WE ARE - Wiener Städtische

WE ARE - Wiener Städtische

WE ARE - Wiener Städtische

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

AnnuAl rePOrt 2010 | WiENER STädTiSchE VERSichERUNg Ag<br />

<strong>WE</strong> <strong>ARE</strong><br />

Austria<br />

ANNUAL REPORT 2010 | <strong>Wiener</strong> StädtiSche 1

2 ANNUAL REPORT 2010 | <strong>Wiener</strong> StädtiSche<br />

NUMBER 1 IN AUSTRIA<br />

<strong>WE</strong> HAVE<br />

APPROXIMATELY 140 BUSINESS OFFICES<br />

AND MORE THAN 2,000 ADVISORS.<br />

NO ONE ELSE IN AUSTRIA CAN OFFER<br />

SO MUCH TO THEIR CUSTOMERS.

<strong>WE</strong> <strong>ARE</strong> AVAILABLE<br />

nation-wide<br />

ANNUAL REPORT 2010 | <strong>Wiener</strong> StädtiSche 3

4 ANNUAL REPORT 2010 | <strong>Wiener</strong> StädtiSche<br />

EVEN MORE TIME FOR YOUR CONCERNS<br />

THE VIENNA INSURANCE GROUP<br />

ASSUMES GROUP AND HOLDING<br />

COMPANY RESPONSIBILITIES, AND <strong>WE</strong><br />

HAVE MORE TIME TO SERVE<br />

OUR CUSTOMERS

<strong>WE</strong> GIVE NEW MEANING TO<br />

problem-free<br />

IN AUSTRIA<br />

ANNUAL REPORT 2010 | <strong>Wiener</strong> StädtiSche 5

6 ANNUAL REPORT 2010 | <strong>Wiener</strong> StädtiSche<br />

OUR RECIPE FOR SUCCESS SINCE 1824<br />

ASSUME LEADERSHIP IN CURRENT INSURANCE<br />

TOPICS AND PRODUCT INNOVATION, AND PROVIDE<br />

PROFESSIONAL ADVISORS AND SERVICE. THE<br />

RESULTS: FAIR, LONG-LASTING CUSTOMER<br />

RELATIONSHIPS

<strong>WE</strong> OFFER THE MOST<br />

professional<br />

ADVISORS AND SERVICE IN AUSTRIA<br />

ANNUAL REPORT 2010 | <strong>Wiener</strong> StädtiSche 7

8 ANNUAL REPORT 2010 | <strong>Wiener</strong> StädtiSche<br />

IT MUST BE IN THE GENES<br />

A CLAIM TO LEADERSHIP IN ALL GENERATIONS.<br />

JUST AS THE VIENNA INSURANCE GROUP<br />

IS AMONG THE LEADERS IN MANY<br />

CEE MARKETS, WIENER STÄDTISCHE<br />

IS NUMBER 1 IN AUSTRIA.

<strong>WE</strong> BELONG TO THE VIENNA INSURANCE GROUP, A<br />

leading family<br />

IN THE CEE REGION<br />

ANNUAL REPORT 2010 | <strong>Wiener</strong> StädtiSche 9

highlightS HigHLights<br />

WelcOMe tO the Future<br />

><br />

Reorganisation of Group structure, Vienna Insurance Group assumes<br />

holding company responsibilities<br />

> New Managing Board team for Austria<br />

> Full concentration on the insurance business in Austria and the branch<br />

offices in Italy and Slovenia<br />

> Number 1 in the Austrian insurance market<br />

> Retirement pensions receiving more attention<br />

cOntinuOuS iMPrOVeMent<br />

> Premium volume increases by 4.2% to EUR 2.4 billion in 2010<br />

> Profit before taxes considerably higher than in the previous year<br />

> Combined ratio of 96.6% once again significantly below 100%<br />

> <strong>Wiener</strong> <strong>Städtische</strong>’s product and service innovations are<br />

on the pulse of the times<br />

> New <strong>Wiener</strong> <strong>Städtische</strong> website offers extensive product<br />

information and service highlights<br />

> Advertising awards<br />

10 ANNUAL REPORT 2010 | <strong>Wiener</strong> StädtiSche

»We Are AuStriA ...«<br />

in August 2010, robert lasshofer assumed the position of ceO for<br />

<strong>Wiener</strong> <strong>Städtische</strong> that had previously been held by günter geyer.<br />

