O R D E R - Company Law Board Mumbai Bench

O R D E R - Company Law Board Mumbai Bench

O R D E R - Company Law Board Mumbai Bench

- TAGS

- company

- board

- mumbai

- bench

- mumbaiclb.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

BEFORE THE COMPANY LAW BOARD,<br />

MUMABI BENCH, AT MUMBAI<br />

PRESENT: SHRI KANTHI NARAHARI, MEMBER<br />

(JUDICIAL)<br />

COMPANAY PETITON NO.1 OF 2008<br />

IN THE MATTER OF THE COMPANIES ACT, 1956 (1 OF<br />

1956)<br />

UNDER SECTIONS 397, 398, 402, 403, 407 & 408<br />

AND<br />

IN THE MATTER OF M/S STORSACK INDIA PVT. LTD.<br />

BETWEEN:<br />

1. Mrs. Rimpal Sanjay Parekh<br />

Residing at A-53, Kalpataru Habitat,<br />

DR. S. S. Rao Road, Parel,<br />

<strong>Mumbai</strong> – 400 012.<br />

AND<br />

1. M/sStorsack India Pvt. Ltd.,<br />

Having its registered office at<br />

103, Atlanta, Nriman Point,<br />

<strong>Mumbai</strong> – 400 021.<br />

CP NO.1 of 2008<br />

Storsack<br />

…..Petitioner<br />

1

2. Sanjay Hasmukh Parekh,<br />

Residing at, 112B, Maker Towers,<br />

Cuffe Parade, <strong>Mumbai</strong> – 400 005.<br />

3. Thomas Noor<br />

Residing at Jugalsrtary,<br />

969469, Winhein Germany.<br />

4. Mr. Oliver Bochme,<br />

Residing at, Kleiststrasses 23, 65187,<br />

Weisbaden Germany.<br />

5. Storsack Gmbh.<br />

Registered in Germany and having its address at<br />

Industries Etrasee,<br />

28-30, 68519 Viernheim,<br />

Germany.<br />

6. Prashant Mawani,<br />

103, Atlanta, Nariman Point,<br />

<strong>Mumbai</strong> – 400 021. ….Respondents<br />

Present for parties<br />

1. Zal Andhyarjuna, Advocate for Petitioner<br />

2. Rajendra. G. Advocate for Petitioner<br />

3. Amit Sarve , Advocate for Petitioner<br />

4. Vibhav Krishna, Advocate for R1, 2 and 6<br />

5. S. D. Israni , Advocate for R5<br />

6. Satyan Isranai, Advocate for R5<br />

CP NO.1 of 2008<br />

Storsack<br />

2<br />

2

CP NO.1 of 2008<br />

Storsack<br />

3<br />

O R D E R<br />

1. The present petition is filed by invoking various provisions of<br />

the Companies Act, 1956 (“The Act”) alleging certain acts of<br />

oppression and mismanagement in the affairs of the R-1 <strong>Company</strong><br />

and sought reliefs as prayed in Para 10 of the petition.<br />

2. The brief facts of the case are that the petitioner is lawfully<br />

wedded wife of 2 nd Respondent, got married on 26.10 2001 with a<br />

high hope of starting a new leaf of life. Soon after the marriage<br />

her dreams started shattering and her matrimonial boat started<br />

rocking. It is submitted that in order to discourage the petitioner to<br />

enforce her personal statutory rights and to create a reign of terror<br />

the 2 nd Respondent is arranging to file a divorce proceeding and<br />

thus it is apparent that the 2 nd Respondent is hell-bent to reduce the<br />

role of the petitioner in the 1 st Respondent company and for the<br />

said purpose he will not leave any stone unturned and therefore<br />

continuously engaged in oppressive acts of mismanagement and<br />

illegally attempting to reduce the petitioner’s status in the 1 st<br />

Respondent and thus company is continuously engaged in the<br />

oppressive acts and the affairs of the company are totally<br />

mismanaged. Resources of the 1 st Respondent are being recklessly<br />

and lavishly spent to support amorous life style of 2 nd Respondent.<br />

3

CP NO.1 of 2008<br />

Storsack<br />

4<br />

It is further submitted that all norms in complying rules,<br />

regulations and the provisions of the Companies Act and so also<br />

the provisions of Memorandum and Articles of Association of 1 st<br />

Respondent <strong>Company</strong> are thrown to wind. No meeting of <strong>Board</strong> of<br />

Directors are ever convened, no statutory record of any kind are<br />

maintained. No meeting of the members of the company has taken<br />

place. The 2 nd Respondent has without the knowledge of the<br />

petitioner, without calling any <strong>Board</strong> Meeting or without calling<br />

meeting of members of 1 st Respondent <strong>Company</strong> has purportedly<br />

appointed two German Citizens, the Respondent No.3 & No.4<br />

herein as Directors stated to be effective from 06.02.2004. The<br />

petitioner felt that she is being side lined as regards the affairs of<br />

1 st Respondent <strong>Company</strong>. The respondent No.3 & No.4 has never<br />

attended any meeting of board of directors to the knowledge of the<br />

petitioner, however their appointment being void abintio as much<br />

as no legal formalities has been complied or followed in appointing<br />

Respondent No.3 & 4 as Directors of Respondent No.1 <strong>Company</strong>.<br />

3. It is stated that the petitioner was also aghast to learn that the<br />

2 nd Respondent has purportedly allotted 4,90,000 shares of Rs.10/-<br />

each of the aggregate value of Rs.49,00,000/- pursuant to the<br />

purported allotment of the shares dated 06.02.2004 is evident by<br />

alleged Form No.2 dated 11.02.2004, certified copy of which is<br />

4

CP NO.1 of 2008<br />

Storsack<br />

5<br />

obtained by the petitioner on or about 29.09.2007. It is also<br />

evident from Form No.2 that the 2 nd Respondent has allotted<br />

himself 65,000 shares of Rs.10/- each to himself and 4,25,000<br />

shares of Rs.10/- each to M/s Storsack Holding Gmbh, Respondent<br />

No.5 herein. The petitioner further says that form No.2 under<br />

section 75(1) of the Companies Act, 1956 has been filed in the<br />

office of Registrar of Companies by the 2 nd Respondent. The<br />

purported allotment of shares is illegal and void abnitio as much as<br />

the same is done in contravention of the provisions of law. No<br />

meeting of <strong>Board</strong> of Director is ever held to consider such<br />

allotment, nor there any mandate by the company in the General<br />

Meeting for issuance of such shares. It is submitted that no<br />

meeting of the <strong>Board</strong> of Directors of the 1 st Respondent <strong>Company</strong><br />

is ever called or held and no statutory records of the 1 st Respondent<br />

<strong>Company</strong> is maintained. The 2 nd Respondent is never appointed as<br />

the Managing Director of the <strong>Company</strong> and no resolution is ever<br />

passed either of the meeting of the <strong>Board</strong> of Director or General<br />

Meeting of the members of the 1 st Respondent <strong>Company</strong>.<br />

4. It is stated that the 2 nd Respondent at the time of<br />

incorporation of the company obtained a signature on a writing<br />

which was meant for opening a bank account. The petitioner<br />

thought that this may be procedural aspect incidental to the<br />

5

CP NO.1 of 2008<br />

Storsack<br />

6<br />

incorporation formalities. Thereafter it appears that the 1 st<br />

Respondent <strong>Company</strong> has opened an account with UTI Bank Ltd.<br />

at Nariman Point now known as Axis Bank Ltd. The petitioner has<br />

not signed any papers for obtaining finance nor of herself as<br />

guarantor to any financial assistance availed from any Bank or<br />

Financial Institution. However, the 2 nd respondent solely is<br />

operating the said account and the petitioner has never objected to<br />

the same in good faith. The petitioner further states that the 2 nd<br />

Respondent has grossly misused the funds of the company for his<br />

own cause and heavily spent the funds of 1 st Respondent company<br />

for his extra marital affair. The petitioner states that as a Director<br />

she was paid salary of Rs.30,000/- per month. The 2 nd Respondent<br />

had always prevented her from utilizing the said money which<br />

were being deposited in a joint account exclusively operated by the<br />

2 nd Respondent and funding her maintenance in a poor way by<br />

utilizing the said account.<br />

5. It is stated that one Mr. Prashant Mawani a confident of 2 nd<br />

Respondent working as a Vice President of 1 st Respondent<br />

<strong>Company</strong> is prompted and encouraged by the 2 nd Respondent in<br />

