Global Life Sciences Cluster Report 2011 - Jones Lang LaSalle

Global Life Sciences Cluster Report 2011 - Jones Lang LaSalle

Global Life Sciences Cluster Report 2011 - Jones Lang LaSalle

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

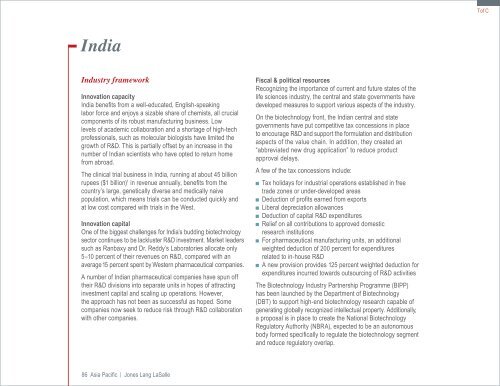

India<br />

Industry framework<br />

Innovation capacity<br />

India benefits from a well-educated, English-speaking<br />

labor force and enjoys a sizable share of chemists, all crucial<br />

components of its robust manufacturing business. Low<br />

levels of academic collaboration and a shortage of high-tech<br />

professionals, such as molecular biologists have limited the<br />

growth of R&D. This is partially offset by an increase in the<br />

number of Indian scientists who have opted to return home<br />

from abroad.<br />

The clinical trial business in India, running at about 45 billion<br />

rupees ($1 billion) 1 in revenue annually, benefits from the<br />

country’s large, genetically diverse and medically naive<br />

population, which means trials can be conducted quickly and<br />

at low cost compared with trials in the West.<br />

Innovation capital<br />

One of the biggest challenges for India’s budding biotechnology<br />

sector continues to be lackluster R&D investment. Market leaders<br />

such as Ranbaxy and Dr. Reddy’s Laboratories allocate only<br />

5–10 percent of their revenues on R&D, compared with an<br />

average 15 percent spent by Western pharmaceutical companies.<br />

A number of Indian pharmaceutical companies have spun off<br />

their R&D divisions into separate units in hopes of attracting<br />

investment capital and scaling up operations. However,<br />

the approach has not been as successful as hoped. Some<br />

companies now seek to reduce risk through R&D collaboration<br />

with other companies.<br />

86 Asia Pacific | <strong>Jones</strong> <strong>Lang</strong> <strong>LaSalle</strong><br />

Fiscal & political resources<br />

Recognizing the importance of current and future states of the<br />

life sciences industry, the central and state governments have<br />

developed measures to support various aspects of the industry.<br />

On the biotechnology front, the Indian central and state<br />

governments have put competitive tax concessions in place<br />

to encourage R&D and support the formulation and distribution<br />

aspects of the value chain. In addition, they created an<br />

“abbreviated new drug application” to reduce product<br />

approval delays.<br />

A few of the tax concessions include:<br />

■ Tax holidays for industrial operations established in free<br />

trade zones or under-developed areas<br />

■ Deduction of profits earned from exports<br />

■ Liberal depreciation allowances<br />

■ Deduction of capital R&D expenditures<br />

■ Relief on all contributions to approved domestic<br />

research institutions<br />

■ For pharmaceutical manufacturing units, an additional<br />

weighted deduction of 200 percent for expenditures<br />

related to in-house R&D<br />

■ A new provision provides 125 percent weighted deduction for<br />

expenditures incurred towards outsourcing of R&D activities<br />

The Biotechnology Industry Partnership Programme (BIPP)<br />

has been launched by the Department of Biotechnology<br />

(DBT) to support high-end biotechnology research capable of<br />

generating globally recognized intellectual property. Additionally,<br />

a proposal is in place to create the National Biotechnology<br />

Regulatory Authority (NBRA), expected to be an autonomous<br />

body formed specifically to regulate the biotechnology segment<br />

and reduce regulatory overlap.<br />

Tof C