Solid Height - Spring Manufacturers Institute

Solid Height - Spring Manufacturers Institute

Solid Height - Spring Manufacturers Institute

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

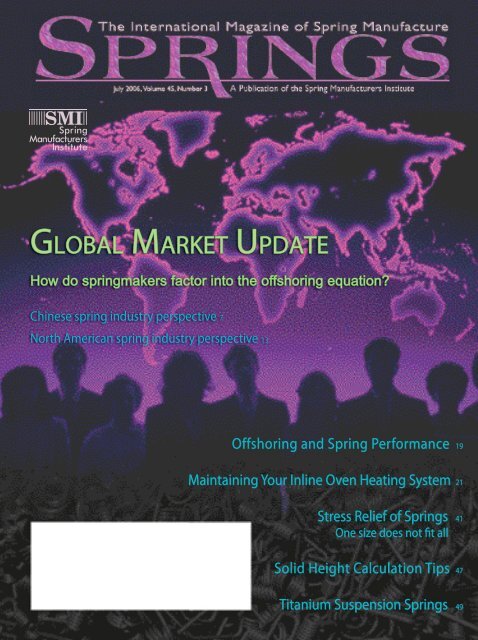

GLOBAL MARKET UPDATE<br />

How do springmakers factor factor into the offshoring equation?<br />

Chinese spring industry perspective 7<br />

North American spring industry perspective 13<br />

Offshoring and <strong>Spring</strong> Performance 19<br />

Maintaining Your Inline Oven Heating System 21<br />

Stress Relief of <strong>Spring</strong>s 41<br />

One size does not fi t all<br />

<strong>Solid</strong> <strong>Height</strong> Calculation Tips 47<br />

Titanium Suspension <strong>Spring</strong>s 49

We Must Capitalize on our Strengths to Meet<br />

Global Pressures<br />

O ffshore<br />

From Dave Weber<br />

“<br />

manufacturing,” “outsourcing” and “global economy”<br />

are all ways of describing the changing competitive<br />

landscape springmakers are facing each day. This has always been<br />

part of the competitive world in which we live, but as means of<br />

communication and logistic systems improve, the pressure from<br />

around the world becomes greater.<br />

As springmakers, we are affected more by what our customers<br />

do than by springmakers located offshore. In general,<br />

the cost of a spring going into a component is insignificant<br />

when compared with the cost of the final product. Many of our<br />

customers look to manufacturing their products where the cost<br />

of labor is low because there is a lot of labor required to manufacture the end product.<br />

Some customers have relocated to take advantage of cheap labor. Once in a new<br />

location, they seek local suppliers for items like springs. In the end, the North American<br />

suppliers lose the business – more because of location than price. In some way, the three<br />

laws of real estate, “location, location, location,” also apply to spring manufacturing.<br />

There is little we can do when our customers move offshore. However, there is an<br />

opportunity for North American springmakers when foreign companies set up operation<br />

here. We offer products that generally do not have high labor content, usually are made<br />

with world-class manufacturing and quality systems, and are inexpensive to get to the<br />

customer’s location. We also enjoy this competitive advantage with our existing customers.<br />

The other “hidden” advantage for North American spring manufacturers is that we<br />

can protect our customers from currency changes. In fact, we have seen some spring<br />

manufacturers from around the world build operations in North America to follow their<br />

customers and get some of our competitive advantages.<br />

As you can see, offshore manufacturing is not a simple case of cause and effect.<br />

North American spring manufacturers are challenged by location but protected by the<br />

low labor content of their products and the high cost of transporting springs here from<br />

other parts of the world. In general, the cost of material is the same worldwide. That<br />

means, for most North American spring manufacturers, proprietary process and valueadded<br />

service are the keys to competitiveness.<br />

Within the pages of this issue of <strong>Spring</strong>s magazine, you will see how some manufacturers<br />

have responded to the changing global marketplace. The information presented<br />

in this, as well as previous issues, is intended to help you compete in today’s world.<br />

SMI’s mission to inform, educate, and provide the opportunity to meet with other<br />

springmakers will make you stronger. I urge you to not only be a member, but also to<br />

participate in our activities as well as those at the regional level. Your membership and<br />

participation will make a difference in our industry.<br />

2 SPRINGS July 2006<br />

Dan Sebastian, MW Industries<br />

dsebastian@mw-ind.com<br />

<strong>Spring</strong>s Magazine Staff<br />

Rita Schauer Kaufman CAE, Editor<br />

editor@smihq.org<br />

Lynne Carr, Advertising Sales<br />

info@smihq.org<br />

Sandie Green, Assistant Editor<br />

Ken Boyce CAE, Publisher<br />

<strong>Spring</strong>s Magazine Committee<br />

Chair, Bob Herrmann, Newcomb<br />

<strong>Spring</strong> of Colorado<br />

Götz Arndt, Wafi os Machinery<br />

Terry Bartel Ph.D., Elgiloy<br />

Specialty Metals<br />

Carol Caldwell, Century <strong>Spring</strong><br />

Randy DeFord, Mid-West<br />

<strong>Spring</strong> & Stamping<br />

Ritchy Froehlich, Ace Wire<br />

<strong>Spring</strong> & Form<br />

Tressie Froehlich, Ace Wire<br />

<strong>Spring</strong> & Form<br />

LuAnn Lanke, Wisconsin Coil <strong>Spring</strong><br />

John Schneider, O’Hare <strong>Spring</strong><br />

Europe liaison, Richard Schuitema,<br />

Dutch <strong>Spring</strong> Association<br />

Technical Advisors<br />

Luke Zubek PE, SMI Technical Director<br />

Loren Godfrey, Colonial <strong>Spring</strong><br />

Advertising sales - Japan<br />

Ken Myohdai<br />

Sakura International Inc.<br />

22-11 Harimacho<br />

1-Chome, Abeno-ku<br />

Osaka 545-0022 Japan.<br />

Phone: +81-6-6624-3601<br />

Fax: +81-6-6624-3602<br />

E-mail: info@sakurain.co.jp<br />

Advertising sales - Europe<br />

Jennie Franks<br />

Franks & Co.<br />

P.O. Box 33 Moulton<br />

Newmarket, Suff olk,<br />

England CB88SH<br />

Phone: +44-1638-751132<br />

Fax: +44-1638-750933<br />

E-mail: franksco@BTopenworld.com<br />

Advertising sales - Taiwan<br />

Robert Yu<br />

Worldwide Services Co. Ltd.<br />

11F-B, No 540, Sec. 1, Wen Hsin Rd.<br />

Taichung, Taiwan<br />

Phone: +886-4-2325-1784<br />

Fax: +886-4-2325-2967<br />

E-mail: stuart@wwstaiwan.com<br />

<strong>Spring</strong>s (ISSN 0584-9667) is published quarterly<br />

by SMI Business Corp., a subsidiary of the<br />

<strong>Spring</strong> <strong>Manufacturers</strong> <strong>Institute</strong>: 2001 Midwest<br />

