hola hola hola hola hola hola hola hola - Asociación Española de ...

hola hola hola hola hola hola hola hola - Asociación Española de ...

hola hola hola hola hola hola hola hola - Asociación Española de ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

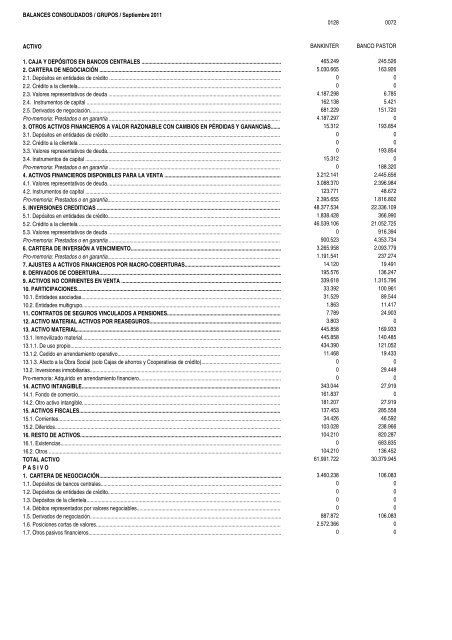

BALANCES CONSOLIDADOS / GRUPOS / Septiembre 2011<br />

0128 0072<br />

ACTIVO<br />

BANKINTER<br />

BANCO PASTOR<br />

1. CAJA Y DEPÓSITOS EN BANCOS CENTRALES ......................................................................................................<br />

2. CARTERA DE NEGOCIACIÓN .....................................................................................................................................<br />

2.1. Depósitos en entida<strong>de</strong>s <strong>de</strong> crédito .............................................................................................................................<br />

2.2. Crédito a la clientela.....................................................................................................................................................<br />

2.3. Valores representativos <strong>de</strong> <strong>de</strong>uda ..............................................................................................................................<br />

2.4. Instrumentos <strong>de</strong> capital ..............................................................................................................................................<br />

2.5. Derivados <strong>de</strong> negociación............................................................................................................................................<br />

Pro-memoria: Prestados o en garantía .............................................................................................................................<br />

3. OTROS ACTIVOS FINANCIEROS A VALOR RAZONABLE CON CAMBIOS EN PÉRDIDAS Y GANANCIAS.......<br />

3.1. Depósitos en entida<strong>de</strong>s <strong>de</strong> crédito .............................................................................................................................<br />

3.2. Crédito a la clientela ....................................................................................................................................................<br />

3.3. Valores representativos <strong>de</strong> <strong>de</strong>uda...............................................................................................................................<br />

3.4. Instrumentos <strong>de</strong> capital ...............................................................................................................................................<br />

Pro-memoria: Prestados o en garantía .............................................................................................................................<br />

4. ACTIVOS FINANCIEROS DISPONIBLES PARA LA VENTA .....................................................................................<br />

4.1. Valores representativos <strong>de</strong> <strong>de</strong>uda...............................................................................................................................<br />

4.2. Instrumentos <strong>de</strong> capital ...............................................................................................................................................<br />

Pro-memoria: Prestados o en garantía..............................................................................................................................<br />

5. INVERSIONES CREDITICIAS ......................................................................................................................................<br />

5.1. Depósitos en entida<strong>de</strong>s <strong>de</strong> crédito..............................................................................................................................<br />

5.2. Crédito a la clientela ....................................................................................................................................................<br />

5.3. Valores representativos <strong>de</strong> <strong>de</strong>uda ..............................................................................................................................<br />

Pro-memoria: Prestados o en garantía .............................................................................................................................<br />

6. CARTERA DE INVERSIÓN A VENCIMIENTO..............................................................................................................<br />

Pro-memoria: Prestados o en garantía..............................................................................................................................<br />

7. AJUSTES A ACTIVOS FINANCIEROS POR MACRO-COBERTURAS......................................................................<br />

8. DERIVADOS DE COBERTURA.....................................................................................................................................<br />

9. ACTIVOS NO CORRIENTES EN VENTA .....................................................................................................................<br />

