notes to the financial statements - Pphg.com

notes to the financial statements - Pphg.com

notes to the financial statements - Pphg.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

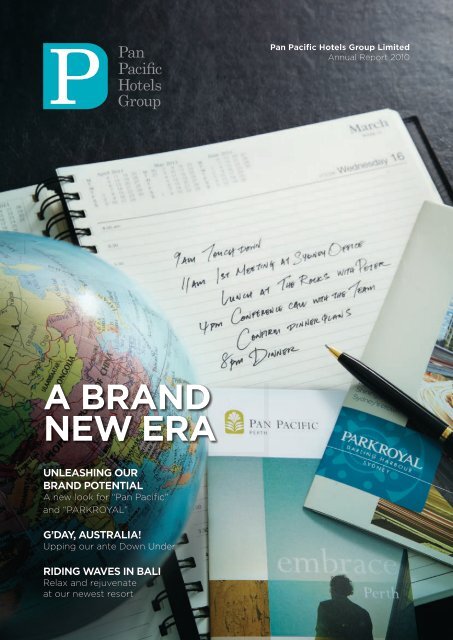

a Brand<br />

neW era<br />

UnLeasHinG OUr<br />

Brand POtentiaL<br />

A new look for “Pan Pacific”<br />

and “PARkRoyAl”<br />

G’day, aUstraLia!<br />

Upping our ante Down Under<br />

ridinG Waves in BaLi<br />

Relax and rejuvenate<br />

at our newest resort<br />

Pan Pacific Hotels Group Limited<br />

Annual Report 2010

a nOte FrOm<br />

Pan PaciFic<br />

HOtels GrOuP<br />

Pan Pacific Hotels Group owns and/or manages<br />

over 30 hotels, resorts and serviced suites across<br />

Asia, Oceania and North America, including those<br />

under development. Headquartered in Singapore,<br />

it is a listed subsidiary of UOL Group Limited,<br />

an established property <strong>com</strong>pany in Asia with a<br />

diversified portfolio.<br />

As an international hotel management <strong>com</strong>pany with more<br />

than 11,000 rooms including those under development,<br />

Pan Pacific Hotels Group is dedicated <strong>to</strong> creating memorable<br />

hotel experiences. Its hospitality offerings are grouped<br />

under two acclaimed brands: “Pan Pacific” features luxurious<br />

ac<strong>com</strong>modations and refreshing experiences that entice<br />

<strong>the</strong> senses; while “PARKROYAL” reflects stylish <strong>com</strong>fort and<br />

au<strong>the</strong>ntic local encounters inspired by <strong>the</strong> interesting locales<br />

of its hotels.<br />

Pan Pacific Hotels Group builds brands that resonate with<br />

guests, cus<strong>to</strong>mers and associates. It enhances shareholders’<br />

value by driving greater innovation, cus<strong>to</strong>mer focus and<br />

partner engagement. Complementing its hospitality brands,<br />

<strong>the</strong> Group also owns and operates <strong>the</strong> award-winning<br />

“St Gregory” spas and “Si Chuan Dou Hua” restaurants.<br />

Our<br />

VisiOn<br />

Creating memorable<br />

hotel experiences…<br />

Our<br />

PurPOse<br />

Great Brands, Great<br />

Hotels, Great People,<br />

Great Relationships!<br />

Our<br />

Values<br />

• We work better<br />

<strong>to</strong>ge<strong>the</strong>r because<br />

we collaborate,<br />

share, care about<br />

each o<strong>the</strong>r and<br />

<strong>com</strong>municate openly<br />

with everyone.<br />

• We keep our<br />

processes as simple<br />

and as un<strong>com</strong>plicated<br />

as possible and take<br />

full responsibility for<br />

our actions.<br />

• We have an “internal<br />

debate, external<br />

cohesion” culture<br />

with a can-do<br />

attitude and always<br />

try <strong>to</strong> have fun.<br />

• We enhance our<br />

performance by<br />

always aiming higher<br />

and are not afraid<br />

of making <strong>the</strong> <strong>to</strong>ugh<br />

decisions.<br />

• We respect and<br />

care for our wider<br />

<strong>com</strong>munity through<br />

being connected<br />

and sharing, we also<br />

recognise and value<br />

diversity in every way.<br />

On tHe cOVer<br />

a Brand<br />

neW era<br />

unleasHinG Our<br />

Brand POtential<br />

A new look for “Pan Pacific”<br />

and “PARKROYAL”<br />

G’day, australia!<br />

Upping our ante Down Under<br />

ridinG WaVes in Bali<br />

Relax and rejuvenate<br />

at our newest resort<br />

Pan Pacific Hotels Group limited<br />

Annual Report 2010<br />

Pan Pacific Hotels<br />

Group ushers in<br />

A Brand New Era,<br />

marked by <strong>the</strong><br />

refreshment of our<br />

“Pan Pacific” and<br />

“PARKROYAL” brand<br />

identities.<br />

Primed for growth,<br />

our brands are geared<br />

for expansion in Asia,<br />

Greater China, North<br />

America and Australia.<br />

Page 22<br />

OUr LeAderSHiP<br />

12 Board of direc<strong>to</strong>rs<br />

16 Key Management<br />

executives<br />

18 Group Structure<br />

OUr BrANdS<br />

22 embracing A<br />

Brand New era<br />

24 Pan Pacific Hotels<br />

and resorts<br />

28 PArKrOYAL Hotels<br />

& resorts<br />

32 Lifestyle Brands<br />

OUr HOteLS<br />

36 Operations Overview<br />

38 Portfolio Summary<br />

42 Sou<strong>the</strong>ast Asia<br />

taBle OF<br />

cOntents<br />

Snapshot<br />

Miles<strong>to</strong>nes<br />

2010/11<br />

Chairman’s<br />

Message<br />

45 People’s republic of China<br />

46 Australia<br />

48 North America<br />

49 Our Awards 2010<br />

50 Our Pipeline Projects<br />

52 Human Capital<br />

and development<br />

54 Sustainability and Corporate<br />

Social responsibility<br />

OUr PerfOrMANCe<br />

58 five-Year <strong>financial</strong><br />

Summary<br />

61 <strong>financial</strong> review<br />

64 Group Value-Added<br />

Statement<br />

65 <strong>financial</strong> Contents<br />

65 <strong>financial</strong> Calendar<br />

1

A BRAND<br />

2 new era<br />

snAPsHOT<br />

KEy FinAnciAL TREnds<br />

2006 2010 CAGR<br />

Revenue $287m $324m 3.10%<br />

RevPAR $105.97 $125.03 4.22%<br />

EBITDA $80m $97m 4.94%<br />

Earnings per share* 6.87 cents 7.53 cents 2.32%<br />

Total assets $740m $1,129m 11.13%<br />

Shareholders' funds $514m $802m 11.75%<br />

* before o<strong>the</strong>r gains/(losses)<br />

and fair value adjustments<br />

350<br />

300<br />

250<br />

200<br />

GROUP REVEnUE $’M<br />

2006 2007 2008 2009 2010<br />

LEGEnd<br />

hOteL<br />

Ownership<br />

hOteL<br />

ManaGeMent<br />

serViCes<br />

pan paCifiC hOteLs GrOup LiMited<br />

prOpertY<br />

inVestMents<br />

inVestMents<br />

900<br />

800<br />

700<br />

600<br />

500<br />

400<br />

300<br />

200<br />

100<br />

RETURn On sHAREHOLdERs’ EQUiTy $’M<br />

0 0<br />

2006 2007 2008 2009 2010<br />

LEGEnd<br />

return<br />

On eQuitY<br />

aVeraGe<br />

sharehOLders’<br />

fund<br />

30%<br />

25%<br />

20%<br />

15%<br />

10%<br />

5%<br />

30<br />

25<br />

20<br />

15<br />

10<br />

5<br />

0<br />

-5<br />

dELiVERinG sHAREHOLdER VALUE<br />

Each year, embracing <strong>the</strong> challenge <strong>to</strong> drive operational<br />

excellence – ensuring profitability, continued growth and<br />

superior brand performance – has enabled Pan Pacific Hotels<br />

Group <strong>to</strong> deliver solid <strong>financial</strong> results.<br />

2010 was no exception. Continued efforts <strong>to</strong> grow our portfolio,<br />

streng<strong>the</strong>n our brands, nurture stakeholder relationships and<br />

develop our human capital have s<strong>to</strong>od us in good stead.<br />

With <strong>the</strong>se endeavours working <strong>to</strong>ge<strong>the</strong>r <strong>to</strong> create memorable<br />

hotel experiences, we are confident in our ability <strong>to</strong> deliver<br />

greater shareholder returns for years <strong>to</strong> <strong>com</strong>e.<br />