Road, Suite 106, Oak Brook, IL 60523; Phone:<br />

(630) 495-8588; Fax: (630) 495-8595; Web site<br />

www.smihq.org. Address all correspondence<br />

and editorial materials to this address.<br />

The editors and publishers of <strong>Spring</strong>s disclaim all<br />

warranties, express or implied, with respect to<br />

advertising and editorial content, and with respect<br />

to all manufacturing errors, defects or omissions<br />

made in connection with advertising or editorial<br />

material submitted for publication.<br />

The editors and publishers of <strong>Spring</strong>s disclaim<br />

all liability for special or consequential damages<br />

resulting from errors, defects or omissions in the<br />

manufacturing of this publication, any submission<br />

of advertising, editorial or other material for<br />

publication in <strong>Spring</strong>s shall constitute an agreement<br />

with and acceptance of such limited liability.<br />

The editors and publishers of <strong>Spring</strong>s assume no<br />

responsibility for the opinions or facts in signed<br />

articles, except to the extent of expressing the view,<br />

by the fact of publication, that the subject treated is<br />

one which merits attention.<br />

Do not reproduce without written permission.<br />

Cover designed by Rita Kaufman

7<br />

21<br />

37<br />

49<br />

4 SPRINGS July 2006<br />

FEATURES<br />

7 Global Market Update: Chinese <strong>Spring</strong> Industry Perspective<br />

Though some Chinese springmakers are investing in technology<br />

and quality, most are still focusing on low-end production<br />

By Maria Trombly, Source Media, Asia Bureau<br />

13 Global Market Update: North American <strong>Spring</strong> Industry Perspective<br />

<strong>Spring</strong>makers specializing, finding niche markets to<br />

capture business that’s difficult to move offshore<br />

By Raquel Chole, special contributor<br />

21 Preventive Maintenance Tips for Your Inline Conveyor Ovens<br />

Part I: The Heating System<br />

By Daniel Pierre III, JN Machinery Corp.<br />

37 Bankruptcy Reform From Both Sides<br />

How the new laws affect businesses that are owed money as well<br />

as those that file<br />

By Mark E. Battersby, tax/financial journalist<br />

49 Titanium Suspension <strong>Spring</strong>s for Production Motorcycles<br />

Less costly alloy brings titanium’s benefits to motocross rear<br />

suspension springs<br />

By Kurt Faller, Timet Automotive<br />

COLUMNS<br />

19 IST <strong>Spring</strong> Technology<br />

Cautionary Tales Part XXXI<br />

Offshoring and <strong>Spring</strong> Performance<br />

By Mark Hayes<br />

35 Be Aware: Safety Tips From Jim Wood<br />

OSHA Issues New Standard for Hexavalent Chromium<br />

41 Technically Speaking with Luke Zubek<br />

Stress Relief of <strong>Spring</strong>s<br />

One size does not fit all<br />

45 Checkpoint: Business Tips From Phil Perry<br />

Bird Flu Pandemic<br />

Protect your company from this and other potential disasters<br />

47 Spotlight on the Shop Floor<br />

<strong>Spring</strong> Essentials (for the rest of us) Part VIII<br />

<strong>Solid</strong> <strong>Height</strong> Calculation and ‘max’ <strong>Solid</strong> <strong>Height</strong><br />

