- Page 1 and 2: Purchasing Intentions and Behavior

- Page 3 and 4: Dedication This work is dedicated t

- Page 5 and 6: Abstract This research is a study o

- Page 7 and 8: List of Acronyms CE - Consumer Ethn

- Page 9 and 10: 2.2.3 The Brand as Providing a Func

- Page 11 and 12: 5.0 Introduction ..................

- Page 13 and 14: 7.5.11 Banks (ATMs) ...............

- Page 15 and 16: A1.9 Summary ......................

- Page 17 and 18: Appendix VII. Main Consumer Survey

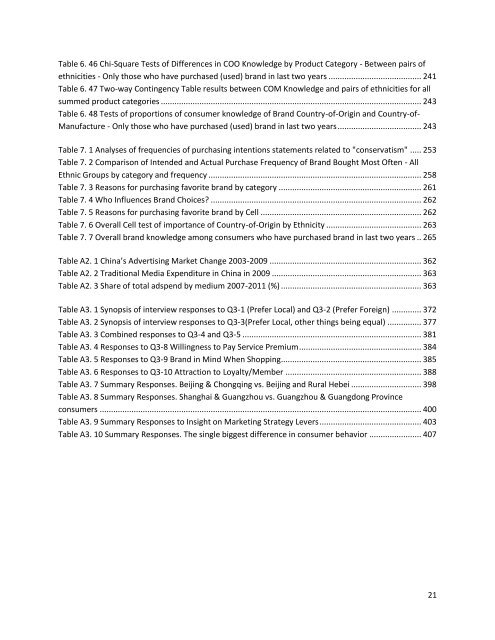

- Page 19: List of Tables Table 5. 1 Pre-teste

- Page 23 and 24: 1.1 Background of Study Once the Ch

- Page 25 and 26: The role that culture plays in gene

- Page 27 and 28: Understanding how to enhance brand

- Page 29 and 30: � Chapter 8 -Summary, Implication

- Page 31 and 32: chips, and ice cream tubs). In Cell

- Page 33 and 34: 2. Managerial and Consumer Perspect

- Page 35 and 36: "non-rational" elements as this alt

- Page 37 and 38: trajectory will angle upward. The l

- Page 39 and 40: determinants of purchase intention,

- Page 41 and 42: line according to a similar taxonom

- Page 43 and 44: objects, or issues (Solomon et al,

- Page 45 and 46: Figure 2. 2 The Tri-components mode

- Page 47 and 48: identifying a set of attributes, we

- Page 49 and 50: them. According to the theory, AACT

- Page 51 and 52: The Theory of Planned Behavior inte

- Page 53 and 54: 2.12 Attitudes toward the advertise

- Page 55 and 56: Figure 2. 5 An adapted multi-attrib

- Page 57 and 58: and (Laurent and Kapferer, 1985). W

- Page 59 and 60: and by consumers’ reactions towar

- Page 61 and 62: 1993). Papadopoulos et al (1993) de

- Page 63 and 64: Figure 2. 8 The Halo Effect of the

- Page 65 and 66: ehavior acted upon perception of br

- Page 67 and 68: However, even though many consumers

- Page 69 and 70: others. This may confuse consumers

- Page 71 and 72:

products (Kaynak and Kara, 2002). A

- Page 73 and 74:

Figure 2. 9 Four broad categories o

- Page 75 and 76:

matrix was presented as the model u

- Page 77 and 78:

aspects, Chinese consumers generall

- Page 79 and 80:

Howard and Sheth (1969) discussed t

- Page 81 and 82:

3.1.3 Hofstede Cultural Dimensions

- Page 83 and 84:

power distant context may be more l

- Page 85 and 86:

tend to be more rational and keep t

- Page 87 and 88:

countries. This has been termed “

- Page 89 and 90:

One of the limitations of Maslow’

- Page 91 and 92:

4. A Framework of brand choice 4.0

- Page 93 and 94:

Figure 4. 1 Engel-Kollat-Blackwell

- Page 95 and 96:

main theoretical foundation for thi

- Page 97 and 98:

The socio-cultural environmental in

- Page 99 and 100:

consists of two parents and one chi

- Page 101 and 102:

ehavior to remain. Yet, with the ve

- Page 103 and 104:

SRQ 1.1.1a.1: Is the intention to p

- Page 105 and 106:

RP 1.1.5: Chinese consumers’ purc

- Page 107 and 108:

RP 1.2.4: The importance of store l

- Page 109 and 110:

inconvenient activity. Beijing's va

- Page 111 and 112:

In our study we investigated the br

- Page 113 and 114:

SRQ 4.1: Do consumers in Guangzhou

- Page 115 and 116:

RP 5.4.0: Chinese consumers are not

- Page 117 and 118:

5. Research Methodology 5.0 Introdu

- Page 119 and 120:

Figure 5. 1 Research Methodology Su

- Page 121 and 122:

with a sample size of between fifty

- Page 123 and 124:

Figure 5. 2 Product Categories for

- Page 125 and 126:

follow-up emails, where applicable,

- Page 127 and 128:

Low Functionality/ Low Representati

- Page 129 and 130:

product category's COO higher than

- Page 131 and 132:

We can see that for product categor

- Page 133 and 134:

the case of household appliances, S

- Page 135 and 136:

Table 5. 8 Selection of brands used

- Page 137 and 138:

Table 5. 9 Expected versus Actual Q

- Page 139 and 140:

5.7 Expert Interviews Marketing exp

- Page 141 and 142:

5.7.1 Results of the Pre-test of Ma

- Page 143 and 144:

esult in high internal validity but

- Page 145 and 146:

6.3 Data Analyses Data analyses wer

- Page 147 and 148:

19 When a new brand of an existing

- Page 149 and 150:

13 price for an unknown brand. My f

- Page 151 and 152:

Table 6. 4 Tests of importance for

- Page 153 and 154:

Table 6. 5 ANOVAs Between Ethnicity

- Page 155 and 156:

Table 6. 6 Summary of Fisher's LSD

- Page 157 and 158:

Table 6. 7 Two Sample Test of Hypot

- Page 159 and 160:

1.1.1 Conservatism: Ethnocentrism i

- Page 161 and 162:

Proposition # Specific Research Que

- Page 163 and 164:

Proposition 1.1.2a, which states th

- Page 165 and 166:

Proposition 1.1.3, which states tha

- Page 167 and 168:

Propositions Specific Research Ques

- Page 169 and 170:

We argued that a "conservative" con

- Page 171 and 172:

important service component, there

- Page 173 and 174:

member/loyalty cards more often tha

- Page 175 and 176:

Consumers from the key cities studi

- Page 177 and 178:

Table 6. 16 Pair-wise tests of sign

- Page 179 and 180:

Table 6. 17 Frequency of Purchase (

- Page 181 and 182:

Table 6. 19 Frequency of Purchase (

- Page 183 and 184:

Based on Cramer's V, the strength o

- Page 185 and 186:

GRQ 2.0: Brand choice and ethnicity

- Page 187 and 188:

four categories there is a very str

- Page 189 and 190:

Table 6. 24 Percentage of urban con

- Page 191 and 192:

Brands by category Beijing Shanghai

- Page 193 and 194:

small to medium effect with respect

- Page 195 and 196:

12 categories for Chongqing consume

- Page 197 and 198:

Beijing Shanghai Chongqing Guangzho

- Page 199 and 200:

table highlights that quality overa

- Page 201 and 202:

the least frequent purchases. Perfu

- Page 203 and 204:

Table 6. 30 Actual Percentage of Co

- Page 205 and 206:

The general research question askin

- Page 207 and 208:

Table 6. 33 Means of Importance of

- Page 209 and 210:

Using Cramer's V to measure the str

- Page 211 and 212:

Specific Research Questions Proposi

- Page 213 and 214:

Table 6. 37 Consumer Knowledge of B

- Page 215 and 216:

Brand % Correct Country of origin C

- Page 217 and 218:

With respect to Leconte, many respo

- Page 219 and 220:

Brand % Correct Country of origin C

- Page 221 and 222:

To determine if those who recently

- Page 223 and 224:

H0: Are those urban consumers who b

- Page 225 and 226:

H0: Are those urban consumers who b

- Page 227 and 228:

no differences between COO and COM

- Page 229 and 230:

H0: Are consumers more aware of COM

- Page 231 and 232:

Table 6.41 summarizes results by in

- Page 233 and 234:

Statistically significant differenc

- Page 235 and 236:

% Correct responses Brand/Ethnicity

- Page 237 and 238:

% Correct responses Brand/Ethnicity

- Page 239 and 240:

Table 6. 45 Two-way Contingency Tab

- Page 241 and 242:

Table 6. 46 Chi-Square Tests of Dif

- Page 243 and 244:

Table 6. 47 Two-way Contingency Tab

- Page 245 and 246:

H0: p1 ≤ p2 ;H1: p1 > p2; z=1.65

- Page 247 and 248:

are misinformed as to the correct C

- Page 249 and 250:

Marketers, moreover, need to be war

- Page 251 and 252:

definitive nature of the survey que

- Page 253 and 254:

With respect to the fourth dimensio

- Page 255 and 256:

Population density likely accounts

- Page 257 and 258:

2006; Wakefield and Inman, 2003; En

- Page 259 and 260:

7.4 Brand Choice (RQ 2.0) This sect

- Page 261 and 262:

Table 7. 3 Reasons for purchasing f

- Page 263 and 264:

influenced. Melewar et al (2004) si

- Page 265 and 266:

Table 7. 7 Overall brand knowledge

- Page 267 and 268:

more than 70 imported or joint vent

- Page 269 and 270:

domestic brands and partly because

- Page 271 and 272:

8. Summary, Implications, and Concl

- Page 273 and 274:

8.1.4. Actual purchase frequency

- Page 275 and 276:

their segmentation and targeting st

- Page 277 and 278:

Ideally the main person responsible

- Page 279 and 280:

counterparts; yet, the interviewee

- Page 281 and 282:

promotions and marketing, differenc

- Page 283 and 284:

8.5.8 Situational factors impacting

- Page 285 and 286:

Anderson, D.R., Sweeney, D.J. & Wil

- Page 287 and 288:

Bettman, J.R. (1970) Information pr

- Page 289 and 290:

Chen, C.H. and Zimitat, C. (2006) U

- Page 291 and 292:

Czinkota, M.R. and Ronkainen, I.A.

- Page 293 and 294:

Ehrenberg, A., Goodhardt, G. & Barw

- Page 295 and 296:

Goffman, E. (1967) Interaction Ritu

- Page 297 and 298:

Hofstede, G. (2001) Culture's Conse

- Page 299 and 300:

Insch G.S. (2003) The Impact of Cou

- Page 301 and 302:

Kluckhohn, C. and F.L. Strodtbeck (

- Page 303 and 304:

Li, J.J. and Su, C. (2007) How Face

- Page 305 and 306:

[Accessed 3 April 2010). McShane, S

- Page 307 and 308:

innovation diffusion: The case of J

- Page 309 and 310:

Perrin, R. and Gong, Y. (2010) Uniq

- Page 311 and 312:

Samiee, S. (1994) Custumer evaluati

- Page 313 and 314:

Su, Y., Xu, D. & Phan, P.H. (2008)

- Page 315 and 316:

Verlegh, P.W. and Steenkamp, J.B. (

- Page 317 and 318:

Wu, K. (1998) Sociology of Educatio

- Page 319 and 320:

Appendix I. The Chinese Marketing E

- Page 321 and 322:

Confucius was not particularly inte

- Page 323 and 324:

China from their bases in Manchuria

- Page 325 and 326:

Figure A1. 1 Administrative Divisio

- Page 327 and 328:

Table A1. 1 Population and Its Comp

- Page 329 and 330:

levels of domestic and internationa

- Page 331 and 332:

Table A1. 4 GDP and Population Dens

- Page 333 and 334:

middle south regions and below nati

- Page 335 and 336:

world’s third-largest economy). B

- Page 337 and 338:

337 Countries Market Size Market Gr

- Page 339 and 340:

Table A1. 6 Year to Year Comparison

- Page 341 and 342:

Table A1. 7 Dimensions and Measures

- Page 343 and 344:

internet access exists but some cen

- Page 345 and 346:

certifications, such as a license.