General Manager Günter Geyer<br />

186 years of experience in the Austrian insurance market<br />

make us strong. The building blocks of our success<br />

are proximity to customers throughout Austria, leadership<br />

in current insurance topics and product innovation, and<br />

providing the most professional advisors and service. We<br />

use our leading position to create sustainable value, based<br />

on the four pillars of region, people, financial strength and<br />

optimal solutions. Our main guiding principle: relieve our<br />

customers of their concerns.<br />

Thanks to the new Group structure, we can now concentrate<br />

even more strongly on the Austrian market. As the<br />

new holding company, the Vienna Insurance Group has<br />

been responsible for managing the Group since August<br />

2010, giving <strong>Wiener</strong> <strong>Städtische</strong> Versicherung AG more<br />

opportunity to focus on its traditional insurance business.<br />

At the same time, responsibility for managing the Company<br />

was assigned to Robert Lasshofer. The modern,<br />

forward-looking management structure of our Group also<br />

allows us to restructure activities in our home market to<br />

become more efficient and customer-focused. So that we<br />

can truly say: <strong>WE</strong> <strong>ARE</strong> AUSTRIA!<br />

General Manager Robert Lasshofer<br />

editOriAl<br />

ANNUAL REPORT 2010 | <strong>Wiener</strong> StädtiSche 11

12 ANNUAL REPORT 2010 | <strong>Wiener</strong> StädtiSche<br />

Managing Board of <strong>Wiener</strong> <strong>Städtische</strong> Versicherung Ag (from left to right) erich leiss, Judit havasi,<br />

general Manager robert lasshofer, christine dornaus, Peter höfinger

»... FAced With the chAllenge OF BecOMing<br />

eVen Better AS nuMBer 1 ...«<br />

An interview with the members of the<br />

Managing Board of <strong>Wiener</strong> <strong>Städtische</strong> Versicherung Ag,<br />

general Manager Robert Lasshofer, christine dornaus,<br />

Judit havasi, Peter höfinger and Erich Leiss.<br />

»We cAn FOcuS<br />

MOre StrOnglY On<br />

the AuStriAn<br />

MArKet.«<br />

Robert Lasshofer<br />

2010 brought fundamental change<br />

for you, the separation of <strong>Wiener</strong><br />

<strong>Städtische</strong> and VIG, which will focus<br />

on holding company and Group management<br />

responsibilities in the future.<br />

What does this mean for you?<br />

Lasshofer: For <strong>Wiener</strong> <strong>Städtische</strong>, it<br />

means a natural continuation of its<br />

successful past. We were one of the<br />

first to dare enter Eastern Europe<br />

after the fall of the Iron Curtain, and<br />

we have grown to become one of<br />

the leading insurance companies in<br />

the region. At the same time, we increased<br />

in size to such an extent that<br />

separating holding company responsibilities,<br />

now managed by VIG, and<br />

operating responsibility for <strong>Wiener</strong><br />

<strong>Städtische</strong>’s insurance business became<br />

a natural next step. This separation<br />

of responsibilities puts us once<br />

again ahead of our times, and allows<br />

us here at <strong>Wiener</strong> <strong>Städtische</strong> to concentrate<br />