By Randy DeFord, Mid-West <strong>Spring</strong> & Stamping<br />

DEPARTMENTS<br />

2 President’s Message: Capitalize on Strengths to Meet Global Pressures<br />

26 Global Highlights<br />

51 New Products:<br />

55 Advertisers’ Index<br />

55 Sprung<br />

56 Snapshot: Thomas G. Armstrong, Duer / Carolina Coil Inc.

T oday,<br />

Chinese <strong>Spring</strong> Industry Perspective<br />

Though some Chinese springmakers are investing in technology and<br />

quality, most are still focusing on low-end production<br />

most Chinese springmakers still lag<br />

behind their rivals from advanced countries<br />

in research, technology and management. Their<br />

most competitive products are mainly those with low<br />

added value. Meanwhile, rising raw material prices<br />

and transportation costs, together with increased<br />

competition, all contribute to compressing the profit<br />

margin of local players.<br />

High-Tech <strong>Spring</strong>making<br />

To sustain profitability, some of the more innovative<br />

local companies have begun to invest in research<br />

and new technology, and bring in modern management<br />

practices.<br />

For example, China <strong>Spring</strong> Factory, a subsidiary<br />

of the Shanghai Automotive Corporation Ltd., began<br />

as a private workshop in 1937 before becoming a<br />

state-owned enterprise in 1949, when the People’s<br />

Republic of China came into being. At the beginning,<br />

the firm produced small springs for mining,<br />

electronic and mechanical use. Its big-<br />

gest leap in technology and scale<br />

took place in 1989, when the<br />

Shanghai Automotive Co.<br />

launched its popular<br />

Santana car model and<br />

demand for springs skyrocketed.<br />

Today, China <strong>Spring</strong><br />

Factory has established<br />

long-term business relationships<br />

with almost all<br />

foreign automotive joint ventures<br />

in China, including GM, Chrysler, Volkswagen,<br />

Audi, Citroen and Renault. Its products<br />

now include automotive coil springs, engine valve<br />

springs, stabilizer bars, die springs, shaped springs,<br />

disc springs, various stampings and a wide range of<br />

precision wire springs.<br />

In addition, China <strong>Spring</strong> Factory has successfully<br />

entered overseas markets. “In 2004, we<br />

exported 400,000 units of springs. The volume<br />

catapulted to two million units in 2005. We expect<br />

even bigger growth in 2006,” says Eric Xie, company<br />

spokesperson. “Our overseas markets are mainly<br />

the U.S. and Europe, which make up one-third of<br />

our current sales.”<br />

Investment in quality and technology was crucial,<br />

Xie says. “Our progress is closely related to huge<br />

By Maria Trombly<br />

Source Media, Asia Bureau<br />

According to the<br />

China <strong>Spring</strong> Industry Association,<br />

there are over 1,100 mid-sized and larger<br />

springmakers in China. Among them, 13 are<br />

wholly foreign owned, and 60 are joint ventures.<br />

The latter, though less than seven percent of<br />

all spring manufacturers, accounted for<br />

one-fifth of total output.<br />

Global Market Update<br />

investments in R&D capability, staff training, quality<br />

control, and examination and testing facilities, with<br />

support from leading universities in China as well<br />

as foreign partners such as CHKK and Scherdel,”<br />

he says, referring to the Japanese Chuo <strong>Spring</strong> Co.<br />

and German springmaker Scherdel GmbH.<br />

However, price still remains a major competitive<br />

advantage, he adds, given that labor is much<br />

cheaper in China than elsewhere, and increasing<br />

sales volume helps to reduce per-unit production<br />

costs even further.<br />

The Price Factor<br />

Meanwhile, most auto parts manufacturers have<br />

not yet made research and development a top priority<br />

or have the ability to do so. A survey by the China<br />

Association of Automobile <strong>Manufacturers</strong> shows<br />

that, despite increasing investments<br />

in facilities, manufacturers spent<br />

less on research in 2004 than<br />

2003, only accounting for<br />

1.75 percent of sales in<br />

2004. The survey covered<br />

more than 750 auto parts<br />

manufacturers of large<br />

size in China. (The 2005<br />

results won’t be available<br />

for several more months.)<br />

As a result of slow investment<br />

in technology and other<br />

factors, many Chinese springmakers<br />

concentrate on the domestic market.<br />

ZheJiang Jinsheng <strong>Spring</strong> Co. Ltd, located in the<br />

southern Zhengjiang province, is a mid-sized private<br />

company specializing in manufacturing spiral,<br />

helical, square and rectangular springs. Its annual<br />

growth rate over the last two years was between 20<br />

percent and 30 percent, according to the company,<br />

but exports only accounted for 10 percent of total<br />

sales.<br />

Company sales manager Xingchao Huo says<br />

competition and shipping costs limit exports. Most<br />

springs produced still have low added value. Because<br />

of the high proportion of raw material costs, the<br />

profit margin is mainly generated from low labor<br />

costs. However, the low investment required for<br />

SPRINGS July 2006 7

Above: Photos of Zhengjiang Jinsheng <strong>Spring</strong><br />

Co.’s manufacturing operations.<br />

8 SPRINGS July 2006<br />

this kind of relatively low-tech production means<br />

more competition, which has sparked a price war.<br />

Furthermore, springs are bulky, so shipping adds<br />

a considerable cost.<br />

Storage also pushes prices up. Most automakers<br />

overseas now have just-in-time inventories, so<br />

the inventory costs actually shift to the suppliers,<br />

Huo says.<br />

By comparison, springmakers located close to<br />

their U.S. and European customers do not need<br />

to rent warehouse space in order to guarantee ontime<br />

delivery. Therefore, their prices can be more<br />

competitive, and they can provide more responsive<br />

and efficient service. Finally, project management<br />

requires close cooperation between both sides during<br />

the whole process, from design through finished<br />

products to after-sale service, which creates communication<br />

challenges for Chinese springmakers<br />

who deal with overseas projects, Huo says.<br />

Shrinking profit margin further hampers the<br />

pace of investment in research and development.<br />

Today, Chinese springmakers lack necessary funds<br />

to upgrade equipment and provide necessary training<br />

for staff, Huo concludes.<br />

The vicious price war makes the job of providing<br />

customers both high quality and low prices a challenge<br />

for springmkers.<br />

Industry Blossoms<br />

Despite these obstacles, the growth of the spring<br />

industry as a whole over the last five years has been<br />

significant. In coil springs, for example (according to<br />

data from the China Automotive Industry Yearbook,<br />

published jointly by the China Automotive Technology<br />

and Research Center and the China Association<br />

of Automobile <strong>Manufacturers</strong>), the output in 2000<br />

was 932,000 units. In 2004, the latest year for which<br />

figures are available, the number grew to 3,456,000<br />

units, an annual average increase of 38.8 percent.<br />

Steel plate spring output in 2000 was reported at<br />

4,694,700 units compared with 9,976,000 units<br />

in 2004, an annual average increase of 20.5 percent.<br />

For other types of springs, the total output in<br />

2000 was 102,600,000 units. The number tripled<br />

to 329,080,000 units in 2004, an annual average<br />

increase of 33.8 percent.<br />

Foreign Players<br />

As domestic Chinese springmakers grow with<br />

the economic boom, an increasing number of foreign<br />

companies has poured into the Chinese market<br />

over the last few years, offering serious competition<br />

to the local players. According to the China <strong>Spring</strong><br />

Industry Association, there are over 1,100 mid-sized<br />

and larger springmakers in China. Among them, 13<br />

are wholly foreign owned, and 60 are joint ventures.

