PDF Download - Deutsche Bahn AG

PDF Download - Deutsche Bahn AG

PDF Download - Deutsche Bahn AG

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Deutsche</strong> <strong>Bahn</strong> <strong>AG</strong><br />

Potsdamer Platz 2<br />

D-10785 Berlin<br />

www.db.de<br />

<strong>Deutsche</strong> <strong>Bahn</strong> <strong>AG</strong> Competition Report 2005<br />

Competition<br />

Report 2005

Competition on German rail is working. This is<br />

eminently clear from the fourth Competition<br />

Report. Never before have so many railway companies<br />

used our infrastructure, have so many train<br />

path kilometres been travelled since <strong>Deutsche</strong> <strong>Bahn</strong><br />

<strong>AG</strong> was founded.<br />

This competition does the railway good – and we<br />

believe that this is not only the case in Germany. In<br />

2004, <strong>Deutsche</strong> <strong>Bahn</strong> <strong>AG</strong> carried more passengers<br />

and more freight than ever before, despite growing<br />

market shares of our competitors on rail. This is because the railway – in<br />

both the passenger and freight sector – has succeeded in winning back market<br />

shares from other transport modes.<br />

Competition will continue to increase. In the years 2006 and 2007, the<br />

European rail freight market will be opened up, followed by the rail passenger<br />

sector in 2010. Germany is well equipped to face these challenges, as<br />

competition is already in place in the national market. Germany is one of the<br />

trailblazers in the EU. Although that is good, it is not enough. The legislative<br />

body of the EU, first and foremost, has to promote free market access, to harmonise<br />

technical standards and legal provisions.<br />

Action is also urgently required in a number of fiscal matters. The different<br />

tax rates on mineral oil have led to international fuel tourism, a trend which<br />

is harmful from both the tax and the environmental point of view. The same<br />

is true of kerosene, which is still exempt from tax. These subjects are focal<br />

points in the debate on both intermodal and intramodal competition. The following<br />

report accordingly pays considerable importance to these issues.<br />

Hartmut Mehdorn<br />

Chairman of the Management Board and CEO of <strong>Deutsche</strong> <strong>Bahn</strong> <strong>AG</strong><br />

Foreword<br />

1

2<br />

Publisher<br />

<strong>Deutsche</strong> <strong>Bahn</strong> <strong>AG</strong><br />

Potsdamer Platz 2<br />

D-10785 Berlin<br />

Werner W. Klingberg,<br />

Group Spokesman (responsible for the contents)<br />

Editors<br />

Joachim Fried, Corporate Representative for<br />

European Affairs and Competition,<br />

Alexandra Bals, Competition and Regulatory Affairs<br />

Consultant, Copy Editor<br />

Alexandra Weiß, Corporate Communications<br />

Photos<br />

DB <strong>AG</strong>, except: Max Lautenschläger (Interview),<br />

Michael Stähle (page 14), European Parliament (page 28),<br />

picture-alliance (page 30), European Community (page 31)<br />

photothek/Imo (page 36), intalliance (page 37),<br />

SBB (page 40)<br />

Design and Layout<br />

KircherBurkhardt Editorial & Corporate<br />

Communication GmbH, Berlin (002404)<br />

Lithography<br />

highlevel GmbH, digitale mediaproduktion, Berlin<br />

Printers<br />

DB Services Technische Dienste GmbH,<br />

Akazienweg 9, 76287 Rheinstetten<br />

Please submit any suggestions or comments on this<br />

report to wettbewerbsbericht@bahn.de<br />

All information correct at January 2005<br />

Market and Competition<br />

Sights Set on the German Rail Market<br />

Germany leads the field in Europe 5<br />

2005 timetable suits customers’ wishes 8<br />

Rail transport continues to grow 10<br />

New challenges for long-distance rail 12<br />

International competition in regional transport 14<br />

Local public road transport market in motion 18<br />

Tighter margins in rail freight market 20<br />

Interview<br />

In Dialogue with a Scientific Expert<br />

“An isolated look at rail transport markets makes no economic sense.” 25<br />

Regulatory Policies<br />

Europe’s Railway Markets in Transition<br />

Competition needs fair conditions 29<br />

EU legislation should create equality 30<br />

Economic motives dominate EBA proceedings 32<br />

Special Areas of Discussion<br />

Setting New Rules for Fair Competition<br />

Go-ahead for alliances 37<br />

Disputed train path and station prices 38<br />

Rights and duties in case of vehicle pools 39<br />

Overview of Companies<br />

More than 300 Railways on the German Rail Network<br />

Increasingly international environment 41<br />

List of companies 43<br />

Increasingly fierce<br />

intermodal and<br />

intramodal<br />

competition in Europe.<br />

3

Sights Set on<br />

the German Rail Market<br />

Germany is one of the most attractive rail markets in Europe. No neighbouring country offers such<br />

good access conditions. Consequently, more and more national and international rail companies are<br />

trying to tap into the German market. The high number of licensed railway undertakings proves that<br />

the rail market is open to intensive competition. This chapter shows the current development status<br />

and looks at the special features of the different market segments.<br />

Germany leads the field in Europe<br />

According to the “Rail Liberalisation Index 2004” (LIB), Germany once again leads<br />

the European field in terms of market opening – irrespective of implementation of the<br />

First EU Railway Package. In a whole number of other aspects, such as the configuration<br />

of institutional regulation, Germany again assumes a model role throughout<br />

Europe. France, on the other hand, still has one of the most impenetrable rail transport<br />

markets in Europe, despite the fact that it has notified implementation of the<br />

First Railway Package and has institutionally separated infrastructure and transport.<br />

The excellent access conditions in Germany facilitate market entry for foreign rail<br />

companies. In addition to the large French transport groups, other major international<br />

transport companies such as Arriva, Hupac, SBB and the Luxembourg railways CFL<br />

are all active in Germany (see chart on p. 6).<br />

The second Liberalisation Index, following the first version of 2002, analyses the<br />

legal and de facto market access opportunities. It investigates the extent to which the<br />

European rail markets in the enlarged EU had opened up by spring 2004. The analysis<br />

also includes Norway and Switzerland.<br />

Free entry to neighbouring countries – a target pursued by only a few<br />

Another finding was that some of the new EU Member States have lower market<br />

access barriers than many of their old counterparts. On their accession to the EU,<br />

however, Hungary and Poland were granted special rights with regard to opening up<br />

their rail freight markets. In fact, Poland recently applied to the European Commission<br />

not only for an extension of these special rights, but to have the entire liberalisation<br />

timetable decelerated.<br />

The findings of the Liberalisation Index were confirmed by “The EU Transport<br />

Policy White Paper: An assessment of progress”, compiled by the Institute for Transport<br />

Studies of Leeds University and headed by Professor Chris Nash. The authors<br />

document the extent to which the targets of the European Commission’s 2001<br />

Transport White Paper have meanwhile been implemented. The development of competition<br />

in the European rail market was a focal point of this critical report.<br />

Conclusion: there is great divergence in the progress made towards liberalisation in<br />

Europe and the most radical reforms in the rail sector have been made in the United<br />

Kingdom, Sweden and Germany, i.e. those countries which also form the leading<br />

group in the “Rail Liberalisation Index 2004”.<br />

Market and Competition<br />

The progress made in opening up the European rail market differs from country to country. In addition<br />

to the UK, Sweden and Germany, the leading nations also include the Netherlands, Denmark, Italy,<br />

Switzerland and Portugal. These findings are also confirmed by the latest Liberalisation Index.<br />

“We have long since<br />

brought French politicians<br />

to Germany to see<br />

for themselves that<br />

competition works.”<br />

Stéphane Richard,<br />

Connex General Manager<br />

5

6<br />

Germany offers excellent access conditions in line with its role as railway hub in the enlarged EU.<br />

“Our activities in Germany<br />

and Italy compensate for<br />

the losses in our domestic<br />

market. Competition is<br />

now a routine feature on<br />

the north-south corridor.”<br />

Daniel Nordmann,<br />

Head of SBB Cargo<br />

Alongside aspects of intramodal competition, the study also analyses the framework<br />

conditions of intermodal competition. It concludes that the European legal framework<br />

for the allocation of infrastructure costs is inadequate:<br />

for years, only the railway has been obliged to charge prices according to the userpays<br />

principle. Although there is a proposal to change the system for road traffic, it is<br />

disappointing with regard to the inclusion of external costs; moreover, it is not certain<br />

whether the proposal will ever be adopted. No progress whatsoever can be reported<br />