harassing the petitioner and obstructing the petitioner in attending<br />

the affairs of the company as a Director and issuing directions to<br />

the staff not to obey her as a Director. Further obstructing her<br />

6

CP NO.1 of 2008<br />

Storsack<br />

7<br />

from entering the office premises and preventing access to any of<br />

the records of the 1 st Respondent <strong>Company</strong> and indulging into<br />

gross in-subordination. The said Mr. Prashant Mawani amply<br />

encouraged by 2 nd Respondent behaves with the petitioner in a<br />

manner not expected of a gentleman. The petitioner apprehends<br />

that no statutory record of any nature whatsoever seems to have<br />

been maintained at least not to the knowledge of the petitioner.<br />

The petitioner says that even if the records are maintained she has<br />

never been allowed any access thereto nor offered for inspection<br />

despite repeated requests. The petitioner states that the 1 st<br />

Respondent <strong>Company</strong> is in fact a glorified partnership between the<br />

petitioner and 2 nd Respondent as is evident from the inception of<br />

the company. The petitioner states that the 2 nd Respondent is<br />

conducting the affairs of Respondent No.1 company in violation of<br />

the provisions of the Act, and corporate governance and<br />

continuing to run the Respondent No.1 company as if it is a<br />

proprietary concern of him and also the affairs of the company<br />

contrary to the interest of the 1 st Respondent <strong>Company</strong>. The<br />

petitioner states that the oppressive acts of the company have been<br />

continuing since the inception of the company as the 2 nd<br />

Respondent took advantage of the matrimonial bond between<br />

herself and 2 nd respondent. The irregular and oppressive acts of 2 nd<br />

Respondent committed in the name of the company came to light<br />

7

CP NO.1 of 2008<br />

Storsack<br />

8<br />

when the petitioner was mistreated in or about December 2006 and<br />

then in spite of demand the 2 nd Respondent caused 1 st Respondent<br />

company to deny the inspection of the records and interfered with<br />

her right as a shareholder and director of the 1 st respondent<br />

company eventually compelled the petitioner to apply for certified<br />

copies and on perusal of certified copies, the petitioner was<br />

shocked to note that the 2 nd Respondent has attempted to tilt the<br />

balance in favour by appointing Respondent No.3 and Respondent<br />

No.4 as directors and also sought to destabilize the shareholding<br />

pattern by purportedly allotting large number of shares in his<br />

favour and to Respondent No.5 and more particularly alleged<br />

return of allotment dated 11.02.2004 purportedly allotting 65,000<br />

shares of Rs.10/- each to himself and 4,25,000 shares of Rs.10/-<br />

each to respondent No.5 on 06.02.2004 without following due<br />

process of law. The petitioner submits that there are only two<br />

shareholders and two directors and there has not been any meeting<br />

of <strong>Board</strong> of Directors or meeting of the members of the company.<br />

The petitioner states that the purported letter of allotment dated<br />

11.02.2004 filed in the office of Registrar of Companies vide Form<br />

No.2 seeking to allot 65,000 shares of Rs.10/- each to himself by<br />

respondent No.2 and 4,25,000 shares of Rs.10/- each to the 5 th<br />

Respondent is null and void and the said return of allotment is<br />

declared to be void and respondent No.2 and respondent No.5 are<br />

8

CP NO.1 of 2008<br />

Storsack<br />

9<br />

required to be injuncted from exercising their right to vote in any<br />

meeting of share holders or directors in respect of those<br />

unauthorizedly allotted shares. The petitioner further says that the<br />

1 st Respondent <strong>Company</strong>’s affairs are being conducted in a manner<br />

detrimental to the petitioner as a 50% shareholder warranting<br />

winding up of the company. However, such an effort will<br />

prejudice the shareholders, creditors and clients, and it would be<br />

unfair to wind up the company, as much as this Hon’ble <strong>Board</strong> in<br />

exercise of power under Section 397 & 398 read with section 402<br />

of the Companies Act can remedy the situation and thus winding<br />

up can be avoided.<br />

6. It is stated that though the petitioner is a Promoter Director<br />

and a member of the company no meeting of board of directors<br />

have ever taken place to approve the accounts or any meeting of<br />

the members, to cause any accounts in spite of repeated requests,<br />

no copy of Balance Sheet or Audited accounts have been furnished<br />

to the petitioner in a bid to keep her in dark and to continue the<br />

affairs of the company at the sweet will of 2 nd respondent. The<br />

petitioner also requested the statutory auditor of the company to<br />

provide the Audited Accounts, the said Auditor adopted a hyper<br />

technical approach. Further, it is stated that the 1 st Respondent has<br />

caused a notice of an alleged EOGM to be held on 31.03.2008 at<br />

9

CP NO.1 of 2008<br />

Storsack<br />

10<br />

10.00 A.M. to consider her removal under Section 284 of the<br />

Companies Act, 1956. The said notice is illegal and not liable to<br />

be implemented on the ground that the alleged requisitionist is not<br />

holding any validly allotted shares and a person sought to be<br />

removed is required to be given a special notice of 14 days<br />

irrespective of any provision of the MOA and AOA of the<br />

company. The person sought to be removed has right to<br />

representation made which has to be circulated among the<br />

members. In view of the back drop of what is stated here in above<br />

the purported EOGM lacks absolute bona fide and is intended to<br />

target the petitioner is illegal and void. In view of the reasons<br />

stated above, the petitioner made out prima facie case to grant the<br />

relief’s as prayed for. The petitioner relied upon the following<br />

decisions:<br />

1. AIR 1992 SC Page 453 In the matter of V. B. Rangaraj Vs.<br />

Gopalakrishnan,. It is held “Transfer of shares contrary to<br />

Articles of Association not bind either on shareholders or on<br />

the <strong>Company</strong><br />

2. (1996) Vol.86 Comp. cases (CLB Principal <strong>Bench</strong>) page 657.<br />

In the matter of M. M. Dua & Ors. Vs. Indian Dairy &<br />

Allied Services Pvt. Ltd. It is held “provision in Article for<br />

preemptive purchase by members in a private company.<br />

10

CP NO.1 of 2008<br />

Storsack<br />

11<br />

Transfers made without being placed before <strong>Board</strong> of<br />

Directors, in violation of Articles amount to oppression”.<br />

3. (2008) 86 SCL 155 (CLB New Delhi) In the matter of<br />

Mohinder Singh Vs. Hoshiarpur Express Transport<br />

<strong>Company</strong> Limited. It is held “Removing Chairman in a<br />

meeting conducted without quorum and without notice is<br />

illegal and without authority”.<br />

7. The respondents have filed a detailed reply and denied the<br />

allegations averments made in the petition. Respondents raised<br />

preliminary objection as to the locus of the petitioner to file the<br />

present petition as she holds only 5000 equity shares in the<br />

Respondent No.1 <strong>Company</strong> which amounts to only 1% of the total<br />

paid up share capital of the company and as such does not meet the<br />

stipulated requirement for filing petition invoking provisions of<br />

sections 397/398 of the Companies Act, 1956. Further the<br />

respondents raised objection that the petitioner was very much<br />

present in the <strong>Board</strong> Meeting held on 6 th February 2004 and was<br />

party to the decision to allot 4,25,000 equity shares to the<br />

Respondent No.5 and a further 65,000 equity shares to the<br />

Respondent No.2 and has signed several documents in connection<br />

with the same. The petitioner has suddenly woke up after 4 years<br />

only due to her matrimonial differences with the Respondent No.2<br />

11

CP NO.1 of 2008<br />

Storsack<br />

12<br />

and as such this petition is hopelessly barred by the laws of<br />

limitation. The Respondents also raised further objection that the<br />

entire petition has no substance whatsoever and is vindictive in<br />

nature as acrimonious matrimonial issues have developed between<br />

the petitioner and respondent No.2. The petitioner is simply<br />

misusing this Hon’ble <strong>Company</strong> <strong>Law</strong> <strong>Board</strong> by indulging in<br />

multifariousness and frivolous litigation and the petition needs to<br />

be dismissed on this ground alone. The Learned Counsel adverting<br />

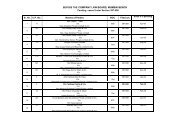

to the facts submitted that the actual details of the share holding<br />

pattern and the capital of the Respondent No.1 <strong>Company</strong> is as<br />

under:<br />

8. The Authorized Share Capital of the <strong>Company</strong> is<br />

Rs.50,00,000/- divided into 5,00,000 equity shares of Rs.10/- each.<br />

The Issued Subscribed and Paid Up Capital is Rs.1,00,000/-<br />

divided into 10,000 equity shares of Rs.10/- each. The Petitioner<br />

holds 5000 equity shares and the Respondent No.2 holds 5000<br />

equity shares. The <strong>Company</strong> made further allotment of shares on<br />

