A Structural Model of Human Capital and Leverage - Duke ...

A Structural Model of Human Capital and Leverage - Duke ...

A Structural Model of Human Capital and Leverage - Duke ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

severance payment in the period he is laid <strong>of</strong>f. This assumption is made for tractability, since alternatively<br />

I would have to solve a dynamic consumption-savings problem with stochastic labor income. The severance<br />

payment as specified provides an upper bound on what the severance payment would have to be if the agent<br />

were to dynamically smooth his consumption. Rather than complicate the model by embedding a dynamic<br />

consumption-savings problem in the current framework, I perform sensitivity analysis by exogenously varying<br />

the severance payment to ensure that this assumption does not drive my results.<br />

4.2 Debt Market Equilibrium<br />

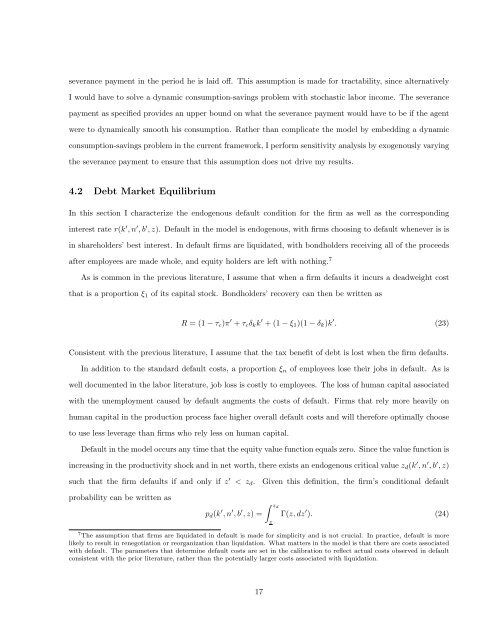

In this section I characterize the endogenous default condition for the firm as well as the corresponding<br />

interest rate r(k ′ , n ′ , b ′ , z). Default in the model is endogenous, with firms choosing to default whenever is is<br />

in shareholders’ best interest. In default firms are liquidated, with bondholders receiving all <strong>of</strong> the proceeds<br />

after employees are made whole, <strong>and</strong> equity holders are left with nothing. 7<br />

As is common in the previous literature, I assume that when a firm defaults it incurs a deadweight cost<br />

that is a proportion ξ1 <strong>of</strong> its capital stock. Bondholders’ recovery can then be written as<br />

R = (1 − τc)π ′ + τcδkk ′ + (1 − ξ1)(1 − δk)k ′ . (23)<br />

Consistent with the previous literature, I assume that the tax benefit <strong>of</strong> debt is lost when the firm defaults.<br />

In addition to the st<strong>and</strong>ard default costs, a proportion ξn <strong>of</strong> employees lose their jobs in default. As is<br />

well documented in the labor literature, job loss is costly to employees. The loss <strong>of</strong> human capital associated<br />

with the unemployment caused by default augments the costs <strong>of</strong> default. Firms that rely more heavily on<br />

human capital in the production process face higher overall default costs <strong>and</strong> will therefore optimally choose<br />

to use less leverage than firms who rely less on human capital.<br />

Default in the model occurs any time that the equity value function equals zero. Since the value function is<br />

increasing in the productivity shock <strong>and</strong> in net worth, there exists an endogenous critical value zd(k ′ , n ′ , b ′ , z)<br />

such that the firm defaults if <strong>and</strong> only if z ′ < zd. Given this definition, the firm’s conditional default<br />

probability can be written as<br />

pd(k ′ , n ′ , b ′ � zd<br />

, z) =<br />

z<br />

Γ(z, dz ′ ). (24)<br />

7 The assumption that firms are liquidated in default is made for simplicity <strong>and</strong> is not crucial. In practice, default is more<br />

likely to result in renegotiation or reorganization than liquidation. What matters in the model is that there are costs associated<br />

with default. The parameters that determine default costs are set in the calibration to reflect actual costs observed in default<br />

consistent with the prior literature, rather than the potentially larger costs associated with liquidation.<br />

17