nET cAsH FLOW RETURns On AssETs<br />

2006 2007 2008 2009 2010<br />

LEGEnd<br />

sinGapOre<br />

hOteLs<br />

aVeraGe<br />

MYanMar<br />

hOteLs<br />

aVeraGe<br />

pan paCifiC<br />

hOteLs GrOup<br />

aVeraGe<br />

austraLia<br />

hOteLs<br />

aVeraGe<br />

China<br />

hOteLs<br />

aVeraGe<br />

VietnaM<br />

hOteLs<br />

aVeraGe<br />

MaLaYsia<br />

hOteLs<br />

aVeraGe<br />

1,200<br />

1,000<br />

800<br />

600<br />

400<br />

200<br />

0<br />

sOURcEs OF FinAncE $’M<br />

2006 2007 2008 2009 2010<br />

LEGEnd<br />

nOn-<br />

COntrOLLinG<br />

interests<br />

interests Of<br />

<strong>the</strong> eQuitY<br />

hOLders Of<br />

<strong>the</strong> COMpanY<br />

BOrrOwinGs<br />

3<br />

ANNUAL REPORT 2010

A BRAND<br />

4 new era<br />

miLEsTOnEs<br />

2010/11<br />

smOOTH sTRidEs<br />

January<br />

inTO sUzHOU<br />

The opening of Pan Pacific Suzhou<br />

marked our second hotel in China.<br />

Fusing traditional landscapes and<br />

ancient aes<strong>the</strong>tics with modern<br />

<strong>com</strong>forts and luxury, this 481-room<br />

hotel wel<strong>com</strong>ed its first guests with<br />

premier facilities and unrivalled<br />

personalised service.<br />

cEmEnTinG cOnnEcTiOns<br />

in cHinA<br />

To reinforce our China presence<br />

and deliver on our global expansion<br />

strategy, our seventh Global Sales<br />

Office was established in Shanghai.<br />

pan paCifiC hOteLs GrOup LiMited<br />

February may<br />

RidinG WAVEs cOmmOn PLATFORm FOR<br />

in BALi sEAmLEss inTEGRATiOn<br />

A hotel management agreement for an integrated resort,<br />

<strong>to</strong> be rebranded Pan Pacific Nirwana Bali Resort, was<br />

inked. Featuring 278 luxurious suites and villas, world-class<br />

amenities and an award-winning golf course designed<br />

by Greg Norman, this 103-ha development in Tanah<br />

Lot overlooks Bali’s magnificent coast and <strong>the</strong> island’s<br />

spectacular volcanic mountains.<br />

On 1 April, <strong>the</strong> rebranded Pan Pacific Nirwana Bali Resort<br />

was launched amidst champagne celebrations and colourful<br />

ceremonies. As part of our Vision <strong>to</strong> create memorable<br />

hotel experiences, <strong>the</strong> resort is undergoing enhancements<br />

<strong>to</strong> improve its integrated and holistic appeal.<br />

march<br />

BUiLdinG OUR BRAnd<br />

in BAnGKOK<br />

Setting industry standards<br />

in Thailand with round-<strong>the</strong>clock<br />

personal assistance<br />

is <strong>the</strong> newly opened Pan<br />

Pacific Serviced Suites<br />

Bangkok. The 148-suite<br />

luxury ac<strong>com</strong>modation<br />

offers easy access <strong>to</strong> <strong>the</strong><br />

city’s business district and<br />

trendiest nightspots while<br />

providing all <strong>the</strong> <strong>com</strong>forts<br />

of home.<br />

SAP was adopted Group-wide as <strong>the</strong> enterprise<br />

resource-planning solution across our owned<br />

hotels. A <strong>com</strong>mon platform for our operating<br />

June<br />

sETTinG OUR<br />

siGHTs On ninGBO<br />

The signing of a hotel management agreement<br />

for <strong>the</strong> 430-room Pan Pacific Ningbo and <strong>the</strong><br />

200-room Pan Pacific Serviced Suites Ningbo<br />

was a highlight for our expansion in China. The<br />

A PARTnERsHiP<br />

ABOVE PAR<br />

The Group teamed up<br />

with Asian Tour as<br />

official hotel partner for<br />

its highly anticipated<br />

golf <strong>to</strong>urnaments in <strong>the</strong><br />

region. Collaboration with<br />

Asia’s official sanctioning<br />

body for professional<br />

golf underscores our<br />

mission <strong>to</strong> reach out <strong>to</strong><br />

new cus<strong>to</strong>mer segments<br />

across Asia.<br />

mEmBERsHiP HAs<br />

iTs PRiViLEGEs<br />

and accounting systems enables quicker and<br />

more efficient decisions as we streamline<br />

business processes.<br />

brand-defining additions, coupled with <strong>the</strong>ir<br />

location in Ningbo’s up and <strong>com</strong>ing industrial and<br />

economic zone, are important stepping-s<strong>to</strong>nes<br />

<strong>to</strong>wards our growth in Greater Shanghai.<br />

“Pan Pacific” and “PARKROYAL” launched<br />

a new guest loyalty programme, GHA<br />

Discovery, founded on <strong>the</strong> Global Hotel<br />

Alliance platform, <strong>the</strong> world’s largest<br />

alliance of 12 independent upscale and<br />

luxury hotel brands. Rewarding members<br />

with ‘Amazing Local Experiences’ unique<br />

<strong>to</strong> wherever <strong>the</strong>y travel, <strong>the</strong> programme<br />

extends more benefits for loyal guests<br />

and cus<strong>to</strong>mers of “Pan Pacific” and<br />

“PARKROYAL”, thus enhancing <strong>the</strong>ir<br />

appeal <strong>to</strong> cus<strong>to</strong>mers.<br />

5<br />

ANNUAL REPORT 2010

A BRAND<br />

6 new era<br />

July<br />

UPPinG OUR AnTE<br />

dOWn UndER<br />

The Group announced its entry in<strong>to</strong><br />

Australia with three hotels: PARKROYAL<br />

Darling Harbour, Sydney, PARKROYAL<br />

Parramatta and Pan Pacific Perth. To<br />

nurture our presence in Australia and<br />

New Zealand and launch our journey<br />

in<strong>to</strong> an exciting growth market, an<br />

Oceania Area Team was appointed <strong>to</strong><br />

synergise efforts across our Operations,<br />

Human Capital & Development and<br />

Marketing & Sales functions.<br />

TOP HOTELiERs<br />

cOnVERGE<br />

Mr Patrick Imbardelli (third from<br />

left), our President and CEO, shared<br />

insights on “Global Issues, Local<br />

Impacts” <strong>to</strong>ge<strong>the</strong>r with industry<br />

experts at <strong>the</strong> 2010 Australia, New<br />

Zealand & Pacific Hotel Industry<br />

Conference held in Sydney. Mr Eric<br />

Levy, Senior Vice President for Growth<br />

& Development, was a panel member<br />

at <strong>the</strong> discussion on “Hot New Brands,<br />

Hotels & Players Take Centre Stage”.<br />

pan paCifiC hOteLs GrOup LiMited<br />

september<br />

nEW PERsPEcTiVEs On<br />

PEOPLE mAnAGEmEnT<br />

Sharing global best practices with HR professionals, our<br />

Senior Vice President for Human Capital & Development,<br />

Mrs Melody King, spoke on “Harnessing Human Capital<br />

for Successful Regionalisation in Asia” at <strong>the</strong> Singapore<br />

Human Capital Summit.<br />

Oc<strong>to</strong>ber<br />

sHARinG sTRATEGic UnLEAsHinG OUR BRAnd<br />

insiGHTs POTEnTiAL<br />

Demonstrating <strong>the</strong> Group’s<br />

thought leadership among<br />

industry peers, Mr Patrick<br />

Imbardelli was a panellist<br />

speaker on “Future Trends/<br />

Bold Predictions” at <strong>the</strong><br />

Hotel Investment Conference<br />

held in Hong Kong.<br />

sTyLisH REsidEncEs in<br />

KUALA LUmPUR<br />

Global branding agency, The<br />

Brand Union was appointed<br />

<strong>to</strong> refresh <strong>the</strong> “Pan Pacific”<br />

and “PARKROYAL” brands.<br />

The exercise was aimed at<br />

streng<strong>the</strong>ning our brands’<br />

identities and offerings so<br />

that <strong>the</strong>y resonate more<br />

strongly with <strong>the</strong> modern<br />

consumer.<br />

The opening of <strong>the</strong> 287-room PARKROYAL Serviced<br />

Suites Kuala Lumpur marked <strong>the</strong> first “PARKROYAL”<br />

extended-stay product outside Singapore. Exuding<br />

stylish <strong>com</strong>fort replete with modern amenities, <strong>the</strong><br />

property offers full access <strong>to</strong> business and leisure<br />

facilities in <strong>the</strong> heart of Kuala Lumpur.<br />

G’dAy, AWAKEninG in<br />

AUsTRALiA! WEsTERn AUsTRALiA<br />

“PARKROYAL” marked its home<strong>com</strong>ing<br />

<strong>to</strong> Australia with <strong>the</strong> 345-room<br />

PARKROYAL Darling Harbour, Sydney<br />

and <strong>the</strong> 196-room PARKROYAL<br />

Parramatta. After a 10-year absence<br />

from where <strong>the</strong> “PARKROYAL” brand<br />

was conceived, <strong>the</strong> newly rebranded<br />

properties put us back on <strong>the</strong> map<br />

with prime locations in down<strong>to</strong>wn<br />

Sydney and Parramatta.<br />

TOUcHdOWn in<br />

november January 2011<br />

december<br />

mELBOURnE<br />

The Group invested fur<strong>the</strong>r in<br />

Australia with an agreement <strong>to</strong><br />

acquire <strong>the</strong> Hil<strong>to</strong>n Melbourne Airport<br />

Hotel. The 276-room landmark<br />

property is sited at Australia’s second<br />

busiest aviation hub.<br />

The opening of <strong>the</strong> 486room<br />

Pan Pacific Perth<br />

signaled <strong>the</strong> brand’s debut<br />

in Australia. Impressing<br />

<strong>the</strong> market with signature<br />

hospitality and elegant<br />

ac<strong>com</strong>modations, <strong>the</strong> hotel<br />

also features spacious<br />

function rooms, indulgent<br />

dining options and great<br />

views of <strong>the</strong> Swan River.<br />

cLicKinG-in<br />

OnLinE<br />

The refreshed “Pan Pacific” and “PARKROYAL” brand<br />

websites were launched. With easy navigation and ones<strong>to</strong>p<br />

reservation just a click away, <strong>the</strong> new look reflects our<br />

rejuvenated brands captured through <strong>the</strong>ir new visual and<br />

verbal identities.<br />

“PARKROyAL” VEnTUREs<br />

inTO cHinA<br />

The Group entered in<strong>to</strong> two hotel management agreements<br />

that will launch <strong>the</strong> “PARKROYAL” brand in China. The 325room<br />