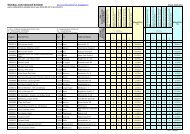

A selection of international transport companies shows that on a European scale,<br />

most are active in Germany.<br />

Country of<br />

origin<br />

United Kingdom Arriva<br />

France<br />

France<br />

France<br />

France<br />

Switzerland<br />

Switzerland<br />

Luxembourg<br />

Germany<br />

Undertaking Type of<br />

transport Denmark<br />

Connex (Veolia)<br />

Keolis (SNCF)<br />

RATP<br />

Transdev<br />

Hupac<br />

SBB<br />

CFL<br />

DB<br />

RPT<br />

RFT<br />

RPT<br />

RFT<br />

RPT<br />

RFT<br />

RPT<br />

RFT<br />

RPT<br />

RFT<br />

RPT<br />

RFT<br />

RPT<br />

RFT<br />

RPT<br />

RFT<br />

RPT<br />

RFT<br />

Germany<br />

France<br />

*<br />

United<br />

Kingdom<br />

Italy<br />

Netherlands<br />

Sweden<br />

Spain<br />

Czech<br />

Republic<br />

* Licence only, not yet active; RPT = rail passenger transport; RFT = rail freight transport; Source: own data<br />

Germany holds top position in terms of market opening<br />

Rail Liberalisation Index 2004: monopolistic structures still exist in many European countries<br />

United Kingdom<br />

Sweden<br />

Germany<br />

Netherlands<br />

Denmark<br />

Italy<br />

Switzerland<br />

Portugal<br />

Norway<br />

Austria<br />

Poland<br />

Czech Republic<br />

Finland<br />

Latvia<br />

Luxembourg<br />

Belgium<br />

Slovakia<br />

Hungary<br />

Slovenia<br />

France<br />

Estonia<br />

Lithuania<br />

Greece<br />

Ireland<br />

Spain<br />

Results of the LIB Index 2004<br />

Market opening<br />

on schedule<br />

delayed pending<br />

departure<br />

Market and Competition<br />

Number<br />

of licensed<br />

RUs<br />

32<br />

17<br />

300<br />

15<br />

6<br />

33<br />

30*<br />

2<br />

1<br />

11<br />

22<br />

8<br />

1<br />

6<br />

1<br />

2<br />

18<br />

2<br />

1<br />

3<br />

4<br />

5<br />

1<br />

1<br />

1<br />

Network length<br />

of largest RIU<br />

in km<br />

16,700<br />

9,900<br />

36,000<br />

2,300<br />

2,300<br />

16,000<br />

3,000**<br />

3,000<br />

4,000<br />

5,700<br />

20,000<br />

9,500<br />

5,800<br />

2,300<br />

300<br />

3,500<br />

3,700<br />

7,700<br />

1,200<br />

29,000<br />

1,000<br />

1,800<br />

2,400<br />

2,000<br />

13,000<br />

* Number of RUs with access to federal infrastructure, ** +240 kilometres BLS, RU = railway undertaking, RIU = rail infrastructure undertaking<br />

Source: Liberalisation Index 2004 and UIC Statistics<br />

for the other transport modes. This unequal, fragmentary development is all the more<br />

incomprehensible as the Commission had already announced the introduction of a<br />

framework directive for the cross-carrier apportionment of infrastructure costs in its<br />

2001 Transport White Paper, with the aim of stimulating fair competitive conditions<br />

between the different transport modes. Moreover, the previous attempts to harmonise<br />

energy taxation lag far behind the necessary changes. Even existing taxation potential<br />

has still not been utilised to date.<br />

Websites:<br />

“Rail Liberalisation Index 2004”; IBM Business Consulting Services and Prof. Christian Kirchner:<br />

www.europa.eu.int/comm/transport/rail/market/doc/lib2004-en.pdf<br />

“The EU Transport Policy White Paper”: www.cer.be/files/ITS%20Study_EN-120818A.pdf<br />

7

8<br />

The provisions of the Railway Infrastructure Usage Regulations (EIBV) apply to all railways without exception for timetable compilation.<br />

2005 timetable suits customers’ wishes<br />

The steadily growing operating performance by non-DB railways is proof of the good access conditions<br />

to the German rail network. Almost all train path applications submitted by customers could be satisfied.<br />

There were no grounds for official complaints.<br />

Last year, operating performance by non-DB railways on<br />

<strong>Deutsche</strong> <strong>Bahn</strong> infrastructure rose once again. Compared<br />

