The Evolution of Sales Models in the Indian Pharma ... - IMS Health

The Evolution of Sales Models in the Indian Pharma ... - IMS Health

The Evolution of Sales Models in the Indian Pharma ... - IMS Health

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Different companies have adopted different strategies, but<br />

<strong>the</strong> key reason cited for adapt<strong>in</strong>g <strong>the</strong>se changes rema<strong>in</strong>s<br />

<strong>the</strong> same: to provide better customer focus and target<strong>in</strong>g,<br />

enhance efficiencies, facilitate expansion to newer bus<strong>in</strong>ess<br />

areas (both <strong>the</strong>rapies and geographies), and <strong>in</strong>crease<br />

accountability <strong>of</strong> <strong>the</strong> resources. One <strong>of</strong> <strong>the</strong> executives<br />

surveyed said, “We created multiple structures to expand<br />

coverage to new markets and <strong>the</strong>rapy areas <strong>in</strong> l<strong>in</strong>e with<br />

growth expectation, support new launches, and streng<strong>the</strong>n<br />

key markets & <strong>in</strong>stitutional sales.”<br />

For specialty products driven companies, task forces account<br />

for nearly 15% <strong>of</strong> <strong>the</strong> total sales force. Key determ<strong>in</strong>ants<br />

<strong>of</strong> adapt<strong>in</strong>g <strong>the</strong>se models are <strong>the</strong>rapy focus,<br />

width <strong>of</strong> product portfolio and target doctor specialties.<br />

Interest<strong>in</strong>gly, responses <strong>of</strong> those companies hav<strong>in</strong>g mature<br />

products tend<strong>in</strong>g to an OTX pr<strong>of</strong>ile suggest that channel<br />

management has already made <strong>in</strong>roads <strong>in</strong>to pharma sales,<br />

account<strong>in</strong>g for nearly 20% <strong>of</strong> sales forces, second only to<br />

traditional sales force.<br />

Geography also emerges as one <strong>of</strong> <strong>the</strong> key determ<strong>in</strong>ants<br />

<strong>of</strong> sales model adoption, which shows that companies are<br />

also look<strong>in</strong>g at realign<strong>in</strong>g <strong>the</strong>ir sales model around <strong>the</strong><br />

varied need <strong>of</strong> various geographies. An <strong>in</strong>dustry executive<br />

contacted by OPPI-<strong>IMS</strong> said “A new BU was created<br />

<strong>in</strong> our company to tap <strong>the</strong> opportunity <strong>in</strong> <strong>the</strong> lower<br />

town classes. <strong>The</strong> BU contribution to <strong>the</strong> overall bus<strong>in</strong>ess<br />

is close to 20%.” Ano<strong>the</strong>r executive said, “Emerg<strong>in</strong>g<br />

and untapped bus<strong>in</strong>ess <strong>in</strong> <strong>the</strong> Class 3 or 4 towns and<br />

rural sector will impact <strong>the</strong> future sell<strong>in</strong>g model,” thus<br />

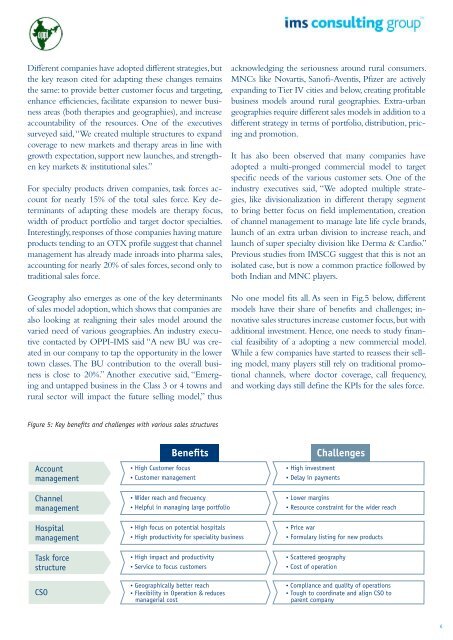

Figure 5: Key benefits and challenges with various sales structures<br />

Account<br />

management<br />

Channel<br />

management<br />

hospital<br />

management<br />

task force<br />

structure<br />

Cso<br />

Benefits<br />

• high Customer focus<br />

• Customer management<br />

• Wider reach and frecuency<br />

• helpful <strong>in</strong> manag<strong>in</strong>g large portfolio<br />

• high focus on potential hospitals<br />

• high productivity for speciality bus<strong>in</strong>ess<br />

• high impact and productivity<br />

• service to focus customers<br />

• geographically better reach<br />

• flexibility <strong>in</strong> operation & reduces<br />

managerial cost<br />

acknowledg<strong>in</strong>g <strong>the</strong> seriousness around rural consumers.<br />

MNCs like Novartis, San<strong>of</strong>i-Aventis, Pfizer are actively<br />

expand<strong>in</strong>g to Tier IV cities and below, creat<strong>in</strong>g pr<strong>of</strong>itable<br />

bus<strong>in</strong>ess models around rural geographies. Extra-urban<br />

geographies require different sales models <strong>in</strong> addition to a<br />

different strategy <strong>in</strong> terms <strong>of</strong> portfolio, distribution, pric<strong>in</strong>g<br />

and promotion.<br />

It has also been observed that many companies have<br />

adopted a multi-pronged commercial model to target<br />

specific needs <strong>of</strong> <strong>the</strong> various customer sets. One <strong>of</strong> <strong>the</strong><br />

<strong>in</strong>dustry executives said, “We adopted multiple strategies,<br />

like divisionalization <strong>in</strong> different <strong>the</strong>rapy segment<br />

to br<strong>in</strong>g better focus on field implementation, creation<br />

<strong>of</strong> channel management to manage late life cycle brands,<br />

launch <strong>of</strong> an extra urban division to <strong>in</strong>crease reach, and<br />

launch <strong>of</strong> super specialty division like Derma & Cardio.”<br />

Previous studies from <strong>IMS</strong>CG suggest that this is not an<br />

isolated case, but is now a common practice followed by<br />

both <strong>Indian</strong> and MNC players.<br />

No one model fits all. As seen <strong>in</strong> Fig.5 below, different<br />

models have <strong>the</strong>ir share <strong>of</strong> benefits and challenges; <strong>in</strong>novative<br />

sales structures <strong>in</strong>crease customer focus, but with<br />

additional <strong>in</strong>vestment. Hence, one needs to study f<strong>in</strong>ancial<br />

feasibility <strong>of</strong> a adopt<strong>in</strong>g a new commercial model.<br />

While a few companies have started to reassess <strong>the</strong>ir sell<strong>in</strong>g<br />

model, many players still rely on traditional promotional<br />

channels, where doctor coverage, call frequency,<br />

and work<strong>in</strong>g days still def<strong>in</strong>e <strong>the</strong> KPIs for <strong>the</strong> sales force.<br />

Challenges<br />

• high <strong>in</strong>vestment<br />

• delay <strong>in</strong> payments<br />

• lower marg<strong>in</strong>s<br />

• resource constra<strong>in</strong>t for <strong>the</strong> wider reach<br />

• price war<br />

• formulary list<strong>in</strong>g for new products<br />

• scattered geography<br />

• Cost <strong>of</strong> operation<br />

• Compliance and quality <strong>of</strong> operations<br />

• tough to coord<strong>in</strong>ate and align Cso to<br />

parent company<br />

6