hola hola hola hola hola hola hola hola - Asociación Española de ...

hola hola hola hola hola hola hola hola - Asociación Española de ...

hola hola hola hola hola hola hola hola - Asociación Española de ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

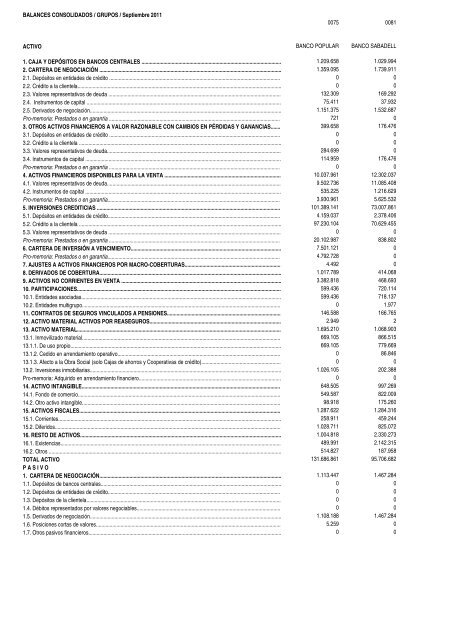

BALANCES CONSOLIDADOS / GRUPOS / Septiembre 2011<br />

0075 0081<br />

ACTIVO<br />

BANCO POPULAR<br />

BANCO SABADELL<br />

1. CAJA Y DEPÓSITOS EN BANCOS CENTRALES ......................................................................................................<br />

2. CARTERA DE NEGOCIACIÓN .....................................................................................................................................<br />

2.1. Depósitos en entida<strong>de</strong>s <strong>de</strong> crédito .............................................................................................................................<br />

2.2. Crédito a la clientela.....................................................................................................................................................<br />

2.3. Valores representativos <strong>de</strong> <strong>de</strong>uda ..............................................................................................................................<br />

2.4. Instrumentos <strong>de</strong> capital ..............................................................................................................................................<br />

2.5. Derivados <strong>de</strong> negociación............................................................................................................................................<br />

Pro-memoria: Prestados o en garantía .............................................................................................................................<br />

3. OTROS ACTIVOS FINANCIEROS A VALOR RAZONABLE CON CAMBIOS EN PÉRDIDAS Y GANANCIAS.......<br />

3.1. Depósitos en entida<strong>de</strong>s <strong>de</strong> crédito .............................................................................................................................<br />

3.2. Crédito a la clientela ....................................................................................................................................................<br />

3.3. Valores representativos <strong>de</strong> <strong>de</strong>uda...............................................................................................................................<br />

3.4. Instrumentos <strong>de</strong> capital ...............................................................................................................................................<br />

Pro-memoria: Prestados o en garantía .............................................................................................................................<br />

4. ACTIVOS FINANCIEROS DISPONIBLES PARA LA VENTA .....................................................................................<br />

4.1. Valores representativos <strong>de</strong> <strong>de</strong>uda...............................................................................................................................<br />

4.2. Instrumentos <strong>de</strong> capital ...............................................................................................................................................<br />

Pro-memoria: Prestados o en garantía..............................................................................................................................<br />

5. INVERSIONES CREDITICIAS ......................................................................................................................................<br />

5.1. Depósitos en entida<strong>de</strong>s <strong>de</strong> crédito..............................................................................................................................<br />

5.2. Crédito a la clientela ....................................................................................................................................................<br />

5.3. Valores representativos <strong>de</strong> <strong>de</strong>uda ..............................................................................................................................<br />

Pro-memoria: Prestados o en garantía .............................................................................................................................<br />

6. CARTERA DE INVERSIÓN A VENCIMIENTO..............................................................................................................<br />

Pro-memoria: Prestados o en garantía..............................................................................................................................<br />

7. AJUSTES A ACTIVOS FINANCIEROS POR MACRO-COBERTURAS......................................................................<br />

8. DERIVADOS DE COBERTURA.....................................................................................................................................<br />

9. ACTIVOS NO CORRIENTES EN VENTA .....................................................................................................................<br />