more strongly on the Austrian<br />

market and branch offices in Italy<br />

and Slovenia, and the security needs<br />

of our customers.<br />

Will customers also see changes? Continuity<br />

is particularly important when it<br />

comes to insurance.<br />

Leiss: And continuity is exactly what<br />

we are focusing on. Our main themes<br />

were, and still remain, absolute<br />

customer-orientation and security.<br />

The concept of security has been<br />

expanded, however, to include not<br />

only our original business of providing<br />

risk coverage, but also security<br />

in a broader sense of safety, lasting<br />

customer relationships. A partner offering<br />

long-term security is precisely<br />

what customers need when deciding<br />

to join a pension plan, for example.<br />

What do you consider your overall role<br />

in the Austrian insurance market? After<br />

all, this Annual Report begins with<br />

the highly confident statement, “We<br />

are Austria.”<br />

Dornaus: Our number 1 position<br />

in the Austrian insurance market is<br />

based on a market share of 14.5%,<br />

approximately 3,500 employees,<br />

2,000 advisors and 1.3 million customers.<br />

Our self-confidence is therefore<br />

based on impressive facts. The<br />

statement “We are Austria”, however,<br />

reflects many other factors. We are<br />

an Austrian company, managed from<br />

Austria, with a successful history of<br />

186 years as Austria’s oldest insur-<br />

interVieW<br />

ANNUAL REPORT 2010 | <strong>Wiener</strong> StädtiSche 13

14 ANNUAL REPORT 2010 | <strong>Wiener</strong> StädtiSche<br />

»... FOrWArd-lOOKing trendSetterS in<br />

»We WAnt tO<br />

PrOVide QuicK<br />

lOng-terM<br />

SOlutiOnS FOr<br />

cuStOMer<br />

needS.«<br />

Erich Leiss<br />

ance company. We are also one of<br />

the largest investors and employers<br />

in the country. We are well positioned<br />

throughout Austria, near to our customers<br />

and responsive to their needs.<br />

Our expansion into the CEE region<br />

was, however, also managed from<br />

Austria. And now, thanks to the reorganisation<br />

of VIG, we can once again<br />

place our full attention on our home<br />

market of Austria.<br />

What does being a part of VIG mean<br />

for you, and your customers?<br />

Höfinger: Being part of an international<br />

group of companies brings us<br />

stability, financial strength and a network<br />

covering the entire CEE region,<br />

which is of particular interest to our<br />

large customers, who often operate<br />

out of Austria in the entire region.<br />

VIG also performs important management<br />

functions that determine<br />

our strategic direction and provide<br />

synergies. This brings considerable<br />

cost benefits, for example in the IT<br />

area or back office. In addition, all<br />

of the companies in VIG benefit from<br />

exchanging know-how and best practices.<br />

It is important to us that the<br />

other companies in the Group meet<br />

the same high goals and standards<br />

as the Group as a whole.<br />

And where specifically do you score<br />

points compared to your competitors?<br />

Leiss: Our goal is to recognise trends<br />

before others do, and to immediately<br />

turn this knowledge into products<br />

that address those needs. We therefore<br />

see ourselves as forward-looking<br />

trendsetters in the Austrian insurance<br />

industry. <strong>Wiener</strong> <strong>Städtische</strong>’s<br />

track record of consistent success<br />

throughout its history shows that we<br />

can achieve this goal. One example:<br />

we were the first in the market to<br />

expand catastrophic protection in<br />

homeowner insurance.<br />

Havasi: We were also first mover with<br />

retirement pensions in the 1960s,<br />

and in the area of nursing care provisions,<br />

where we were the first in<br />

Austria to offer an insurance solution.<br />

Aside from product innovation, however,<br />

one of the crucial differences,<br />

particularly in a business based on<br />

trust, is the high level of professional<br />

service and support we provide. Because<br />

of our nation-wide network,<br />

we truly are near to our customers<br />

everywhere in Austria. Another factor<br />

that perhaps none of us would<br />

have suspected, and that also underscores<br />

longterm performance, is<br />

that we have been the trusted insurance<br />

company of many monasteries<br />

and other parts of the Austrian clergy<br />

since the Company was established.<br />

How does it look in terms of profitability?<br />

The last few years have also been<br />

difficult for insurance companies.<br />

How did the Company do in 2010?<br />

Lasshofer: Very well. Premium volume<br />

increased by more than 4%, exceeding<br />

our target for the year, and<br />

the result from ordinary activities is<br />

also considerably higher than the<br />

year before.<br />

Single-premium life insurance policies<br />

made a particularly large contribution<br />

to premium volume, the cost<br />

reduction programme begun in 2009<br />

was brought to a successful conclusion,<br />

and the reorganisation measures<br />

needed when the Company was<br />

split off from VIG were also completed<br />

quickly. This increased efficiency<br />

considerably.