PARKROYAL Serviced Suites, Green City, Shanghai<br />

will open its doors in 2012, followed by <strong>the</strong> 200-room<br />

PARKROYAL Suzhou Taihu Resort, Suzhou in 2014.<br />

7<br />

ANNUAL REPORT 2010

A BRAND<br />

8 new era<br />

cHAiRmAn’s<br />

mEssAGE<br />

dR WEE cHO yAW<br />

Chairman, Pan Pacific Hotels Group<br />

<strong>the</strong> Group’s hotel management<br />

division continued its expansion<br />

during <strong>the</strong> year with <strong>the</strong> addition<br />

of six new properties <strong>to</strong> its brands.<br />

2010 Performance And dividend<br />

2010 saw a strong rebound from <strong>the</strong> global<br />

economic slowdown in 2009. In line with <strong>the</strong><br />

improvements in <strong>the</strong> global economy, Singapore<br />

achieved a strong GDP growth of 14.5% in 2010.<br />

International travel and <strong>to</strong>urism which is driven<br />

by <strong>the</strong> global economy gained momentum in<br />

2010 with <strong>the</strong> Asia Pacific region leading <strong>the</strong><br />

recovery.<br />

For <strong>the</strong> year under review, Group’s pre-tax profit<br />

before impairment charge and fair value losses<br />

increased by 19% <strong>to</strong> $60.2 million from <strong>the</strong> $50.8<br />

million achieved in 2009. In 2010, <strong>the</strong> Group also<br />

recognised a fair value gain of $10.0 million on<br />

its investment properties (2009: fair value loss<br />

of $1.6 million). As a result, <strong>the</strong> Group’s profit<br />

before tax increased by $21.2 million or 43% <strong>to</strong><br />

$70.4 million (2009: $49.2 million). The Group’s<br />

net profit attributable <strong>to</strong> shareholders increased<br />

by 36% <strong>to</strong> $53.6 million from $39.3 million<br />

achieved in 2009.<br />

Your Board is re<strong>com</strong>mending a first and final<br />

dividend of 4 cents per share (2009: first and<br />

final dividend of 3.5 cents) amounting <strong>to</strong> $24<br />

million (2009: $21 million) for <strong>the</strong> year ended 31<br />

December 2010.<br />

Operations<br />

singapore Operations<br />

Benefiting from <strong>the</strong> opening of <strong>the</strong> two<br />

integrated resorts and <strong>the</strong> pickup in business<br />

travel, visi<strong>to</strong>r arrivals <strong>to</strong> Singapore increased<br />

by 20% <strong>to</strong> reach a record high of 11.6 million in<br />

2010. Average occupancy for <strong>the</strong> hotel industry<br />

increased by 9.8 percentage points <strong>to</strong> 86% while<br />

average room rate increased by 12% <strong>to</strong> $212<br />

in 2010 (2009: $190). The Group’s hotels and<br />

pan paCifiC hOteLs GrOup LiMited<br />

serviced suites in Singapore benefited from <strong>the</strong><br />

increase in visi<strong>to</strong>r arrivals and achieved higher<br />

revenue and profit.<br />

Overseas Operations<br />

Outside Singapore, <strong>the</strong> Group’s hotels in Australia<br />

and Myanmar benefited from improvements in<br />

occupancy and average room rates while <strong>the</strong><br />

Vietnam hotels, despite enjoying improved<br />

occupancy still lagged in average room rates<br />

when <strong>com</strong>pared <strong>to</strong> 2009. In Malaysia, while<br />

<strong>the</strong> Kuala Lumpur hotel showed improvements<br />

in occupancy and average room rates, <strong>the</strong><br />

average occupancy rate of <strong>the</strong> hotel in Penang<br />

was affected by <strong>the</strong> re-opening of a <strong>com</strong>peti<strong>to</strong>r<br />

hotel previously under renovation. Our hotel<br />

in Suzhou, China continues <strong>to</strong> be affected by<br />

increased <strong>com</strong>petition.<br />

Hotel management division<br />

The Group’s hotel management division<br />

continued its expansion during <strong>the</strong> year with <strong>the</strong><br />

addition of six new properties <strong>to</strong> its brands. Three<br />

of <strong>the</strong> Group owned hotels were rebranded <strong>to</strong><br />

“Pan Pacific” or “PARKROYAL” during <strong>the</strong> course<br />

of 2010 when <strong>the</strong> management contracts with<br />

third party opera<strong>to</strong>rs expired. The Pan Pacific<br />

Suzhou was rebranded in January 2010 while<br />

PARKROYAL Darling Harbour and PARKROYAL<br />

Parramatta were rebranded in November 2010.<br />

The Group saw <strong>the</strong> opening of two new serviced<br />

suites, namely <strong>the</strong> 148-unit Pan Pacific Serviced<br />

Suites Bangkok in March 2010 and <strong>the</strong> 287-unit<br />

PARKROYAL Serviced Suites Kuala Lumpur in<br />

Oc<strong>to</strong>ber 2010. The Group also expanded its<br />

profile in Indonesia with <strong>the</strong> rebranding of <strong>the</strong><br />

278-room Pan Pacific Nirwana Bali Resort in<br />

April 2010.<br />

During <strong>the</strong> year, <strong>the</strong> Group also secured <strong>the</strong><br />

management rights <strong>to</strong> two new developments<br />

in China, namely <strong>the</strong> Pan Pacific Ningbo<br />

(<strong>com</strong>prising 430 hotel guestrooms and 200<br />

serviced suites) and <strong>the</strong> PARKROYAL Serviced<br />

Suites Green City, Shanghai (325 serviced<br />

suites). The two properties are expected <strong>to</strong> open<br />

in <strong>the</strong> first quarter of 2012.<br />

In January 2011, <strong>the</strong> Group rebranded <strong>the</strong> 486room<br />

Pan Pacific Perth when <strong>the</strong> management<br />

contract with a third party opera<strong>to</strong>r expired.<br />

The Group also secured <strong>the</strong> management rights<br />

<strong>to</strong> a resort development in Suzhou, China. The<br />

200-room PARKROYAL Taihu Resort, Suzhou is<br />

scheduled <strong>to</strong> open in 2014.<br />

corporate developments<br />

incorporation of new subsidiary in china<br />

To enhance <strong>the</strong> management and operations<br />

of hotels and serviced suites in China, <strong>the</strong><br />

Group incorporated a new wholly owned<br />

subsidiary named Pan Pacific (Shanghai) Hotel<br />

Management Co., Ltd. in Shanghai <strong>to</strong> support<br />

<strong>the</strong> development of our two brands.<br />

Acquisition of shares in subsidiaries<br />

In May 2010, <strong>the</strong> Company acquired <strong>the</strong> remaining<br />

5% interest in Success City Pty Limited (“SCPL”)<br />

fur<strong>the</strong>r <strong>to</strong> <strong>the</strong> exercise of <strong>the</strong> put options by <strong>the</strong><br />

two minority shareholders. Total consideration<br />

of A$2.0 million (S$2.5 million) was paid for <strong>the</strong><br />

2,151,042 ordinary shares.<br />

The Company also acquired from <strong>the</strong> same<br />

parties <strong>the</strong> remaining 40% interest in Success<br />

Venture Investments (Australia) Ltd (“SVIA”)<br />

in November 2010 for a <strong>to</strong>tal consideration of<br />

A$34.0 million (approximately S$43.5 million).<br />

SVIA is an investment <strong>com</strong>pany with its principal<br />

assets being two hotels in Sydney, Australia,<br />

namely PARKROYAL Darling Harbour and<br />

PARKROYAL Parramatta.<br />

Following <strong>the</strong> acquisitions, SCPL and SVIA<br />

became wholly owned subsidiaries.<br />

Hotel / serviced suites development<br />

Hotel & <strong>com</strong>mercial development at<br />

Upper Pickering street, singapore<br />

Construction works are in progress for <strong>the</strong><br />

development of <strong>the</strong> 363-room hotel and<br />

approximately 7,300 square metres of office<br />

space. The project is expected <strong>to</strong> be <strong>com</strong>pleted<br />

in mid-2012.<br />

Redevelopment at The Plaza,<br />

Beach Road, singapore<br />

Works for <strong>the</strong> redevelopment of <strong>the</strong> existing<br />

Furniture Mall located at The Plaza in<strong>to</strong> a 184unit<br />

serviced suites, with a column-free ballroom<br />

and meeting rooms, <strong>com</strong>menced in September<br />

2010. Piling works are in progress and <strong>the</strong><br />

project is scheduled <strong>to</strong> be <strong>com</strong>pleted in <strong>the</strong><br />

fourth quarter of 2012.<br />

Acquisition of Hotel in melbourne, Australia<br />

The Group entered in<strong>to</strong> a conditional agreement<br />

for <strong>the</strong> acquisition of <strong>the</strong> Hil<strong>to</strong>n Melbourne<br />

