Annual Report - Li Ning

Annual Report - Li Ning

Annual Report - Li Ning

- TAGS

- annual

- ning

- www.lining.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to the Consolidated Financial Statements (Continued)<br />

(All amounts in RMB unless otherwise stated)<br />

27. Share-based compensation (Continued)<br />

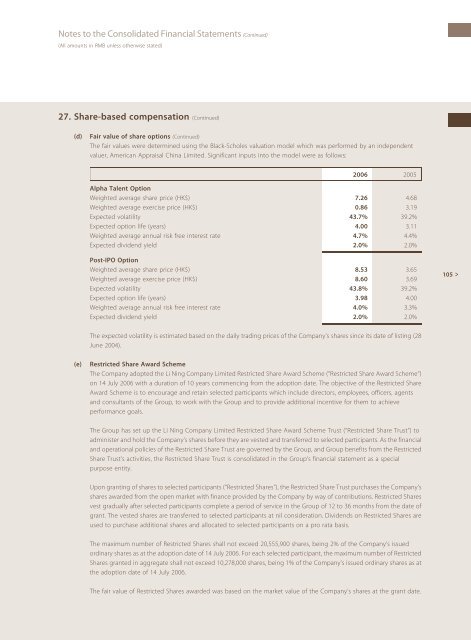

(d) Fair value of share options (Continued)<br />

The fair values were determined using the Black-Scholes valuation model which was performed by an independent<br />

valuer, American Appraisal China <strong>Li</strong>mited. Significant inputs into the model were as follows:<br />

2006 2005<br />

Alpha Talent Option<br />

Weighted average share price (HK$) 7.26 4.68<br />

Weighted average exercise price (HK$) 0.86 3.19<br />

Expected volatility 43.7% 39.2%<br />

Expected option life (years) 4.00 3.11<br />

Weighted average annual risk free interest rate 4.7% 4.4%<br />

Expected dividend yield 2.0% 2.0%<br />

Post-IPO Option<br />

Weighted average share price (HK$) 8.53 3.65<br />

Weighted average exercise price (HK$) 8.60 3.69<br />

Expected volatility 43.8% 39.2%<br />

Expected option life (years) 3.98 4.00<br />

Weighted average annual risk free interest rate 4.0% 3.3%<br />

Expected dividend yield 2.0% 2.0%<br />

The expected volatility is estimated based on the daily trading prices of the Company’s shares since its date of listing (28<br />

June 2004).<br />

(e) RestrictedShareAwardScheme<br />

The Company adopted the <strong>Li</strong> <strong>Ning</strong> Company <strong>Li</strong>mited Restricted Share Award Scheme (‘‘Restricted Share Award Scheme’’)<br />

on 14 July 2006 with a duration of 10 years commencing from the adoption date. The objective of the Restricted Share<br />

Award Scheme is to encourage and retain selected participants which include directors, employees, officers, agents<br />

and consultants of the Group, to work with the Group and to provide additional incentive for them to achieve<br />

performance goals.<br />

The Group has set up the <strong>Li</strong> <strong>Ning</strong> Company <strong>Li</strong>mited Restricted Share Award Scheme Trust (‘‘Restricted Share Trust’’) to<br />

administer and hold the Company’s shares before they are vested and transferred to selected participants. As the financial<br />

and operational policies of the Restricted Share Trust are governed by the Group, and Group benefits from the Restricted<br />

Share Trust’s activities, the Restricted Share Trust is consolidated in the Group’s financial statement as a special<br />

purpose entity.<br />

Upon granting of shares to selected participants (‘‘Restricted Shares’’), the Restricted Share Trust purchases the Company’s<br />

shares awarded from the open market with finance provided by the Company by way of contributions. Restricted Shares<br />

vest gradually after selected participants complete a period of service in the Group of 12 to 36 months from the date of<br />

grant. The vested shares are transferred to selected participants at nil consideration. Dividends on Restricted Shares are<br />

used to purchase additional shares and allocated to selected participants on a pro rata basis.<br />

The maximum number of Restricted Shares shall not exceed 20,555,900 shares, being 2% of the Company’s issued<br />

ordinary shares as at the adoption date of 14 July 2006. For each selected participant, the maximum number of Restricted<br />

Shares granted in aggregate shall not exceed 10,278,000 shares, being 1% of the Company’s issuedordinarysharesasat<br />

the adoption date of 14 July 2006.<br />

The fair value of Restricted Shares awarded was based on the market value of the Company’s shares at the grant date.<br />

105 >