QUEENSLAND PERFORMING ARTS CENTRE ANNUAL REPORT ...

QUEENSLAND PERFORMING ARTS CENTRE ANNUAL REPORT ...

QUEENSLAND PERFORMING ARTS CENTRE ANNUAL REPORT ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>QUEENSLAND</strong> <strong>PERFORMING</strong> <strong>ARTS</strong> <strong>CENTRE</strong><br />

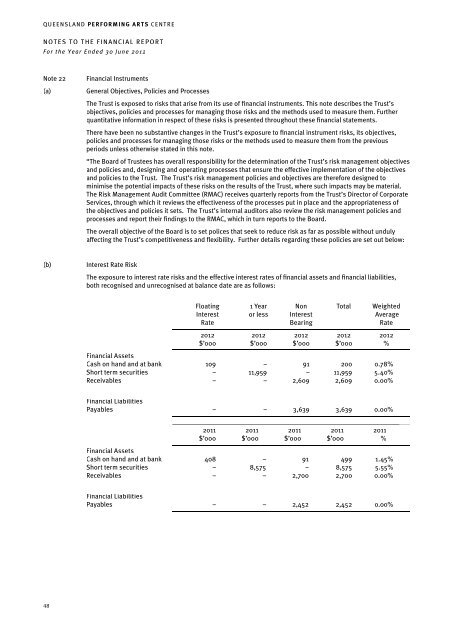

NOTES TO THE FINANCIAL <strong>REPORT</strong><br />

For the Year Ended 30 June 2012<br />

Note 22 Financial Instruments<br />

(a) General Objectives, Policies and Processes<br />

48<br />

The Trust is exposed to risks that arise from its use of fi nancial instruments. This note describes the Trust’s<br />

objectives, policies and processes for managing those risks and the methods used to measure them. Further<br />

quantitative information in respect of these risks is presented throughout these fi nancial statements.<br />

There have been no substantive changes in the Trust’s exposure to fi nancial instrument risks, its objectives,<br />

policies and processes for managing those risks or the methods used to measure them from the previous<br />

periods unless otherwise stated in this note.<br />

“The Board of Trustees has overall responsibility for the determination of the Trust’s risk management objectives<br />

and policies and, designing and operating processes that ensure the effective implementation of the objectives<br />

and policies to the Trust. The Trust’s risk management policies and objectives are therefore designed to<br />

minimise the potential impacts of these risks on the results of the Trust, where such impacts may be material.<br />

The Risk Management Audit Committee (RMAC) receives quarterly reports from the Trust’s Director of Corporate<br />

Services, through which it reviews the effectiveness of the processes put in place and the appropriateness of<br />

the objectives and policies it sets. The Trust’s internal auditors also review the risk management policies and<br />

processes and report their fi ndings to the RMAC, which in turn reports to the Board.<br />

The overall objective of the Board is to set polices that seek to reduce risk as far as possible without unduly<br />

affecting the Trust’s competitiveness and fl exibility. Further details regarding these policies are set out below:<br />

(b) Interest Rate Risk<br />

The exposure to interest rate risks and the effective interest rates of fi nancial assets and fi nancial liabilities,<br />

both recognised and unrecognised at balance date are as follows:<br />

Floating 1 Year Non Total Weighted<br />

Interest or less Interest Average<br />

Rate Bearing Rate<br />

2012 2012 2012 2012 2012<br />

$’000 $’000 $’000 $’000 %<br />

Financial Assets<br />

Cash on hand and at bank 109 – 91 200 0.78%<br />

Short term securities – 11,959 – 11,959 5.40%<br />

Receivables – – 2,609 2,609 0.00%<br />

Financial Liabilities<br />

Payables – – 3,639 3,639 0.00%<br />

2011 2011 2011 2011 2011<br />

$’000 $’000 $’000 $’000 %<br />

Financial Assets<br />

Cash on hand and at bank 408 – 91 499 1.45%<br />

Short term securities – 8,575 – 8,575 5.55%<br />

Receivables – – 2,700 2,700 0.00%<br />

Financial Liabilities<br />

Payables – – 2,452 2,452 0.00%