The latter, though they are less than seven percent<br />

of all spring manufacturers, accounted for one-fifth<br />

of total output.<br />

One of these companies is Associated <strong>Spring</strong><br />

Raymond, a subsidiary of the Bristol, CT-based<br />

Barnes Group, which began moving into the Chinese<br />

market in 1986 through local agents and established<br />

a factory in Tianjing in 1999. This facility specializes<br />

in stock precision engineered components and<br />

die component products. In 2005, it realized sales<br />

worth US $10 million, compared with US $9 million<br />

in 2004. Of that, domestic sales accounted for 60<br />

percent; and overseas 40 percent, mainly to American<br />

and European markets. The annual average<br />

increase in sales was between 15 percent and 20<br />

percent, according to the company.<br />

“There are two main reasons for our investment<br />

in China,” says Andy He, marketing manager<br />

of Associated <strong>Spring</strong> Raymond China. “First, more<br />

and more of our clients based in the U.S. are moving<br />

into China, establishing new production bases<br />

here.” Having a production base in China helps the<br />

company better communicate with Chinese clients.<br />

“Second, China itself is a huge market.”<br />

“For example, when a client requires a sample,<br />

we can show them immediately,” he explains. “That<br />

would cost a lot of time if we had to send it from<br />

the U.S.” Apart from faster response to client needs,<br />

the company can also save time and money by not<br />

having to deal with customs declarations and clearances<br />

each time it ships product from the U.S.<br />

He says there was no significant challenge in<br />

setting up shop in China.<br />

“Next, we plan to focus on expanding production<br />

capacity,” he says. “We will open a new factory in<br />

Shanghai in the near future.”<br />

According to Ningwu Sheng, deputy secretarygeneral<br />

of the China Association of Automobile<br />

<strong>Manufacturers</strong>, foreign-invested manufacturers have<br />

an edge over their local competitors when it comes to<br />

technological superiority, and also enjoy preferential<br />

treatment from the Chinese government.<br />

By sourcing components and materials locally,<br />

foreign manufacturers can keep operating costs<br />

down and are better able to compete on price. In<br />

addition, with more and more major machine component<br />

suppliers moving to China, local springmakers<br />

as sub-suppliers can work more closely with their<br />

clients.<br />

For example, at the end of 2005, Volkswagen<br />

announced that it would continue to expand the<br />

scale of localization for engine assemblies, and other<br />

auto accessories and parts for its two joint ventures<br />

in China.<br />

“Regarding sourcing, it is part of Volkswagen’s<br />

strategy in China to further increase the local con-<br />

SPRINGS July 2006 9

tent of its products from today’s 65 percent, on<br />

average, to more than 80 percent,” says Volkswagen<br />

spokesman Kai Grueber. “Volkswagen and its joint<br />

ventures are cooperating with around 800 suppliers<br />

in China. The goal of the Volkswagen Group is to<br />

generate an annual turnover greater than US $1 billion<br />

with parts for its worldwide production network<br />

that will be sourced from China.”<br />

According to Xingye Zhang, honorary president<br />

of the Society of Automotive Engineers of China,<br />

most leading players in the auto industry worldwide<br />

10 SPRINGS July 2006<br />

are sourcing from China. “Generally speaking, they<br />

fall in three categories: The first category contains<br />

the ones that establish purchasing organizations in<br />

China, such as GM, Ford and Chrysler. The products<br />

purchased from China directly serve their headquarters.<br />

The second refers to those joint ventures such<br />

as Delphi. What they produce and purchase in<br />

China serves both domestic and overseas markets,<br />

including the U.S. The third group includes auto<br />

component import-export companies from overseas.<br />

The items mainly meet the needs of overseas OEM<br />

manufacturers and the after-sales<br />

markets.”<br />

For example, Bosch recently<br />

opened a new engineering center<br />

in Suzhou, near Shanghai. In a<br />

statement, Rudolf Colm, head of<br />

Asia Pacific operations for Bosch<br />

Group, says that the establishment<br />

of the center, together with expansion<br />

of automotive components<br />

production and localization, has<br />

strengthened its global research<br />

and development system. It will<br />

also assure fast response time to<br />

customers’ requests.<br />

Recently, Bosch announced<br />

that from 2005 to 2007, its total<br />

investment in China would amount<br />

to 650 million euros (roughly<br />

US $821 million). Until 2004,<br />

Bosch had invested 550 million<br />

euros (about US $695 million) in<br />

establishing and expanding business<br />

in China. Within just five<br />

years, Bosch doubled its number of<br />

factories in China from 10 to 20.<br />

Bosch is not alone. Delphi,<br />

for example, has established a<br />

research center, a training center<br />

and 15 companies in China. Its<br />

total investment in China has<br />

exceeded US $500 million. According<br />

to Shanghai-based Timeroute<br />

Automobile Consulting, more<br />

than 70 percent of top Global 100<br />

component suppliers have set<br />

up shop in China. The number<br />

of foreign and joint venture auto<br />

parts manufacturers has reached<br />

nearly 1,200. In terms of market<br />

share, exclusively foreign-owned<br />

companies and joint ventures of<br />

transnational enterprises hold<br />

more than 50 percent of the Chinese<br />

OEM market at present. Of

that number, the top 10 transnational components<br />

suppliers, such as Delphi and Bosch, hold 10-15<br />

percent of market share. The Chinese top 10 component<br />

manufacturers in sales, by comparison,<br />

together account for less than 11 percent of the<br />

domestic market, Timeroute reports.<br />

Growing Pains<br />

However, the sharp rise in investments has a<br />

downside. Recently, Kai Ma, Minister of the National<br />

Development and Reform commission, told the official<br />

Xinhua news agency that there was a serious<br />

problem of overcapacity in 11 fields of industry,<br />

including automotive. He added that steel prices<br />

have even at times dropped below production costs,<br />

and auto industry capacity has outgrown demand<br />

by two million units.<br />

Xiaohua Qiu, Deputy Commissioner of the<br />

National Bureau of Statistics, said on Chinese TV<br />

that the basic reason for overproduction was limited<br />

to Chinese buying power. China’s rapid development<br />

in the past years largely relied on foreign investment<br />

instead of domestic market needs. When those<br />

investments resulted in over capacity, there was not<br />

enough local demand. Despite increasing annual<br />

investment growth, the growth rate of domestic<br />

consumption has been leveling off in recent years,<br />

he said.<br />

Meanwhile, in addition to new foreign competitors<br />

and inadequate local demand, Chinese<br />

springmakers have to overcome their technology<br />

problems. For example, China still lags the West in<br />

metallurgy.<br />

“Many raw materials must be imported from<br />

overseas,” says George Zhu, sourcing team manager<br />

of Valeo Asia Purchasing Office. “As a result, there<br />

are no price advantages when exporting to European<br />

and American markets.” Valeo is a U.S.-based auto<br />

parts supplier.<br />

Currently, Valeo’s purchases in China only<br />

account for around three percent of its global<br />

volume. <strong>Spring</strong>s account for about five percent of<br />

Valeo’s China purchases. “We hope to increase the<br />

quantity, but there are difficulties,” says Zhu. “The<br />

improvements needed are how to reduce related<br />

costs to enable the prices to be more competitive.<br />

Generally speaking, it does not work very well.”<br />

According to Richard Anderson, a partner in<br />

Hangzhou EAR Information Technology Inc., a training<br />

consultancy based in Hangzhou, China, many<br />

Chinese manufacturers have still not learned to<br />

adjust material composition through heat treating<br />

and other metallurgical techniques. “Some of the<br />

large spring, stamping and forging industries have<br />

begun to modernize their equipment but have not<br />

done much modernization in training. Most of the<br />

small and mid-sized enterprises have done little to<br />

modernize either their technology or training. Consequently,<br />

they don’t understand the meaning of<br />

making quality,” says Anderson. He was previously<br />

employed by Associated <strong>Spring</strong> in Plymouth and<br />

Ann Arbor, MI.<br />

Another disadvantage of Chinese springmakers<br />

is their limited design ability. “Today, Chinese<br />

springmakers still mainly produce products according<br />

to the blueprints provided by the clients, instead<br />

of designing the blueprint according to the requirements<br />

of clients,” says Andy He of Associated <strong>Spring</strong><br />

Raymond China. “As a result, the clients may have<br />

a lot of choices and advantages over the negotiation<br />

of prices.<br />

TRW Automotive is one of the many auto parts<br />

manufacturers that turn to joint ventures because<br />

of quality concerns. “Generally we evaluate a supplier<br />

in three aspects: quality and management,<br />

prices, and services,” says William Wang, TRW’s<br />

Asia Pacific strategic sourcing commodity manager.<br />

“Local springmakers have advantages with prices<br />

but are not so adequate in other aspects.”<br />

TRW now has more than 10 joint ventures in<br />

China. Its list of spring purchases includes torsion<br />

SPRINGS July 2006 11

springs, extension springs, compression springs<br />

and many other automotive springs. However, the<br />

present purchase quantity is insignificant, only<br />

accounting for less than three percent of total purchase<br />

volume, Wang says.<br />

The Upside<br />

Meanwhile, globalization and competition not<br />

only bring challenges but also growth opportunities<br />

to Chinese springmakers. Xingchao Huo, sales<br />

12 SPRINGS July 2006<br />

manager of Jinshen <strong>Spring</strong>, says that the technical<br />

knowledge gained from clients has significantly<br />

improved their technology development.<br />

China <strong>Spring</strong> Factory also reports that manufacturers’<br />

moves to China have helped increase<br />

the market; introduce more advanced technology,<br />

including design, development and production; and<br />

improve management practices.<br />

In addition, Chinese springmakers can enter<br />

an overseas market rapidly through the existing<br />

marketing channels of their jointventure<br />

foreign partners, says<br />

Xingye Zhang of the Society of<br />

Automotive Engineers of China.<br />

Some of that growth is already<br />

here.<br />

According to the National<br />

Bureau of Statistics, in 2005,<br />

investment in the transportation<br />

equipment manufacturing industry,<br />

and the electrical machinery<br />

and equipment manufacturing<br />

industry rose 51.1 percent and<br />

44.9 percent respectively, compared<br />

with the same time last year.<br />

This is almost double the overall<br />

fixed-asset investment increase of<br />

27.2 percent.<br />

If the industry continues to<br />

grow faster than the rest of the<br />

Chinese economy, which is already<br />

expanding faster than anyplace<br />