Airport Hotel for an aggregate cash consideration<br />

of A$108.9 million (or approximately S$141.6<br />

million). The Hil<strong>to</strong>n Melbourne Airport Hotel<br />

<strong>com</strong>prises a 276-room hotel with three food and<br />

beverage outlets and extensive convention and<br />

meeting facilities. The acquisition is scheduled<br />

<strong>to</strong> be <strong>com</strong>pleted on 31 March 2011 and <strong>the</strong> hotel<br />

will be rebranded as PARKROYAL Melbourne<br />

Airport.<br />

Outlook for 2011<br />

The economies of Singapore and <strong>the</strong> region<br />

should continue <strong>to</strong> grow in 2011, albeit at a more<br />

moderate pace. The Asia Pacific is expected <strong>to</strong><br />

be <strong>the</strong> most dynamic region for <strong>to</strong>urism with<br />

strong growth in intra-regional travel. Against<br />

this background of robust outlook, <strong>the</strong> Group<br />

expects <strong>to</strong> see improved occupancy and/or<br />

room rates for its hotels.<br />

Acknowledgement<br />

Dr Lim Kee Ming who has served as a direc<strong>to</strong>r<br />

since 1995, has indicated that he would not be<br />

standing for re-appointment at <strong>the</strong> forth<strong>com</strong>ing<br />

Annual General Meeting. On behalf of <strong>the</strong> Board,<br />

I would like <strong>to</strong> thank Dr Lim for his invaluable<br />

contributions in <strong>the</strong> past 16 years.<br />

On behalf of <strong>the</strong> Board, I wish <strong>to</strong> express my<br />

appreciation and thanks <strong>to</strong> <strong>the</strong> management and<br />

staff for <strong>the</strong>ir hard work and <strong>to</strong> our shareholders<br />

and business associates for <strong>the</strong>ir continuing<br />

support. My appreciation goes <strong>to</strong> my colleagues<br />

on <strong>the</strong> Board for <strong>the</strong>ir counsel and guidance<br />

during <strong>the</strong> past year.<br />

dR WEE cHO yAW<br />

Chairman<br />

February 2011<br />

9<br />

ANNUAL REPORT 2010

A BRAND<br />

10 new era<br />

pan paCifiC hOteLs GrOup LiMited<br />

OUR<br />

LEAdERsHiP<br />

in THis sEcTiOn<br />

Board of direc<strong>to</strong>rs<br />

Key Management executives<br />

Group structure<br />

11<br />

ANNUAL REPORT 2010

A BRAND<br />

12 new era<br />

1 2 3 4 5<br />

BOARd OF diREcTORs<br />

1. dR WEE cHO yAW<br />

ChairMan<br />

Dr Wee is <strong>the</strong> Chairman of <strong>the</strong> Company<br />

(“PPHG”) and its holding <strong>com</strong>pany, UOL<br />

Group Limited (“UOL”). He was appointed<br />

<strong>to</strong> <strong>the</strong> Board since 25 May 1973 and was last<br />

re-appointed as Direc<strong>to</strong>r at PPHG’s Annual<br />

General Meeting on 21 April 2010.<br />

Dr Wee, who is a non-executive and nonindependent<br />

Direc<strong>to</strong>r of PPHG, is also <strong>the</strong><br />

Chairman of <strong>the</strong> Executive Committee<br />

and a Member of <strong>the</strong> Nominating and<br />

Remuneration Committees.<br />

Dr Wee received Chinese high school<br />

education and he is a career banker with<br />

more than 50 years of experience. He is <strong>the</strong><br />

Chairman of United Overseas Bank Limited,<br />

Far Eastern Bank Limited, United Overseas<br />

Insurance Limited, United International<br />

Securities Ltd, Haw Par Corporation Limited,<br />

United Industrial Corporation Limited,<br />

Singapore Land Limited and Marina Centre<br />

Holdings Private Limited. He is also <strong>the</strong><br />

Chairman of Wee Foundation.<br />

Dr Wee is <strong>the</strong> Honorary President of <strong>the</strong><br />

Singapore Federation of Chinese Clan<br />

Associations, Singapore Hokkien Huay<br />

Kuan and Singapore Chinese Chamber of<br />

Commerce & Industry and a Pro-Chancellor<br />

of Nanyang Technological University.<br />

In 2008, he was conferred an honorary<br />

Doc<strong>to</strong>r of Letters by <strong>the</strong> National University<br />

of Singapore for his ac<strong>com</strong>plishments<br />

in banking, education and <strong>com</strong>munity<br />

leadership. He was a recipient of <strong>the</strong> Credit<br />

Suisse Ernst & Young Lifetime Achievement<br />

Award in 2006 and named Singapore<br />

pan paCifiC hOteLs GrOup LiMited<br />

Businessman of <strong>the</strong> Year in 1990 and<br />

2001. In 2009, he was conferred a Lifetime<br />

Achievement Award by The Asian Banker.<br />

2. mR GWEE LiAn KHEnG<br />

GrOup Chief exeCutiVe<br />

Mr Gwee is <strong>the</strong> Group Chief Executive of<br />

PPHG and UOL and has been with <strong>the</strong><br />

UOL Group since 1973. He was appointed<br />

<strong>to</strong> <strong>the</strong> Board since 20 January 1987 and<br />

was last re-elected as Direc<strong>to</strong>r at PPHG’s<br />

Annual General Meeting on 28 April 2009.<br />

Mr Gwee, who is an executive and nonindependent<br />

Direc<strong>to</strong>r, is also a Member of<br />

<strong>the</strong> Executive Committee.<br />

Mr Gwee is a Direc<strong>to</strong>r of various subsidiaries<br />

in <strong>the</strong> PPHG Group and UOL Group. He<br />

is also a Direc<strong>to</strong>r of United Industrial<br />

Corporation Limited and Singapore Land<br />

Limited and was previously a Direc<strong>to</strong>r of<br />

Overseas Union Enterprise Limited.<br />

He holds a Bachelor of Accountancy<br />

(Honours) degree from <strong>the</strong> University<br />

of Singapore and is a Fellow Member of<br />

<strong>the</strong> Chartered Institute of Management<br />

Accountants and Association of Chartered<br />

Certified Accountants in <strong>the</strong> United<br />

Kingdom and <strong>the</strong> Institute of Certified<br />

Public Accountants of Singapore.<br />

Mr Gwee was awarded <strong>the</strong> Pingat Bakti<br />

Masyarakat (PBM) Public Service Medal and<br />

<strong>the</strong> Bintang Bakti Masyarakat (BBM) Public<br />

Service Star in 1994 and 2002 respectively<br />

by <strong>the</strong> President of Singapore.<br />

3. mR ALAn cHOE FOOK cHEOnG<br />

Mr Alan Choe was appointed <strong>to</strong> <strong>the</strong> Board<br />

since 2 May 1990 and was last re-appointed<br />

as Direc<strong>to</strong>r at PPHG’s Annual General<br />

Meeting on 21 April 2010. Mr Choe, who is<br />

an independent and non-executive Direc<strong>to</strong>r,<br />

is also <strong>the</strong> Chairman of <strong>the</strong> Nominating<br />

Committee and a Member of <strong>the</strong> Executive,<br />

Audit and Remuneration Committees. He is<br />

also a Direc<strong>to</strong>r of UOL.<br />

An architect and <strong>to</strong>wn planner by<br />

profession, Mr Choe was <strong>the</strong> first General<br />

Manager of <strong>the</strong> Urban Redevelopment<br />

Authority and a Senior Partner of one<br />

of <strong>the</strong> largest architectural practices in<br />

Singapore. He was <strong>the</strong> Chairman of Sen<strong>to</strong>sa<br />

Development Corporation, Sen<strong>to</strong>sa Cove<br />

Pte Ltd, Pasir Ris Resort Pte Ltd, a Trustee<br />

of NTUC In<strong>com</strong>e and Member of Singapore<br />

Tourism Board.<br />

Mr Choe holds a Bachelor of Architecture<br />

degree, a Diploma in Town & Regional<br />

Planning from University of Melbourne<br />

and a Fellowship Diploma from <strong>the</strong> Royal<br />

Melbourne Institute of Technology. He is a<br />

Fellow Member of <strong>the</strong> Singapore Institute of<br />

Architects, Singapore Institute of Planners<br />

and Royal Australian Institute of Architects.<br />

He is also a Member of <strong>the</strong> Royal Institute<br />

of British Architects, Royal Town Planning<br />

Institute, Royal Australian Planning Institute<br />

and American Planning Association.<br />

He was awarded <strong>the</strong> Public Administration<br />

Medal (Gold) in 1967, <strong>the</strong> Meri<strong>to</strong>rious Service<br />

