2004 ANNUAL REPORT

2004 ANNUAL REPORT

2004 ANNUAL REPORT

- TAGS

- annual

- www.uic.edu

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

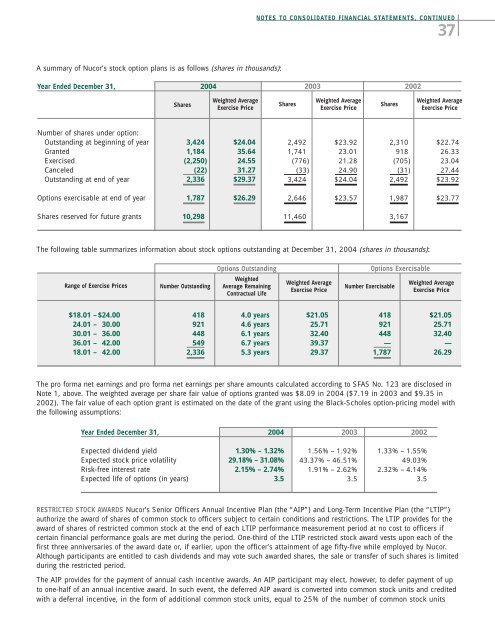

A summary of Nucor’s stock option plans is as follows (shares in thousands):<br />

Year Ended December 31,<br />

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS, CONTINUED<br />

37<br />

Number of shares under option:<br />

Outstanding at beginning of year 3,424 $24.04 2,492 $23.92 2,310 $22.74<br />

Granted 1,184 35.64 1,741 23.01 918 26.33<br />

Exercised (2,250) 24.55 (776) 21.28 (705) 23.04<br />

Canceled (22) 31.27 (33) 24.90 (31) 27.44<br />

Outstanding at end of year 2,336 $29.37 3,424 $24.04 2,492 $23.92<br />

Options exercisable at end of year 1,787 $26.29 2,646 $23.57 1,987 $23.77<br />

Shares reserved for future grants 10,298 11,460 3,167<br />

The following table summarizes information about stock options outstanding at December 31, <strong>2004</strong> (shares in thousands):<br />

Range of Exercise Prices<br />

Shares<br />

Number Outstanding<br />

<strong>2004</strong> 2003 2002<br />

Weighted Average<br />

Exercise Price<br />

The pro forma net earnings and pro forma net earnings per share amounts calculated according to SFAS No. 123 are disclosed in<br />

Note 1, above. The weighted average per share fair value of options granted was $8.09 in <strong>2004</strong> ($7.19 in 2003 and $9.35 in<br />

2002). The fair value of each option grant is estimated on the date of the grant using the Black-Scholes option-pricing model with<br />

the following assumptions:<br />

Year Ended December 31, <strong>2004</strong> 2003 2002<br />

Expected dividend yield 1.30% – 1.32% 1.56% – 1.92% 1.33% – 1.55%<br />

Expected stock price volatility 29.18% – 31.08% 43.37% – 46.51% 49.03%<br />

Risk-free interest rate 2.15% – 2.74% 1.91% – 2.62% 2.32% – 4.14%<br />

Expected life of options (in years) 3.5 3.5 3.5<br />

RESTRICTED STOCK AWARDS Nucor’s Senior Officers Annual Incentive Plan (the “AIP”) and Long-Term Incentive Plan (the “LTIP”)<br />

authorize the award of shares of common stock to officers subject to certain conditions and restrictions. The LTIP provides for the<br />

award of shares of restricted common stock at the end of each LTIP performance measurement period at no cost to officers if<br />

certain financial performance goals are met during the period. One-third of the LTIP restricted stock award vests upon each of the<br />

first three anniversaries of the award date or, if earlier, upon the officer’s attainment of age fifty-five while employed by Nucor.<br />

Although participants are entitled to cash dividends and may vote such awarded shares, the sale or transfer of such shares is limited<br />

during the restricted period.<br />

The AIP provides for the payment of annual cash incentive awards. An AIP participant may elect, however, to defer payment of up<br />

to one-half of an annual incentive award. In such event, the deferred AIP award is converted into common stock units and credited<br />

with a deferral incentive, in the form of additional common stock units, equal to 25% of the number of common stock units<br />

Shares<br />

Weighted Average<br />

Exercise Price<br />

Shares<br />

Options Outstanding Options Exercisable<br />

Weighted<br />

Average Remaining<br />

Contractual Life<br />

Weighted Average<br />

Exercise Price<br />

Number Exercisable<br />

Weighted Average<br />

Exercise Price<br />

Weighted Average<br />

Exercise Price<br />

$18.01 – $24.00 418 4.0 years $21.05 418 $21.05<br />

24.01 – 30.00 921 4.6 years 25.71 921 25.71<br />

30.01 – 36.00 448 6.1 years 32.40 448 32.40<br />

36.01 – 42.00 549 6.7 years 39.37 — —<br />

18.01 – 42.00 2,336 5.3 years 29.37 1,787 26.29