else in the world, then many of<br />

the problems currently faced will<br />

be remembered as nothing more<br />

than growing pains.<br />

Maria Trombly has been the<br />

Shanghai Bureau Chief for Securities<br />

Industry News since early<br />

2004. She regularly writes about<br />

Asian finance, technology and<br />

manufacturing. Her 15-plus years<br />

in journalism have taken her all<br />

over Asia, and to Central Asia,<br />

Russia and Eastern Europe.<br />

Daisy Huang contributed to this<br />

article. She is a Chinese freelance<br />

writer based in Shanghai, China.<br />

She has previously worked with<br />

Trombly on stories about Radio<br />

Frequency Identification (RFID)<br />

technology and about Shanghai’s<br />

automotive industry. v

S tatistics<br />

North American <strong>Spring</strong><br />

Industry Perspective<br />

<strong>Spring</strong>makers specializing, finding niche markets to<br />

capture business that’s difficult to move to low-cost countries<br />

on exactly how many springs enter<br />

North America from low-cost countries (LCCs)<br />

are difficult to come by. To begin with, springs<br />

are lumped into categories with other metal formed<br />

products, and the metal formed products category<br />

is quite broad. To compound that, springs are being<br />

exported as part of assemblies. While an exact dollar<br />

figure to cover the impact of business lost to LCCs<br />

is difficult to pinpoint, there is hardly a manufacturer<br />

in North America who has not been touched<br />

by offshore manufacturing.<br />

In the beginning of the offshore manufacturing<br />

trend, North American metal formers were able to rely<br />

on their ability to produce higher quality products<br />

than were available from LCCs. What springmaker<br />

has not savored the story of a manufacturer who<br />

moved business to Asia but had to bring it home<br />

due to quality and delivery issues? As time has<br />

marched on, though, expertise in metal<br />

forming has grown exponentially in<br />

these countries, primarily due to<br />

foreign investment and support.<br />

Sourcing metal formed products<br />

overseas, which was at<br />

one time simply a trend, has<br />

become business as usual for<br />

major manufacturers across<br />

North America. Moreover, at this<br />

stage, most of it is not coming home<br />

due to a lack of quality, though there may<br />

be other reasons to bring it home, as we will explore<br />

in this article.<br />

Many manufacturers in low-cost Asian countries<br />

have stepped up to the plate, in terms of developing<br />

the resources they need to compete on a global basis.<br />

Bit by bit, they have chipped away at every level<br />

of the business so that many are now world-class<br />

suppliers of metal products from the idea stages to<br />

the finished products. No longer are U.S. and Canadian<br />

engineers always required for the design stages.<br />

LCCs have impressive talent pools to work through<br />

engineering issues. Tooling can be done quite competently<br />

overseas. State-of-the-art manufacturing is<br />

available in Asian countries. Lead times for shipping<br />

are more reliable. It’s all here – or, rather, there.<br />

The result is that we are on the way to a fairly<br />

level playing field except for two issues: labor and<br />

fuel costs. North American labor is high, but ship-<br />

“Asian manufacturers<br />

are making solid<br />

inroads in the springmaking business.<br />

India is there. Malaysia is there.<br />

China is making progress...”<br />

~ Bill Dagoe, Chamberlain<br />

<strong>Spring</strong><br />

By Raquel Chole<br />

Special Contributor<br />

Global Market Update<br />

ping from Asia is increasing in price daily, as the<br />

cost of fuel continues to rise. The labor issue may<br />

ultimately be the LCCs’ Achilles heel, though. As<br />

the labor force in LCCs grows accustomed to steady<br />

income, the hunger for a better life comes with it,<br />

which, will lead to higher wages and result in higher<br />

manufacturing costs for LCC production. That has<br />

become the light at the end of the tunnel for North<br />

American springmakers and manufacturers in<br />

general.<br />

In China today, the markets for automatic washing<br />

machines, refrigerators and automobiles are<br />

fairly exploding now that Chinese workers have the<br />

disposable income that comes with steady employment.<br />

Higher wages and some level of employment<br />

benefits (holidays, vacation days, insur-<br />

ance, etc.) will also be required to<br />

satisfy workers’ needs. This will<br />

drive manufacturing costs<br />

higher and narrow the gap<br />

between North American wages<br />

and Asian wages.<br />

How long before major<br />

manufacturers come back to<br />

North America? No one can say<br />

for certain; however, leaders in our<br />

industry are now more hopeful than<br />

ever before. There are two reasons for this more<br />

positive attitude: First, the cost of doing business in<br />

LCCs is ever rising due to increasing labor and fuel<br />

costs. Second, because surviving North American<br />

springmakers are finding niche markets to capture<br />

business that is more difficult to move for one reason<br />

or another.<br />

Chamberlain <strong>Spring</strong><br />

Richmond, British Columbia, Canada<br />

Chamberlain <strong>Spring</strong> Ltd. makes hot- and<br />

cold-wound springs for automotive OEMs and the<br />

aftermarket. Chamberlain neutralizes the shipping<br />

issue by including fully prepaid shipping and brokerage<br />

as part of quotes on springs that will ship<br />

within North America.<br />

Bill Dagoe, springs group general sales manager,<br />

says Asian manufacturers are making solid<br />

SPRINGS July 2006 13

inroads in the springmaking business. India is there.<br />

Malaysia is there. China is making progress, but is<br />

not quite at the level of other Asian countries yet.<br />

Dagoe has a high level of confidence that Chinese<br />

manufacturers will be able to master springmaking<br />

eventually.<br />

“I haven’t been impressed with the quality from<br />

China,” he says, “but I, like everyone, own lots of<br />

Chinese-made goods of very high quality, so I expect<br />

them to get there in springmaking soon.” He predicts<br />

that the Chinese will find a niche market in custom<br />

aftermarket coil springs for import cars, especially<br />

in “coil-over” applications.<br />

Dagoe sees the cost of transportation and the<br />

price of raw materials as the leveling factors. “If<br />

anything, the cost of manufacturing a spring is<br />

borne in three ways, he says. “First, there is the<br />

cost of raw materials. Then, there is the labor input.<br />

Finally, you have transportation. Our steel cost is the<br />

same here as it is in Asia. Long-distance shipping<br />

is expensive. In the final analysis, the labor input is<br />

the key factor, but that is offset to some degree by<br />

the cost of shipping.”<br />

Dagoe feels the Canadian government is fairly<br />

well on track and that the administration has<br />

14 SPRINGS July 2006<br />

assisted Canadian manufacturers to compete on a<br />

global level. “They are making international commerce<br />

possible, which matters to me because I ship<br />

all over the world,” he says. “I’d like to see them<br />

lower taxes, of course, but our taxes really are on<br />

par with the rest of the world, so I don’t really have<br />

much of an issue there.”<br />

Renton Coil <strong>Spring</strong><br />

Renton, WA<br />

Chuck Pepka, SMI past president<br />

and president of Renton Coil<br />

<strong>Spring</strong>, feels strongly about offshoring<br />

issues.<br />

Pepka looks to the core beliefs<br />

of SMI for future direction: “The<br />

SMI charter is to foster growth in North American<br />

spring companies. We will need to find even more<br />

ways to do this to combat offshoring.” He says SMI<br />

and other North American manufacturing organizations<br />

can lead the way by using North American<br />

vendors for association products and services.<br />

Furthermore, by lobbying and organizing<br />

member involvement with Congress, associations<br />

can pressure the government to equalize the balance

of trade. “I’m not against trade, as long as the rules<br />

are fair for all sides,” he says. “Right now we’re at a<br />

disadvantage because of tariffs and restrictions that<br />

prevent companies from being involved offshore.”<br />

Pepka feels the cost of capital is a major issue,<br />

and this is where the U.S. and Canadian governments<br />

could be of significant help to manufacturers.<br />

“If the government was really concerned, they would<br />

help us to control the cost of capital and narrow the<br />

gap between the borrowing power of Asian companies<br />

and that of North American companies,” he<br />

explains. “Then we’d be better able to invest in stateof-the-art<br />

equipment.”<br />

In the 1990s, SMI did a study on the cost of<br />

doing business in the U.S. vs. Japan and vs. Europe.<br />

“We found that the U.S. had the lowest cost at that<br />

time,” says Pepka. “We also discovered that access<br />

to capital was one key to successful business in<br />

Japan; it was four to five points lower than in North<br />

America. It costs much more to borrow money here,<br />

which gives them a bit of an edge.”<br />

“Companies that are going to succeed in the future<br />

need to purchase equipment that raises the amount<br />

of sales per employee, as a metric,” explains Pepka.<br />

“We need to buy equipment that can be retooled easily<br />

and is autonomous, rather than having 50 people<br />

with hand tools working in a finishing department,<br />

as the Asians do right now. In the future, they will<br />

adopt technology as it becomes cheaper. Therefore,<br />

we need to be able to stay a step ahead.”<br />

“We’ve been exporting for 20 to 25 years, so the<br />

international marketplace is not a big deal to us,”<br />

says Pepka. “There is one aspect of international<br />

trade that is significant for all manufacturers,<br />

though: The cost of fuel affects everyone in about<br />

the same way. The Japanese, however, have been<br />

doing this [exporting] for so many years that they are<br />

very good at it and have big tonnage relationships<br />

with shippers. Some projects have scale to them,<br />

so the shipping relationships become a key factor.<br />

Here is where small, North American-based companies<br />

have an issue; it’s hard for them to compete<br />

against this.”<br />

Pepka sees a value to overseas manufacturing<br />

of springs in certain areas. “If I were on the low-tech<br />

side of the industry, competing just on dollars, I’d<br />

be looking overseas,” he says. “You have to be aware<br />

that everything is not going to be at the same level<br />

of quality you’d get here, though. There are a lot<br />

of high-level people in big companies who thought<br />

going cheap was the right way, but they may not have<br />

been correct. The quality of materials is not as good<br />

in China, and the flow of materials is slower.”<br />

These issues would be significant in the market<br />

Pepka serves. “I service the aircraft industry in 12 different<br />

countries. We represent a limited marketplace<br />

in a high-tech industry and have to be committed to<br />

high quality to be able to do that,” he explains.<br />

“For all products, including springs, people are<br />

willing to pay more money at some quality level,” he<br />

continues. “The products that have high perceived<br />

value will be successful in the international market.<br />

When a North American springmaker competes in<br />

