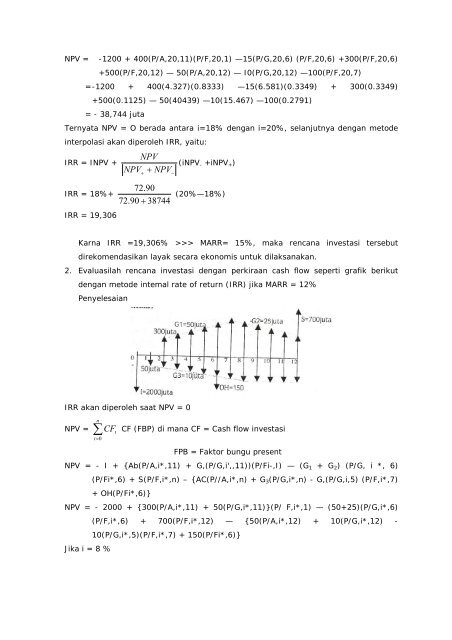

IRR akan diperoleh saat NPV = 0 4 perlu dicari NPV dengan i yang berbeda untuk mendapatkan NPV mendekati nol. n NPV = ∑ t= 0 Cf t (FBP) di mana CF = Cash flow investasi FPB = Faktor bunga present i* = i yang akan dicari NPV = - I + Ab(P/A,i*,11)(P/F,i*,1) - G1(P/G,i*,6)(p/ F,i*,6) +Ls(P/F,i*,6) + S(P/F,i*n) -AC(P/A,i k' n) - G,(P/G,i*,n) - OH(P/F,i*,7) NPV = -1200 + 400(P/A,i*,11)(P/F,i*,1) - 15(P/G,i*,6)(p/ F,i*,6) + 300(P/F,i*,6) + 500(P/Fj*12) - 50(p/ A,i*,12) - I0(P/G,i*,12) - 100(P/Fi*,7) Jika i=15% NPV = -1200 + 400(P/A,i*,11)(P/Fi*,I) -15 (P/G,i*,6) (P/ F,i*,6) + 300(P/F,i*,6) + 500(P/Fi*12) - 50(p/ A,i*,12) - I0(P/G,i*,12) - 100(P/F,i*,7) NPV = -1200+400(P/A,15,11)(P/F,15,1) -15(P/G,1S,6) (P/F,15,6) +300(P/F,15,6) +500(P/F,15,12) - 50(P/A,15,12) - I0(P/G,15,12) -100(P/F,15,7) = -1200+400(5.234)(0.8696)-15(7.937)(0.4323) +300(0.4323) +500(0.1869) - 50(5.421) -10(21.185) -100(0.3759) = + 271,744 juta Jika 1=18% NPV = -1200 + 400(P/A,i*,11)(P/Fi*,I) - 15(P/G,i*,6)(p/ F,i*,6) + 300(P/F,i*,6) + 500(P/F,i*12) - 50(p/ A,i*,12) - 10(P/G,i*,12) - 100(P/F,i*,7) NPV= -1200 + 400(P/A,18,11)(P/F18,1) -15(P/G,18,6) (P/F,18,6) +300(P/F,18,6) +500(P/F,18,12) 50 (P/A, 18,12) - 10 (P/G, 18,12) -100 (P/F, 18,7) = -1200 + 400(4.656)(0.8475) -15(7.083)(0.37CJ4) +300(0.3704) +500(0.1372) - 50(4.793) 10(17.481) -100(0.3139) = + 72,90 juta jika I = 20% NPV = -1200 + 400(P/A,i*,1 1) (P/Fi*,I) —15 (P/G,i*,6) (P/ F,i*,6) + 300(P/F,i*,6) + 500(P/F,i*12) — 50(P/ A,i*,12) — I0(P/G,i*,12) — 100(P/F,i*,7)