10. PARTICIPACIONES.....................................................................................................................................................<br />

10.1. Entida<strong>de</strong>s asociadas..................................................................................................................................................<br />

10.2. Entida<strong>de</strong>s multigrupo.................................................................................................................................................<br />

11. CONTRATOS DE SEGUROS VINCULADOS A PENSIONES...................................................................................<br />

12. ACTIVO MATERIAL ACTIVOS POR REASEGUROS................................................................................................<br />

13. ACTIVO MATERIAL.....................................................................................................................................................<br />

13.1. Inmovilizado material.................................................................................................................................................<br />

13.1.1. De uso propio..........................................................................................................................................................<br />

13.1.2. Cedido en arrendamiento operativo.......................................................................................................................<br />

13.1.3. Afecto a la Obra Social (solo Cajas <strong>de</strong> ahorros y Cooperativas <strong>de</strong> crédito)..........................................................<br />

13.2. Inversiones inmobiliarias............................................................................................................................................<br />

Pro-memoria: Adquirido en arrendamiento financiero........................................................................................................<br />

14. ACTIVO INTANGIBLE.................................................................................................................................................<br />

14.1. Fondo <strong>de</strong> comercio....................................................................................................................................................<br />

14.2. Otro activo intangible.................................................................................................................................................<br />

15. ACTIVOS FISCALES...................................................................................................................................................<br />

15.1. Corrientes...................................................................................................................................................................<br />

15.2. Diferidos.....................................................................................................................................................................<br />

16. RESTO DE ACTIVOS...................................................................................................................................................<br />

16.1. Existencias.................................................................................................................................................................<br />

16.2. Otros ..........................................................................................................................................................................<br />

TOTAL ACTIVO<br />

P A S I V O<br />

1. CARTERA DE NEGOCIACIÓN.....................................................................................................................................<br />

1.1. Depósitos <strong>de</strong> bancos centrales....................................................................................................................................<br />

1.2. Depósitos <strong>de</strong> entida<strong>de</strong>s <strong>de</strong> crédito..............................................................................................................................<br />

1.3. Depósitos <strong>de</strong> la clientela..............................................................................................................................................<br />

1.4. Débitos representados por valores negociables.........................................................................................................<br />

1.5. Derivados <strong>de</strong> negociación............................................................................................................................................<br />

1.6. Posiciones cortas <strong>de</strong> valores.......................................................................................................................................<br />

1.7. Otros pasivos financieros.............................................................................................................................................<br />

465.249 245.526<br />

5.030.665 163.926<br />

0 0<br />

0 0<br />

4.187.298 6.785<br />

162.138 5.421<br />

681.229 151.720<br />

4.187.297 0<br />

15.312 193.854<br />

0 0<br />

0 0<br />

0 193.854<br />

15.312 0<br />

0 188.320<br />

3.212.141 2.445.656<br />

3.088.370 2.396.984<br />

123.771 48.672<br />

2.395.655 1.816.802<br />

48.377.534 22.336.109<br />

1.838.428 366.990<br />

46.539.106 21.052.725<br />

0 916.394<br />

900.523 4.353.734<br />

3.265.958 2.093.779<br />

1.191.541 237.274<br />

14.120 19.491<br />

195.576 136.247<br />

339.618 1.315.796<br />

33.392 100.961<br />

31.529 89.544<br />

1.863 11.417<br />

7.789 24.903<br />

3.803 0<br />

445.858 169.933<br />

445.858 140.485<br />

434.390 121.052<br />

11.468 19.433<br />

0 0<br />

0 29.448<br />

0 0<br />

343.044 27.919<br />

161.837 0<br />

181.207 27.919<br />

137.453 285.558<br />

34.426 46.592<br />

103.028 238.966<br />

104.210 820.287<br />

0 683.835<br />

104.210 136.452<br />

61.991.722 30.379.945<br />

3.460.238 106.083<br />

0 0<br />

0 0<br />

0 0<br />

0 0<br />

887.872 106.083<br />

2.572.366 0<br />

0 0