the international market, our perceived value advantage<br />

is that we can respond to requests for prototypes<br />

quickly. If you are quoting 30 weeks lead-time, as the<br />

Asian manufacturers do, you are probably not going<br />

to get the business; however, if you can turn around<br />

prototypes fast, you can succeed in this climate.<br />

North American springmakers have the resources<br />

and expertise to do this. Once you service the prototype<br />

needs, it is logical for the buyer to keep the<br />

business with you for production.”<br />

“North American springmakers with the agility<br />

to do things quickly will be able to make money,” he<br />

continues. “If someone wants 100k springs, you will<br />

have to be able to say you can deliver in a month,<br />

and that helps level the playing field because you<br />

can get the products to the customer faster than if<br />

that customer went offshore.”<br />

Pepka sees the U.S. government market as an<br />

asset to manufacturers. “If you sell to our govern-<br />

SPRINGS July 2006 15

ment, that’s a huge market, and government buyers<br />

are invoking the Buy American clause more often<br />

than they did in the past, so you can do well,” he<br />

says. The Buy American initiative has been around<br />

for a long time, but it was not enforced heavily. “It<br />

is being enforced now,” says Pepka, emphatically.<br />

“There are Buy American regulations for export and<br />

import controls, especially related to components that<br />

go into weapons.” These include the Defense Federal<br />

Acquisition Regulation Supplement (DFARS).<br />

“I think there will continue to be a spring industry<br />

in the U.S. China will have to deal with inflationary<br />

costs that are substantial, and everything will<br />

even out in 10-15 years,” he predicts. “Nevertheless,<br />

offshoring will continue. It’s a marketplace where<br />

buyers will often go to the lowest cost producer,<br />

regardless of where in the world they are.”<br />

Pepka posits, on the macro scale, that is it time<br />

for the owner of a spring company to decide which<br />

markets he wants to be in. “Here is how I would put<br />

it,” says Pepka, “Do you want to run an $8 million<br />

company that has a good profit level or a $10 million<br />

company that breaks even? You can’t always make<br />

up profit in volume. Sometimes, you have to ask<br />

yourself if it’s time to fire a few customers.”<br />

16 SPRINGS July 2006<br />

Pepka says springmakers must determine where<br />

they want to position themselves. “For example,” he<br />

says, “if you are in the oil patch business, you have to<br />

maintain high quality and timeliness, and still have to<br />

be agile. If you are in the aviation parts business, you<br />

have to maintain certifications and keep improving<br />

the shop floor. How successful you can be has a lot<br />

to do with what market niche you choose.”<br />

Dudek & Bock <strong>Spring</strong> Manufacturing Co.<br />

Chicago, IL<br />

Matt Puz, vice<br />

president of sales and<br />

marketing, has been<br />

to China to explore<br />

partnership options<br />

on behalf of Dudek<br />

& Bock. He says the<br />

offshoring trend will<br />

definitely continue and<br />

that investigation of the<br />

Asian market is a natural<br />

course of business in<br />

this climate. Dudek & Bock currently has plants in<br />

Chicago, IL; Detroit, MI; and Mexico.

“The lure of cheap labor and other cost drivers<br />

will continue, no doubt, because of the need of<br />

large users of our product types to further explore<br />

and pursue offshoring to low-cost country sources<br />

where appropriate,” says Puz. “However, sitting here<br />

in 2006, I think we’re all a little wiser about what is<br />

involved in sourcing products in general, and springs<br />

specifically, overseas, especially in China.”<br />

“The things that we all knew could very realistically<br />

go wrong, somehow inevitably seemed to<br />

do so: unannounced material changes, production<br />

pre-runs not complying dimensionally with original<br />

sample submissions, logistical snafus and the like,”<br />

continues Puz.<br />

“Also, the sheer number of springmakers in<br />

low-cost countries – particularly in China – makes<br />

it difficult to distinguish between those that are<br />

truly capable of consistently, effectively supplying<br />

U.S.-based production lines and those that are not,”<br />

he adds.<br />

Puz also addresses the ”save money at all<br />

costs” attitude of OEMs that prevailed in the early<br />

2000s. He sees the pendulum swinging the other<br />

way regarding some aspects of the business. For<br />

example, the large OEMs now realize that they<br />

cannot compromise their new product launches<br />

by depending entirely on LCCs for support. “These<br />

companies are now counting heavily on innovative<br />

launches as a means of breaking their products out<br />

of what some call the ‘commodity syndrome,’ ” says<br />

Puz. “In short, as large OEMs seem to be increasingly<br />

choosing to wage their own competitive wars<br />

on the front of differentiated new products [vs. price<br />

points alone as key drivers], we view this as both a<br />

challenge and opportunity to provide valued designbased<br />

input.”<br />

Puz is secure in the knowledge that springmakers<br />

are the best engineers for designing<br />

products that include springs. “As springmakers,<br />

we can provide very targeted information, specific to<br />

the function of our products in their applications.<br />

This, combined with full service, product launchrelated<br />

support, forms the basis of our new value<br />

proposition that may have been somewhat undervalued<br />

during the ‘save money at all costs’ era that<br />

plagued our industry during the dark years of the<br />

early 2000s,” he says. “This is where North American<br />

springmakers have a clear advantage over the<br />

LCC competition.”<br />

“Is overseas sourcing still a looming threat?” he<br />

asks. “Sure, you bet. But in our view, the criteria<br />

by which value is assessed in 2006 fortunately<br />

provides a more favorable landscape for the battles<br />

we’re now fighting. We now see that these battles<br />

are winnable.”<br />

SAIC USA Inc.<br />

Detroit, MI<br />

Tom Shen is the chief North<br />

American representative for SAIC<br />

USA Inc. His perspective is a bit<br />

different because he is selling<br />

Chinese-manufactured springs<br />

to U.S. companies. Though he<br />

agrees that there are some leveling factors between<br />

U.S. and Chinese springmakers, he pinpoints the<br />

issue we all know well: The labor cost in China is<br />

cheaper than it is in the U.S.<br />

“Surprisingly, 30 to 40 percent of the spring<br />

companies in China are actually owned by foreigners<br />

or are joint ventures,” he says. “These foreign<br />

investments have an inherent advantage over the<br />

locally owned companies that make up the balance<br />

of the spring companies in China for one reason:<br />

The joint ventures and foreign-owned companies are<br />

more able to invest in state-of-the-art equipment.<br />

That eliminates the technology barrier to doing business<br />

with China.”<br />

“In China, the technology and the equipment are<br />

at the same level as in the U.S.,” insists Shen. “The<br />

only real difference is that the labor cost is cheaper<br />

than in the U.S. In fact, Chinese labor costs are low<br />

SPRINGS July 2006 17

enough to offset the transportation costs of shipping<br />

from China.”<br />

“Right now,” says Shen, “I am working for the<br />

Big Three to introduce Chinese suspension spring<br />

manufacturers to them. Locally, I just do some<br />

warehousing and coordination.”<br />

According to Shen, the key issue is to find the<br />

right people to coordinate for both sides. “I personally<br />

think there are opportunities for cooperation<br />

between North American springmakers and Chinese<br />

springmakers,” he says. “This is especially important<br />

for quality issues.”<br />

Based on his experience, Shen says there is a<br />

typical way that North American springmakers go<br />

about sourcing in low-cost countries that leaves<br />

them open to potential problems. “I see American<br />

companies try to work out sourcing in China independently.<br />

In the beginning, all is good with the<br />

PPAPs, etc. The customer is satisfied. However, as<br />

the months go on, shipments become later, physical<br />

dimensions of the parts change, and so on,” he says.<br />

“Over there, they are not always so serious about<br />

the quality side of the business.”<br />

“In my case,” he continues, “I send my quality<br />

people to plants in China to check the quality. This<br />

avoids wasting transportation costs and losing time.<br />

18 SPRINGS July 2006<br />

I believe that if American companies were to source<br />

in this way, they could eliminate the problems of<br />

sourcing in Asia all together.”<br />

Many North American springmakers are seeing a<br />

light at the end of the tunnel concerning the exodus<br />

of their business to low cost countries for a number<br />

of reasons: They have found innovative ways to capture<br />

new markets and to take advantage of LCC<br />

manufacturing themselves. Like Renton <strong>Spring</strong>,<br />

they have ferreted out the markets that can’t go<br />

to LCCs due to sensitivity of the product or safety<br />

issues or national security issues. Like Dudek &<br />

Bock, they are exploring the issues with eyes wide<br />

open and finding how they can fit into the mix by,<br />

in some cases, opening plants in LCCs, including<br />

Mexico. And, like Chamberlain <strong>Spring</strong>, they are offering<br />

value-added services to keep North American<br />

manufacturing in North America.<br />

Raquel Chole is the sales and marketing manager<br />

for Dudek & Bock <strong>Spring</strong> Mfg . in Chicago, IL. In addition<br />

she is a special contributor to <strong>Spring</strong>s.<br />

Previously, she was a freelance writer for 15<br />

years, operating Ryan Publishing Service. Readers<br />

may contact her by phone at (630) 662-8611. v

Cautionary Tales XXXI<br />

Offshoring and <strong>Spring</strong> Performance<br />

By Mark Hayes<br />

The British perspective on offshoring is bound<br />

to be rather different from that in the U.S. For<br />

a start, the term “offshoring” is not yet frequently<br />

used in the UK, where people might take it to mean<br />

that you are involved in the North Sea oil and gas<br />

industry (but since our oil and gas resources are<br />

diminishing, this is clearly not the industry of the<br />

future). Hence, it is reasonable to assume that the<br />

word means, “manufacturing goods<br />

offshore (mainly in China, India<br />

and Far Eastern countries with<br />

low labor costs).”<br />

Increasingly, IST<br />

receives springs for<br />

investigation that were<br />

manufactured in China or<br />

India. A few of the springs<br />

made in India are destined<br />

for export to Europe or the<br />

U.S., but the springs from China<br />

are always parts of assemblies<br />

made in China. Naturally, IST has to keep details<br />

of all these investigations confidential, but there are<br />

some trends emerging that are reasonable to relate<br />

in this Cautionary Tale.<br />

First and foremost, IST’s customers are very<br />

suspicious of the quality of the raw materials used<br />

when springs made offshore do not function as they<br />

should. These suspicions are mostly ill-founded. The<br />

Mark Hayes is the Senior Metallurgist<br />

at the <strong>Institute</strong> of <strong>Spring</strong> Technology (IST)<br />