with 2003, it increased by 25 per cent to 87.8 million<br />

train path kilometres. More than 60 per cent of that performance<br />

refers to regional transport and around 30 per<br />

cent to freight transport.<br />

Only 76 of 8,707 applications could not be granted<br />

Compared with 2003, there was a slight drop (–1.1<br />

per cent) in the number of train path applications submitted<br />

by all railways for the 2005 timetable. The share<br />

of non-DB railways simultaneously rose from 16 to 19<br />

per cent. Nonetheless, the number of train path conflicts<br />

involving other railways which could not be resolved fell<br />

from 1.9 per cent the previous year to 1.1 per cent (93<br />

cases), despite new planning and quality parameters<br />

introduced by DB Netz, which in some cases meant<br />

changes in journey and connecting times for the railways.<br />

The new parameters are aimed at improving punctuality.<br />

DB Netz failed to offer a train path in response to only<br />

76 of the 8,707 applications by non-DB railways. There<br />

were no official complaints. These 76 cases refer to the<br />

following applications:<br />

Following an invitation to tender by a forwarding<br />

company, several bidders duly applied for 45 train paths<br />

on the Italy – Switzerland – Ruhr area – Benelux/Scandinavia<br />

corridor. This led to overlaps, as the train paths<br />

applied for exceeded the number actually required. Not<br />

all the applications could be fully granted. The contracts<br />

for the tender package were awarded to several applicants.<br />

One applicant cancelled some of the requested<br />

train paths, as they had lost their traffic importance as a<br />

result of the contract award configuration. Another<br />

bidder, who also won part of the tender, then submitted<br />

a new application for the consequently now available<br />

capacity.<br />

Another railway undertaking had applied for ten train<br />

paths on the Italy – Netherlands route for potential<br />

transports by the same forwarder – a duplicate order, as<br />

the railway already used these train paths on the same<br />

route and was consequently competing with itself. It<br />

could therefore only be given one offer from DB Netz for<br />

the ten train paths it had used to date.<br />

One railway undertaking ordered three freight train<br />

paths for the Lübeck – Meimersdorf route. The individual<br />

slots could not be provided as regular-interval regional<br />

services already uses virtually the full capacity of the<br />

single-track Lübeck – Kiel route. The regular-interval<br />

timetable demanded by the regional and local transport<br />

orderer would otherwise have had to be disrupted. Enabling<br />

train crossings at the station would also have meant<br />

either shortening the freight train or modifying the infrastructure.<br />

Only a night-time train path could be offered<br />

on an alternative route and this did not satisfy the applicant’s<br />

requirements, so that DB Netz did not make an<br />

offer. In accordance with the train path allocation priorities<br />

specified in the General Terms and Conditions of<br />

Railway Infrastructure Usage of DB Netz <strong>AG</strong> (ABN) and<br />

the General Railway Act (AEG), regular-interval regional<br />

traffic enjoys priority, as it makes regular use of the infrastructure.<br />

This case was referred to the Eisenbahn-Bundesamt<br />

(Federal Railway Office), which endorsed the<br />

decision by DB Netz.<br />

In recent years, a railway company applied for 18 train<br />

paths for ferry transport to the island of Sylt. In 2003,<br />

the Federal Railway Office already ruled that the transport<br />

interest of this company is not significant. Especially<br />

in view of the lack of rolling stock, it was doubtful whether<br />

the announced service would actually be implemented<br />

in 2004. DB Netz decided on the basis of train path<br />

allocation priorities and in this case did not offer a train<br />

path.<br />

Flexibility demanded from all parties<br />

Preparing the annual timetable is a highly complex<br />

undertaking and the requested train paths have to be<br />

adjusted constantly to obtain a workable version. That is<br />

the only way to meet practically all customers’ wishes. It<br />

is not just a question of forming practicable train paths,<br />

but also ensuring minimum traction and personnel<br />

expenses for the operating company. DB Netz consequently<br />

also advises the railway undertakings at the planning<br />

stage. In freight operations in particular, additional<br />

railway assets are required locally for loading, unloading<br />

and train formation.<br />

The relevant infrastructure has to be available at the<br />

required times and linked with inward and outward train<br />

path. DB Netz amended its ABN in January 2005 to<br />

Market in motion<br />

100<br />

80<br />

60<br />

40<br />

20<br />

13.3<br />

Market and Competition<br />

Since 1998, performance by non-DB railways on DB infrastructure<br />

has increased more than sixfold. (All figures in million train path<br />

kilometres)<br />

1998<br />

20.4<br />

1999<br />

26.0<br />

2000<br />

39.0<br />

2001<br />

50.1<br />

2002<br />

70.3<br />

2003<br />

Most train path applications for 2005 satisfied<br />

Despite increasing applications by non-DB railways, the share of<br />

non-realised train paths remains negligibly low.<br />

40<br />

30<br />

20<br />

10<br />

46,045 46,782 46,283<br />

39,642<br />

6,403<br />

2003<br />

39,139<br />

2.1 1.9<br />

7,643<br />

2004<br />

37,576<br />

8,707<br />

2005<br />

87.8<br />

2004<br />

Total applications<br />

Applications<br />

<strong>Deutsche</strong> <strong>Bahn</strong><br />

Share of non-realised<br />

train paths for non-DB<br />

railways (in per cent)<br />

Applications<br />

non-DB<br />

railways<br />

include provisions governing the use of sidings, which<br />

now have to be ordered by the railway undertakings.<br />

They are allocated according to available capacities and<br />

operators have the option of shared use. Special provisions<br />

apply if a siding is used predominantly by one operator.<br />

In that case, the company has to notify DB Netz of<br />

the occupation times so that other companies can also<br />

use the sidings at short notice when they are free.<br />

1.1<br />

Source: own data<br />

Source: own data<br />

9

10<br />

Rail transport continues to grow<br />

In a growing overall market, rail freight transport succeeded in raising its share to 16.9 per cent.<br />

Although the conditions for passenger transport were less favourable, the rail mode booked a slight<br />

increase despite a generally declining market.<br />

Upswing While rail passenger transport volume rose, growth for inner-<br />

German air traffic slowed down.<br />

2004 saw a consolidation of the slight upturn in the German<br />

economy. In real terms, gross domestic product was<br />

approx. 1.7 per cent up on the previous year. After<br />

adjustment for the difference in working days, this equalled<br />

an increase of 1.1 per cent. The positive economic<br />

trend can be attributed primarily to growth in the export<br />

surplus. The domestic economy, on the other hand,<br />

remained weak: continuing uncertainty amongst both<br />

investors and consumers adversely affected domestic<br />

investment activities and private consumption. The poor<br />

labour market and low income development led to a<br />

slight decline in private consumer expenditure compared<br />

with the preceding year. In real terms, retail sales also<br />

declined by a good 1.5 per cent in 2004, with the trend<br />

again poorer than private consumption as a whole.<br />

Rail passenger transport increases market shares<br />

Transport performance (in passenger kilometres) in the<br />

German passenger transport market declined by approx.<br />

one per cent, which was only around half the drop<br />

sustained the year before (–2.1 per cent). These figures<br />

take into account private motorised transport, as well as<br />

rail, public road transport and inner-German air traffic.<br />

This shows a continuous downturn for the passenger<br />

transport market, which has now declined for the fifth<br />

year in succession. As in the previous years, the decline is<br />

due primarily to the negative trend in private motorised<br />

transport (–1.5 per cent) . In addition to the weak overall<br />

economic development, the sharp increase in fuel prices<br />

again had a negative effect. 1 For the second time running,<br />

the railway’s share was up on the previous year and<br />

amounted to 8.6 per cent in 2004.<br />

Demand for public road transport rose by 0.6 per cent<br />

and was thus slightly higher than in 2003, when growth<br />

had been just 0.2 per cent. This positive trend can be<br />

attributed primarily to increased volumes in regular<br />

transport services, whereas demand for non-regular services<br />

was stagnant.<br />

Slower growth for inner-German air traffic<br />

Growth in the inner-German air traffic sector substantially<br />

lost pace during the year under review, achieving a<br />

rate of just 1.3 per cent compared with almost five per<br />

cent in 2003. Growth for domestic lines was thus slower<br />

than for the international air sector. By 2002, most of the<br />

lucrative routes were already served by low-cost airlines,<br />

which were therefore unable to repeat the strong growth<br />

achieved in 2003.<br />

Freight transport profits from good economic climate<br />

Thanks to positive impetus from the economic environment,<br />

transport performance in the overall German<br />

market – rail, inland waterway and road – enjoyed<br />

strong growth in the year under review. With an increase<br />

of around six per cent, growth more than trebled compared<br />

with the 1.7 per cent of the preceding year.<br />

Despite ongoing fierce intermodal competition, the<br />

transport volume in the German rail freight market rose<br />

once again. With a good eight per cent increase, growth<br />

was far stronger than in 2003, when it amounted to just<br />

4.7 per cent. The market share of rail freight increased at<br />

the expense of inland shipping.<br />

After growth of 3.1 per cent in 2003, road freight<br />

transport increased by a good five per cent. This figure<br />

does not include German local truck traffic or foreign<br />

trucks. The monthly growth rates in cross-border traffic<br />

were as high as 30 per cent in some cases. This was<br />

boosted above all by strong foreign trade and the EU enlargement<br />

to the east. Foreign truck traffic was one of the<br />

main beneficiaries of these developments. Negative impetus<br />

came from the continuing weak situation in the building<br />

trade, although the overall downturn slowed down in<br />

that sector.<br />

After poor performance during the first six months of<br />

2004, inland shipping transport volumes showed substantial<br />

growth during the second half: transports which<br />

had had to be cancelled owing to the low water levels in<br />

2003 now accounted for growth in the following year.<br />

However, the approx. 9.5 per cent increase in transport<br />

volume does not fully compensate for the absolute losses<br />

of 2003.<br />

1) Taking into account the review of car transport volume for the years<br />

1994 to 2003 presented by the German Institute of Economic Research<br />

(DIW), traffic volume trends for private car transport, and thus in the overall<br />

market, have been substantially better since 1999 than previously indicated<br />

in the official statistics. However, owing to several methodological<br />

weaknesses in calculation of the traffic volume by DIW, the non-revised<br />

values still serve as a basis.<br />

Market and Competition<br />

Passenger transport trends<br />

Economic climate provided hardly any positive impetus for the<br />

passenger market. (Change from previous year in per cent)<br />

gainfully employed -1.0<br />

nominal disposable<br />

income<br />

private consumption<br />

-real-<br />

0.0<br />

fuel price<br />

+1.2<br />

-0.3<br />

+0.3<br />

+1.3<br />

+4.6 +4.4<br />

2003 2004*<br />

Modal split – the rail share rose slightly in 2004. (Figures in per cent)<br />

Basis: Transport performance<br />

1.0<br />

8.6<br />

81.7<br />

1.0<br />

8.2<br />

82.2<br />

1.1<br />

8.7<br />

8.7<br />

2001<br />

2002<br />

Freight transport trends<br />

8.3<br />

81.7<br />

8.9<br />

2003<br />

8.6<br />

1.1<br />

81.3<br />

9.0<br />

2004*<br />

Building investments -3.2 -2.5<br />

2003 2004*<br />

Rail<br />

Air<br />

Private car<br />

Public road<br />

transport<br />

Economic climate provided mainly positive impetus for the freight<br />

market. (Change from previous year in per cent)<br />

Processing industry 0.2 3.1<br />

Automobile industry 2.1 5.0<br />

Crude steel (in tonnes) -0.4 3.6<br />

Modal split – the rail share rose slightly in 2004. (Figures in per cent)<br />

Basis: Transport performance<br />

16.3<br />

69.9<br />

13.8<br />

2001<br />

16.1<br />

70.4<br />

16.5<br />

71.4<br />

16.9<br />

70.7<br />

Rail<br />

Road<br />

13.5<br />

12.1<br />

12.4 Barge<br />

2002<br />

2003 2004*<br />

* Estimate, source: Stat. Bundesamt (Fed. Statistical Office),<br />

Kraftfahrt-Bundesamt (Fed. Office for Motor Traffic) and own data<br />

11

12<br />

New challenges for long-distance rail<br />

Low-cost airlines are thronging onto the European market. Offering attractive prices, they compete with<br />

