2004 ANNUAL REPORT

2004 ANNUAL REPORT

2004 ANNUAL REPORT

- TAGS

- annual

- www.uic.edu

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

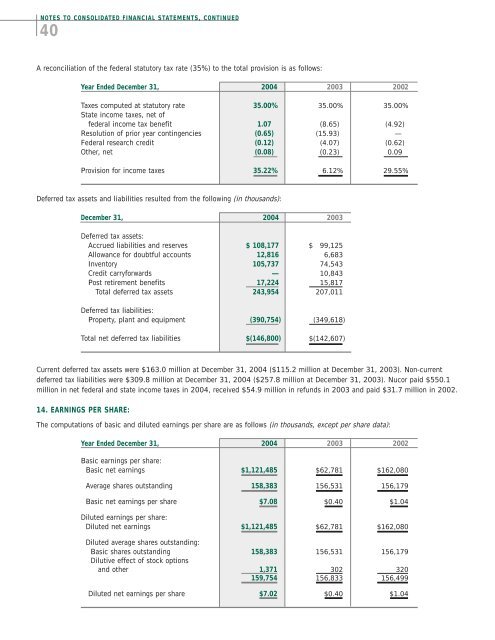

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS, CONTINUED<br />

40<br />

A reconciliation of the federal statutory tax rate (35%) to the total provision is as follows:<br />

Year Ended December 31, <strong>2004</strong> 2003 2002<br />

Taxes computed at statutory rate 35.00% 35.00% 35.00%<br />

State income taxes, net of<br />

federal income tax benefit 1.07 (8.65) (4.92)<br />

Resolution of prior year contingencies (0.65) (15.93) —<br />

Federal research credit (0.12) (4.07) (0.62)<br />

Other, net (0.08) (0.23) 0.09<br />

Provision for income taxes 35.22% 6.12% 29.55%<br />

Deferred tax assets and liabilities resulted from the following (in thousands):<br />

December 31, <strong>2004</strong> 2003<br />

Deferred tax assets:<br />

Accrued liabilities and reserves $ 108,177 $ 99,125<br />

Allowance for doubtful accounts 12,816 6,683<br />

Inventory 105,737 74,543<br />

Credit carryforwards — 10,843<br />

Post retirement benefits 17,224 15,817<br />

Total deferred tax assets 243,954 207,011<br />

Deferred tax liabilities:<br />

Property, plant and equipment (390,754) (349,618)<br />

Total net deferred tax liabilities $(146,800) $(142,607)<br />

Current deferred tax assets were $163.0 million at December 31, <strong>2004</strong> ($115.2 million at December 31, 2003). Non-current<br />

deferred tax liabilities were $309.8 million at December 31, <strong>2004</strong> ($257.8 million at December 31, 2003). Nucor paid $550.1<br />

million in net federal and state income taxes in <strong>2004</strong>, received $54.9 million in refunds in 2003 and paid $31.7 million in 2002.<br />

14. EARNINGS PER SHARE:<br />

The computations of basic and diluted earnings per share are as follows (in thousands, except per share data):<br />

Year Ended December 31, <strong>2004</strong> 2003 2002<br />

Basic earnings per share:<br />

Basic net earnings $1,121,485 $62,781 $162,080<br />

Average shares outstanding 158,383 156,531 156,179<br />

Basic net earnings per share $7.08 $0.40 $1.04<br />

Diluted earnings per share:<br />

Diluted net earnings $1,121,485 $62,781 $162,080<br />

Diluted average shares outstanding:<br />

Basic shares outstanding 158,383 156,531 156,179<br />

Dilutive effect of stock options<br />

and other 1,371 302 320<br />

159,754 156,833 156,499<br />

Diluted net earnings per share $7.02 $0.40 $1.04