Medal in 1990, and <strong>the</strong> Distinguished<br />

Service Order in 2001.<br />

4. dR Lim KEE minG<br />

Dr Lim Kee Ming was appointed <strong>to</strong> <strong>the</strong><br />

Board since 1 June 1995 and was last<br />

re–appointed as Direc<strong>to</strong>r at PPHG’s Annual<br />

13<br />

General Meeting on 21 April 2010. Dr Lim,<br />

who is an independent and non-executive<br />

Direc<strong>to</strong>r, is also <strong>the</strong> Chairman of <strong>the</strong> Audit<br />

and Remuneration Committees and a<br />

Member of <strong>the</strong> Nominating Committee. He<br />

is also a Direc<strong>to</strong>r of UOL.<br />

Dr Lim is <strong>the</strong> Chairman of Lim Teck Lee<br />

Group of <strong>com</strong>panies. He is also a Direc<strong>to</strong>r<br />

of Haw Par Corporation Limited and is<br />

presently <strong>the</strong> President of Ngee Ann Kongsi<br />

and Chairman of Ngee Ann Development.<br />

He is an Honorary President of Singapore<br />

Chinese Chamber of Commerce & Industry,<br />

Teochew Poit Ip Huay Kuan and Advisor of<br />

Network China.<br />

He was awarded <strong>the</strong> Pingat Bakti<br />

Masyarakat (PBM) Public Service Medal and<br />

<strong>the</strong> Bintang Bakti Masyarakat (BBM) Public<br />

Service Star in 1995 and 2004 respectively<br />

by <strong>the</strong> President of Singapore and also<br />

The Royal Order of <strong>the</strong> Polar Star “Class of<br />

Commander” by his Excellency, <strong>the</strong> King of<br />

Sweden in 1982.<br />

Dr Lim holds a Master of Science<br />

(International Trade & Finance) degree<br />

from Columbia University, New York,<br />

and a Bachelor of Science (Business<br />

Administration) degree from New York<br />

University, USA.<br />

In 2009, Dr Lim was conferred <strong>the</strong> degree<br />

of Doc<strong>to</strong>r of <strong>the</strong> University of Adelaide<br />

honoris causa, for his distinguished service<br />

<strong>to</strong> <strong>the</strong> <strong>com</strong>munity.<br />

5. mR WEE EE cHAO<br />

Mr Wee was appointed <strong>to</strong> <strong>the</strong> Board since<br />

9 May 2006 and was last re-elected as<br />

ANNUAL REPORT 2010

A BRAND<br />

14 new era<br />

Direc<strong>to</strong>r at PPHG’s Annual General Meeting<br />

on 21 April 2010. Mr Wee, who is a nonexecutive<br />

and non-independent Direc<strong>to</strong>r, is<br />

a Member of <strong>the</strong> Executive Committee and<br />

also a Direc<strong>to</strong>r of UOL.<br />

Mr Wee has led <strong>the</strong> management of UOB-<br />

Kay Hian Holdings Limited for more than<br />

25 years. He is currently <strong>the</strong> Chairman<br />

and Managing Direc<strong>to</strong>r of UOB-Kay Hian<br />

Holdings Limited and a Direc<strong>to</strong>r of most of<br />

<strong>the</strong> UOB-Kay Hian Group of <strong>com</strong>panies. Mr<br />

Wee also manages Kheng Leong Company<br />

(Private) Limited which is involved in real<br />

estate development and investments and<br />

is a non-executive direc<strong>to</strong>r of Haw Par<br />

Corporation Limited. He had previously<br />

served as Chairman of <strong>the</strong> Singapore<br />

Tourism Board between 2002 <strong>to</strong> 2004.<br />

Mr Wee holds a Bachelor of Business<br />

Administration degree from The American<br />

University Washing<strong>to</strong>n DC, USA.<br />

6. mR JAmEs KOH cHER siAnG<br />

Mr James Koh was appointed <strong>to</strong> <strong>the</strong> Board<br />

since 23 November 2005 and was last<br />

re-elected as Direc<strong>to</strong>r at PPHG’s Annual<br />

General Meeting on 23 April 2008. Mr Koh,<br />

who is an independent and non-executive<br />

Direc<strong>to</strong>r, is also a Direc<strong>to</strong>r of UOL.<br />

Mr Koh joined <strong>the</strong> Housing & Development<br />

Board (“HDB”) in July 2005 after retiring<br />

from 35 years of distinguished service in <strong>the</strong><br />

civil service. He is currently <strong>the</strong> Chairman of<br />

<strong>the</strong> HDB. His prior appointments included<br />

Permanent Secretary, Ministry of National<br />

Development (1979), Ministry of Community<br />

Development (1987) and Ministry of<br />

Education (1994) as well as Commissioner of<br />

pan paCifiC hOteLs GrOup LiMited<br />

6 7 8 9 10<br />

Inland Revenue and Chief Executive Officer<br />

of Inland Revenue Authority of Singapore.<br />

Mr Koh is also <strong>the</strong> Chairman of CapitaMall<br />

Trust Management Limited, Singapore<br />

Deposit Insurance Corporation Limited<br />

and Singapore Island Country Club. He<br />

is also a Direc<strong>to</strong>r of CapitaLand Limited,<br />

Singapore Airlines Limited, Singapore<br />

Cooperation Enterprise and CapitaLand<br />

Hope Foundation. He is also a Member<br />

of <strong>the</strong> Presidential Council for Religious<br />

Harmony and an Adjunct Professor of <strong>the</strong><br />

Lee Kuan Yew School of Public Policy.<br />

Mr Koh holds a Bachelor of Arts (Honours)<br />

degree in Philosophy, Political Science<br />

and Economics, Master of Arts degree<br />

from University of Oxford, UK and holds<br />

a Master in Public Administration degree<br />

from Harvard University, USA.<br />

He was awarded <strong>the</strong> Public Administration<br />

Medal (Gold) in 1983 and <strong>the</strong> Meri<strong>to</strong>rious<br />

Service Medal in 2002.<br />

7. mR LOW WEnG KEOnG<br />

Mr Low was appointed <strong>to</strong> <strong>the</strong> Board since<br />

23 November 2005. He was last re-elected<br />

as Direc<strong>to</strong>r at PPHG’s Annual General<br />

Meeting on 23 April 2008. Mr Low, who is<br />

an independent and non-executive Direc<strong>to</strong>r,<br />

is a Member of <strong>the</strong> Audit Committee and<br />

also a Direc<strong>to</strong>r of UOL.<br />

Mr Low is also an independent Direc<strong>to</strong>r<br />

of listed <strong>com</strong>panies Rivers<strong>to</strong>ne Holdings<br />

Limited and Unionmet (Singapore) Limited.<br />

He is also a direc<strong>to</strong>r of Singapore Institute<br />

of Accredited Tax Professionals Limited. He<br />

was a former Country Managing Partner of<br />

Ernst & Young, Singapore and is currently<br />

<strong>the</strong> President and Chairman of <strong>the</strong> Board<br />

of Direc<strong>to</strong>rs of CPA Australia Limited.<br />

Mr Low is a Fellow Member of CPA Australia,<br />

Institute of Chartered Accountants in<br />

England & Wales, Institute of Certified<br />

Public Accountants of Singapore and an<br />

Associate Member of Chartered Institute<br />

of Taxation (UK).<br />

8. mR WEE EE Lim<br />

Mr Wee was appointed <strong>to</strong> <strong>the</strong> Board since<br />

9 May 2006. He was last re-elected as<br />

Direc<strong>to</strong>r at PPHG’s Annual General Meeting<br />

on 21 April 2010. Mr Wee, who is a nonexecutive<br />

and non-independent Direc<strong>to</strong>r,<br />

is also a Direc<strong>to</strong>r of UOL.<br />

He joined Haw Par Corporation Limited<br />

(“Haw Par”) in 1986 and is currently <strong>the</strong><br />

President and Chief Executive Officer of<br />

Haw Par. He is also a Direc<strong>to</strong>r of United<br />

Industrial Corporation Limited, Singapore<br />

Land Limited, Hua Han Bio-Pharmaceutical<br />

Holdings Limited (a <strong>com</strong>pany listed on<br />

<strong>the</strong> Hong Kong S<strong>to</strong>ck Exchange) and<br />

Wee Foundation. He was previously a<br />

board member of Sen<strong>to</strong>sa Development<br />

Corporation.<br />

Mr Wee holds a Bachelor of Arts (Economics)<br />

degree from Clark University, USA.<br />

9. ms WEE WEi LinG<br />

Ms Wee was appointed <strong>to</strong> <strong>the</strong> Board since<br />

24 March 1994 and has been with <strong>the</strong> PPHG<br />

Group for over 20 years.<br />

She was last re-elected as Direc<strong>to</strong>r at<br />

PPHG’s Annual General Meeting on 28 April<br />

2009. Ms Wee, who is an executive and<br />

15<br />

non–independent Direc<strong>to</strong>r, is also a direc<strong>to</strong>r<br />

of various subsidiaries in PPHG.<br />

She oversees <strong>the</strong> asset management<br />

of PPHG’s hotel properties and is also<br />

responsible for <strong>the</strong> management of <strong>the</strong><br />

chain of St Gregory Spa and Si Chuan Dou<br />

Hua Restaurants.<br />

Ms Wee holds a Bachelor of Arts degree<br />

from Nanyang University, Singapore.<br />

10. mR AmEdEO PATRicK imBARdELLi<br />

Mr Imbardelli is <strong>the</strong> President and Chief<br />

Executive Officer and was appointed<br />

<strong>to</strong> <strong>the</strong> Board since 21 August 2009. He<br />

was last re-elected as Direc<strong>to</strong>r at PPHG’s<br />

Annual General Meeting on 21 April 2010.<br />

Mr Imbardelli, who is an executive and nonindependent<br />

Direc<strong>to</strong>r, is also a direc<strong>to</strong>r of<br />

various subsidiaries in PPHG.<br />

Prior <strong>to</strong> joining PPHG, Mr Imbardelli<br />

held senior management positions at<br />

InterContinental Hotels Group, Sou<strong>the</strong>rn<br />

Pacific Hotel Corporation and Hil<strong>to</strong>n<br />

International. He has over 25 years of<br />

experience in <strong>the</strong> hotel industry including<br />

managing global multibrand organisations.<br />

He leads <strong>the</strong> strategic management<br />

and expansion of PPHG’s hotels and<br />

businesses, including both “Pan Pacific”<br />

and “PARKROYAL” brands across <strong>the</strong> Asia<br />

Pacific region.<br />

Mr Imbardelli holds a Master of Science<br />

(Honours) degree in Finance from The City<br />

University of New York, USA. He is a Fellow<br />

of <strong>the</strong> American Academy of Financial<br />

Management, USA and a Member of <strong>the</strong><br />

Young Presidents’ Organisation and its<br />

Singapore Executive Committee.<br />

ANNUAL REPORT 2010

A BRAND<br />

16 new era<br />

KEy mAnAGEmEnT<br />

ExEcUTiVEs<br />

5 6<br />

1 2<br />

pan paCifiC hOteLs GrOup LiMited<br />

7<br />

3<br />

8<br />

4<br />

9<br />

1. mR GWEE LiAn KHEnG<br />

2. ms WEE WEi LinG<br />

3. mR AmEdEO PATRicK imBARdELLi<br />

The profiles of Mr Gwee, Ms Wee and<br />

Mr Imbardelli are in <strong>the</strong> Board of Direc<strong>to</strong>rs<br />