the AuStriAn inSurAnce MArKet ...«<br />

Dornaus: In the investments area,<br />

we used a very conservative and security-oriented<br />

investment policy to<br />

minimise our exposure to default risk.<br />

This produced an excellent financial<br />

result. Earnings were also increased<br />

by a successful property sale, which<br />

was reported in the extraordinary result.<br />

Independent of this sale, we further<br />

expanded our real estate portfolio<br />

to increase security and stabilise<br />

our actuarial reserve fund.<br />

What were the most important external<br />

factors? The media often reported<br />

on natural catastrophes and an increased<br />

trend towards retirement provisions.<br />

Höfinger: 2010 was, in fact, greatly<br />

affected by natural catastrophes.<br />

In terms of our private customers,<br />

although there was no single largescale<br />

event, like the flood of the millennium<br />

that occurred in 2002, there<br />

were many smaller events spread<br />

over the year. In the business segment,<br />

since we accompany many<br />

Austrian companies as they move<br />

into foreign countries, we are naturally<br />

also affected by natural events<br />

in other regions and on other continents.<br />

In total, we paid out EUR 1.4<br />

billion in insurance benefits last year.<br />

Our reinsurance policy has proven its<br />

value here, as it allowed the charges<br />

for <strong>Wiener</strong> <strong>Städtische</strong> itself to be<br />

kept to a minimum. Due to the large<br />

number of major losses, however, the<br />

reinsurance market has become considerably<br />

more cautious.<br />

Havasi: With respect to provisions for<br />

retirement, demographic change and<br />

increasingly tight government budgets<br />

have caused this area to grow<br />

strongly for years. After a short inter-<br />

ruption due to the financial and economic<br />

crisis, the trend is now returning<br />

even more strongly. Single-premium<br />

policies, traditional life insurance,<br />

and our “Prämienpension” pension<br />

product showed clear signs of this in<br />

2010. In overall terms, life insurance<br />

premiums rose by 12.9% last year.<br />

What were the most important initiatives<br />

in the product and services areas<br />

in 2010?<br />

Leiss: We once again made a very<br />

large number of product additions<br />

and modifications in 2010. The<br />

central principle was to provide increased<br />

ease of use and transparency<br />

by, for example, promoting the<br />

use of the Internet, smartphones, and<br />

the like. For example, we now offer<br />

apps and claims processing tools for<br />

these channels. The main goal was to<br />

satisfy customer requirements, both<br />

in terms of sustainability, which is important<br />

in areas like retirement provisions,<br />

for example, which demand a<br />

great deal of advisory services, and<br />

in terms of speed, for example in motor<br />

vehicle claims settlement. At the<br />

same time, we also worked intensively<br />

in 2010 on preparations for the<br />

product innovation initiative that is<br />

planned for 2011.<br />

With respect to employees, in addition<br />

to a professional organisational structure,<br />

customer-orientation and good<br />

service require committed, competent<br />

employees.<br />

Lasshofer: That is why we are continuously<br />

investing in our employees.<br />

This is done with two goals in mind.<br />

First, we want to ensure that we have<br />

the best employees in our team and,<br />

second, we need to ensure that our<br />

»We chOOSe<br />

Secure inVeStMentS<br />

FOr cuStOMer<br />

PreMiuMS.«<br />

Christine Dornaus<br />

interVieW<br />

ANNUAL REPORT 2010 | <strong>Wiener</strong> StädtiSche 15

16 ANNUAL REPORT 2010 | <strong>Wiener</strong> StädtiSche<br />