06.02.2004 to the Respondent No.5 to an extent of 4,25,000 equity<br />

shares and 65,000 equity shares to Respondent No.2. Thus the<br />

entire equity of the company was subscribed and paid as stated<br />

above. The Respondent <strong>Company</strong> increased its share capital from<br />

12

CP NO.1 of 2008<br />

Storsack<br />

13<br />

Rs.50,00,000/- to Rs.2,00,00,000/- on 24.05.2006 and the present<br />

share holding of the company is as under:<br />

1. Storsack Holdings Gmbh (Resp.5) 85% 4,25,000 eq.sh<br />

2. Sanjay Parekh (Resp.2) 14% 70,000 eq.sh<br />

3. Rimpal Parekh (Petnr.) 1% 5,000 eq.sh<br />

------------------<br />

5,00,000 eq.sh<br />

==========<br />

9. It is stated that the above shareholding pattern is existing for<br />

more than last four years. The Respondent No.5 holds 85%,<br />

Respondent No.2 holds 14% and the petitioner holds only 1% of<br />

the total paid up share capital of the Respondent <strong>Company</strong>.<br />

Further it is submitted that, the valid board meetings have been<br />

duly held and the petitioner herself has been present at the said<br />

board meetings and has herself voted in favour of the said<br />

allotment of 4,90,000 equity shares on 06.02.2004 which she is<br />

now disputing after more than 4 years and the same shall be<br />

evident from the correct facts being brought on record by the<br />

Respondents. The Respondent <strong>Company</strong> was promoted by the<br />

Respondent No.2 and the Respondent No.5 which is also the<br />

holding company. The Respondent No.2 was already in talks with<br />

Respondent Nos.3 and 4 who are the Directors of Respondent No.5<br />

13

CP NO.1 of 2008<br />

Storsack<br />

14<br />

for creating a joint venture company in India as far back as<br />

October, 2003. The Respondent No.5 wanted to create an Indian<br />

subsidiary with the name Storsack India Pvt. Ltd. (as the name of<br />

the holding company was Storsack Holdings GmbH) and were in<br />

talks with the Respondent No.2 for the completion of the<br />

necessary formalities such as paid up capital, transfer of funds,<br />

joint venture agreement approvals etc. The respondents submit<br />

that there is not a single communication with the petitioner since<br />

she was never concerned with this entire process or operation. It is<br />

further submitted that it was the Respondent No.2 who suggested<br />

the name of his wife, i.e. the petitioner to be the joint subscriber<br />

and first director of the Respondent <strong>Company</strong> as a mere tool for<br />

convenience since it would make the entire process of<br />

incorporation of the Respondent <strong>Company</strong> quicker due to both the<br />

subscribers and directors being Indian residents. It is further<br />

submitted that the appointment of the Petitioner as a Director and<br />

Subscriber was more by default rather than merit as she was a mere<br />

housewife. The respondents 3, 4 & 5 naturally agreed and hence,<br />

in that manner the Respondent <strong>Company</strong> was incorporated. It is<br />

also pertinent to note that there has been absolutely no investment<br />

from the petitioner into the Respondent <strong>Company</strong>. All the money<br />

which was invested has been from the funds of the Respondent<br />

No.2 from his personal account. It is further submitted that as per<br />

14

CP NO.1 of 2008<br />

Storsack<br />

15<br />

the Joint Venture Agreement between the Respondent No.2 and the<br />

Respondent No.5, the representatives of Respondent No.5 would<br />

be appointed on the board of the Respondent <strong>Company</strong> after its<br />

incorporation and shares would be allotted to the Respondent No.5<br />

to give it complete control over the Respondent <strong>Company</strong>.<br />

Accordingly, on 6 th February 2004, a board meeting of the<br />

Respondent No.1 was commenced in which the Petitioner was also<br />

present. As per the Joint Venture Agreement dated 15 th December<br />

2003 to an extent of 4,25,000 Equity Shares were allotted to the<br />

Respondent No.5 and share certificates were also issued in respect<br />

of the same signed by both the petitioner and the Respondent No.2<br />

(A copy of the said share certificate signed by both the Petitioner<br />

and the Respondent No.2 is annexed hereto as Exhibit D). The<br />

requisite Form 2 in respect of the said allotment was filed with the<br />

Registrar of Companies on 17 th February, 2004 itself (A copy of<br />

the said Form 2 is annexed hereto as Exhibit E). Further, as per the<br />

said Joint Venture Agreement, both the Respondent No.3 and<br />

Respondent No.4 were appointed as Directors in the said <strong>Board</strong><br />

Meeting dated 6 th February 2004. The requisite form 32 in respect<br />

of the same was filed on 17 th March, 2004.<br />

10. Further, all the funds for acquiring the said 4,25,000 equity<br />

shares were received from the Respondent No.5 by the R1<br />

15

CP NO.1 of 2008<br />

Storsack<br />

16<br />

<strong>Company</strong> in February 2004 itself as can be clearly borne out from<br />

the Foreign Inward Remittance Certificate issued by the bank of<br />

the Respondent <strong>Company</strong>. The Respondent humbly submit that<br />

due to lack of sufficient grounds and evidence, the petitioner has<br />

made a deliberate and calculated attempt to mislead the Hon’ble<br />

<strong>Company</strong> <strong>Law</strong> <strong>Board</strong> by dragging the matrimonial dispute and<br />

making it a subject matter of the petition. The Respondent further<br />

submit that the matrimonial dispute and the allegations of the<br />

petitioner are completely irrelevant and have nothing whatsoever<br />

to do with the Respondent <strong>Company</strong> and hence cannot be the<br />

subject matter of the petition and she should strictly refrain from<br />

bringing such personal differences in the public domain. It is also<br />

submitted that there are separate divorce proceedings already<br />

underway between the Petitioner and the Respondent No.2. The<br />

petitioner did not raise one single complaint regarding her<br />

shareholding, the directorships of Respondent No.5 nor challenge<br />

the directorships of Respondent 3, 4 and 6, since the date of<br />

incorporation December 2003 till mid 2007. It is not out of place<br />

to mention that the petitioner has filed various false and frivolous<br />

police complaints including one under Section 498A of the IPC as<br />

a result of which the Respondent No.2 was even put into judicial<br />

custody due to the severity of even complaining under the said<br />

provision. The respondents have been duly and diligently holding<br />

16

CP NO.1 of 2008<br />

Storsack<br />

17<br />

the board meeting and general meetings of the company as is<br />

evidenced from the Minutes of the <strong>Board</strong> Meeting, the minutes of<br />

the General Meeting and the annual return and annual reports duly<br />

filed with Registrar of Companies. The Respondents reiterate and<br />

submit that the appointment of the respondent Nos.3 and 4 as<br />

Directors of the Respondent <strong>Company</strong> was made on 6 th February<br />

2004 in a board meeting in which the petitioner was very much<br />

present and that the said appointments were made in accordance<br />

with the Joint Venture Agreement. Respondents 3 and 4 have<br />

always been completely involved in the decision making process<br />

of the Respondent <strong>Company</strong> since it is a subsidiary of the<br />

Respondent No.5 of which the Respondents 3 and 4 are<br />

representatives. In fact, on few occasions board meetings of the<br />

Respondent <strong>Company</strong> has also been held in Germany at the office<br />

of the Respondent No.5 which is the holding company of the<br />

Respondent No.1 <strong>Company</strong>. The respondents reiterate that the<br />

petitioner was appointed as a Director of the Respondent <strong>Company</strong><br />

only as a matter of convenience and as she was the wife of the<br />

Respondent No.2, the Respondent No.5 did not foresee any<br />

problem with the same. It is further submitted that right from<br />

incorporation, the Petitioner has been only an Ordinary Director<br />

and has never been involved in the day to day management of the<br />

Respondent <strong>Company</strong>. The claim of the Petitioner that she was<br />