the relevant rail connections. DB has successfully launched new products in response to the increasingly<br />

challenging market conditions facing the long-distance rail sector.<br />

In 2004, <strong>Deutsche</strong> <strong>Bahn</strong> again managed to raise its longdistance<br />

transport volume to a figure of 32.3 billion passenger<br />

kilometres, which corresponds to an increase of<br />

2.2 per cent on the preceding year. In 2003, the transport<br />

volume had dropped by 4.7 per cent despite a marked<br />

reduction in fares (see specific fare revenues in the chart).<br />

This development was achieved primarily by adjusting<br />

the product range, for instance to accommodate increased<br />

demand for regional services.<br />

Improved punctuality, attractive special offers and<br />

more services on the Cologne – Rhine/Main new-build<br />

line more than compensated for the adverse effects of the<br />

weak labour market and poor income trends last year.<br />

However, the company has still not achieved the 2001<br />

figures again (see chart on right).<br />

No growth for competitors<br />

Although no official figures are yet available on longdistance<br />

transport performance by other railways in<br />

2004, according to press reports one competitor suffered<br />

a drastic decline in the number of passengers carried in<br />

2004, which fell by more than 100,000 to 371,000.<br />

Last year, DB’s competitors did not expand their product<br />

range. Considering the increasingly fierce intermodal<br />

competition, it remains to be seen whether they will be<br />

able to do so. Apart from <strong>Deutsche</strong> <strong>Bahn</strong>, only Georg<br />

Verkehrsorganisation and Connex currently offer individual<br />

routes in eastern Germany.<br />

In December 2004, Connex was forced to adjust its<br />

services as in some cases there was not sufficient demand<br />

to enable non-subsidised operations. It discontinued the<br />

Cottbus – Berlin line. One pair of trains now runs between<br />

Dresden and Berlin three times a week.<br />

The planned extension of the Interconnex Rostock –<br />

Gera route to Adorf could not be effected for the time<br />

being. This would have entailed changing individual<br />

regional transport train paths on the single-track line in<br />

favour of Interconnex. No agreement could be reached<br />

with the orderer. Zweckverband Vogtland had agreed to<br />

subsidise Connex with a figure of EUR 280,000 per<br />

annum, initially until the end of 2006<br />

Direct competition with low-cost airlines<br />

As a result of the low-cost airlines now flooding the<br />

European market, the product range expanded substantially<br />

in 2003, especially on inner-German routes. DB<br />

Fernverkehr is faced with a sharp increase in intermodal<br />

competition on important routes such as Cologne –<br />

Hamburg, where the Metropolitan lost some 30 per cent<br />

of demand immediately after the launch of the low-cost<br />

airline route. A study conducted by Münster University 1<br />

in July 2003 and Institut d’Economie Industrielle (IDEI)<br />

in Toulouse 2 in October 2004 confirm severe substitution<br />

effects from rail to air.<br />

The DB long-distance division has to respond to this<br />

changing competitive environment and also cope with the<br />

special challenges in the German market. The longdistance<br />

rail sector is not only at a disadvantage in terms<br />

of taxes and infrastructure costs. Special circumstances<br />

make it difficult to respond adequately: the population<br />

Difficult market environment for DB Fernverkehr<br />

Following the slump in 2003, both transport performance and fare<br />

revenues increased in 2004. (Figures for DB Fernverkehr scheduled<br />

daytime services in per cent, index 100 = 1998. To enable a<br />

comparison of transport performance (p km), these have been<br />

adjusted by operating performance (train path kilometres = t p km)<br />

120<br />

115<br />

110<br />

105<br />

100<br />

95<br />

transport<br />

performance<br />

p km/t p km<br />

specific<br />

fare revenues<br />

euro cent/p km<br />

1998 1999 2000 2001 2002 2003 2004*<br />

* Provisional, source: own data<br />

Long-distance rail market faces fierce intermodal competition.<br />

structure in Germany demands a high number of stops to<br />

serve long-distance travel requirements. In some cases,<br />

the public demands stops which make no economic sense<br />

and moreover extend the journey times. The situation in<br />

France is completely different, where non-stop services<br />

with correspondingly high speeds are possible to and<br />

from Paris as the dominant metropolis.<br />

Framework conditions affect price structures<br />

These numerous intermediate stops also limit <strong>Deutsche</strong><br />

<strong>Bahn</strong>’s pricing leeway. A low-price offer for the Cologne<br />

– Berlin route, for example, would then have to include<br />

even lower prices for all parts of journey along that route<br />

(e.g. Cologne – Hanover). Such far-reaching low fares<br />

would not be economically acceptable. Low-cost airlines,<br />

on the other hand, have far more flexibility when it<br />

comes to pricing because there is no need to consider<br />

passengers boarding or disembarking along a flight route.<br />

This means that low-cost airlines can offer finely differentiated,<br />

aggressively promoted loss leaders on routes<br />

with interesting passenger volumes. The customer decides<br />

which transport mode to use on the basis of the most<br />

attractive fare.<br />

DB Fernverkehr has nevertheless initiated various activities<br />

and established a good market position. Campaigns<br />

such as the Summer Special, special international fare<br />

offers and <strong>Bahn</strong>&Bett show how <strong>Deutsche</strong> <strong>Bahn</strong> can suc-<br />

Market and Competition<br />

ceed even in this new intermodal competitive environment.<br />

This changing situation is not a short-term trend,<br />

but a phenomenon that is here to stay. It is clear from the<br />

US reference market that the low-cost airline sector can<br />

survive for decades. Despite several consolidation phases,<br />

the market shares of the low-cost airlines in the USA continued<br />

to grow despite constant pressure on prices.<br />

In Germany, for example, Air Berlin has just placed a<br />

firm order for 60 Airbus planes, announcing a vast<br />

expansion in capacity. An increasingly dense network is<br />

also emerging for the European market, where airlines<br />

are using regional airports to expand their product range<br />

beyond the original core routes. This indicates that competition<br />

will continue to intensify in this sector, too.<br />

When reassessing the legal framework for long-distance<br />

rail transport, it is therefore vital to pay much more<br />

attention to the intermodal competitive situation. The<br />

railways are particularly keen to ensure harmonisation of<br />

the fiscal conditions for the individual transport modes.<br />

1) Meffert, Grunberg, Nießing: “Akzeptanz von Billigfliegern –<br />

Bedrohungspotenzial und Handlungsempfehlungen für den<br />

Personenverkehr der <strong>Deutsche</strong>n <strong>Bahn</strong> <strong>AG</strong>”, July 2003<br />

2) Friebel: “Intermodal Competition in the Transportation Market –<br />

The Entry of the Low-Cost Airlines in Germany”, October 2004<br />

13

14<br />

More than 50 railway undertakings now offer regional transport services.<br />

International competition in regional transport<br />

In 2004, the Federal Laender and orderers have continued to promote the transition towards competition in<br />

regional transport. As well as discretionary transportation contract awards, tenders and price inquiries are<br />

now common practice. Moreover, international groups are successfully buying their way into the market.<br />