NPV = -1200 + 400(P/A,20,11)(P/F,20,1) —15(P/G,20,6) (P/F,20,6) +300(P/F,20,6) +500(P/F,20,12) — 50(P/A,20,12) — I0(P/G,20,12) —100(P/F,20,7) = -1200 + 400(4.327)(0.8333) —15(6.581)(0.3349) + 300(0.3349) +500(0.1125) — 50(40439) —10(15.467) —100(0.2791) = - 38,744 juta Ternyata NPV = O berada antara i=18% dengan i=20%, selanjutnya dengan metode interpolasi akan diperoleh IRR, yaitu: IRR = INPV + IRR = 18%+ IRR = 19,306 NPV NPV + NPV + − 72.90 72.90 + 38744 (iNPV - +iNPV + ) (20%—18%) Karna IRR =19,306% >>> MARR= 15%, maka rencana investasi tersebut direkomendasikan layak secara ekonomis untuk dilaksanakan. 2. Evaluasilah rencana investasi dengan perkiraan cash flow seperti grafik berikut dengan metode intemal rate of return (IRR) jika MARR = 12% Penyelesaian IRR akan diperoleh saat NPV = 0 n NPV = ∑ t= 0 CF t CF (FBP) di mana CF = Cash flow investasi FPB = Faktor bungu present NPV = - I + {Ab(P/A,i*,11) + G,(P/G,i',,11))(P/Fi-,I) — (G 1 + G 2 ) (P/G, i *, 6) (P/Fi*,6) + S(P/F,i*,n) – {AC(P//A,i*,n) + G 3 (P/G,i*,n) - G,(P/G,i,5) (P/F,i*,7) + OH(P/Fi*,6)} NPV = - 2000 + {300(P/A,i*,11) + 50(P/G,i*,11)}(P/ F,i*,1) — (50+25)(P/G,i*,6) (P/F,i*,6) + 700(P/F,i*,12) — {50(P/A,i*,12) + 10(P/G,i*,12) - 10(P/G,i*,5)(P/F,i*,7) + 150(P/Fi*,6)} Jika i = 8 %

- Page 2 and 3:

EKONOMI TEKNIK Drs. M. Giatman, MSI

- Page 4 and 5:

KATA SAMBUTAN Membangun Indonesia k

- Page 6 and 7:

KATA PENGANTAR Buku ini ditulis dal

- Page 8 and 9:

Metode Benefit Cost Ratio (BCR) 79

- Page 10 and 11:

DAFTAR GAMBAR Gambar 1.1. Grafik Fu

- Page 12 and 13:

Gambar 7.7. n Perpindahan 160 Gamba

- Page 14 and 15:

metode, material, waktu, dan lainny

- Page 16 and 17:

pengertian kegiatan ekonomi bagi pr

- Page 18 and 19:

lingkungan, maka dirancang bangunan

- Page 20 and 21:

karena itu, Ekonomi Teknik adalah s

- Page 22 and 23:

dilaksanakan. Dalam suatu investasi

- Page 24 and 25:

3. biaya berdasarkan produknya; 4.

- Page 26 and 27:

c. Biaya Perawatan (Maintenance Cos

- Page 28 and 29:

Biaya komersial merupakan akumulasi

- Page 30 and 31: • Upah Tukang : 1,25 hari x Rp 40

- Page 32 and 33: BEP (Q) = BEP (Q) = FC S −VC di m

- Page 34 and 35: BAB 3 MATEMATIKA UANG Kompetensi: M

- Page 36 and 37: Periode (t) Cash Flow Cash Out (-)