17

CP NO.1 of 2008<br />

Storsack<br />

18<br />

being sidelined and never given any notices etc. are completely<br />

false and motivated with motives and mala fide intention. The<br />

Respondent reiterate that the said allotment of the 4,90,000 equity<br />

shares was validly made and the necessary Form 2 was also filed<br />

on 17 th February 2004 itself. In fact, a share certificate had also<br />

been issued to the Respondent No.5 at that very board meeting<br />

dated 6 th February 2004 and it bears the signature of both the<br />

Respondent No2 and the Petitioner. In fact, the lies of the<br />

Petitioner is also evident from the fact that the Petitioner has also<br />

signed the Audited Balance Sheet and Profit/Loss Account of the<br />

Respondent <strong>Company</strong> for the year ending 31 st March 2004 which<br />

was filed with the Income Tax authorities for the Assessment Year<br />

2004-05, which clearly show the paid up share capital of the<br />

Respondent <strong>Company</strong> as Rs.50 Lacs and not the Rs.1 Lac as is<br />

being claimed by the petitioner. Hence, the petitioner cannot<br />

suddenly feign ignorance and claim innocence when she was<br />

actually party to all these proceedings.<br />

11. The Respondent No.2 had opened bank account for the<br />

Respondent <strong>Company</strong> to carry out its day to day operations. There<br />

was never any need to take the signature of the petitioner to<br />

operate the said Bank account since she was never involved in the<br />

day to day affairs and management of the Respondent <strong>Company</strong>.<br />

18

CP NO.1 of 2008<br />

Storsack<br />

19<br />

The petitioner never even once bothered to ask the Respondent<br />

No.2 as to how the Respondent <strong>Company</strong> was being managed or<br />

the state of its affairs. However, since January 2008, she has<br />

started questioning each and every thing only to harass the<br />

Respondent No.2 as a direct fallout of the matrimonial dispute<br />

between the petitioner and the Respondent No.2. The petitioner is<br />

only supposed to attend the board meetings of the Respondent<br />

<strong>Company</strong> as and when she is called upon to do so. Hence, there is<br />

no question of her attending to any affairs of the Respondent<br />

<strong>Company</strong> or issuing instructions since she has no authority<br />

whatsoever in that regard. It is further reiterated that the<br />

Respondent No.6 has been associated with the Respondent<br />

<strong>Company</strong> since incorporation and has been elevated to the status of<br />

Director in 2006. The Respondent No.6 and the Petitioner are on<br />

an equal footing so far as the Respondent <strong>Company</strong> is concerned<br />

and therefore, the question of insubordination does not arise at all.<br />

The petitioner is simply making wild, value and concocted<br />

allegations about non maintenance of the statutory records,<br />

registers, accounts etc. without producing any evidence to support<br />

her allegations. The Respondents have duly convened and held all<br />

the board and general meetings in due compliance with the<br />

provisions of law as can be evidenced from the documents annexed<br />

to this reply. In fact the respondents submit that the Respondent<br />

19

CP NO.1 of 2008<br />

Storsack<br />

20<br />

<strong>Company</strong> has shown substantial growth from the date of<br />

incorporation till date and this is only due to the hard labour and<br />

skill of the Respondent No.2 in running the affairs of the<br />

Respondent <strong>Company</strong>. The Respondent <strong>Company</strong> is a profit<br />

making company and has been making continuous profits for the<br />

last 4 years since incorporation. The Respondents reiterate that the<br />

oppressive acts being alleged by the petitioner are all concocted<br />

bunch of lies and a figment of her imagination. She has been<br />

unable to point out even a single instance of oppression of her<br />

rights as a shareholder or mismanagement of affairs of the<br />

Respondent <strong>Company</strong>. In fact, it is pertinent to note that the<br />

petitioner is blatantly and in utter contempt and disregard for the<br />

law, making one false statement after the other and for this reason<br />

alone the petition needs to be dismissed with costs. The petitioner<br />

has since incorporation of the Respondent <strong>Company</strong> never<br />

bothered about its affairs and never visited its office except to<br />

attend board meetings. The petitioner had never even asked for or<br />

sought inspection of books and records of the Respondent<br />

<strong>Company</strong> prior to 2008 and she is put to strict proof thereof to<br />

prove that she was never denied inspection as she is so blatantly<br />

claiming. Further, even in 2008 when she asked for inspection she<br />

was not denied the same. She is simply making false allegations<br />

20

CP NO.1 of 2008<br />

Storsack<br />

21<br />

with mala fide intentions to further her nefarious designs and<br />

ulterior motives.<br />

12. Further it is submitted that the Respondent <strong>Company</strong> has<br />

only 5 directors presently viz. Respondents 2, 3, 4 and 6 and Mr.<br />

Vinod Rana. The petitioner has already been removed as a<br />

Director pursuant to the resolution passed by the shareholders in<br />

the Extra-ordinary General Meeting held on 31 st March 2008. It is<br />

pertinent to note here that the Petitioner did not even bother to<br />

attend the said general meeting and vote against her removal.<br />

Further, as already highlighted herein above the Respondent<br />

<strong>Company</strong> has three shareholders namely, the Respondent No.5<br />

which holding 85% of the total paid up capital and is the holding<br />

company, Respondent No.2 holding 14% and the Petitioner<br />

holding 1%. There is no prejudice being caused in any manner<br />

whatsoever to the petitioner who is just a 1% shareholder of the<br />

Respondent company. The petitioner has been daily visiting the<br />

registered office of the Respondent <strong>Company</strong> and has been<br />

threatening the employees of the Respondent <strong>Company</strong> with<br />

physical and bodily injury, and raising a hue and cry and disturbing<br />

the peace and quiet of the environment. As a result, two<br />

employees have already resigned being unable to bear the tension<br />

and stress and the Respondents apprehend that more employees<br />

21

CP NO.1 of 2008<br />

Storsack<br />

22<br />

may follow suit. In fact, the petitioner went to the criminal court<br />

and obtained a restrained order against her husband i.e.<br />

Respondent No.2 and on the other hand she herself goes to his<br />

office every day to harass him and his staff. Being apprehensive of<br />

her actions and for the security of the company staff, the<br />

Respondents were constrained to install CC TV cameras.<br />

Respondent No.5 requisitioned an EOGM on 31 st March 2008 for<br />

the removal of the petitioner as director of the Respondent<br />

<strong>Company</strong>. Despite receipt of proper notice, the petitioner chose<br />

not to attend the EOGM and instead approached the Hon’ble<br />

<strong>Company</strong> <strong>Law</strong> <strong>Board</strong> by filing a petition wherein the Hon’ble<br />

<strong>Company</strong> <strong>Law</strong> <strong>Board</strong> allowed the EOGM to go on and ordered that<br />

all the resolutions were subject to its final decision. As a result,<br />

with effect from 31 st March 2008, the petitioner is no longer<br />

director of the Respondent <strong>Company</strong> albeit subject to the final<br />

decision of this Hon’ble <strong>Company</strong> <strong>Law</strong> <strong>Board</strong>. The Respondents<br />

reiterate and submit that notices of all meetings were always given<br />

to the petitioner. The Petitioner had in fact attended all the<br />

meetings except those held in Germany. She was never a part of<br />

the day to day affairs of the Respondent <strong>Company</strong> and therefore<br />

was not concerned with the affairs and hence, the question of<br />

keeping her in the dark did not arise. She has never even once<br />

prior to 2008 asked for copies of any document let alone the<br />

22

CP NO.1 of 2008<br />

Storsack<br />

23<br />

balance sheet of the Respondent <strong>Company</strong> and this just shows her<br />

callous attitude. She is asking for all the documents now only with<br />

a premeditated view to create correspondence to use against the<br />

Respondent <strong>Company</strong> to further her own ulterior motives. It is<br />

further submitted that the Petitioner was paid only a salary of<br />

Rs.30,000/- every month and there were absolutely no perquisites<br />

as is being falsely claimed with a calculated attempt to mislead this<br />

Hon’ble <strong>Company</strong> <strong>Law</strong> <strong>Board</strong>. The statements of the petitioner<br />

regarding preventing her from utilizing her money are completely<br />

untrue and false and she is put to strict proof thereof. In fact, the<br />

petitioner never once wanted to use the money deposited in her<br />

account since the last five years. It is only since things have turned<br />

advantage of any thing she can cling on to. All this while since<br />

2003 the petitioner had no problem with the functioning of the<br />

company or the funds in her account. However, all of a sudden she<br />

has awoken to her remuneration in 2008. This itself is a clinching<br />

fact which tells the tale of deceit of the petitioner. The respondents<br />

further vehemently deny the insinuations and accusation leveled at<br />

the Respondent No.2 of acting in vengeance to harass the<br />

petitioner and put her to strict proof there of.<br />

13. The petitioner was always holding only 1% shares so there<br />

was no question of her shareholding being reduced further. The<br />

23

CP NO.1 of 2008<br />

Storsack<br />

24<br />

notice from Respondent No.5 was to requisition an EOGM for the<br />

removal of the petitioner as Director since her actions were<br />

becoming more and more prejudicial to the interests of the<br />

Respondent No.5 and the Respondent <strong>Company</strong>. In fact, when the<br />

petitioner approached the Hon’ble <strong>Company</strong> <strong>Law</strong> <strong>Board</strong> to stop the<br />

said EOGM, she was not allowed to do so and the resolution for<br />

her removal has been passed unanimously, albeit subject to the<br />

final decision of the Hon’ble <strong>Company</strong> <strong>Law</strong> <strong>Board</strong>. Hence, the<br />