In 2004, the market share of <strong>Deutsche</strong> <strong>Bahn</strong> competitors<br />

in terms of ordered train performance (train kilometres)<br />

rose to 11.9 per cent. That is the greatest increase ever<br />

made in one year. It is estimated that this transport volume<br />

involves revenues of more than 700 million euros. In<br />

terms of transport performance (passenger kilometres),<br />

the competitors also booked substantial growth, from 1.7<br />

to 2.1 billion passenger kilometres. Their share of the<br />

total regional and local rail passenger transport performance<br />

thus rose from 4.3 per cent in 2003 to more than<br />

five per cent last year.<br />

More contracts awarded through tenders<br />

In 2004, DB Regio and DB Stadtverkehr (Berlin rapid<br />

transit) were awarded six transportation contracts in<br />

discretionary procedures for an initial volume of approx.<br />

215 million train kilometres. During the term of the contracts,<br />

individual lines or sections will be released from<br />

the contract package and re-awarded by the Laender authorities<br />

and orderers in competitive procedures. Hence<br />

the number of tender procedures will continue to rise in<br />

the coming years. Transportation contracts awarded in<br />

discretionary procedures were not only signed with DB.<br />

Three more contracts for around two million train kilometres<br />

were awarded to Lausitzbahn and Sächsisch-Böhmische<br />

Eisenbahn on a discretionary basis.<br />

In 2004, the Laender authorities and orderers awarded<br />

far more transport services via invitations to tender and<br />

price inquiries than in any previous year, for a total of<br />

almost 27 million train kilometres. A further six contracts<br />

from 2004 for 6.6 million train kilometres had still not<br />

been decided by the beginning of this year. A clear increase<br />

in the number of tender procedures is again expect-<br />

ed for 2005, with 19 tenders anticipated for a volume of<br />

more than 40 million train kilometres.<br />

If DB wishes to defend its regional transport market<br />

share of more than 70 per cent , it will have to improve<br />

its present success rate of 45 per cent substantially. Based<br />

on the current rate, its market share would first fall below<br />

the 50 per cent mark in the year 2015, if all transportation<br />

contracts are in future awarded through tender procedures<br />

and price inquiries.<br />

Arriva established in the German market<br />

Whereas competitors previously sought access to regional<br />

transport in Germany mainly through tenders or<br />

discretionary contract awards, 2004 showed signs that<br />

they are now buying up other companies to achieve that<br />

goal. This policy enabled Arriva to secure a successful<br />

place in the German transport market within just a few<br />

months. The British transport group, which booked revenues<br />

of approx. 2.5 billion euros in 2003, is meanwhile<br />

the third-largest provider of regional transport services,<br />

after DB and Connex.<br />

In spring 2004, Arriva took over Prignitzer Eisenbahn<br />

Holding <strong>AG</strong>, enabling the British group to operate regional<br />

services in Berlin/Brandenburg, Mecklenburg-Western<br />

Pomerania and North Rhine-Westphalia through Prignitzer<br />

Eisenbahngesellschaft and its 50 per cent subsidiary<br />

Ostdeutsche Eisenbahn. In autumn 2004, it also took<br />

over Regentalbahn <strong>AG</strong>. Arriva paid more than 60 million<br />

euros for 76.9 per cent of the shares, which were previously<br />

owned by the Free State of Bavaria. Regentalbahn<br />

<strong>AG</strong> and its subsidiaries Regental <strong>Bahn</strong>betriebsgesellschaft<br />

and Vogtlandbahn run regional services in Bavaria, Saxony<br />

and Thuringia. As a result of these transactions, Arriva<br />

gained influence over an annual transport volume of<br />

around ten million train kilometres.<br />

The takeover of Prignitzer Eisenbahn meant a further<br />

drop in the market share held by small and medium-sized<br />

enterprises (SME) railways. International transport corporations,<br />

most of them listed on the stock exchange,<br />

now account for almost half of all train performance by<br />

other railways.<br />

The second major group that competes with DB involves<br />

municipal and Land-owned railways, which account<br />

for more than 40 per cent of the market. As from<br />

December 2005, Abellio – whose majority shareholder is<br />

Essener Versorgungs- und Verkehrsgesellschaft – will be<br />

the next municipal railway to offer regional services.<br />

Market and Competition<br />

Success rates in competitive bids<br />

Five companies won more than three quarters of all train<br />

performance contracts*. (Figures in per cent)<br />

Basis: 114.6 million train kilometres 1995-2004<br />

4.5<br />

4.5<br />

21.9<br />

7.1<br />

17.0<br />

44.9<br />

DB Regio<br />

Connex<br />

Arriva<br />

Hessische Landesbahn<br />

Hamburger Hochbahn<br />

other railways<br />

* Train performance by bidding syndicates/joint ventures allocated to the<br />

groups in accordance with their shares.<br />

Source: own data<br />

Train performance trends<br />

The market shares of non-DB railways continue to grow steadily.<br />

(Figures in million train kilometres*)<br />

591<br />

38<br />

553<br />

6.4<br />

2000<br />

Total<br />

non-DB railways<br />

<strong>Deutsche</strong> <strong>Bahn</strong><br />

Market share of<br />

non-DB railways<br />

(in per cent)<br />

Transport performance trends<br />

The market shares of non-DB railways continue to grow steadily.<br />

(Figures in billion passenger kilometres)<br />

39.2<br />

1.0<br />

38.2<br />

2.6<br />

2000<br />

599<br />

49<br />

550<br />

8.2<br />

2001<br />

40.4<br />

1.3<br />

39.1<br />

3.2<br />

2001<br />

604<br />

52<br />

552<br />

8.6<br />

2002<br />

38.2<br />

1.5<br />

36.7<br />

3.9<br />

2002<br />

619<br />

61<br />

558<br />

9.9<br />

2003<br />

628<br />

553<br />

Total<br />

* In contrast to previous Competition Reports, the figures for <strong>Deutsche</strong> <strong>Bahn</strong> show the train<br />

performance actually rendered (incl. special transports). Previous reports showed the<br />

contractually agreed figures. A review of train performance by competitors has led to<br />

corrections.<br />

** Estimate Source: Stat. Bundesamt (Fed. Statistical Office) and own data<br />

75<br />

11.9<br />

2004**<br />

39.6<br />

1.7<br />

37.9<br />

4.3<br />

2003<br />

633<br />

84<br />

549<br />

13.2<br />

2005**<br />

40.1<br />

2.1<br />

37.9<br />

5.3<br />

2004**<br />

Source: own data<br />

non-DB railways<br />

<strong>Deutsche</strong> <strong>Bahn</strong><br />

Market share of<br />

non-DB railways<br />

(in per cent)<br />

15

16<br />

Regional transport market shares of DB and its competitors in 2004<br />

The transition to a competitive market is effected solely by the Federal Laender and orderers. (Figures in per cent)<br />

Basis: train kilometres<br />

Market shares<br />

Rhineland-<br />

Palatinate<br />

7 93<br />

Saarland<br />

6<br />

94<br />

11<br />

Bremen<br />

North-Rhine<br />

Westphalia<br />

8 92<br />

Schleswig-<br />

Holstein<br />

Competitors under 5%<br />

Competitors between 10% and 15%<br />

Competitors between 5% and 10% Competitors over 15%<br />

89<br />

8<br />

Hesse<br />

30<br />

92<br />

Baden-<br />

Württemberg<br />

26<br />

74<br />

70<br />

Lower Saxony<br />

17<br />

83<br />

26<br />

Hamburg<br />

6<br />

Thuringia<br />

5<br />

94<br />

2<br />

Saxony-<br />

Anhalt<br />

74<br />

Bavaria<br />

95<br />

Mecklenburg-<br />

West. Pomerania<br />

24 76<br />

98<br />

<strong>Deutsche</strong> <strong>Bahn</strong><br />

Competitors<br />

17<br />

Berlin-<br />

Brandenburg<br />

2 98<br />

Saxony<br />

83<br />

Source: own data<br />

Contract awards in regional transport in 2004<br />

Contract award procedure New contract<br />

Market and Competition<br />

Contract Federal Previous million Term<br />

awarded Land<br />

in<br />

Procedure Network/Routes operator Operator train km Begins (years)<br />

Jan. 04 BW Tender Schwarzwaldbahn DB Regio DB Schwarzwaldbahn 3.1 Dec. 06 10<br />

Jan. 04 BW Tender Seehas EuroThurbo<br />

on behalf of<br />

DB Regio<br />

EuroThurbo 1.1 Dec. 06 10<br />

March 04 MV Price inquiry Bergen – Lauterbach Karsdorfer Ostmecklenburgische 0.1 March 04 3<br />

Mole Eisenbahn Eisenbahn<br />

March 04 ST, NI Tender,<br />

Negotiation<br />

Nordharz DB Regio Connex Verkehr 2.8 Dec. 05 12<br />

March 04 BE, BB Tender Heidekrautbahn DB Regio Niederbarnimer<br />

Eisenbahn<br />

0.7 Dec. 05 15<br />

April 04 ST Tender Altmark-Börde-Anhalt DB Regio DB Harzbahn 3.4 Dec. 06 12<br />

May 04 SL Discretionary DB-routes in Saarland DB Regio DB Regio 6.4* Dec. 04 14<br />

May 04 ST Discretionary Leipzig – Geithain DB Regio Lausitzbahn 0.5 Dec. 04 3<br />

June 04 SH, HH Tender Flensburg-Express Nord-Ostsee- DB Regionalbahn 1.0 Dec. 05 9<br />