section of this report.<br />

4. mR FOO THiAm FOnG WELLinGTOn<br />

Mr Foo joined UOL in 1977 after graduating<br />

from University of Singapore with<br />

a Bachelor of Accountancy (Honours)<br />

degree. He is Company Secretary of both<br />

UOL and PPHG, and a direc<strong>to</strong>r of several of<br />

<strong>the</strong>ir subsidiaries. He is also Chief Financial<br />

Officer of UOL.<br />

Mr Foo is a Fellow of <strong>the</strong> Institute of<br />

Certified Public Accountants of Singapore<br />

and CPA Australia, and an Associate of<br />

both <strong>the</strong> Institute of Chartered Secretaries<br />

and Administra<strong>to</strong>rs and <strong>the</strong> Chartered<br />

Institute of Management Accountants.<br />

5. mR nEO sOOn HUP<br />

Mr Neo is Chief Financial Officer of PPHG<br />

and a direc<strong>to</strong>r of several of its subsidiaries.<br />

He oversees <strong>the</strong> <strong>financial</strong> management<br />

of PPHG and focuses on improving<br />

efficiency <strong>to</strong> drive business performances.<br />

Mr Neo was a Senior Audit Manager with<br />

PricewaterhouseCoopers prior <strong>to</strong> joining<br />

UOL in 2003 and has 14 years of experience<br />

in auditing.<br />

He is a Fellow of <strong>the</strong> Institute of Certified<br />

Public Accountants of Singapore and<br />

a member of <strong>the</strong> Singapore Institute of<br />

Chartered Secretaries and Administra<strong>to</strong>rs.<br />

6. mR KEVin cROLEy<br />

Mr Croley joined Pan Pacific Hotels and<br />

Resorts in 2005 and is currently Senior Vice<br />

President, Marketing & Sales of PPHG. He is<br />

responsible for <strong>the</strong> development of brand<br />

strategies and platforms for distribution,<br />

e-<strong>com</strong>merce and revenue management. He<br />

has over 29 years of experience in sales and<br />

marketing, of which 22 years were spent in<br />

<strong>the</strong> Asia Pacific region.<br />

After starting his career with First<br />

Hospitality Corporation of America, Mr<br />

Croley worked with Hil<strong>to</strong>n International,<br />

InterContinental Hotels Group and <strong>the</strong><br />

Royal Garden Resorts Hotel Group. He<br />

holds a Diploma in Hotel Management<br />

and Operations from Belfast College of<br />

Business Studies, UK.<br />

7. mR dEAn scHREiBER<br />

Mr Schreiber was appointed PPHG’s Senior<br />

Vice President, Operations in 2010. His<br />

responsibilities include <strong>the</strong> development<br />

of operational systems and management<br />

of service quality standards across all “Pan<br />

Pacific” and “PARKROYAL” properties.<br />

17<br />

Mr Schreiber’s 24-year career in hospitality<br />

management has spanned nine countries<br />

and five continents. Prior <strong>to</strong> PPHG, he<br />

was Group Managing Direc<strong>to</strong>r with KOP<br />

Group, where he was instrumental in <strong>the</strong><br />

development and operation of premium<br />

hospitality brands including Franklyn Hotels<br />

& Resorts and Montigo Resorts. He was also<br />

Group Operations Leader with Pan Pacific<br />

Hotels and Resorts from 2004 <strong>to</strong> 2007<br />

before joining luxury hospitality group,<br />

Essque, as Vice President Operations.<br />

8. mR ERic LEVy<br />

Mr Levy joined PPHG in 2009 and is currently<br />

Senior Vice President, Growth & Development.<br />

He leads <strong>the</strong> Group’s global development<br />

efforts <strong>to</strong> expand its hotel portfolio.<br />

He has over 31 years of experience in hotel<br />

operations, development advisory and<br />

private equity, having previously established<br />

his own hospitality investment and<br />

advisory firms, Octagon Capital Partners<br />

and Tourism Solutions International. His<br />

previous appointments include senior roles<br />

at Horwath Asia Pacific and Colony Capital<br />

in Asia Pacific.<br />

Mr Levy holds a Bachelor of Science<br />

degree in hotel administration from Cornell<br />

University in Ithaca, New York.<br />

9. mRs mELOdy KinG<br />

Mrs King joined PPHG in 2009 and is<br />

currently Senior Vice President, Human<br />

Capital & Development. She leads <strong>the</strong><br />

Group’s efforts in building capability and<br />

developing talent.<br />

A veteran with over 21 years of experience in<br />

human resource management, she has held<br />

senior Human Resources leadership roles<br />

with multi-national <strong>com</strong>panies including<br />

Siebe Intelligent Au<strong>to</strong>mation, Asea Brown<br />

Broveri (ABB) and Herbalife International.<br />

Mrs King graduated from Les Roches Hotel<br />

and Tourism School in Bluche-Montana,<br />

Switzerland.<br />

ANNUAL REPORT 2010

A BRAND<br />

18 new era<br />

GROUP<br />

sTRUcTURE<br />

As at 2 March 2011<br />

pan paCifiC hOteLs GrOup LiMited<br />

au Incorporated in Australia<br />

BVi Incorporated in The British<br />

Virgin Islands<br />

MY Incorporated in Malaysia<br />

Mn Incorporated in Myanmar<br />

in Incorporated in Indonesia<br />

Jp Incorporated in Japan<br />

prC Incorporated in The People’s<br />

Republic of China<br />

th Incorporated in Thailand<br />

usa Incorporated in United States<br />

of America<br />

Vn Incorporated in Vietnam<br />

PRinciPAL AcTiViTiEs<br />

Investment holding and o<strong>the</strong>rs<br />

Hotelier<br />

Hotel management services<br />

Spa, lifestyle and restaurant operations<br />

Associated <strong>com</strong>panies<br />

pan paCifiC hOteLs GrOup LiMited<br />

100%<br />

100%<br />

100%<br />

100%<br />

100%<br />

100%<br />

100%<br />

100%<br />

100%<br />

100%<br />

100%<br />

100%<br />

100%<br />

100%<br />

100%<br />

39.4%<br />

100%<br />

100%<br />

100%<br />

hOteL inVestMents (suzhOu) pte. Ltd.<br />

hOteL inVestMents (hanOi) pte. Ltd.<br />

YipL inVestMent pte. Ltd.<br />

hOteL pLaza prOpertY<br />

(sinGapOre) pte. Ltd.<br />

new parK hOteL (1989) pte Ltd<br />

parKrOYaL hOteLs & resOrts pte. Ltd.<br />

parKrOYaL serViCed residenCes pte. Ltd.<br />

parKrOYaL internatiOnaL pte. Ltd.<br />

pan paCifiC hOspitaLitY hOLdinGs pte. Ltd.<br />

pan paCifiC internatiOnaL pte. Ltd.<br />

united LifestYLe hOLdinGs pte Ltd<br />

st GreGOrY spa pte Ltd<br />

dOu hua restaurants pte Ltd<br />

hpL prOperties (MaLaYsia) sdn. Bhd. [MY]<br />

Garden pLaza COMpanY LiMited [Vn]<br />

piLKOn deVeLOpMent COMpanY<br />

LiMited [BVi]<br />

suCCess Venture inVestMents<br />

(wa) LiMited [BVi]<br />

suCCess CitY ptY LiMited [au]<br />

suCCess Venture inVestMents<br />

(austraLia) Ltd [BVi]<br />

100%<br />

75%<br />

95%<br />

100%<br />

100%<br />

100%<br />

100%<br />

66.7% president hOteL<br />

sdn Berhad [MY]<br />

65%<br />

100%<br />

100%<br />

100%<br />

100%<br />

suzhOu wuGOnG<br />

hOteL CO., Ltd [prC]<br />

westLaKe internatiOnaL<br />

COMpanY [Vn]<br />

YanGOn hOteL<br />

LiMited [Mn]<br />

pan paCifiC hOteLs and<br />

resOrts pte. Ltd.<br />

pan paCifiC MarKetinG<br />

serViCes pte. Ltd.<br />

pan paCifiC teChniCaL<br />

serViCes pte. Ltd.<br />

pan paCifiC<br />

hOspitaLitY pte. Ltd.<br />

33.3%<br />

pLaza hOteL<br />

COMpanY LiMited [Vn]<br />

suCCess Venture (wa)<br />

unit trust [au]<br />

