch in the DIFC in<br />

2006 in order to take advantage of the growing<br />

opportunities in the region. The bank soon became<br />

a founding member of the DIFX, the free zone’s<br />

stock exchange, and was the first to list products<br />

when it launched in September 2005.<br />

“The Middle East has been developing significantly<br />

over the past few years and is now a key market for<br />

the international banking industry,” said Micheal<br />

Cohrs, head of global banking at Deutsche Bank.<br />

“This is an initial step in the bank’s growth plans.”<br />

Commerzbank, Germany’s second largest bank,<br />

opened its DIFC branch a year later in 2007.<br />

Commerzbank provides banking services for<br />

institutional investors in the Middle East, as well as<br />

asset management services through Cominvest, a<br />

wholly owned subsidiary.<br />

Aside from offering conventional banking services,<br />

Commerzbank also became the region’s first<br />

specialist in international banking for real estate.<br />

This catered uniquely to the local markets, as<br />

real estate investing has had a strong tradition,<br />

particularly in the Gulf region.<br />

“The addition of Commerzbank to the DIFC’s<br />

growing number of eminent financial institutions<br />

will help strengthen ties between this region<br />

and the markets of Europe,” said Nasser Al Shaali,<br />

the DIFC Authority’s chief executive at the time<br />

the bank opened. “Commerzbank is a respected<br />

and influential force in global banking, and its<br />

presence in the Middle East will significantly<br />

invigorate the sector here.”<br />

As these two institutions made headway in new<br />

territory, the German banking industry began to<br />

grow in size as other banks decided to expand their<br />

presence in the region. In 2008, Landesbank Baden-<br />

Württemberg, shipping giant HVB, and private<br />

bank Dresden Bank were among the prominent<br />

German banks to open branches in the UAE.<br />

Most of these institutions used Dubai and the<br />

DIFC as a hub from which to service the rest of the<br />

region. For Landesbank, the focus of the business<br />

was to provide consulting and financial services<br />

to German medium-sized businesses entering the<br />

regional markets, from Libya all the way to the<br />

Arabian Gulf. Iran and Pakistan are also serviced by<br />

the firm’s office in the DIFC.<br />

Investors are demanding an<br />

increasing exposure to MENA<br />

investments, but historically they<br />

have had little access to these<br />

opportunities.<br />

- Nazem Al Kudsi, CEO, ADIC<br />

04 | GERMANY SUPPLEMENT GERMANY SUPPLEMENT | 05<br />

“<br />

“<br />

“<br />

“