10. PARTICIPACIONES.....................................................................................................................................................<br />

10.1. Entida<strong>de</strong>s asociadas..................................................................................................................................................<br />

10.2. Entida<strong>de</strong>s multigrupo.................................................................................................................................................<br />

11. CONTRATOS DE SEGUROS VINCULADOS A PENSIONES...................................................................................<br />

12. ACTIVO MATERIAL ACTIVOS POR REASEGUROS................................................................................................<br />

13. ACTIVO MATERIAL.....................................................................................................................................................<br />

13.1. Inmovilizado material.................................................................................................................................................<br />

13.1.1. De uso propio..........................................................................................................................................................<br />

13.1.2. Cedido en arrendamiento operativo.......................................................................................................................<br />

13.1.3. Afecto a la Obra Social (solo Cajas <strong>de</strong> ahorros y Cooperativas <strong>de</strong> crédito)..........................................................<br />

13.2. Inversiones inmobiliarias............................................................................................................................................<br />

Pro-memoria: Adquirido en arrendamiento financiero........................................................................................................<br />

14. ACTIVO INTANGIBLE.................................................................................................................................................<br />

14.1. Fondo <strong>de</strong> comercio....................................................................................................................................................<br />

14.2. Otro activo intangible.................................................................................................................................................<br />

15. ACTIVOS FISCALES...................................................................................................................................................<br />

15.1. Corrientes...................................................................................................................................................................<br />

15.2. Diferidos.....................................................................................................................................................................<br />

16. RESTO DE ACTIVOS...................................................................................................................................................<br />

16.1. Existencias.................................................................................................................................................................<br />

16.2. Otros ..........................................................................................................................................................................<br />

TOTAL ACTIVO<br />

P A S I V O<br />

1. CARTERA DE NEGOCIACIÓN.....................................................................................................................................<br />

1.1. Depósitos <strong>de</strong> bancos centrales....................................................................................................................................<br />

1.2. Depósitos <strong>de</strong> entida<strong>de</strong>s <strong>de</strong> crédito..............................................................................................................................<br />

1.3. Depósitos <strong>de</strong> la clientela..............................................................................................................................................<br />

1.4. Débitos representados por valores negociables.........................................................................................................<br />

1.5. Derivados <strong>de</strong> negociación............................................................................................................................................<br />

1.6. Posiciones cortas <strong>de</strong> valores.......................................................................................................................................<br />

1.7. Otros pasivos financieros.............................................................................................................................................<br />

1.209.658 1.029.994<br />

1.359.095 1.739.911<br />

0 0<br />

0 0<br />

132.309 169.292<br />

75.411 37.932<br />

1.151.375 1.532.687<br />

721 0<br />

399.658 176.476<br />

0 0<br />

0 0<br />

284.699 0<br />

114.959 176.476<br />

0 0<br />

10.037.961 12.302.037<br />

9.502.736 11.085.408<br />

535.225 1.216.629<br />

3.930.961 5.625.532<br />

101.389.141 73.007.861<br />

4.159.037 2.378.406<br />

97.230.104 70.629.455<br />

0 0<br />

20.102.987 838.802<br />

7.501.121 0<br />

4.792.728 0<br />

4.492 0<br />

1.017.789 414.068<br />

3.382.818 468.693<br />

599.436 720.114<br />

599.436 718.137<br />

0 1.977<br />

146.588 166.765<br />

2.949 2<br />

1.695.210 1.068.903<br />

669.105 866.515<br />

669.105 779.669<br />

0 86.846<br />

0 0<br />

1.026.105 202.388<br />

0 0<br />

648.505 997.269<br />

549.587 822.009<br />

98.918 175.260<br />

1.287.622 1.284.316<br />

258.911 459.244<br />

1.028.711 825.072<br />

1.004.818 2.330.273<br />

489.991 2.142.315<br />

514.827 187.958<br />

131.686.861 95.706.682<br />

1.113.447 1.467.284<br />

0 0<br />

0 0<br />

0 0<br />

0 0<br />

1.108.188 1.467.284<br />

5.259 0<br />

0 0