<strong>Bahn</strong> Schleswig-Holstein<br />

July 04 ST Tender Sachsen-Anhalt Süd Burgenlandbahn Burgenlandbahn 1.6 Dec. 06 12<br />

July 04 NW Discretionary DB-routes in Verkehrsverbund<br />

Rhein-Ruhr<br />

DB Regio NRW DB Regio NRW 40.9* Dec. 03 15<br />

July 04 NW Discretionary DB-routes in Nahverkehrsverbund<br />

Niederrhein<br />

DB Regio NRW DB Regio NRW 3.1* Dec. 03 15<br />

Aug. 04 BE, BB Discretionary S-<strong>Bahn</strong>-network Berlin S-<strong>Bahn</strong> Berlin S-<strong>Bahn</strong> Berlin 32.4* Jan. 03 15<br />

Aug. 04 BE, BB Discretionary Regional transport of<br />

DB in Berlin and<br />

Brandenburg<br />

DB Regio DB Regio 35.0* Dec. 02 10<br />

Oct. 04 SN, BB Discretionary Zittau – Cottbus Lausitzbahn Lausitzbahn 1.2 Dec. 05 3<br />

Nov. 04 BY Discretionary Regional transport of DB Regio DB Regio 98.1* Jan. 03 11**<br />

DB in Bavaria and S-<strong>Bahn</strong> S-<strong>Bahn</strong><br />

S-<strong>Bahn</strong>-network<br />

Munich and Nuremberg<br />

München München<br />

Nov. 04 NW Price inquiry Emscher-Ruhrtal-Netz<br />

(Essen – Hagen)<br />

DB Regio Abellio 0.6 Dec. 05 2<br />

Nov. 04 NW Price inquiry Emscher-Ruhrtal-Netz<br />

(Bochum – Essen)<br />

DB Regio Abellio 0.4 Dec. 05 12<br />

Dec. 04 HE, NI, Tender Nordost-Hessen-Netz DB Regio Hessische Landes- 3.6 Dec. 06 10<br />

TH bahn, Hamburger<br />

Hochbahn<br />

Dec. 04 SN Discretionary Zittau – Eibau Sächsisch- Sächsisch 0.2 Dec. 05 3<br />

Böhmische Böhmische<br />

Eisenbahn Eisenbahn<br />

Dec. 04 NW, NI Tender Teutoburger-Wald-Netz DB Regionalbahn<br />

Westfalen<br />

Westfalenbahn*** 4.0 Dec. 07 10<br />

Dec. 04 HE, BW Tender Odenwaldbahn DB Regio Verkehrsgesellschaft<br />

Frankfurt,<br />

Rurtalbahn<br />

1.8 Dec. 05 10<br />

Dec. 04 NI Tender Uelzen – Göttingen DB Regio metronom 2.8 Dec. 05 8<br />

* Performance volume drops owing to cancellations during contract term<br />

** Contract term for S-<strong>Bahn</strong>-network 15 years<br />

*** Award announced, not yet final Source: own data<br />

17

18<br />

Integrated products facilitate access to local public transport.<br />

Local public road transport market in motion<br />

The economic requirements of public road transport are becoming more and more stringent. The providers<br />

are therefore opting for joint ventures, mergers or selling shares in the company. Foreign companies<br />

are exploiting this trend for their own expansion purposes.<br />

The local public road transport market refers primarily<br />

to scheduled tram, bus and underground services. With a<br />

revenue volume of 13.5 billion euros including public<br />

compensation payments, this market is larger than the<br />

rail passenger sector. However, it is much more fragmented:<br />

whereas 35 ordering organisations are responsible<br />

for regional and local rail passenger transport, local road<br />

passenger transport is the responsibility of 440 municipal<br />

duty holders. The provider structure is equally fragmentary:<br />

there are currently 270 municipal transport companies<br />

providing urban transport services. In rural Germany,<br />

in addition to some 100 municipal transport companies,<br />

there are more than 2,000 private providers. With a<br />

market share of eight per cent – in terms of revenues –<br />

<strong>Deutsche</strong> <strong>Bahn</strong> is just one actor amongst many in this<br />

sector.<br />

Seizing the opportunities of a changing market<br />

Compensation payments are being drastically cut back<br />

all over Germany. According to an extrapolation by the<br />

Association of German Transport Undertakings, the cut-<br />

backs in school transport resulting from the Koch-Steinbrück<br />

plan will amount to approx. 120 million euros per<br />

annum as from 2006. Additional cost pressure results<br />

from the fact that some Federal Laender are increasingly<br />

awarding contracts through tenders or direct awards at<br />

reduced prices. The primary driving factor for this development<br />

is the tight public budget situation.<br />

The local public road transport market is in motion as<br />

companies prepare to face the competition by imposing<br />

strict restructuring programmes. Joint ventures and mergers<br />

are intended to facilitate access to capital and exploit<br />

synergies and thus enable the providers to cope with the<br />

pressure to raise efficiency. This frequently entails hiving<br />

off corporate divisions, leading to another form of competition<br />

in this market. This is no longer a question of<br />

individual transport lines or sections, but of transport<br />

companies and their franchises. At the end of December,<br />

for example, the British Arriva company applied to the<br />

Federal Cartel Office to take over the entire shares in Sippel,<br />

a medium-sized bus company. The stakes held by the<br />

French Connex group in Verkehrsgesellschaft Görlitz and<br />

Niederschlesische Verkehrsgesellschaft, or by Keolis,<br />

another French company, in Niederrheinische Verkehrsbetriebe<br />

<strong>AG</strong> in Moers show that competition for local<br />

and regional networks in Germany has long since assumed<br />

international dimensions.<br />

Concentration on the European markets<br />

Oligopolies have already formed in other European<br />

countries, where only a few providers control the markets:<br />

Arriva, Connex and City-Trafik are dominant in<br />

Denmark, for example, as are Connex and Keolis in Sweden.<br />

Local public road transport in the United Kingdom<br />

is provided by Arriva and just four other companies,<br />

while Connex and Keolis have shaped the French market<br />

together with Transdev/RATP.<br />

Germany is also expected to undergo such a concentration<br />

process. The increasing presence of international<br />

transport corporations shows how attractive they consider<br />

the German road transport market. Connex holds<br />

shares in 23 urban transport companies, while the French<br />

Keolis has six subsidiaries in the bus sector. After taking<br />

over the Sippel group, Arriva has now also gained a foothold<br />

on the German bus market. Alongside municipal<br />

companies seeking to expand, such as Abellio and Hamburger<br />

Hochbahn, they currently rank amongst the most<br />

active market players.<br />

Hamburger Hochbahn heads for success<br />

The municipal company Hamburger Hochbahn boasts<br />

faster supra-regional growth than other companies.<br />

Cooperating with local partners, it operates rail transport<br />

on routes in Berlin/Brandenburg, Mecklenburg-Western<br />

Pomerania, Lower Saxony and Schleswig-Holstein. In the<br />

local public road transport sector, it is now active in Kiel,<br />

Lübeck, Wiesbaden and Fulda as well as its home market<br />

of Hamburg, making it one of the largest local transport<br />

companies in Germany. Coming from a protected home<br />

market, its expansion is based on extremely close product<br />

costing.<br />

Market structure 2004<br />

Market and Competition<br />

With a 71 per cent share, municipal companies currently dominate<br />

the German road transport market.<br />

Number of companies<br />

Total: 2,634<br />

European bus markets<br />

In other European countries, the market is dominated by a few large<br />

companies.<br />

United Kingdom<br />

Arriva<br />

FirstGroup<br />

Go-Ahead<br />

National Express<br />

Stagecoach<br />

Market share:<br />

almost 70%<br />

France<br />

Transdev/RATP<br />

Keolis<br />

Connex<br />

Market share: 80%<br />

2,260 private companies*<br />

3 companies owned/partly owned by<br />

foreign companies<br />

370 municipal transport companies<br />

1<br />

DB Stadtverkehr GmbH<br />

Market share (revenues)<br />

Total: 13.5 billion euros<br />

19%<br />

2%<br />

71%<br />

8%<br />

* companies mainly providing scheduled services, source: own data<br />

Sweden<br />

Swebus<br />

Busslink (Keolis)<br />

Linjebuss (Connex)<br />

Market share:<br />

over 50%<br />

Denmark<br />

Arriva<br />

Connex<br />

City-Trafik<br />

Market share: 75%<br />

Source: Ernst & Young, 2003<br />

19

The railways are setting up Europe-wide transport networks geared to market requirements.<br />