suCCess Venture ptY<br />

LiMited [au]<br />

suCCess Venture (darLinG<br />

harBOur) unit trust [au]<br />

suCCess Venture<br />

(parraMatta) unit trust [au]<br />

100%<br />

99%<br />

100%<br />

100%<br />

48.9%<br />

100%<br />

100%<br />

pan paCifiC hOteLs and<br />

resOrts aMeriCa, inC. [usa]<br />

pt pan paCifiC hOteLs &<br />

resOrts indOnesia [in]<br />

pan paCifiC hOteLs and<br />

resOrts Japan CO., Ltd [Jp]<br />

pan paCifiC (shanGhai) hOteL<br />

ManaGeMent CO., Ltd. [prC]<br />

pphr (thaiLand)<br />

COMpanY LiMited [th]<br />

Grand eLite sdn. Bhd. [MY]<br />

Grand eLite (penanG)<br />

sdn. Bhd. [MY]<br />

100%<br />

19<br />

pan paCifiC hOteLs and<br />

resOrts seattLe, LLC [usa]<br />

1%<br />

ANNUAL REPORT 2010

A BRAND<br />

20 new era<br />

OUR<br />

BRAnds<br />

in THis sEcTiOn<br />

embracing a Brand new era<br />

pan pacific hotels and resorts<br />

parKrOYaL hotels & resorts<br />

Lifestyle Brands<br />

pan paCifiC hOteLs GrOup LiMited<br />

21<br />

ANNUAL REPORT 2010

A BRAND<br />

22 new era<br />

pan paCifiC hOteLs GrOup LiMited<br />

EmBRAcinG<br />

A BRAnd<br />

nEW ERA<br />

<strong>the</strong> “pan pacific” and “parKrOYaL” identities<br />

have always been associated with distinctive<br />

ac<strong>com</strong>modations and high service standards.<br />

Over time, as <strong>the</strong> industry and consumer<br />

preferences evolve and change, so <strong>to</strong>o do brands<br />

<strong>to</strong> address <strong>the</strong>se changes.<br />

01<br />

The drive <strong>to</strong> connect with our guests at a level<br />

that is meaningful and relevant was <strong>the</strong> reason<br />

for an 18-month initiative that resulted with<br />

fresh interpretations of our “Pan Pacific” and<br />

“PARKROYAL” brands.<br />

Quite clearly, <strong>the</strong> rebranding of two acclaimed<br />

and well-established identities was not carried<br />

out in isolation. We appointed established<br />

international brand consultancy Interbrand,<br />

and through a series of focus groups involving<br />

qualitative interviews with hundreds of guests<br />

and cus<strong>to</strong>mers, we were able <strong>to</strong> determine <strong>the</strong><br />

nuances and unique elements that defined “Pan<br />

Pacific” and “PARKROYAL”. We also worked<br />

with experts at The Brand Union, ano<strong>the</strong>r global<br />

branding agency, <strong>to</strong> articulate <strong>the</strong> refreshed<br />

brands’ positioning with new visual and verbal<br />

elements.<br />

Associate engagement workshops are a<br />

quintessential element of <strong>the</strong> programme, so<br />

that <strong>the</strong> right values and brand behaviours may<br />

be imparted <strong>to</strong> each and every associate from<br />

back office <strong>to</strong> front desk, and greater consistency<br />

is achieved through our service delivery.<br />

Ultimately, great brands offer unique experiences<br />

that are valued and preferred over o<strong>the</strong>rs. The<br />

rebranding initiative we have embarked on will<br />

continue <strong>to</strong> evolve in tandem with industry<br />

benchmarks and global standards.<br />

we also worked with experts<br />

at <strong>the</strong> Brand union, ano<strong>the</strong>r<br />

global branding agency,<br />

<strong>to</strong> articulate <strong>the</strong> refreshed<br />

brands’ positioning with new<br />

visual and verbal elements.<br />

01: New “Pan Pacific” visual identity as<br />

expressed in in-room <strong>com</strong>pendium<br />

and key cards.<br />

02: New “PARKROYAL” visual identity as<br />

expressed in hotel brochures, outdoor<br />

advertising and key cards.<br />

23<br />

02<br />

ANNUAL REPORT 2010

A BRAND<br />

24 25<br />

24 new era<br />

19<br />

hotels, resorts<br />

and serviced suites<br />

11 countries<br />

OVER<br />

20<br />

industry honours and<br />

<strong>to</strong>p awards in 2010/2011<br />

OVER<br />

35 years of global<br />

recognition<br />

A Unique Pacific Ocean Blend<br />

The “Pan Pacific” portfolio features<br />

19 premium hotels, resorts and<br />

serviced suites across Asia, North<br />

America and Oceania. For over<br />

35 years, <strong>the</strong>se properties have<br />

delighted guests with sensory<br />

voyages, offering an invigorating<br />

blend of <strong>the</strong> best that <strong>the</strong> Pacific<br />

region has <strong>to</strong> offer.<br />

Our Pacific Touch is <strong>the</strong> key <strong>to</strong><br />

enriching experiences that enliven<br />

<strong>the</strong> senses and reinvigorate <strong>the</strong><br />

soul. Each property delivers a<br />

sense of modern vibrancy and <strong>the</strong><br />

warmth of Pacific Rim hospitality.<br />

This year, our outstanding brand of<br />

hospitality was backed by various<br />

accolades. Pan Pacific Hotels and<br />

Resorts garnered World Travel<br />

Awards in various categories with<br />

Pan Pacific Singapore (‘Leading<br />

Business Hotel in <strong>the</strong> World’),<br />

Pan Pacific Nirwana Bali Resort<br />

(‘Indonesia’s Leading Golf Resort’),<br />

Pan Pacific Vancouver (‘Leading<br />

Hotel in Canada’) and Pan Pacific<br />

Serviced Suites Singapore<br />

(‘Singapore’s Leading Serviced<br />

Apartments’).<br />

We also received <strong>the</strong> World Luxury<br />

Hotel Award for ‘Luxury Airport<br />

Hotel’ and APBF BrandLaureate<br />

Award for ‘Best Airport Hotel Brand’<br />

with Pan Pacific Kuala Lumpur<br />

International Airport, as well as<br />

coveted rankings on Travel+Leisure,<br />

Condé Nast and o<strong>the</strong>r prestigious<br />

magazines.<br />

In 2010, <strong>the</strong> “Pan Pacific” footprint<br />

was augmented with more great<br />

hotels: Pan Pacific Suzhou, <strong>the</strong><br />

integrated Pan Pacific Nirwana Bali<br />

Resort, and in January 2011, Pan<br />

Pacific Perth. In its ever-expanding<br />

pipeline are also Pan Pacific Ningbo<br />

and Pan Pacific Serviced Suites<br />

Ningbo in China, which are set <strong>to</strong><br />

open in 2012.<br />

pan paCifiC hOteLs GrOup LiMited ANNUAL REPORT 2010

A BRAND<br />

26 new era<br />

OUR<br />

PROmisE<br />

<strong>the</strong> “pan pacific” brand provides refreshing<br />

pacific experiences inspired by an invigorating<br />

blend of its pacific rim locations. it is focussed<br />

on enriching experiences that draw on a diversity<br />

of landscapes and cultures; and relevant choices<br />

that convey freedom and individuality.<br />

The brand is delivered through an unmistakable “Pacific Touch” –<br />

wel<strong>com</strong>ing environments where easy efficiency is met by warm<br />

hospitality, and contemporary styles reflect <strong>the</strong>ir local surrounds.<br />

In line with its expansion strategy <strong>to</strong> grow <strong>the</strong> Pan Pacific Hotels<br />

and Resorts portfolio in Asia, Greater China, North America and<br />

Oceania, “Pan Pacific” debuted in Australia with <strong>the</strong> launch of Pan<br />

Pacific Perth in 2011.<br />

The opening of Pan Pacific Ningbo and Pan Pacific Serviced Suites<br />

Ningbo, scheduled for 2012, will streng<strong>the</strong>n <strong>the</strong> brand’s presence<br />