Petitioner is no longer Director of the Respondent <strong>Company</strong>. The<br />

Respondent No.2 further submits that he is ready and willing to<br />

buy out the entire shareholding of the petitioner in the Respondent<br />

<strong>Company</strong> for a price determined by an independent valuation done<br />

by independent valuers of repute. The EOGM was validly<br />

requisitioned and held and her removal under section 284 is valid<br />

and in fact, the Hon’ble <strong>Company</strong> <strong>Law</strong> <strong>Board</strong> did not even deem it<br />

fit to stay the holdings of the said EOGM and passing of the said<br />

resolution except to state that the resolutions were subject to the<br />

final decision of the Hon’ble <strong>Company</strong> <strong>Law</strong> <strong>Board</strong>. The<br />

respondent submit that it is a fit and proper case for allowing the<br />

implementation of the resolution which was passed unanimously,<br />

as the petitioner is holding only 1% of the shareholding of the<br />

Respondent <strong>Company</strong> which is a subsidiary of Respondent No.5<br />

and has been acting completely against the interest of the<br />

24

CP NO.1 of 2008<br />

Storsack<br />

25<br />

shareholders and as such is causing severe and grave harm and<br />

injury to the shareholders and the Respondent <strong>Company</strong> and has<br />

completely lost the faith and trust of the <strong>Board</strong> and despite having<br />

notice chose neither to respond to requisition for her removal nor<br />

to attend the said EOGM where the resolution for her removal was<br />

passed unopposed. The petitioner was given a special notice as per<br />

law, she chose to completely ignore it and did not choose to<br />

respond to it. The EOGM has been held in consonance with the<br />

Articles of the Respondent <strong>Company</strong>. It is reiterated that the<br />

<strong>Board</strong> of the Respondent <strong>Company</strong> is duly constituted. In the<br />

circumstances, it is a fit and proper case to allow the<br />

implementation of the resolution already passed unanimously for<br />

the removal of the petitioner. In view of the above, the<br />

Respondents 1,2,3,4, and 6 pray to the Hon’ble <strong>Company</strong> <strong>Law</strong><br />

<strong>Board</strong> as follows:<br />

a) That the issue and allotment of 4,25,000 equity shares to<br />

respondent No.5 made on 6 th February, 2004 be declared as<br />

valid;<br />

b) That the issue and allotment of 65,000 equity shares to<br />

respondent No.2 made on 6 th February 2004, be declared as<br />

valid;<br />

25

CP NO.1 of 2008<br />

Storsack<br />

26<br />

c) That the appointments of Respondents 3 and 4 as directors on<br />

6 th February 2004 be declared as valid;<br />

d) That it be declared that the petitioner has been acting against<br />

the interests of the Respondent <strong>Company</strong> and it share<br />

holders;<br />

e) That the Respondent <strong>Company</strong> be allowed to act upon the<br />

resolution passed at the Extra Ordinary General Meeting held<br />

on 31 st March, 2008;<br />

f) That the petitioner be directed to sell to the Respondent No.2<br />

her entire shareholding in the Respondent <strong>Company</strong> for a<br />

price determined by an independent valuation done by<br />

independent valuers of repute.<br />

g) That the petition be dismissed as false vexatious and<br />

frivolous with heavy costs being imposed on the petitioner.<br />

14. In view of the facts and reasons stated above the Respondents<br />

pray this <strong>Bench</strong> to dismiss the <strong>Company</strong> Petition as it is devoid of<br />

merits. In support of the case, relied upon a decision reported in<br />

(1950) 20 Comp. cases 179 (SC). In the matter of Nanalal Zaver<br />

& Anr. Vs. Bombay Life Assurance <strong>Company</strong> Limited & Ors. It<br />

is held “if the directors exercise the power for the benefit of the<br />

company and at the same time, they have a subsidiary motive<br />

which in no way affects the <strong>Company</strong> or its interest or the existing<br />

26

CP NO.1 of 2008<br />

Storsack<br />

27<br />

shareholders, then the very basis of interference of the Court is<br />

absent, for the Court of equity only intervenes in order to prevent a<br />

breach of trust on the part of the directors and to protect the<br />

cesqui que trust, namely, the <strong>Company</strong> and possibility the existing<br />

shareholders. If as between the directors and the <strong>Company</strong> and<br />

the existing shareholders, there is no breach of trust or bad faith,<br />

there can be no occasion for the exercise of the equitable<br />

jurisdiction of the Court.<br />

15. The respondent No.5 also filed counter to the petition and<br />

raised a preliminary objection as to the locus of the petitioner to<br />

file the petition since she holds only 5000 equity shares which<br />

constitute only 1% of the paid up capital of the <strong>Company</strong> and does<br />

not meet the stipulated requirement for filing of the petition under<br />

Sec.397-398 of the Act. It is submitted that the petitioner was very<br />

much present in the <strong>Board</strong> Meeting held on 6 th Feb.2004 and was<br />

party to the decision to allot 4,25,000 equity shares to this<br />

respondent and a further 65000 equity shares to the 2 nd Respondent<br />

and signed several documents in connection with the same. The<br />

petitioner filed the present petition due to her matrimonial<br />

differences with the 2 nd Respondent belatedly as such, the petition<br />

is hopelessly barred by the laws of limitation. This respondent<br />

adopted the counter filed by the other respondents. Since this<br />

27

CP NO.1 of 2008<br />

Storsack<br />

28<br />

respondent counter also on the same lines of the counter of the<br />

other respondents, hence the same is not brought in, to avoid<br />

repeatence. In support of the arguments the Learned Counsel for<br />

the Respondents No.5 relied upon a decision reported in (2008)<br />

141 Comp.Cases.505 (CLB New Delhi). In the matter of Rahul<br />

Shah & Ors. Vs. AVI Sales Pvt. Ltd. & Ors. It is held<br />

“Petitioners not coming with clean hands and filed after a delay of<br />

three years and no sufficient reasons given for delay, the petition is<br />

liable to be dismissed. Director having knowledge of removal and<br />

allotment of shares and tacit consent by promoters of <strong>Company</strong>,<br />

the directorial complaints cannot be entertained”.<br />

16. The <strong>Bench</strong> after careful examination of the pleadings,<br />

documents and citations relied upon by them, framed the issues<br />

and decided the matter by giving detailed reasons to each issue.<br />

The petition was dismissed by an reasoning order dated 30.8.2010.<br />

Upon its dismissal all the interim orders vacated and also disposed<br />

off all the applications pending as on that date. The petitioner<br />

preferred an appeal before the High Court of Bombay against the<br />

order of this <strong>Bench</strong> dated 30.8.2010. The High Court by its order<br />

dated 21.12.2011, set aside the order passed in CP 1 of 2008 and<br />

restored to the file of the CLB and directed to decide the petition<br />

on merits in accordance with law within a period of 3 months from<br />

28

CP NO.1 of 2008<br />

Storsack<br />

29<br />

the date of receipt of copy of the order. The CLB received the<br />

copy of the High Court order on 6.1.2012 and sent notices to the<br />

parties on 11.1.2012 intimating them the date and time of hearing<br />

of the petition i.e. on 23.1.2012 at 2.30 P.M. On that date of<br />

hearing, the counsel appeared on behalf of the petitioner sought<br />

adjournment of the matter and at his request the matter is posted<br />

on 13 th February 2012 at 2.30 P.M. for hearing. On that date the<br />

petitioner filed two applications one being CA 20 of 2012 seeking<br />

directions to the respondents to maintain status quo and allow the<br />

petitioner to continue as director of R1 company and direct the<br />

respondents to pay salary of Rs.30,000/- per month. The other<br />

application being CA No.21 of 2012 whereby she prayed this<br />

<strong>Bench</strong> to allow the petitioner to place on record the documents<br />

along with the list of annexures enclosed to the application. The<br />

petitioner insisted this <strong>Bench</strong> to grant reliefs as prayed in CA<br />