- Page 38 and 39: (1) Akhir tahun (2) Bunga per tahun

- Page 40 and 41: Bunga = i x P x n Dimana: i = suku

- Page 42 and 43: Simbol-simbol i = Interest rate/suk

- Page 44 and 45: Contoh: 1. Jika Mira ingin memiliki

- Page 46 and 47: F = P (1+i) n jika P = A, Maka F =

- Page 48 and 49: F F F F ⎡(1 + i) = A⎢ ⎣ i −

- Page 50 and 51: F = 1G(1+1) n-2 + 2G(1+i) n-1 +3G(I

- Page 52 and 53: F G ⎡(1 + i) = i ⎢ ⎣ i n −1

- Page 54 and 55: Gambar. 3.21 Geometric Gradient Tab

- Page 56 and 57: ) Penjualan tahun 2005: A n = A, (I

- Page 58 and 59: = 18%/tahun m = 12 x per tahun ⎞

- Page 60 and 61: dari biaya operasional (operation c

- Page 62 and 63: Jika : NPV > 0 artinya investasi ak

- Page 64 and 65: Penyelesaian Gambar 4.4 Cash Flow I

- Page 66 and 67: AE = n ∑ t= 0 Cc t ( FBA) t AE =

- Page 68 and 69: AE = 1200(0.1468) + 400(6.495)(0.90

- Page 70 and 71: PWC = I + Ac(P/A,i,n) + G 2 (P/G,i,

- Page 72 and 73: Karena BCR = 2,85 >>> 1, maka renca

- Page 74 and 75: Thn ke- Alt. A Alt. B Alt. C o -100

- Page 76 and 77: Selanjutnya jika dihitung discounte

- Page 78 and 79: sumbu nol. Saat NPV sama dengan nol

- Page 82 and 83: NPV=-2000+ {300(P/A,8,11) +50(P/G,8

- Page 84 and 85: a. alternatif harus bersifat exhaus

- Page 86 and 87: NPV = 2600 + 750(P/A,8,10) + 550(P/

- Page 88 and 89: NPV = - 1600 + 850(7.536) + 450(0.7

- Page 90 and 91: NPV = Rp 125,227 juta Alternatif B

- Page 92 and 93: n AE = ∑ t= 0 CF t FBP) t Gambar

- Page 94 and 95: sementara) disebut dengan defender

- Page 96 and 97: NPVB = -18000+3800(P/A,15,10)+1000(

- Page 98 and 99: IRRB B-A = 20% + 2,169% = 22,169% K

- Page 100 and 101: NPV C = -2000+720(P/A,20,8)+50(P/G,

- Page 102 and 103: 7. Siklus di atas dilakukan berulan

- Page 104 and 105: Analisis sensisitivitas umumnya men

- Page 106 and 107: Jika i=10% NPV = — 1000+400(P/A,1

- Page 108 and 109: Dengan cara yang sama, sensitivitas

- Page 110 and 111: akan dibutuhkan setelah 14 tahun ya

- Page 112 and 113: BAB 7 DEPRESIASI DAN PAJAK Kompeten

- Page 114 and 115: sama setiap tahun selama umur perhi

- Page 116 and 117: Rumus: SOYD 1 = — Umur sisa aset

- Page 118 and 119: didapatkan laju penurunan depresias

- Page 120 and 121: t=2 → DDBD 2 = N 2 2 21 = N N ⎛

- Page 122 and 123: menggabungkan metode DDBD dengan SL

- Page 124 and 125: Dengan demikian, jadwal lengkap dep

- Page 126 and 127: 15.000m 50.000m t=5 → UPD 5 = 3 t

- Page 128 and 129: a. Metode Double Dedining Balance D

- Page 130 and 131:

DDBD t=1 = 10 2 (700) = 140 DDBDt=6

- Page 132 and 133:

BAB 8 ANALISIS REPLACEMENT Kompeten

- Page 134 and 135:

Penurunan fungsi-fungsi fisik dan k

- Page 136 and 137:

Diminta a. Lukislah diagram cash fl

- Page 138 and 139:

EUAC D = Rp 17,145 juta. n Cc EUAC

- Page 140 and 141:

TABEL FAKTOR BUNGA MAJEMUK COMPOUND

- Page 142 and 143:

TABEL FAKTOR BUNGA MAJEMUK COMPOUND

- Page 144 and 145:

TABEL FAKTOR BUNGA MAJEMUK COMPOUND

- Page 146 and 147:

TABEL FAKTOR BUNGA MAJEMUK COMPOUND

- Page 148 and 149:

TABEL FAKTOR BUNGA MAJEMUK COMPOUND

- Page 150 and 151:

TABEL FAKTOR BUNGA MAJEMUK COMPOUND

- Page 152 and 153:

TABEL FAKTOR BUNGA MAJEMUK COMPOUND

- Page 154 and 155:

TABEL FAKTOR BUNGA MAJEMUK COMPOUND

- Page 156 and 157:

TABEL FAKTOR BUNGA MAJEMUK COMPOUND

- Page 158 and 159:

TABEL FAKTOR BUNGA MA)EMUK COMPOUND

- Page 160 and 161:

TABEL FAKTOR BUNGA MAJEMUK COMPOUND

- Page 162 and 163:

TABEL FAKTOR BUNGA MAJEMUK COMPOUND

- Page 164 and 165:

DAFTAR REFERENSI D., Newnan. 1998,