in China.<br />

pan paCifiC hOteLs GrOup LiMited<br />

Visually engaging collateral<br />

highlight <strong>the</strong> play of light, warmth<br />

and <strong>the</strong> expanse of <strong>the</strong> Pacific Rim.<br />

OUR<br />

idEnTiTy<br />

As part of <strong>the</strong> “Pan Pacific”<br />

brand refreshment, refinements<br />

<strong>to</strong> <strong>the</strong> logo and typography<br />

were introduced <strong>to</strong> symbolise<br />

<strong>the</strong> sensory enhancements <strong>to</strong><br />

<strong>the</strong> “Pan Pacific” experience.<br />

A soothing colour palette,<br />

<strong>to</strong>ge<strong>the</strong>r with refreshed<br />

designs for marketing materials<br />

and hotel amenities were<br />

also created <strong>to</strong> highlight <strong>the</strong><br />

moods and physical sensations<br />

associated with ‘discovery’.<br />

Visually, <strong>the</strong> brand essence<br />

is redefined through a<br />

pho<strong>to</strong>graphy style in advertising<br />

and marketing collateral that<br />

captures <strong>the</strong> sensual appeal<br />

of <strong>the</strong> Pacific, <strong>the</strong> human<br />

<strong>to</strong>uch that conveys intuitive<br />

yet unobtrusive service, and<br />

emotive textures inspired by<br />

each hotel’s location.<br />

Locally sourced ingredients and<br />

innovative visual presentations are<br />

at <strong>the</strong> heart of <strong>the</strong> Pacific palate.<br />

THE PAciFic<br />

cUisinE<br />

ExPERiEncE<br />

Gastronomically, <strong>the</strong> “Pan<br />

Pacific” brand is evoked through<br />

culinary experiences that<br />

appeal <strong>to</strong> <strong>the</strong> five senses. From<br />

locally sourced ingredients <strong>to</strong><br />

innovative visual presentations,<br />

<strong>the</strong> Pacific Cuisine experience<br />

features menus that boast <strong>the</strong><br />

best food <strong>the</strong> Pacific Rim has<br />

<strong>to</strong> offer.<br />

It also offers a range of<br />

unique settings and dining<br />

environments <strong>to</strong> <strong>com</strong>plement<br />

each experience.<br />

To fur<strong>the</strong>r enhance <strong>the</strong> Pacific<br />

Cuisine experience, a list of<br />

signature Pacific Cocktails was<br />

also created, showcasing <strong>the</strong><br />

choicest local ingredients –<br />

from Californian pomegranates<br />

<strong>to</strong> Thai calamansi – and<br />

some of <strong>the</strong> latest mixology<br />

techniques.<br />

27<br />

Offering enriching experiences and<br />

relevant choices <strong>to</strong> guests define<br />

our service philosophy.<br />

i Am<br />

PAn PAciFic<br />

The “Pan Pacific” brand is<br />

dedicated <strong>to</strong> a way of doing<br />

things that is different from its<br />

<strong>com</strong>peti<strong>to</strong>rs. “I am Pan Pacific”<br />

is an attitude that empowers<br />

all associates <strong>to</strong> act as brand<br />

ambassadors, infusing service<br />

with a personal <strong>to</strong>uch.<br />

Every associate is actively<br />

involved in <strong>the</strong> “Pan Pacific”<br />

brand through a variety<br />

of <strong>to</strong>uch points ranging<br />

from guests’ arrivals and<br />

departures, <strong>to</strong> <strong>the</strong> Pacific<br />

Cuisine, guestrooms and<br />

spa experience. The brand<br />

advocates going <strong>the</strong> extra<br />

mile <strong>to</strong> meet guests’ needs<br />

according <strong>to</strong> <strong>the</strong>ir time<br />

zones.<br />

ANNUAL REPORT 2010

A BRAND<br />

28 29<br />

28 new era<br />

cLOsE TO<br />

5decades<br />

of trusted<br />

hospitality<br />

10<br />

destinations across<br />

Asia Pacific<br />

2010<br />

PARKROyAL <strong>com</strong>es<br />

home <strong>to</strong> Australia<br />

15<br />

hotels, resorts<br />

and serviced suites<br />

A Trusted Local <strong>com</strong>panion<br />

The “PARKROYAL” portfolio <strong>com</strong>prises<br />

15 hotels, resorts and serviced suites<br />

in gateway cities across Australia,<br />

China, Malaysia, Myanmar, Singapore<br />

and Vietnam, including those under<br />

development.<br />

Exuding <strong>the</strong> spirit and individuality<br />

of <strong>the</strong>ir location, each “PARKROYAL”<br />

provides a connection <strong>to</strong> au<strong>the</strong>ntic<br />

local experiences. A trusted provider<br />

of hospitality that is consistently<br />

supportive, modern and un<strong>com</strong>plicated,<br />

“PARKROYAL” leverages a strong<br />

heritage that has flourished in<strong>to</strong><br />

a reputable, upscale brand in <strong>the</strong><br />

Asia-Pacific.<br />

In 2010, <strong>the</strong> brand opened its first<br />

extended-stay property outside<br />

Singapore with PARKROYAL Serviced<br />

Suites Kuala Lumpur. It also marked<br />

its home<strong>com</strong>ing <strong>to</strong> Australia, a market<br />

where <strong>the</strong> brand was conceived, with<br />

<strong>the</strong> launch of PARKROYAL Darling<br />

Harbour, Sydney and PARKROYAL<br />

Parramatta.<br />

The brand continues <strong>to</strong> chart its<br />

journey in Australia with <strong>the</strong> up<strong>com</strong>ing<br />

PARKROYAL Melbourne Airport in<br />

April 2011. Streng<strong>the</strong>ning its footprint<br />

in Singapore, <strong>the</strong> brand’s flagship<br />

hotel in <strong>the</strong> city’s Central Business<br />

District, PARKROYAL on Pickering,<br />

is scheduled <strong>to</strong> open in 2012.<br />

In addition, “PARKROYAL” is set <strong>to</strong><br />

debut in China with PARKROYAL<br />

Serviced Suites Green City, Shanghai<br />

and PARKROYAL Taihu Resort,<br />

Suzhou.<br />

pan paCifiC hOteLs GrOup LiMited ANNUAL REPORT 2010

A BRAND<br />

30<br />

new era<br />

OUR<br />

PROmisE<br />

<strong>the</strong> “parKrOYaL” brand is centred on <strong>the</strong> idea<br />

of being a trusted local <strong>com</strong>panion for guests<br />

and cus<strong>to</strong>mers. it is focussed on providing<br />

travellers with <strong>the</strong> best local knowledge and<br />

connections in modern, <strong>com</strong>fortable and<br />

wel<strong>com</strong>ing environments through which <strong>the</strong>y<br />

can explore <strong>the</strong>ir surrounds.<br />

Energised by <strong>the</strong> sights, sounds and flavours of <strong>the</strong>ir respective<br />

unique locales, each “PARKROYAL” hotel weaves a tapestry<br />

of personable charm fused with thoughtful creative <strong>to</strong>uches,<br />

local tastes and au<strong>the</strong>ntic encounters that connect guests <strong>to</strong><br />

<strong>the</strong> local environment.<br />

Above all, “PARKROYAL” values a standard of service that is<br />

consistent, genuine and un<strong>com</strong>plicated. It caters <strong>to</strong> travellers’<br />

needs by providing ac<strong>com</strong>modations that are hospitable,<br />

contemporary and <strong>com</strong>fortable.<br />

pan paCifiC hOteLs GrOup LiMited<br />

What <strong>to</strong> see, where <strong>to</strong> go, what <strong>to</strong><br />

do – <strong>the</strong> best local tips presented<br />

through vivid pho<strong>to</strong>graphy and a<br />

vibrant palette.<br />

OUR<br />

idEnTiTy<br />

The refreshed “PARKROYAL”<br />

brand is captured visually<br />

through key enhancements<br />

<strong>to</strong> its logo, <strong>the</strong> introduction<br />

of a vivid colour palette and<br />

a series of stylised motifs that<br />

symbolise <strong>the</strong> vibrant cultures<br />

of its respective regions.<br />

These are carried through in<br />

<strong>the</strong> brand’s print collaterals,<br />

we b s i t e a n d g u e s t ro o m<br />

amenities. Visually, <strong>the</strong> allure<br />

and unobtrusive service at<br />

each “PARKROYAL” destination<br />

is conveyed in a pho<strong>to</strong>graphy<br />

style that reflects spontaneity,<br />

movement and friendly faces.<br />

Personable charm, friendly support<br />

and un<strong>com</strong>plicated service are<br />

exemplified by our PARKROYAL<br />

People.<br />

OUR<br />

PARKROyAL<br />

PEOPLE<br />

PARKROYAL People are unified<br />

by “PARKROYAL’s” objective<br />

o f b e i n g a t r u ste d l o c a l<br />

<strong>com</strong>panion. Wherever <strong>the</strong>y are,<br />

our PARKROYAL People are<br />

important <strong>to</strong>uch points for <strong>the</strong><br />

brand, channelling <strong>the</strong>ir skills,<br />

talents and local knowledge<br />

<strong>to</strong> create a unique experience<br />

that is consistently supportive,<br />

au<strong>the</strong>ntic and personable.<br />

As brand ambassadors,<br />

PARKROYAL People bring a<br />

caring human <strong>to</strong>uch <strong>to</strong> every<br />

aspect of <strong>the</strong> brand experience.<br />

They also lend personality<br />

and character <strong>to</strong> <strong>the</strong> rich<br />

diversity of cus<strong>to</strong>ms, cultures<br />

and languages that define<br />

<strong>the</strong> au<strong>the</strong>nticity of every local<br />

experience.<br />

31<br />

Au<strong>the</strong>ntic local encounters, through<br />

expert advice and knowledge,<br />

connect guests <strong>to</strong> each destination.<br />

TRULy LOcAL<br />

ExPERiEncEs<br />

Every “PARKROYAL” property<br />

is enlivened by <strong>the</strong> spirit and<br />

individuality of its location.<br />

Through locally inspired<br />

accents, cuisines and truly<br />

au<strong>the</strong>ntic encounters, <strong>the</strong> brand<br />

invites travellers <strong>to</strong> discover<br />

a personal connection <strong>to</strong> <strong>the</strong><br />

local destination and culture.<br />

By involving every <strong>to</strong>uch point<br />

available from <strong>the</strong> moment<br />

of arrival, <strong>the</strong> “PARKROYAL”<br />

brand is an experience greater<br />

than <strong>the</strong> sum of its parts, going<br />

above and beyond <strong>to</strong> inject<br />

extraordinary encounters with<br />

local life and culture that bring<br />

a genuine and unforgettable<br />

dimension <strong>to</strong> <strong>the</strong> wonder of<br />

travel.<br />

ANNUAL REPORT 2010

A BRAND<br />

32 new era<br />

01: The ‘Mu Tong’ Milk Bath<br />

treatment performed in<br />

traditional cedar wood hot<br />

tubs imported from <strong>the</strong><br />

United States.<br />

02: 功夫茶 (Gong Fu Cha)<br />

– an exacting ritual of<br />

tea preparation by a Tea<br />

Connoisseur.<br />

03: A skilled Tea Master in action.<br />

04: Chong Qing Diced Chicken<br />

with Dried Chilli – a<br />

signature Sichuan dish.<br />

pan paCifiC hOteLs GrOup LiMited<br />

LiFEsTyLE<br />

BRAnds<br />

Complementing our<br />

hospitality services are<br />

three lifestyle brands that<br />

extend our philosophy<br />

of creating memorable<br />

experiences <strong>to</strong> <strong>the</strong> domains<br />

of fine dining and premium<br />

spas. each brand offers<br />

<strong>com</strong>plete indulgence for<br />

<strong>the</strong> senses – exemplifying<br />

our aspiration <strong>to</strong> provide<br />