Global Life Sciences Cluster Report 2011 - Jones Lang LaSalle

Global Life Sciences Cluster Report 2011 - Jones Lang LaSalle

Global Life Sciences Cluster Report 2011 - Jones Lang LaSalle

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

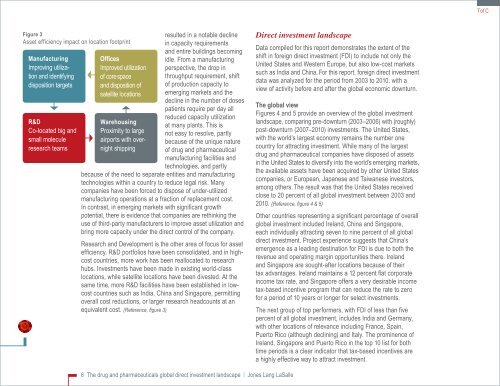

Figure 3<br />

Asset efficiency impact on location footprint<br />

Manufacturing<br />

Improving utilization<br />

and identifying<br />

disposition targets<br />

R&D<br />

Co-located big and<br />

small molecule<br />

research teams<br />

Offices<br />

Improved utilization<br />

of core space<br />

and disposition of<br />

satellite locations<br />

Warehousing<br />

Proximity to large<br />

airports with overnight<br />

shipping<br />

resulted in a notable decline<br />

in capacity requirements<br />

and entire buildings becoming<br />

idle. From a manufacturing<br />

perspective, the drop in<br />

throughput requirement, shift<br />

of production capacity to<br />

emerging markets and the<br />

decline in the number of doses<br />

patients require per day all<br />

reduced capacity utilization<br />

at many plants. This is<br />

not easy to resolve, partly<br />

because of the unique nature<br />

of drug and pharmaceutical<br />

manufacturing facilities and<br />

technologies, and partly<br />

because of the need to separate entities and manufacturing<br />

technologies within a country to reduce legal risk. Many<br />

companies have been forced to dispose of under-utilized<br />

manufacturing operations at a fraction of replacement cost.<br />

In contrast, in emerging markets with significant growth<br />

potential, there is evidence that companies are rethinking the<br />

use of third-party manufacturers to improve asset utilization and<br />

bring more capacity under the direct control of the company.<br />

Research and Development is the other area of focus for asset<br />

efficiency. R&D portfolios have been consolidated, and in highcost<br />

countries, more work has been reallocated to research<br />

hubs. Investments have been made in existing world-class<br />

locations, while satellite locations have been divested. At the<br />

same time, more R&D facilities have been established in lowcost<br />

countries such as India, China and Singapore, permitting<br />

overall cost reductions, or larger research headcounts at an<br />

equivalent cost. (Reference, figure 3)<br />

6 The drug and pharmaceuticals global direct investment landscape | <strong>Jones</strong> <strong>Lang</strong> <strong>LaSalle</strong><br />

Direct investment landscape<br />

Data compiled for this report demonstrates the extent of the<br />

shift in foreign direct investment (FDI) to include not only the<br />

United States and Western Europe, but also low-cost markets<br />

such as India and China. For this report, foreign direct investment<br />

data was analyzed for the period from 2003 to 2010, with a<br />

view of activity before and after the global economic downturn.<br />

The global view<br />

Figures 4 and 5 provide an overview of the global investment<br />

landscape, comparing pre-downturn (2003–2006) with (roughly)<br />

post-downturn (2007–2010) investments. The United States,<br />

with the world’s largest economy remains the number one<br />

country for attracting investment. While many of the largest<br />

drug and pharmaceutical companies have disposed of assets<br />

in the United States to diversify into the world’s emerging markets,<br />

the available assets have been acquired by other United States<br />

companies, or European, Japanese and Taiwanese investors,<br />

among others. The result was that the United States received<br />

close to 20 percent of all global investment between 2003 and<br />

2010. (Reference, figure 4 & 5)<br />

Other countries representing a significant percentage of overall<br />

global investment included Ireland, China and Singapore,<br />

each individually attracting seven to nine percent of all global<br />

direct investment. Project experience suggests that China’s<br />

emergence as a leading destination for FDI is due to both the<br />

revenue and operating margin opportunities there. Ireland<br />

and Singapore are sought-after locations because of their<br />

tax advantages. Ireland maintains a 12 percent flat corporate<br />

income tax rate, and Singapore offers a very desirable income<br />

tax-based incentive program that can reduce the rate to zero<br />

for a period of 10 years or longer for select investments.<br />

The next group of top performers, with FDI of less than five<br />

percent of all global investment, includes India and Germany,<br />

with other locations of relevance including France, Spain,<br />

Puerto Rico (although declining) and Italy. The prominence of<br />

Ireland, Singapore and Puerto Rico in the top 10 list for both<br />

time periods is a clear indicator that tax-based incentives are<br />

a highly effective way to attract investment.<br />

Tof C