No.20 of 2012 and CA No.21 of 2012. Having no other option I<br />

was compelled to direct the respondents to file counter to those<br />

applications within 2 days and the CA’s are posted on 20.2.2012 at<br />

2.30 P.M for hearing. The CA’s were heard and the following<br />

order is passed only in CA No.20 of 2012 and the full text of order<br />

is reproduced here under:<br />

i) “The Hon’ble High Court by its order dated 21.12.2011<br />

which was received by this <strong>Bench</strong> on 6 th January, 2012 directed<br />

29

CP NO.1 of 2008<br />

Storsack<br />

30<br />

the CLB, to dispose of the petition afresh within a period of 3<br />

months from the date of receipt of copy of that order. The <strong>Bench</strong><br />

taken up the matter along with application being CA No.78 of<br />

2010 for disposal as directed. The petitioner filed two applications<br />

being CA No.20 of 2012 whereby she sought directions to the<br />

respondents to maintain status-quo and allow the petitioner to<br />

continue as director of R1 company and direct the respondents to<br />

pay salary of Rs.30,000/- per month. The other application being<br />

CA No.21 of 2012 whereby she prayed this <strong>Bench</strong> to allow the<br />

petitioner to place on record the documents along with the list of<br />

annexures enclosed to the application. The petitioner insisted this<br />

<strong>Bench</strong> to grant reliefs as prayed in CA No.20 of 2012 and insisted<br />

this <strong>Bench</strong> to allow the CA No.21 of 2012.<br />

ii) The respondents filed replies to both the applications. In<br />

view of the pressure brought on me I have no other alternative but<br />

to take up the applications for hearing and dispose off the same<br />

before deciding the petition and CA No.78 of 2010. Now, I am<br />

dealing with CA No.20 of 2012. The counsel for the petitioner<br />

narrated the facts. It is stated that the CA No.20 of 2012 is filed<br />

under section 309 of the Companies Act, 1956 for the interim relief<br />

in respect of remuneration payable to director i.e. the petitioner<br />

together with perquisites. The advocates stated that the CLB by<br />

30

CP NO.1 of 2008<br />

Storsack<br />

31<br />

order dated 9.4.2008 directed the respondents to maintain status-<br />

quo with regard to continuation as director including the payment<br />

of salary to the petitioner. The respondents have deliberately<br />

failed and neglected to comply with the above order. The CLB<br />

dismissed the CP on 30.8.2010. The petitioner filed an appeal<br />

against the order before the High Court. The High Court set aside<br />

the order of CLB and remanded the CP for fresh hearing on merits.<br />

Since the company petition had been restored for fresh<br />

consideration the interim relief prayed in the said CP be allowed.<br />

iii) The respondents filed reply to the CA and stated that the High<br />

Court vide its order dated 21.12.2011 has directed the CLB to<br />

consider the petition afresh on merits and after giving opportunity<br />

to the petitioner to substantiate her challenge based on additional<br />

documents on the basis of application taken out. Therefore, the<br />

order is clear that the petitioner can urge the petition on merits<br />

afresh and can rely upon the additional documents as stated in her<br />

application dated 23.6.2010. In view of the parameters of the<br />

hearing on the basis of the documents produced under application<br />

dated 23.6.2010 only to be heard. Any attempt on behalf of the<br />

petitioner shall be an attempt to misrepresent, misinterpret the<br />

order of High Court and shall tentamount to a disobedience and<br />

contemptuous conduct and shall render the petitioner liable for<br />

31

CP NO.1 of 2008<br />

Storsack<br />

32<br />

contempt. The entitlement of the salary at the interim stage is<br />

unjustified since the earlier order of status-quo passed by the CLB<br />

has merged into the final order of the CLB dated 30.8.2010 and<br />

therefore there is no basis for claiming revival of the directions for<br />

status-quo. The petitioner has been guilty of having misuse her<br />

position and the conduct of the petitioner is blame worthy. Even<br />

otherwise the petitioner has not come to the court with clean hands<br />

and the present proceedings are not filed bonafide and as such is<br />

false, frivolous and bogus. It is settled law that personal disputes<br />

of the family members cannot be made the subject matter of the<br />

proceedings under oppression and mismanagement. The petitioner<br />

is not entitled to any reliefs.<br />

iv) Heard the advocates appeared for the parties. Before dealing<br />

with the crux of the issue it is necessitated for me to say, that the<br />

parties are in habit of blaming the CLB for their lapses. Therefore,<br />

to be careful and cautious, I intend to record that the number of<br />

pages filed by the petitioner and the respondents in their<br />

applications/petitions. The CA No.20 of 2012 consists of 6 pages.<br />

The reply filed by the respondents 1 and 2 consists of 12 pages.<br />

Except those, no other paper is available or filed to consider the<br />

said application. It is made clear to the parties that only those<br />

papers which have been mentioned herein above will be taken into<br />

32

CP NO.1 of 2008<br />

Storsack<br />

33<br />

consideration while deciding the application. If any documents<br />

filed subsequently in this application cannot be taken into<br />

consideration. If the parties filed any papers with anti dated after<br />

disposal of this application to blame the CLB, the CLB is not<br />

responsible for the same. It appears that the intention of the parties<br />

is not to oblige the order of the High Court but to fix the CLB in<br />

contempt by filing various applications to delay the hearing. The<br />

<strong>Bench</strong> after hearing the parties elaborately dismissed the CP No.1<br />

of 2008 on 30.8.2010 by passing a detailed order and vacated all<br />

the interim orders and disposed of all the company applications, if<br />

any pending as on that date. While deciding the petition it is one<br />

of the issue framed by this <strong>Bench</strong> is with regard to the removal of<br />

petitioner in an EOGM held on 31.3.2008 pursuant to the alleged<br />

requisition dated 6.03.2008 is valid or not. The relevant portion of<br />

the findings of the order is extracted herein: “I do not find any<br />

irregularities or illegality in conducting the meetings. Moreover<br />

the appointment or removal of directors is the wisdom of the share<br />

holders. The CLB will not interfere in the internal affairs of the<br />

company unless and until if it is found that there is violation of<br />

articles of the company and the law”. The issue was accordingly<br />

answered and hold that there is no illegality in removing the<br />

petitioner as director. When the petition was dismissed all the<br />

interim orders stand vacated and the petitioner has not made any<br />

33

CP NO.1 of 2008<br />

Storsack<br />

34<br />

application after vacating the order seeking to continue the interim<br />

orders at least to the extent of payment of remuneration/salary<br />

though she is not a director. It is seen that, from the date of<br />

dismissal of the petition till its restoration, the petitioner has not<br />

made any application seeking payment of salary. The Hon’ble<br />

High Court directed this <strong>Bench</strong> to proceed on the basis of the<br />

application for production of additional documents and the<br />

petitioner can rely on those documents in support of her<br />

contention. The High Court set aside the order of this <strong>Bench</strong> dated<br />

