2004 ANNUAL REPORT

2004 ANNUAL REPORT

2004 ANNUAL REPORT

- TAGS

- annual

- www.uic.edu

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

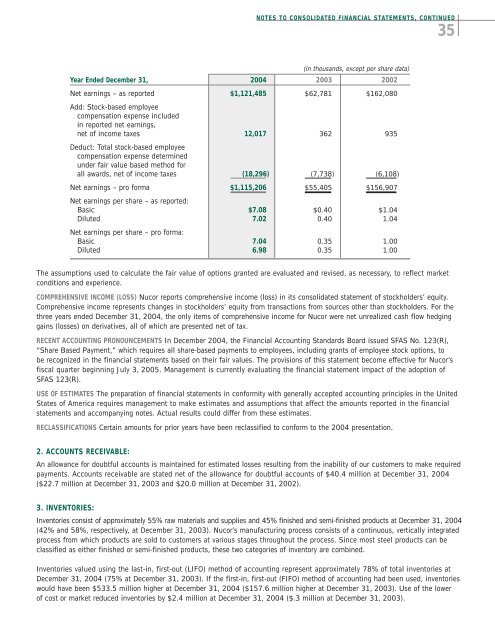

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS, CONTINUED<br />

35<br />

(in thousands, except per share data)<br />

Year Ended December 31, <strong>2004</strong> 2003 2002<br />

Net earnings – as reported<br />

Add: Stock-based employee<br />

compensation expense included<br />

in reported net earnings,<br />

$1,121,485 $62,781 $162,080<br />

net of income taxes 12,017 362 935<br />

Deduct: Total stock-based employee<br />

compensation expense determined<br />

under fair value based method for<br />

all awards, net of income taxes (18,296) (7,738) (6,108)<br />

Net earnings – pro forma $1,115,206 $55,405 $156,907<br />

Net earnings per share – as reported:<br />

Basic $7.08 $0.40 $1.04<br />

Diluted 7.02 0.40 1.04<br />

Net earnings per share – pro forma:<br />

Basic 7.04 0.35 1.00<br />

Diluted 6.98 0.35 1.00<br />

The assumptions used to calculate the fair value of options granted are evaluated and revised, as necessary, to reflect market<br />

conditions and experience.<br />

COMPREHENSIVE INCOME (LOSS) Nucor reports comprehensive income (loss) in its consolidated statement of stockholders’ equity.<br />

Comprehensive income represents changes in stockholders’ equity from transactions from sources other than stockholders. For the<br />

three years ended December 31, <strong>2004</strong>, the only items of comprehensive income for Nucor were net unrealized cash flow hedging<br />

gains (losses) on derivatives, all of which are presented net of tax.<br />

RECENT ACCOUNTING PRONOUNCEMENTS In December <strong>2004</strong>, the Financial Accounting Standards Board issued SFAS No. 123(R),<br />

“Share Based Payment,” which requires all share-based payments to employees, including grants of employee stock options, to<br />

be recognized in the financial statements based on their fair values. The provisions of this statement become effective for Nucor’s<br />

fiscal quarter beginning July 3, 2005. Management is currently evaluating the financial statement impact of the adoption of<br />

SFAS 123(R).<br />

USE OF ESTIMATES The preparation of financial statements in conformity with generally accepted accounting principles in the United<br />

States of America requires management to make estimates and assumptions that affect the amounts reported in the financial<br />

statements and accompanying notes. Actual results could differ from these estimates.<br />

RECLASSIFICATIONS Certain amounts for prior years have been reclassified to conform to the <strong>2004</strong> presentation.<br />

2. ACCOUNTS RECEIVABLE:<br />

An allowance for doubtful accounts is maintained for estimated losses resulting from the inability of our customers to make required<br />

payments. Accounts receivable are stated net of the allowance for doubtful accounts of $40.4 million at December 31, <strong>2004</strong><br />

($22.7 million at December 31, 2003 and $20.0 million at December 31, 2002).<br />

3. INVENTORIES:<br />

Inventories consist of approximately 55% raw materials and supplies and 45% finished and semi-finished products at December 31, <strong>2004</strong><br />

(42% and 58%, respectively, at December 31, 2003). Nucor’s manufacturing process consists of a continuous, vertically integrated<br />

process from which products are sold to customers at various stages throughout the process. Since most steel products can be<br />

classified as either finished or semi-finished products, these two categories of inventory are combined.<br />

Inventories valued using the last-in, first-out (LIFO) method of accounting represent approximately 78% of total inventories at<br />

December 31, <strong>2004</strong> (75% at December 31, 2003). If the first-in, first-out (FIFO) method of accounting had been used, inventories<br />

would have been $533.5 million higher at December 31, <strong>2004</strong> ($157.6 million higher at December 31, 2003). Use of the lower<br />

of cost or market reduced inventories by $2.4 million at December 31, <strong>2004</strong> ($.3 million at December 31, 2003).