2004 ANNUAL REPORT

2004 ANNUAL REPORT

2004 ANNUAL REPORT

- TAGS

- annual

- www.uic.edu

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

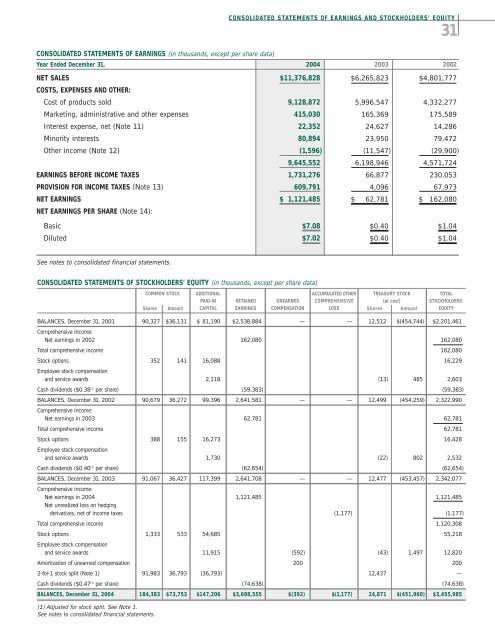

CONSOLIDATED STATEMENTS OF EARNINGS (in thousands, except per share data)<br />

Year Ended December 31, <strong>2004</strong> 2003 2002<br />

NET SALES $11,376,828 $6,265,823 $4,801,777<br />

COSTS, EXPENSES AND OTHER:<br />

Cost of products sold 9,128,872 5,996,547 4,332,277<br />

Marketing, administrative and other expenses 415,030 165,369 175,589<br />

Interest expense, net (Note 11) 22,352 24,627 14,286<br />

Minority interests 80,894 23,950 79,472<br />

Other income (Note 12) (1,596) (11,547) (29,900)<br />

9,645,552 6,198,946 4,571,724<br />

EARNINGS BEFORE INCOME TAXES 1,731,276 66,877 230,053<br />

PROVISION FOR INCOME TAXES (Note 13) 609,791 4,096 67,973<br />

NET EARNINGS $ 1,121,485 $ 62,781 $ 162,080<br />

NET EARNINGS PER SHARE (Note 14):<br />

Basic $7.08 $0.40 $1.04<br />

Diluted $7.02 $0.40 $1.04<br />

See notes to consolidated financial statements.<br />

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY (in thousands, except per share data)<br />

BALANCES, December 31, 2001<br />

Comprehensive income:<br />

90,327 $36,131 $ 81,190 $2,538,884 — — 12,512 $(454,744) $2,201,461<br />

Net earnings in 2002 162,080 162,080<br />

Total comprehensive income 162,080<br />

Stock options<br />

Employee stock compensation<br />

352 141 16,088 16,229<br />

and service awards 2,118 (13) 485 2,603<br />

Cash dividends ($0.38 (1) per share) (59,383) (59,383)<br />

BALANCES, December 31, 2002<br />

Comprehensive income:<br />

90,679 36,272 99,396 2,641,581 — — 12,499 (454,259) 2,322,990<br />

Net earnings in 2003 62,781 62,781<br />

Total comprehensive income 62,781<br />

Stock options<br />

Employee stock compensation<br />

388 155 16,273 16,428<br />

and service awards 1,730 (22) 802 2,532<br />

Cash dividends ($0.40 (1) per share) (62,654) (62,654)<br />

BALANCES, December 31, 2003<br />

Comprehensive income:<br />

91,067 36,427 117,399 2,641,708 — — 12,477 (453,457) 2,342,077<br />

Net earnings in <strong>2004</strong><br />

Net unrealized loss on hedging<br />

1,121,485 1,121,485<br />

derivatives, net of income taxes (1,177) (1,177)<br />

Total comprehensive income 1,120,308<br />

Stock options<br />

Employee stock compensation<br />

1,333 533 54,685 55,218<br />

and service awards 11,915 (592) (43) 1,497 12,820<br />

Amortization of unearned compensation 200 200<br />

2-for-1 stock split (Note 1) 91,983 36,793 (36,793) 12,437 —<br />

Cash dividends ($0.47 (1) per share) (74,638) (74,638)<br />

BALANCES, December 31, <strong>2004</strong> 184,383 $73,753 $147,206 $3,688,555 $(392) $(1,177) 24,871 $(451,960) $3,455,985<br />

(1) Adjusted for stock split. See Note 1.<br />

See notes to consolidated financial statements.<br />

CONSOLIDATED STATEMENTS OF EARNINGS AND STOCKHOLDERS’ EQUITY<br />

31<br />

COMMON STOCK ADDITIONAL<br />

ACCUMULATED OTHER TREASURY STOCK<br />

PAID-IN RETAINED UNEARNED COMPREHENSIVE<br />

(at cost)<br />

Shares Amount<br />

CAPITAL EARNINGS COMPENSATION LOSS<br />

Shares Amount<br />

TOTAL<br />

STOCKHOLDERS’<br />

EQUITY