Tighter margins in rail freight market<br />

Although the freight railways have greatly increased transport performance, they are faced with fierce<br />

competition and consequently pressure on prices. This is aggravated by the better conditions for road<br />

freight transport. The railways see growth potential above all in the international segment.<br />

2004 was a successful year for the freight railways: with a<br />

provisional volume of almost 86.4 billion tonne kilometres,<br />

performance was a good eight per cent up on 2003.<br />

Railion Deutschland managed to raise the previous year’s<br />

good figures even further, with performance up a good<br />

five per cent to 77.6 billion tonne kilometres. With a<br />

growth of 50 per cent, competitors of Railion Deutschland<br />

again boasted a significant increase in rail transport<br />

performance.<br />

Cheaper fuel across the border<br />

Different price benefits for forwarders who buy their fuel in neighbouring<br />

EU countries.<br />

EU Member State Price saving in euros<br />

per litre 900-litre tank<br />

Denmark 0.01 9<br />

France 0.10 90<br />

Netherlands 0.12 108<br />

Czech Republic 0.13 117<br />

Belgium 0.17 153<br />

Austria 0.17 153<br />

Poland 0.27 243<br />

Luxembourg 0.29 261<br />

Their market share now amounts to around ten per cent.<br />

This positive trend does not change the fact that the railways<br />

face increasing intra- and intermodal competition,<br />

and thus growing pressure on prices. In its latest market<br />

report, the Federal Office for Freight Traffic notes that<br />

competition is meanwhile routine in the block train segment.<br />

Apart from competition amongst the freight railways<br />

themselves, sinking margins in rail freight can be attributed<br />

to competition with road haulage. The delayed introduction<br />

of the electronic toll system for heavy goods<br />

vehicles in Germany and abolition of the Eurovignette as<br />

from 2004 reduced the costs of road transport. In addition,<br />

more and more German road haulage companies<br />

now purchase their fuel in neighbouring European countries,<br />

where prices are substantially lower. Fuel accounts<br />

for approx. 20 per cent of the total costs of truck transport,<br />

so that their level has a decisive impact on competitiveness.<br />

The EU enlargement to the east has led to more competition<br />

with road haulage companies from Central and<br />

Eastern Europe, whose costs are far lower. The previous<br />

long waits – sometimes for days – at the borders have now<br />

also been reduced, so that the prices for road transport<br />

with the new EU Member States and also on other routes<br />

have been reduced by up to 20 per cent. The EU accession<br />

has also brought advantages for trucks from these countries<br />

in terms of fuel costs, as the import limit of 200 litres<br />

of duty-free fuel no longer applies. With tank capacities of<br />

more than 900 litres and the consequent transport ranges,<br />

trucks from Central and Eastern Europe can now make the<br />

most of their cost advantages not only in cross-border<br />

transports, but also in the transit segment.<br />

The introduction of tolls for truck traffic in Germany<br />

was a first important step towards harmonising the competitive<br />

circumstances in the transport market. However, the<br />

tolls will not significantly raise prices in the freight sector,<br />

as forwarders will be able to compensate for the additional<br />

costs almost fully by purchasing fuel in other countries and<br />

increasing productivity, for instance by better capacity utilisation.<br />

This will not close the gap between the price competitiveness<br />

of road and rail. The situation is particularly<br />

serious in the new Member States, where train path prices<br />

are up to four times higher than in e.g. Germany, making<br />

rail freight transport correspondingly more expensive (see<br />

chart on p. 22). We therefore cannot expect to see any<br />

significant shift of transport volume from road to rail.<br />

Freight railways expand international routes<br />

Numerous companies have pushed ahead with the internationalisation<br />

of rail freight transport, expanding their<br />

networks in two different ways: by founding subsidiaries<br />

in foreign countries, and by joint ventures with foreign<br />

partners. These are aimed at improving cross-border transport<br />

chains and offering an efficient alternative to road<br />

transport. Through traction without time-consuming<br />

change of locomotive and driver at the border lowers costs<br />

and reduces transport times. Offering through transport<br />

services as a one-stop shop and with just one provider<br />

responsible for the entire chain corresponds to the demand<br />

from shippers.<br />

The expansion of international transports continues to<br />

focus on block train connections running from the Dutch<br />

and Belgian ports through Germany and on to Switzerland,<br />

Austria and Italy. In this segment, there is competition<br />

between for example TX Logistik with subsidiaries in<br />

Austria, Switzerland and Sweden, and Rail4chem with subsidiaries<br />

in Switzerland and the Netherlands. In 2004, Railion<br />

acquired interests in the private Italian railways Strade<br />

Market and Competition<br />

Transport trends in the rail freight market<br />

2004 again saw a clear increase in freight transport.<br />

(Change from previous year in per cent)<br />

Basis: tonne kilometres<br />

+52.6 +50.0<br />

2003 2004*<br />

* Estimate, source: Fed. Statistical Office and own data<br />

20 21<br />

Rail total<br />

Railion Deutschland<br />

other railways<br />

+4.7 +8.2<br />

+2.1 +5.0<br />

Compensation potential for road tolls<br />

Companies which succeed in raising productivity and buying cheaper<br />

fuel will suffer only a slight impact from road tolls.<br />

Fuel purchased in the Netherlands*<br />

(price difference 0.12 euros/litre)<br />

100%<br />

Cost level<br />

2004<br />

110.2%<br />

Toll effect<br />

2005 excl.<br />

compensation<br />

105.2%<br />

101.3%<br />

Toll effect 2005 Toll effect +<br />

incl. compen- compensation +<br />

sation fuel purchase abroad<br />

Fuel purchased in Poland* (price difference 0.27 euros/litre)<br />

100%<br />

Cost level<br />

2004<br />

+1.3%<br />

-3.5%<br />

110.2%<br />

Toll effect<br />

2005 excl.<br />

compensation<br />

105.2%<br />

-3.9%<br />

-8.7%<br />

96.5%<br />

Toll effect 2005 Toll effect +<br />

incl. compen- compensation +<br />

sation fuel purchase abroad<br />

* German trucks, 40 t articulated truck on long-distance routes,<br />

mileage 135,000 km, motorway share 90 %, consumption 34 l/100 km;<br />

Index 100 = 2004 Source: own data

22<br />

Railion optimises cross-border rail transports.<br />

Ferrate del Mediterraneo and Rail Traction Company to<br />

expand its range of products for transit traffic through<br />

Switzerland and Austria. Together with BLS Cargo, Railion<br />

now carries freight destined for Switzerland and Italy<br />

on the Lötschberg-Simplon route. After obtaining the<br />

appropriate Swiss safety certificate, Railion has also been<br />

able to run services on the Gotthard route since December<br />

2004.<br />

Train path prices for freight trains differ greatly<br />

12<br />

10<br />

8<br />

6<br />

4<br />

2<br />

SBB Cargo has succeeded in substantially raising its<br />

transport performance abroad. In Germany, the company<br />

has increased the number of trains fourfold to 320 per<br />

week and raised performance in Italy fivefold, to 210<br />

trains per week. One reason for this higher volume is<br />

that SBB Cargo now runs international trains on its own<br />

responsibility along the entire route, as against previous<br />

practice where it handled only the Swiss leg. SBB Cargo<br />

also won tenders from combined transport operators.<br />

Technical obstacles for international transports<br />

High train path prices, especially in Central and Eastern Europe, are jeopardising rail’s competitive position.<br />

