2004 ANNUAL REPORT

2004 ANNUAL REPORT

2004 ANNUAL REPORT

- TAGS

- annual

- www.uic.edu

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

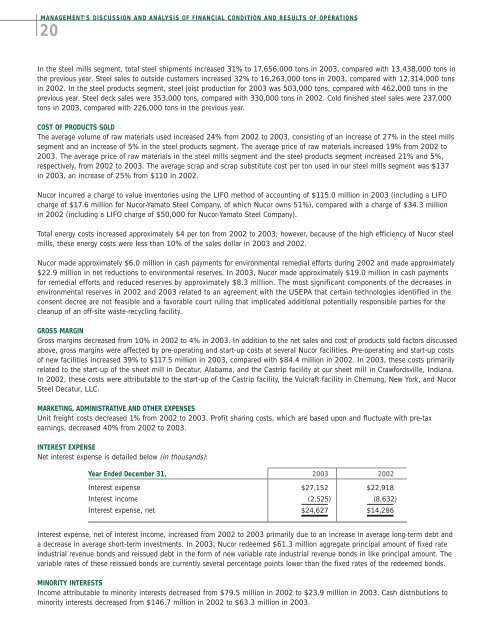

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS<br />

20<br />

In the steel mills segment, total steel shipments increased 31% to 17,656,000 tons in 2003, compared with 13,438,000 tons in<br />

the previous year. Steel sales to outside customers increased 32% to 16,263,000 tons in 2003, compared with 12,314,000 tons<br />

in 2002. In the steel products segment, steel joist production for 2003 was 503,000 tons, compared with 462,000 tons in the<br />

previous year. Steel deck sales were 353,000 tons, compared with 330,000 tons in 2002. Cold finished steel sales were 237,000<br />

tons in 2003, compared with 226,000 tons in the previous year.<br />

COST OF PRODUCTS SOLD<br />

The average volume of raw materials used increased 24% from 2002 to 2003, consisting of an increase of 27% in the steel mills<br />

segment and an increase of 5% in the steel products segment. The average price of raw materials increased 19% from 2002 to<br />

2003. The average price of raw materials in the steel mills segment and the steel products segment increased 21% and 5%,<br />

respectively, from 2002 to 2003. The average scrap and scrap substitute cost per ton used in our steel mills segment was $137<br />

in 2003, an increase of 25% from $110 in 2002.<br />

Nucor incurred a charge to value inventories using the LIFO method of accounting of $115.0 million in 2003 (including a LIFO<br />

charge of $17.6 million for Nucor-Yamato Steel Company, of which Nucor owns 51%), compared with a charge of $34.3 million<br />

in 2002 (including a LIFO charge of $50,000 for Nucor-Yamato Steel Company).<br />

Total energy costs increased approximately $4 per ton from 2002 to 2003; however, because of the high efficiency of Nucor steel<br />

mills, these energy costs were less than 10% of the sales dollar in 2003 and 2002.<br />

Nucor made approximately $6.0 million in cash payments for environmental remedial efforts during 2002 and made approximately<br />

$22.9 million in net reductions to environmental reserves. In 2003, Nucor made approximately $19.0 million in cash payments<br />

for remedial efforts and reduced reserves by approximately $8.3 million. The most significant components of the decreases in<br />

environmental reserves in 2002 and 2003 related to an agreement with the USEPA that certain technologies identified in the<br />

consent decree are not feasible and a favorable court ruling that implicated additional potentially responsible parties for the<br />

cleanup of an off-site waste-recycling facility.<br />

GROSS MARGIN<br />

Gross margins decreased from 10% in 2002 to 4% in 2003. In addition to the net sales and cost of products sold factors discussed<br />

above, gross margins were affected by pre-operating and start-up costs at several Nucor facilities. Pre-operating and start-up costs<br />

of new facilities increased 39% to $117.5 million in 2003, compared with $84.4 million in 2002. In 2003, these costs primarily<br />

related to the start-up of the sheet mill in Decatur, Alabama, and the Castrip facility at our sheet mill in Crawfordsville, Indiana.<br />

In 2002, these costs were attributable to the start-up of the Castrip facility, the Vulcraft facility in Chemung, New York, and Nucor<br />

Steel Decatur, LLC.<br />

MARKETING, ADMINISTRATIVE AND OTHER EXPENSES<br />

Unit freight costs decreased 1% from 2002 to 2003. Profit sharing costs, which are based upon and fluctuate with pre-tax<br />

earnings, decreased 40% from 2002 to 2003.<br />

INTEREST EXPENSE<br />

Net interest expense is detailed below (in thousands):<br />

Year Ended December 31, 2003 2002<br />

Interest expense $27,152 $22,918<br />

Interest income (2,525) (8,632)<br />

Interest expense, net $24,627 $14,286<br />

Interest expense, net of interest income, increased from 2002 to 2003 primarily due to an increase in average long-term debt and<br />

a decrease in average short-term investments. In 2003, Nucor redeemed $61.3 million aggregate principal amount of fixed rate<br />

industrial revenue bonds and reissued debt in the form of new variable rate industrial revenue bonds in like principal amount. The<br />

variable rates of these reissued bonds are currently several percentage points lower than the fixed rates of the redeemed bonds.<br />

MINORITY INTERESTS<br />

Income attributable to minority interests decreased from $79.5 million in 2002 to $23.9 million in 2003. Cash distributions to<br />

minority interests decreased from $146.7 million in 2002 to $63.3 million in 2003.