in Sheffield, England. Hayes manages IST’s<br />

spring failure analysis service, and all metallurgical<br />

aspects of advice given by the<br />

<strong>Institute</strong>. He also gives the majority of<br />

the spring training courses that IST offers<br />

globally.<br />

Readers are encouraged to contact<br />

him with comments about this Cautionary<br />

Tale, and with suggested subjects for future Tales, by phone at<br />

(011) 44 114 252 7984 (direct dial), fax at (011) 44 114 2527997 or<br />

e-mail at m.hayes@ist.org.uk.<br />

<strong>Spring</strong><br />

Technology<br />

surface quality of the spring materials available in<br />

both India and China is improving and nearly always<br />

meets international standards (particularly U.S.<br />

standards, which are generally the least stringent<br />

in the world, but that is another tale). The most<br />

frequently encountered problem with materials is a<br />

lack of understanding exactly what is required. For<br />

example, it took me several e-mails to explain to<br />

a Chinese manufacturer what prestressing<br />

was. In another case,<br />

austempering was specified<br />

and innumerable e-mails<br />

never achieved an understanding,<br />

so the parts<br />

are now accepted in the<br />

hardened-and-tempered<br />

condition.<br />

Explaining to Chinese<br />

manufacturers that their<br />

interpretation of the drawing<br />

requirements is not correct is a<br />

difficult task. There are language, cultural and<br />

technical barriers to overcome, which can be very<br />

frustrating. Nevertheless, the spring industry’s customers<br />

will continue to relocate the manufacture of<br />

goods or assemblies when volumes are high and the<br />

manufacture or assembly is labor intensive. Global<br />

market forces will out.<br />

IST’s response to the threat to spring manufacturing<br />

from offshore competition is to promote<br />

research to advance spring technology. Stress analysis<br />

methods are the area in which most progress can<br />

be made, in our opinion. If finite element analysis,<br />

use of high-speed cameras, residual stress analysis<br />

and other methods can be made more readily<br />

accessible to spring manufacturers, they will have a<br />

basis to design and manufacture leaner and meaner<br />

products that offshore manufacturers will not be<br />

able to match. IST is leading a consortium of European<br />

companies and is in the last stages of trying to<br />

secure a contract from the European Commission<br />

for research into these areas.<br />

SPRINGS July 2006 19

Back to the subject<br />

Relative Costs of Manufacture<br />

of the problem proved to<br />

of offshoring: Recently<br />

in Selected Countries<br />

be the way the spring fit<br />

for the first time, IST<br />

received stainless<br />

Labor Raw Materials<br />

on mating components,<br />

which weren’t being<br />

springs in an assembly<br />

made in China that<br />

worked better than<br />

China<br />

India<br />

5<br />

6<br />

1<br />

1<br />

machined consistently<br />

enough.<br />

It is certain that IST<br />

those made in Europe; USA 100 1<br />

will see more examples<br />

they lasted twice as<br />

long in a fatigue life<br />

Germany 100 1<br />

of offshore manufacturing<br />

challenges in months<br />

test. The reason for<br />

this proved to be the<br />

passivation process<br />

Japan<br />

UK<br />

100<br />

85<br />

1<br />

1<br />

to come. Globalization is<br />

here to stay, and it will<br />

only make sense to man-<br />

applied, as a matter of Poland 16 1<br />

ufacture some products<br />

course, in China.<br />

in low-labor-cost coun-<br />

The more usual<br />

tries. The table to the left<br />

story, though, is that springs made offshore do not showing the ratio of labor costs to material costs for<br />

work as well as those made in Europe. In one case,<br />

springs made in India passed their relaxation test<br />

various countries illustrates this point.<br />

in India (only just), but failed at the end user (mar- The time when manufacturing ceases to be<br />

ginally) because they had grown in transit after hot transferred is difficult to predict, but you can be<br />

prestressing.<br />

certain that China and India’s capacity to absorb<br />

In another case, Chinese assemblies sometimes more manufacturing has not yet been reached. Even<br />

failed a test while European-made ones always when it has, there are plenty of other countries in<br />

passed. The zinc-plated compression spring was the Far East and Africa able and willing to offer their<br />

