GSN_Nov-Dec_FINAL_Yumpu

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

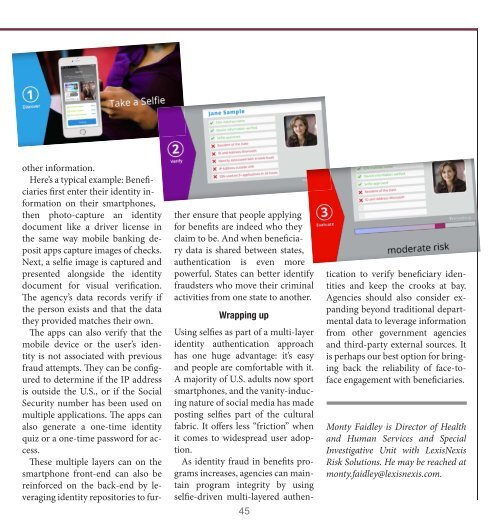

other information.<br />

Here’s a typical example: Beneficiaries<br />

first enter their identity information<br />

on their smartphones,<br />

then photo-capture an identity<br />

document like a driver license in<br />

the same way mobile banking deposit<br />

apps capture images of checks.<br />

Next, a selfie image is captured and<br />

presented alongside the identity<br />

document for visual verification.<br />

The agency’s data records verify if<br />

the person exists and that the data<br />

they provided matches their own.<br />

The apps can also verify that the<br />

mobile device or the user’s identity<br />

is not associated with previous<br />

fraud attempts. They can be configured<br />

to determine if the IP address<br />

is outside the U.S., or if the Social<br />

Security number has been used on<br />

multiple applications. The apps can<br />

also generate a one-time identity<br />

quiz or a one-time password for access.<br />

These multiple layers can on the<br />

smartphone front-end can also be<br />

reinforced on the back-end by leveraging<br />

identity repositories to further<br />

ensure that people applying<br />

for benefits are indeed who they<br />

claim to be. And when beneficiary<br />

data is shared between states,<br />

authentication is even more<br />

powerful. States can better identify<br />

fraudsters who move their criminal<br />

activities from one state to another.<br />

Wrapping up<br />

Using selfies as part of a multi-layer<br />

identity authentication approach<br />

has one huge advantage: it’s easy<br />

and people are comfortable with it.<br />

A majority of U.S. adults now sport<br />

smartphones, and the vanity-inducing<br />

nature of social media has made<br />

posting selfies part of the cultural<br />

fabric. It offers less “friction” when<br />

it comes to widespread user adoption.<br />

As identity fraud in benefits programs<br />

increases, agencies can maintain<br />

program integrity by using<br />

selfie-driven multi-layered authen-<br />

45<br />

tication to verify beneficiary identities<br />

and keep the crooks at bay.<br />

Agencies should also consider expanding<br />

beyond traditional departmental<br />

data to leverage information<br />

from other government agencies<br />

and third-party external sources. It<br />

is perhaps our best option for bringing<br />

back the reliability of face-toface<br />

engagement with beneficiaries.<br />

Monty Faidley is Director of Health<br />

and Human Services and Special<br />

Investigative Unit with LexisNexis<br />

Risk Solutions. He may be reached at<br />

monty.faidley@lexisnexis.com.