30.8.2010 and directed the CLB to consider the petition afresh on<br />

merits and in accordance with law after giving an opportunity to<br />

the petitioner to substantiate her challenge based on the additional<br />

documents. In view of the directions of the High Court this <strong>Bench</strong><br />

has to dispose off the petition on merits and taking into<br />

consideration the additional documents filed by the petitioner.<br />

Pending disposal of the petition, granting any interim relief would<br />

be pre determining the issues in favour of the petitioner and<br />

completely holding the balance of convenience in favour of the<br />

petitioner without adjudicating the matter. On dismissal of the CP,<br />

the petitioner ceased to be a director of the company. The present<br />

application is filed by invoking section 309 of the Companies Act,<br />

1956, which deals with the remuneration of directors. As per the<br />

above provision of law the remuneration of director shall be<br />

34

CP NO.1 of 2008<br />

Storsack<br />

35<br />

determined in accordance with the provisions of section 198 and<br />

section 309 of the Act, or the articles of the company or by a<br />

special resolution if the articles so required in case the director<br />

continues to hold office. When the director cease to hold office the<br />

payment of remuneration would not arise. In the present case, this<br />

<strong>Bench</strong> hold the removal of the petitioner as legal, therefore, the<br />

petitioner ceased to be a director and the payment of remuneration<br />

does not arise unless the removal of the petitioner is set aside.<br />

Since the petition has been remanded to this <strong>Bench</strong>, this <strong>Bench</strong> will<br />

consider the arguments of the petitioner and before deciding the<br />

legality of the petitioner being director or not, in my opinion, the<br />

payment of remuneration does not arise. Irrespective of the above,<br />

the conduct of the parties is blame worthy. From the reply of the<br />

respondents it is on the record that they are making contemptuous<br />

statements at para 3. The relevant portion is extracted hereunder:<br />

“In addition thereto it is the duty of this Hon’ble Court to ensure<br />

that the order dated 21.12.2011 passed by High Court, Bombay is<br />

followed in its entirety and is not subject to the interpretation,<br />

misinterpretation and distortions by this Hon’ble Court. It is<br />

beyond the power of this Hon’ble Court to enlarge the scope of the<br />

order and what is permitted therein. The order of the High Court<br />

dated 21.12.2011 being self explanatory, this Hon’ble Court<br />

cannot be permitted to go beyond the said order. Any such<br />

35

CP NO.1 of 2008<br />

Storsack<br />

36<br />

permission shall be illegal and beyond the jurisdiction of this<br />

Hon’ble Court”. The said statements by the respondents in their<br />

affidavit is clearly dictating the terms to this <strong>Bench</strong>. It is highly<br />

condemnable. The CLB being a quasi-judicial body discharging<br />

the powers as vested in the Companies Act, is functioning<br />

completely impartial without fear or favour and abided by the<br />

principle of natural justice and the law. However, some parties<br />

like in these proceedings trying to blame the institution is<br />

unwarranted. Even though the parties attempt to make the<br />

contemptuous statement the <strong>Bench</strong> will function impartially<br />

without fear or favour. In view of the above, the petitioner is not<br />

entitled to the reliefs hence the CA liable to be dismissed.<br />

Accordingly, the CA No.20 of 2012 is dismissed. However, CA<br />

No.21 of 2012 will be heard along with main petition on 12 th<br />

March 2012 at 10.30 A.M.”<br />

17. The High Court by its order dated 21.12.2011 specifically<br />

directed this <strong>Bench</strong> to “consider the petition afresh on merits and<br />

in accordance with law after giving an opportunity to the<br />

appellant-petitioner to substantiate her challenge based on the<br />

additional documents”. Further the High Court directed at para<br />

10 which reads as “in the light of the agreed position before me,<br />

the <strong>Company</strong> <strong>Law</strong> <strong>Board</strong> should proceed on the basis that the<br />

36

CP NO.1 of 2008<br />

Storsack<br />

37<br />

application for production of additional documents has been<br />

granted by this court and that the appellant-petitioner can rely on<br />

those documents in support of her contentions and allegations in<br />

the main petition”. In view of the directions, the petitioner and the<br />

respondents were given opportunity to substantiate their case and<br />

accordingly ample opportunity was given to them to hear the<br />

matter on 23.1.2012, 13.2.2012, 20.2.2012 and on 12.3.2012.<br />

However, one Mr. Rajendra G. advocate representing the petitioner<br />

sought adjournment on 12.3.2012. The <strong>Bench</strong> refused to grant<br />

adjournment on the reason that the matter has to be disposed off in<br />

compliance of the directions of the High Court. The <strong>Bench</strong> is of<br />

the view that the petitioner intentionally attempting to delay the<br />

matter without any sufficient reason and also filed various<br />

applications. It was made clear to the parties that sufficient time<br />

was granted to the parties and no more time will be granted and the<br />

matter will be reserved for orders. Accordingly the matter was<br />

reserved for orders. It is high time to mention that the petitioner<br />

instead of assisting the CLB to comply the order of the High<br />

Court, tried to delay the same by filing various applications which<br />

itself is evident that she has least respect towards this <strong>Bench</strong>. The<br />

petitioner had placed the following citations in support of her case.<br />

viz. i) (2012) 18 Taxmann.com 40 (Delhi) In the matter of Ajay<br />

Paliwal Vs. Sanjay Paliwal at para 39 it is held. “Further this Court<br />

37

CP NO.1 of 2008<br />

Storsack<br />

38<br />

has compared the original admitted signatures of Mr. J. K. Paliwal<br />

on the company petition filed before CLB as well as on the<br />

aforesaid statement recorded by this Court on 16.9.2008 with the<br />

original form produced by the appellants and this court is of the<br />

view that there are significant differences in signatures of Mr. J. K.<br />

Paliwal on the transfer deed produced by the appellant.<br />

Constantly, the finding of the CLB with regard to this issue<br />

requires no interference. ii) (2010) 104 SCL 401 (Punjab &<br />

Haryana) In the matter of Jiwan Mehta Vs. EMM Bros. Forgings<br />

(P) Ltd. iii) (2005) 1 SCC 212 In the matter of Dale & Carrington<br />

Investment (P) Ltd. & another Vs. P.K. Prathapan & Ors. It was<br />

held “A company is a juristic person and it acts through its<br />

directors who are collectively referred to as the <strong>Board</strong> of directors.<br />

An individual director has no power to act on behalf of a company<br />

of which he is a director unless by some resolution of the <strong>Board</strong> of<br />

directors of the company specific power is given to him/her.<br />

18. After careful examination of pleadings, documents, citations<br />

and CA No.78 of 2010 along with documents and CA No.21 of<br />

2012 along with documents and citations relied upon by the<br />

respective counsel, the following issues are felt for consideration<br />

and the same need to be addressed:<br />

i. Whether the petition is maintainable?<br />

38

CP NO.1 of 2008<br />

Storsack<br />

39<br />

ii. Whether allotment of 4,25,000 shares of Rs.10/- each to the<br />

Respondent No.5 and 65,000 shares of Rs.10/- each to the<br />

Respondent No.2 is valid?<br />

iii. Whether removal of petitioner in an EOGM held on 31.3.2008<br />

pursuant to the alleged requisition dt.6.3.2008 is valid?<br />

iv. Whether appointment of Respondents 3, 4, & 6 as directors of<br />

R1 <strong>Company</strong> is valid?<br />

v. Whether any acts of oppression and mismanagement made out<br />

by the petitioner?<br />

vi. Even after taking into consideration the CA No.78 of 2010<br />

along with the additional documents whether the petitioner has<br />

made out any case either on oppression or mismanagement?<br />

vii. Whether the documents filed along with CA No.21 of 2012<br />

will have any bearing on the petition?<br />

viii. To what relief:<br />

Now I deal with the issue No.i):<br />

The Respondents raised a preliminary objection that the petition is<br />

not maintainable since she holds 1% of the total paid up share<br />

capital of the <strong>Company</strong>. Admittedly, the petitioner holds only<br />

5000 shares in the R1 <strong>Company</strong> which amounts to only 1% of the<br />

paid up share capital. However, the petitioner is challenging to the<br />

further allotment of shares in this petition, hence, the petition is<br />

39

CP NO.1 of 2008<br />

Storsack<br />

40<br />

maintainable. The CLB in several cases hold that when there is<br />

challenge to the further allotment of shares in the petition, even if<br />

the petitioner does not fulfill the criteria as enumerated under<br />

Sec.399 of the Act, is maintainable. I hold that the petition is<br />

maintainable. Hence, the issue is answered accordingly.<br />

Now I deal with the issue No.ii):<br />

The R1 <strong>Company</strong> was incorporated on 4 th December 2003. Prior<br />

to incorporation the 2 nd Respondent corresponded with the<br />

representative of the R5 <strong>Company</strong> vide e-mail dated 28 th October,<br />