suspected to be the reason, but the actual cause labor forces. v<br />

20 SPRINGS July 2006

Preventive Maintenance Tips for<br />

Your Inline Conveyor Ovens<br />

Part I: The Heating System<br />

By Daniel Pierre III, JN Machinery Corp.<br />

F<br />

undamentally, an inline conveyor oven is nothing<br />

more than four sections: a heating system, an<br />

insulated box, a conveyor mechanism and a control<br />

panel. This article will focus on preventive maintenance<br />

of the heating system. The other oven sections<br />

will be discussed in future issues.<br />

Each oven maker assembles the four sections in<br />

different ways, and this is what differentiates one<br />

oven from another. There also are differences in<br />

the quality and quantity of parts. Some ovens have<br />

specialized functions or added tooling. Finally, the<br />

methods used for assembling an oven will greatly<br />

affect the cost and ease of maintenance.<br />

<strong>Spring</strong> manufacturers use various makes and<br />

models of ovens in their plants for a number of<br />

reasons: price and availability, presence of special<br />

functions, reliability of the oven and its supplier, as<br />

well as the ease of maintenance. These are probably<br />

the top reasons for selecting a particular model.<br />

However, once you have purchased and used<br />

your inline oven for a few years, how do you know<br />

if it is still giving you the same performance as it<br />

did when new?<br />

The good news is that a quality oven can last for<br />

20 or more years if well maintained and not abused<br />

too much. However, the very operation of an inline<br />

oven subjects it to stress, and good old wear and tear.<br />

It has to withstand changing from room temperature<br />

up to 900°F and back to room temperature numerous<br />

times. As parts go through an oven, smoke, oily<br />

mists and other small particles become airborne,<br />

often becoming trapped inside the heat chamber. No<br />

matter how gentle you are with an inline oven, there<br />

are some parts that simply will wear out over time.<br />

Proper maintenance is by far the best way to<br />

protect your investment in this kind of equipment.<br />

Also, the more you understand what is going on<br />

inside an oven, the more you will begin to see that<br />

periodic downtime is really necessary to ensure a<br />

long useful life of the machine. Moreover, you can<br />

actually boost performance by following some of the<br />

tips and suggestions offered in this article.<br />

Heating Elements<br />

Let me start by explaining the heating system.<br />

First and foremost, the heat source is usually electric<br />

heating elements. Heating elements basically do<br />

just two things: “go on” and “go off.” Nevertheless, a<br />

heating element has a limited useful life. The length<br />

of time you can use an element depends on its quality,<br />

of course; the number of times it goes on and<br />

off; and, to a lesser extent, its operating temperature<br />

range. (A fourth factor – the way electricity is supplied<br />

to the element – will be discussed in the article<br />

focusing on the control panel). In the course of one<br />

shift, or even one production run, heating elements<br />

will go on and off hundreds of times. Components<br />

in the control panel will determine how often they<br />

go on or off in order to get the chamber to a certain<br />

temperature.<br />

In a small furnace with three to six elements, if<br />

one element burns out, you can usually notice an<br />

immediate drop in performance, since 17 to 33 percent<br />

of the heating power is suddenly gone. In large<br />

furnaces, there can be 60, 72 or even 90 elements<br />

inside. If one element burns out in a large furnace,<br />

you may or may not immediately notice a change<br />

in performance. For this reason, in large ovens, it<br />

is imperative to check the elements individually on<br />

a regular basis.<br />

There are several methods for checking an element,<br />

but the easiest is to take an ohmmeter and<br />

test for continuity. If an element is burned out, you<br />

will get a “nonsense” reading on the meter. (On our<br />

meter, the numbers flash “1.000”). With a good<br />

element, you will get a certain, steady resistance<br />

reading. The photo below shows how each end of an<br />

element is touched to test for continuity. Note: You<br />

do not have to remove an element to perform this<br />

test. However, you do have to remove any wires or<br />

jumpers from the ends to make sure you are testing<br />

only one element at a time.<br />

An ohmmeter is touched to each end of a heating element to<br />

test for continuity.<br />

SPRINGS July 2006 21

A standoff, such as these two types, is used to safely and<br />

easily change an element by directly connecting the new<br />

one to the old one and threading them through the oven.<br />

Many inline ovens have elements wired in series,<br />

deltas or other configurations. This means a group of<br />

elements is working together. More often than not, a<br />

bad element will drag down the others directly connected<br />

to it. Therefore, if you find a bad element, you<br />

should suspect any other element with a direct connection<br />

to it. Elements do not slowly deteriorate until<br />

they go bad; they either “work” or “don’t work.” So,<br />

although it is possible to find only one element that<br />

has actually gone bad, be aware that other elements<br />

connected to it will probably go bad soon, too.<br />

Replacing an element is straightforward. Clamshell<br />

ovens afford the opportunity to open the<br />

chamber to assist threading the element through an<br />

oven. However, there is a risk of touching an element<br />

or other part of the heat chamber that is still hot.<br />

The easiest and safest way to change an element is<br />

with a standoff. A standoff directly connects the new<br />

element to the old one and, as you push the new one<br />

in, the old one will come out the other side. See the<br />

above photo of two types of standoffs. After replacing<br />

an element, make sure all the wire connections<br />

are tight and the terminals are snug. Anything loose<br />

or sticking out can cause arcing when electricity is<br />

returned to the oven.<br />

Thermocouples<br />

The next item that should be considered is the<br />

thermocouple. Various types of thermocouples exist,<br />

and each inline oven company will use a style most<br />

suited to its particular oven design. No matter the<br />

style, you should know that typical heat-treatment<br />

temperatures for springmakers range from 400°F<br />

to 950°F, and J-type thermocouples are the fastest<br />

reacting and most accurate type in this temperature<br />

range. A thermocouple is basically two wires of different<br />

materials attached at one end. It is at this tip<br />

where the oven temperature reading takes place.<br />

The temperature reading is the most important<br />

function in an inline oven, and three things can<br />

22 SPRINGS July 2006<br />

happen to a thermocouple that can cause problems.<br />

First, if the fused connection (where the two metal<br />

wires are welded together) breaks, the thermocouple<br />

cannot take a reading, and the thermocouple will<br />

need to be replaced. Similarly, if either of the two<br />

wires has any break or disconnection between the<br />

thermocouple and the temperature controller, the<br />

signal to the temperature controller will be lost.<br />

Luckily, almost every temperature controller on the<br />

market will display something if there is any sort of<br />

discontinuity. For example, instead of displaying a<br />

temperature, it may display “- - - -.” So, the tip of<br />

the thermocouple is the first thing to check if the<br />

display indicates discontinuity. If the tip is OK, trace<br />

back the wire connections<br />

all the way to the temperature<br />

controller to find the<br />

source of discontinuity.<br />

The second common<br />

issue related to a thermocouple<br />

is the physical<br />

displacement of the thermocouple<br />

itself. The tip of<br />

the thermocouple must<br />

extend into the furnace<br />

chamber, but sometimes<br />

it can get pushed up into<br />

the insulation, either by<br />

an airborne object hitting<br />

it or by a mistaken posi-<br />

The fused (good) tip of a<br />

thermocouple.<br />

tioning when a thermocouple is replaced. If the tip<br />

of a thermocouple is inside the insulation, the heat<br />

from the elements will not reach the thermocouple.<br />

As a result, the temperature controller will think<br />

the oven is cooler than it should be, and will tell<br />

the heating elements to go on in order to increase<br />

temperature in the chamber. If this happens, the<br />

chamber can easily reach higher than 1,000°F, while<br />

the temperature display may only show 700°F. This<br />

can cause a serious situation, such as burning out<br />

the elements or starting a fire.<br />

The third thermocouple issue is perhaps the<br />

easiest to prevent but seldom checked until a severe<br />

situation develops. This is when oils and other particles<br />

build up on the tip of the thermocouple. All<br />

day long, oily mists burn off the surface of the wire<br />

being heat treated and, due to thermodynamics, a lot<br />

of it ends up at the top of the heat chamber. This is<br />

where most thermocouples are located. If a buildup<br />

occurs, it is similar to having the thermocouple positioned<br />

in the insulation. The temperature readings<br />

will become sluggish, thus affecting the reactivity of<br />

the oven. The oven will begin to operate erratically<br />

and in a wider range of temperatures than desired.<br />

Even if most of your applications use light oil or you<br />

only run light springs through an oven, it is recommended<br />

that you check thermocouples as part of

A clamshell furnace opened to reveal the heat shield, which<br />

prevents heat loss and reflects heat back onto parts.<br />

a regular maintenance program and replace them<br />

approximately once a year.<br />

Heat Shield<br />

The next item that warrants attention is the heat<br />

shield. A cheap furnace may not have one, but most<br />

of the major oven makers have them in one form or<br />

another. The heat shield does pretty much what its<br />

namesake indicates. Its purpose is to keep as much<br />

24 SPRINGS July 2006<br />

heat in the heat chamber as possible and not let it<br />

leak into other areas. Heat can bounce off a heat<br />

shield and reflect back onto your parts, assisting<br />

in the heat-treatment process. A good heat shield<br />

that can reflect heat will reduce the need for the<br />

elements to stay on, thus improving the useful life<br />

of an element.<br />

As with thermocouples, the heat shield should be<br />

checked for any buildup of materials on its surface.<br />

The more “gunk” that lodges up in the heat shield,<br />

the less heat that will reflect back down. Further,<br />

too much buildup of oil can potentially cause a fire.<br />

Standard cleansers that work on stainless steel can<br />

be used to restore a heat shield, but make sure the<br />

chamber is cool before applying them, and follow the<br />

directions on the cleanser’s label for further safety.<br />

Fan Motor and Fan Blades<br />

These items can vary dramatically among oven<br />

makers and even from model to model from the same<br />

maker. All inline ovens need circulating air to even<br />

out the temperature inside the heat chamber. Without<br />

such air circulation, you will only have radiant<br />

heat coming from the heating elements, and very<br />

little heat transfer (heat treatment) will take place.<br />

The most common method to circulate air is with<br />

a fan blade unit attached to a motor. Smaller ovens<br />

can be connected directly to a good-quality motor.

Average-quality motors will consistently burn out<br />

quickly, so if you try to save money by using a cheap<br />

replacement motor, you will end up spending more<br />

through more frequent replacements. Large ovens<br />

absolutely require an indirect connection between<br />

the fan and the motor. In large ovens, the heat in the<br />

chamber would travel up the fan shaft and burn out<br />

the motor if the two were directly connected.<br />

The fan blade unit rotates quite fast, so it must<br />

be balanced and properly secured to the fan motor.<br />

If even one blade got knocked off, the whole unit<br />

could become unbalanced enough that it could<br />

disintegrate.<br />

A jam-up in the chamber could cause parts to<br />

pile up high enough to touch the fan blades. The<br />

unit needs to rotate freely in the space between the<br />

heating elements and the heat shield.<br />

Furthermore, care must be given not to place the<br />

fan blades too close to the elements, as the elements<br />

can bend upward slightly when they get hot and<br />