The Evolving Air Transport Industry

The Evolving Air Transport Industry

The Evolving Air Transport Industry

- TAGS

- evolving

- komaristaya.ru

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

14 INTRODUCTION TO AIR TRANSPORT ECONOMICS<br />

costs globally.4 Moreover, since higher fuel costs affect all airlines in a somewhat similar<br />

manner, there is little or no competitive advantage to be gained in this area. <strong>The</strong>refore,<br />

as this extra cost is passed on to the consumer, the relative price structure should remain<br />

proportionately the same. In this case, the ultimate question of profitability depends to a<br />

large extent on the elasticity of demand for the product and the cost containment ability<br />

of the airline's management.<br />

AIRLINE INDUSTRY CONSOLIDATION<br />

<strong>The</strong> airline industry has been affected by economic recession, rising fuel costs, political<br />

uncertainty, and stiff competition. <strong>The</strong>se factors have caused some major carriers, such<br />

as Eastern <strong>Air</strong>lines, Pan Am, and Piedmont into liquidation, and US <strong>Air</strong>ways, United<br />

<strong>Air</strong>lines, Delta <strong>Air</strong> Lines, and Northwest <strong>Air</strong>lines into bankruptcy protection.<br />

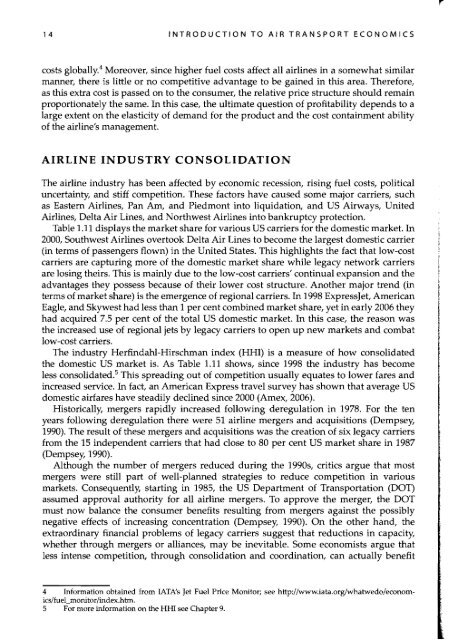

Table 1.11 displays the market share for various US carriers for the domestic market. In<br />

2000, Southwest <strong>Air</strong>lines overtook Delta <strong>Air</strong> Lines to become the largest domestic carrier<br />

(in terms of passengers flown) in the United States. This highlights the fact that low-cost<br />

carriers are capturing more of the domestic market share while legacy network carriers<br />

are losing theirs. This is mainly due to the low-cost carriers' continual expansion and the<br />

advantages they possess because of their lower cost structure. Another major trend (in<br />

terms of market share) is the emergence of regional carriers. In 1998 ExpressJet, American<br />

Eagle, and Skywest had less than 1 per cent combined market share, yet in early 2006 they<br />

had acquired 7.5 per cent of the total US domestic market. In this case, the reason was<br />

the increased use of regional jets by legacy carriers to open up new markets and combat<br />

low-cost carriers.<br />

<strong>The</strong> industry Herfindahl-Hirschman index (HHI) is a measure of how consolidated<br />

the domestic US market is. As Table 1.11 shows, since 1998 the industry has become<br />

less consolidated. s This spreading out of competition usually equates to lower fares and<br />

increased service. In fact, an American Express travel survey has shown that average US<br />

domestic airfares have steadily declined since 2000 (Amex, 2006).<br />

Historically, mergers rapidly increased following deregulation in 1978. For the ten<br />

years following deregulation there were 51 airline mergers and acquisitions (Dempsey,<br />

1990). <strong>The</strong> result of these mergers and acquisitions was the creation of six legacy carriers<br />

from the 15 independent carriers that had close to 80 per cent US market share in 1987<br />

(Dempsey, 1990).<br />

Although the number of mergers reduced during the 1990s, critics argue that most<br />

mergers were still part of well-planned strategies to reduce competition in various<br />

markets. Consequently, starting in 1985, the US Department of <strong>Transport</strong>ation (DOT)<br />

assumed approval authority for all airline mergers. To approve the merger, the DOT<br />

must now balance the consumer benefits resulting from mergers against the possibly<br />

negative effects of increasing concentration (Dempsey, 1990). On the other hand, the<br />

extraordinary financial problems of legacy carriers suggest that reductions in capacity,<br />

whether through mergers or alliances, may be inevitable. Some economists argue that<br />

less intense competition, through consolidation and coordination, can actually benefit<br />

4 Information obtained from lATA's Jet Fuel Price Monitor; see http://www.iata.org/whatwedo/economics/fuel_monitor/index.htffi.<br />

5 For more information on the HH.I see Chapter 9.