(Figures in euros/train path kilometres for 1,400-tonne freight trains)<br />

Prorail-Netherlands<br />

RFF-France<br />

SNCB-Belgium<br />

Banverket-Sweden<br />

RFI-Italy<br />

Jernbanverket-Norway<br />

REFER-Portugal<br />

MAV-Hungary<br />

CFL-Luxembourg<br />

DB Netz-Germany<br />

Banestyreisen-Denmark<br />

The different electric current, signalling and train control<br />

systems in force in Europe pose a great challenge.<br />

Locomotives and drivers have to be licensed in the countries<br />

concerned. Licensing procedures vary greatly from<br />

country to country, are not transparent and are both timeconsuming<br />

and expensive.<br />

The licensing procedure for just one locomotive type<br />

can cost up to eight million euros. The time required to<br />

obtain a licence can also be considerable and differs<br />

greatly according to the individual country. While licensing<br />

takes less than six months in Switzerland, it requires<br />

more than 36 months in France. Such obstacles severely<br />

raise the costs of cross-border transports and are counterproductive<br />

to efforts to boost the railway’s competitiveness<br />

compared with road transport.<br />

RHK-Finland<br />

ÖBB-Austria<br />

CFR-Romania<br />

SBB-Switzerland<br />

SZ-Slovenia<br />

CD-Czech Republic<br />

PLK-Poland<br />

LDZ-Latvia<br />

ZSR-Slovakia<br />

LG-Lithuania<br />

NRIC-Bulgaria<br />

Source: Community of European Railways<br />

System borders in Europe<br />

Market and Competition<br />

The high number of different systems in Europe calls for standard and transparent licensing procedures<br />

for locomotives throughout Europe.<br />

Country Current systems<br />

Albania not electrified<br />

Austria 15 kV 16 2/3 Hz<br />

Belarus 25 kV 50 Hz<br />

Belgium 3 kV DC<br />

Bosnia & Herzegovina 25 kV 50 Hz<br />

Bulgaria 25 kV 50 Hz<br />

Croatia 3 kV DC 25 kV 50 Hz<br />

Czech Republic 3 kV DC 25 kV 50 Hz<br />

Denmark 25 kV 50 Hz<br />

Estonia 3 kV DC<br />

Finland 25 kV 50 Hz<br />

France 1.5 kV DC 25 kV 50 Hz<br />

Greece not electrified<br />

Germany 15 kV 16 2/3 Hz<br />

Hungary 25 kV 50 Hz<br />

Italy 3 kV DC<br />

Ireland not electrified<br />

Latvia 3 kV DC<br />

Lithuania 25 kV 50 Hz<br />

Luxembourg 25 kV 50 Hz<br />

Macedonia 25 kV 50 Hz<br />

Moldavia not electrified<br />

Netherlands 1.5 kV DC<br />

Norway 15 kV 16 2/3 Hz<br />

Poland 3 kV DC<br />

Portugal 25 kV 50 Hz<br />

Romania 25 kV 50 Hz<br />

Russia 3 kV DC 25 kV 50 Hz<br />

Slovakia 3 kV DC 25 kV 50 Hz<br />

Slovenia 3 kV DC 25 kV 50 Hz<br />

Spain 3 kV DC 25 kV 50 Hz<br />

Sweden 15 kV 16 2/3 Hz<br />

Switzerland 15 kV 16 2/3 Hz<br />

Ukraine 3 kV DC 25 kV 50 Hz<br />

United Kingdom 750 V DC 25 kV 50 Hz<br />

Yugoslavia 25 kV 50 Hz<br />

DC = direct current, Hz = hertz, kV = kilovolt Source: own data<br />

23

In Dialogue with<br />

a Scientific Expert<br />

Professor Hermann-Josef Bunte, antitrust expert and author of one of the most important<br />

commentaries on national and European antitrust law is interviewed by Joachim Fried,<br />

Competition Officer of <strong>Deutsche</strong> <strong>Bahn</strong> <strong>AG</strong>.<br />

“An isolated look at rail transport markets<br />

makes no economic sense.”<br />

FRIED: In order to determine whether a company controls the market, that market<br />

first has to be defined. However, the methods applied by the experts differ in that<br />

respect. Some regard the railway market as a nationally closed, uniform market –<br />

what is your opinion?<br />

BUNTE: It is wrong to regard rail-bound transport service as an isolated segment.<br />

The competition that exists with other transport modes must not be ignored on any<br />

account. The purpose of defining the market is to determine the competitive pressure<br />

imposed on the providers. To obtain a correct economic evaluation, the substitution<br />

relations between the railway and other transport modes have to be taken into<br />

account.<br />

FRIED: <strong>Deutsche</strong> <strong>Bahn</strong> has lost passengers to low-cost airlines. So do we have to<br />

include the competition between rail and air in the long-distance passenger sector?<br />

BUNTE: Definitely. This interaction is the best indication that it makes no sense to<br />

assess the rail transport markets as an isolated segment. The transport mode the passenger<br />

chooses depends on the price differences between the different providers. This<br />

has also been shown in a recent study by Toulouse University, which found a far higher<br />

cross-price elasticity in the demand for rail and air services than was previously<br />

suspected. What this really means is that the railway has to adjust its prices in response<br />

to the prices offered by the airlines if it is not to lose customers.<br />

FRIED: Does that mean we also have to include private motorised traffic when defining<br />

the long-distance market?<br />

BUNTE: Of course. It still holds good: a competitive situation between different<br />

transport modes has to be taken into account when defining the market. After all, as<br />

a potential consumer, I decide whether to take the car, train or plane. So I cannot pretend<br />

that these alternatives are not competing against each other. For instance, if I can<br />

fly from Hamburg to Salzburg and back for 50 euros with a low-cost airline, the railway<br />

can no longer compete unless it adjusts its prices. That is the market-reality.<br />

FRIED: And what about local transport?<br />

BUNTE: The private car is an alternative to bus or train in this sector and consequently<br />

imposes competitive pressure on these two transport modes. In terms of antitrust<br />

law, this has to be taken into account when defining the market, although the<br />

Federal Cartel Office does not do so. I believe that excluding the private car is a<br />

problem here.<br />

Interview<br />

<strong>Deutsche</strong> <strong>Bahn</strong> – market dominator or one provider among many? How realistic are the assessments of<br />

the Federal Cartel Office? How much leeway is left for the market? Hermann-Josef Bunte, an expert who<br />

has known the market for many years, takes a critical look at competition policies.<br />

“Market control cannot<br />

be determined merely<br />

by the number of trains<br />

operated.”<br />

Hermann-Josef Bunte<br />

25

26<br />

Prof. Dr. Hermann-Josef<br />

Bunte, born 1941, has taught at<br />

several universities, latterly private<br />

and economic law at the German<br />

Armed Forces University in<br />

Hamburg. He was a judge at<br />

Bielefeld Regional Court and at the<br />

Hanseatic Higher Regional Court.<br />

Since 2004 has been Of Counsel<br />

of the German antitrust law group<br />

of the international law firm<br />

Allen & Overy LLP.<br />

FRIED: In the regional and local public transport sector, the Federal Cartel Office<br />

defines strict regional markets. How do you view that approach?<br />

BUNTE: The whole point of monitoring mergers is to prevent companies from joining<br />

forces to obtain positions in which they control the market. Or from expanding<br />

such positions. However, the strict market definition of the Federal Cartel Office<br />

makes it more difficult, and in fact sometimes even prevents mergers and alliances in<br />

the local public transport sector which could be conducive to the market. Düsseldorf<br />

Higher Regional Court (“OLG”) does not share the reservations of the Cartel Office.<br />

In a recent ruling, it rejected the strict market definition applied by the Cartel Office,<br />

which will facilitate local transport alliances in future.<br />

FRIED: Which leaves market definition in the freight sector…<br />

BUNTE: In contrast to the passenger transport market, the Federal Cartel Office acknowledges<br />

the substitution relations in that market. And rightly so. In principle it<br />

makes no difference whether his freight is carried on rail, road, inland waterway or as<br />

airfreight. The crucial competitive criteria for freight transports are in fact compliance<br />

with deadlines, transport quality and freight rates. From the fundamental viewpoint,<br />

carriage on rail could easily be replaced by road haulage or inland waterway. That<br />

was also recognised by the EU Commission when it approved the merger of <strong>Deutsche</strong><br />

<strong>Bahn</strong> with Stinnes.<br />

FRIED: Is it still right to say that the <strong>Deutsche</strong> <strong>Bahn</strong> has a dominant position in any<br />

of the above markets, if the market is defined more loosely?<br />

BUNTE: Market dominance can certainly not be judged solely by the share of operated<br />

trains. One has to take into account the current competitive strength of the individual<br />

market players. As far as the local rail passenger market is concerned, high shares<br />

in terms of rail transport performance do not automatically mean that the company<br />

has a dominant position in the market. Effective competition exists if there are<br />

enough efficient providers available in the contract award procedure. OLG Düsseldorf<br />

rightly ruled that <strong>Deutsche</strong> <strong>Bahn</strong> does not control the local rail passenger market.<br />

FRIED: On what grounds?<br />