- Page 347 and 348:

Table A1. 8 Business Monitor Intern

- Page 349 and 350:

China’s political environment is

- Page 351 and 352:

and makers to reduce the stigma of

- Page 353 and 354:

making comparisons between differen

- Page 355 and 356:

2007). Each of the populations in t

- Page 357 and 358:

Walmart in 2007, who explained that

- Page 359 and 360:

From a manufacturer's perspective,

- Page 361 and 362:

among others as well as China's own

- Page 363 and 364:

Table A2. 2 Traditional Media Expen

- Page 365 and 366:

The size of China's online display

- Page 367 and 368:

Appendix III. Industry Interviews -

- Page 369 and 370:

A3.3. Q3-2 Do Chinese consumers try

- Page 371 and 372:

cigarettes."; "Older people prefer

- Page 373 and 374:

a bias toward foreign brands due to

- Page 375 and 376:

guarantee or promise of good qualit

- Page 377 and 378:

Table A3. 2 Synopsis of interview r

- Page 379 and 380:

A3.6. Q3-5 Are Chinese consumers sl

- Page 381 and 382:

Table A3. 3 Combined responses to Q

- Page 383 and 384:

products even for foreign brands bu

- Page 385 and 386:

A3.10. Q3-9 Do Chinese consumers ge

- Page 387 and 388:

deposit or some stores don't allow

- Page 389 and 390:

their related product categories. P

- Page 391 and 392:

agreement that Beijing consumers ar

- Page 393 and 394:

administration and white-collar wor

- Page 395 and 396:

� Shanghai and Guangzhou consumer

- Page 397 and 398:

trying new products). Thus, consump

- Page 399 and 400:

A3.14. Q4-3 Would you consider urba

- Page 401 and 402:

Response No. of expert mentions* Ye

- Page 403 and 404:

Experts also unanimously agreed tha

- Page 405 and 406:

Strategy lever Useful Insights Pric

- Page 407 and 408:

awareness of brand names, relative

- Page 409 and 410:

Appendix IV. Research Consent Forms

- Page 411 and 412:

A4.2 Research Consent Form - Depth

- Page 413 and 414:

Appendix V. Survey of Consumer Bran

- Page 415 and 416:

Bottled Water 矿泉水或纯净水

- Page 417 and 418:

Ice Cream Tubs 冰淇淋浴盆 Yes

- Page 419 and 420:

Potato Chips (Crisps) 薯片(脆片

- Page 421 and 422:

Household Appliances (refrigerators

- Page 423 and 424:

Airlines 航空公司 1. Singapore

- Page 425 and 426:

Appendix VI. Specification of brand

- Page 427 and 428:

11. Banks (including ATMs) 中国

- Page 429 and 430:

消费者购买行为调查 请根

- Page 431 and 432:

C 对于以下品牌产品当中,

- Page 433 and 434:

C 对于以下品牌产品当中,

- Page 435 and 436:

品牌之间的关系 如下所示,

- Page 437 and 438:

品牌之间的关系 如下所示,

- Page 439 and 440:

品牌之间的关系 如下所示,

- Page 441 and 442:

Appendix VIII. Main Consumer Behavi

- Page 443 and 444:

II. Relationship to Product Categor

- Page 445 and 446:

III. Relationship to Brands C Speci

- Page 447 and 448:

III. Relationship to Brands C Speci

- Page 449 and 450:

III. Relationship to Brands C Speci

- Page 451 and 452:

COO/COM 品牌之间的关系 3. To

- Page 453 and 454:

453 7. Perfume 香水 兰蔻Lancome

- Page 455 and 456:

COO/COM 品牌之间的关系 11. B

- Page 457 and 458:

Appendix IX. Interview Guide for Ma

- Page 459 and 460:

3.2. Would you consider consumers i

- Page 461 and 462:

potential sampling (Type I) error b

- Page 463 and 464:

A10.9 Coefficients of Correlation F

- Page 465 and 466:

The main general research questions

- Page 467 and 468:

The main general research questions

- Page 469 and 470:

Study(Year) Country Findings Jordan

- Page 471 and 472:

Appendix XIV. Brand Choice - Other

- Page 473 and 474:

Category Brand Beijing Shanghai Cho

- Page 475 and 476:

Appendix XV. Unique Promotional App

- Page 477 and 478:

Distribution of shopping discount c

- Page 479 and 480:

479

- Page 481 and 482:

481

- Page 483 and 484:

483

- Page 485 and 486:

485

- Page 487 and 488:

487

- Page 489 and 490:

489

- Page 491 and 492:

491

- Page 493 and 494:

with negative rhetoric and pejorati

- Page 495 and 496:

literature where consumers consider

- Page 497 and 498:

correctly point out that their stud

- Page 499 and 500:

quite difficult to research the mod

- Page 501 and 502:

dissuades them from accepting brand

- Page 503:

esponsibility and argued that socia