2003 wherein the R2 put the proposal to start working together and<br />

incorporate a company in the name of Storsack India Limited in<br />

India. There are several e-mail correspondences between the 2 nd<br />

respondent and the representatives of the R5 <strong>Company</strong>. The R5<br />

and the R2 have entered a shareholders’ agreement dated 15 th<br />

December 2003 just after incorporation of the R1 <strong>Company</strong>. As<br />

per the shareholders’ agreement, the R1 company being<br />

established inter alia to manufacture, sale and carry on the business<br />

flexible intermediate bulk containers and container liners and allied<br />

products and the parties to this agreement agreed to become<br />

shareholders of the new company on the terms and conditions<br />

contained in that agreement. The R1 <strong>Company</strong> is represented by<br />

Respondent No.2 and R5 <strong>Company</strong> is represented by R3 for all the<br />

40

CP NO.1 of 2008<br />

Storsack<br />

41<br />

purposes in respect of the affairs of the <strong>Company</strong>. Thus, it is clear<br />

from the shareholders’ agreement that the Respondent No.5 will<br />

become a shareholder in the R1 <strong>Company</strong>. The Article ‘4’ of the<br />

shareholders’ agreement deals with the issue of shares. As per the<br />

said article, the shareholding pattern of the R1 <strong>Company</strong> will be as<br />

under:<br />

a) 85% of the initially issued and paid up share capital of the<br />

R1 <strong>Company</strong> shall be subscribed and held by R5 for cash<br />

at par.<br />

b) Balance 15% of the initially issued and paid up sharre<br />

capital of the R1 <strong>Company</strong> shall be subscribed and held by<br />

R2 and his associates for cash at par.<br />

Thus, it is clear from the shareholders’ agreement that 85% of the<br />

initially issued and paid up share capital shall be subscribed by the<br />

R5 and the balance 15% of the initially issued and paid up share<br />

capital shall be subscribed by the R2 and his associates. As per the<br />

Memorandum and Articles of the R1 <strong>Company</strong>, the authorized<br />

share capital is Rs.50 lacs divided into 5,00,000 equity shares of<br />

Rs.10/- each. The paid up share capital of the R1 company is<br />

Rs.1,00,000/- divided into 10,000 equity shares. To incorporate a<br />

private company minimum two persons are required, therefore the<br />

2 nd respondent and the petitioner initially subscribed to the<br />

41

CP NO.1 of 2008<br />

Storsack<br />

42<br />

Memorandum and was allotted 5,000 equity shares of Rs.10/- each.<br />

From the Authorized Capital, the company can further allot<br />

4,90,000 equity shares. As per Article 5 of the Articles of<br />

Association of the R1 company, the shares will be under the<br />

control of the <strong>Board</strong> who may allot or otherwise dispose off the<br />

same or any of them to such persons, in such proportion and on<br />

such terms and conditions and either at a premium or at a par<br />

subject to the provisions of Sec.79 of the Act at discount and at<br />

such times as they may think fit and proper. Thus it is clear from<br />

the articles of association, that the remaining un-allotted shares<br />

will be under the control of the <strong>Board</strong>. As per the share holders’<br />

agreement 85% of the issued and paid up share capital shall be<br />

subscribed by the Respondent No.5 and the balance 15% shall be<br />

subscribed by R2 and his associates. As per the terms and<br />

conditions of the agreement the Respondent No.1 company allotted<br />

4,25,000 shares to the R5 and 65,000 shares to R2 on 6.2.2004 and<br />

filed form 2 regarding return of allotment pursuant to Sec.75(1) of<br />

the Act with the ROC showing allotment of the said shares. With<br />

the said allotment of shares, the <strong>Company</strong> exhausted its paid up<br />

capital. To complete the formalities, the Respondent No.1<br />

<strong>Company</strong> issued share certificate to the R5 and it was signed by<br />

the petitioner and 2 nd Respondent along with the other signatory. It<br />

is also evident that the <strong>Company</strong> also received consideration on its<br />

42

CP NO.1 of 2008<br />

Storsack<br />

43<br />

allotment of shares to the respective parties. Moreover, the<br />

allotment of shares pertains to the year of 2004 and the petitioner is<br />

party to the said allotment and the company filed its returns for the<br />

year 2005, 2006, 2007 and the balance sheet as at 31.3.2004 which<br />

was signed by the petitioner showing the share capital and the<br />

shareholding pattern i.e. R5 holds 4,25,000 shares, R2 holds<br />

70,000 shares and the petitioner holds 5,000 shares. The petitioner<br />

being director is aware of the acts done by the company.<br />

Moreover, the acts pertain to the year 2004 and approaching this<br />

<strong>Bench</strong> in the year 2008 is belated and no cause of action shown by<br />

the petitioner. Further, having party to all the acts the petitioner<br />

cannot claim her ignorance and cannot volte face to mould the<br />

situation to her convenience. The petitioner is acquisioned to the<br />

acts. From the pleadings it is also clear that there are serious<br />

matrimonial difference between the petitioner and the R2. The<br />

<strong>Company</strong> being a legal entity will run by the <strong>Board</strong> of Directors<br />

who shall in a fiduciary duty to run the company in the best<br />

interest of the company and its shareholders and public at large.<br />

The family disputes should not be brought into the company’s<br />

affairs and the company should not be made a battle ground to<br />

settle their scores. From the letters it appears that the petitioner is<br />

addressing her letters to the <strong>Company</strong> from the year 2008 onwards<br />

only. There is no single document to show that the petitioner<br />

43

CP NO.1 of 2008<br />

Storsack<br />

44<br />

ventilated her grievance immediately after the allotment of shares<br />

to the Respondent 5 & 2 or appointment of Respondents 3, 4 & 6<br />

as directors. Moreover, the petitioner’s counsel vide his letter<br />

dated 25.2.2008 stated that his client was aghast to learn that<br />

4,25,000 shares were allotted to the R5 in the year 2004. The<br />

allegations, grievances of the petitioner is that the allotment of<br />

shares to the Respondents 5 and 2 is illegal, does not substantiate<br />

and is devoid of any merit and relied upon the citation of the Apex<br />

Court in the matter of Dale & Carrington. The Hon’ble Apex<br />

Court hold that in the matter of issue of shares, directors owe a<br />

fiduciary duty to the share holders of the company to issue shares<br />

for a proper purpose. In the present case the petitioner was the<br />

party to the meetings in which the allotment of shares was taken<br />

place. Further, all it has been done I accordance with the<br />

Memorandum of understanding/Agreement. Moreover, as stated<br />

supra, the petitioner has not raised any objection with regard to<br />

allotment of shares for quite a longer time. Therefore, this <strong>Bench</strong><br />

is of the firm view that the allotment of shares is done in<br />

accordance with law and there is no illegality found. Further, it is<br />

not the case of the petitioner that the <strong>Company</strong> has not received<br />

consideration from the parties and thereby the company was put to<br />

loss. In view of the reasons stated supra there is no substance in<br />

44

CP NO.1 of 2008<br />

Storsack<br />

45<br />

the allegations of the petitioner and the same are negated.<br />

Accordingly the issue is answered.<br />

Now I deal with the issue No.iii):<br />

As per the Memorandum and Articles the petitioner is the 1 st<br />

director of the company. It is the contention of the respondents<br />

that the petitioner is merely an ordinary director of the company<br />

and she has no other function or capacity in the company since its<br />

incorporation. It is also contended that the petitioner is only<br />

supposed to attend the <strong>Board</strong> Meetings as and when she is called<br />

upon to do so. It is a fact that the Respondent No.5 issued<br />

requisition letter dated March 6, 2008 under Sec. 284(2) read with<br />

Section 190 of the Companies Act, intending to move an ordinary<br />

resolution to remove the petitioner from the office of the director<br />

on the ground that various illegal and malicious acts being done by<br />

the petitioner as a result of which the business of the company is<br />

badly affected and seriously jeopardized its future profitability and<br />

existence. On receipt of the notice by the <strong>Company</strong>, the company<br />

issued notice dated 14 th March, 2008 calling EOGM on 31 st March<br />

2008 to remove the petitioner. The petitioner vide her letter dated<br />

14 th March, 2008 stated that she will attend the meeting under<br />

protest to mark her presence. From the perusal of correspondence<br />

it appears that there is no illegality in conducting the meeting after<br />

due notice to the parties. The R5 being 85% shareholder has right<br />

45

CP NO.1 of 2008<br />

Storsack<br />

46<br />

to call EOGM to transact the business to remove the petitioner.<br />

The petitioner was given opportunity to make her representation. I<br />

do not find any irregularity or illegality in conducting the meeting.<br />