»... <strong>Wiener</strong> StädtiSche’S SucceSS iS<br />

»Our reinSurAnce<br />

POlicY hAS PrOVen<br />

itS VAlue.«<br />

Peter Höfinger<br />

advisors provide the high level of<br />

professional service demanded by<br />

the market. We use something similar<br />

to a double-brand strategy here.<br />

The image of our Company, and its<br />

success, are a product of both the<br />

“<strong>Wiener</strong> <strong>Städtische</strong>” brand and the<br />

personal “brand” of each individual<br />

employee. <strong>Wiener</strong> <strong>Städtische</strong>’s success<br />

is also the success of each individual<br />

employee, and vice versa. This<br />

is why we invest large sums in training<br />

and advanced training, motivation,<br />

and the development of young employees,<br />

as well as the targeted use<br />

of experienced employee expertise,<br />

and the use of job rotation to promote<br />

networking within the Group. High<br />

priority is also given to informational<br />

events and training courses for our<br />

field staff, who are of key importance<br />

to our sales.<br />

Without our employees, we could not<br />

have achieved the good result we reported<br />

for the year just ended, and<br />

I would like to take the opportunity<br />

here to thank them deeply for their<br />

past and future support.<br />

Mr. Lasshofer, you took on the position<br />

of CEO in August 2010. What does this<br />

mean for you personally, and what areas<br />

are you planning to focus on?<br />

Lasshofer: The need for security has<br />

been with us since the dawn of mankind,<br />

and I would like to build on this<br />

basic principle to further strengthen<br />

<strong>Wiener</strong> <strong>Städtische</strong>’s leading position<br />

in the market. We want to continue to<br />

follow the successful path we are on,<br />

and add further to our achievements.<br />

Our challenge, therefore, is to further<br />

improve our position as number 1. In<br />

terms of what the new position means<br />

to me personally, it brings great en-<br />

joyment, but also brings a high level<br />

of responsibility, both to our employees<br />

and our customers. I am pleased<br />

to take on the challenge!<br />

Two members of the Managing Board<br />

are women. This is completely unheard<br />

of for a large Austrian company.<br />

What are your thoughts about equal<br />

treatment in general?<br />

Dornaus: The situation is excellent<br />

at <strong>Wiener</strong> <strong>Städtische</strong>, but society as<br />

a whole unfortunately has a long way<br />

to catch up. We don’t need a quota<br />

system in the Company; everything<br />

is simply based on performance. This<br />

holds true for all areas of the company,<br />

including the Managing Board. Of<br />

the total 1,546 inside employees of<br />

<strong>Wiener</strong> <strong>Städtische</strong>, 953 are women.<br />

That is more than 60%.<br />

Havasi: As another example, we also<br />

have one of the first company daycare<br />

centres in Austria, with 105 children<br />

currently registered. This also<br />

fits the image we have of ourselves as<br />

a first mover. One result is that 90% of<br />

mothers return after maternity leave,<br />

which is likely to be a new record. We<br />

also use targeted measures to encourage<br />

women to join the Company.<br />

Each year, for example, the Company<br />

holds a “Daughters’ Day” event,<br />

where the daughters of employees<br />

can learn more about the professional<br />

careers available for women in the<br />

insurance industry. At the same time,<br />

equal treatment is also an important<br />

principle for us in other areas. For<br />

example, <strong>Wiener</strong> <strong>Städtische</strong> has 96<br />

employees with disabilities.<br />

What is the situation in terms of corporate<br />

social responsibility, in particular,<br />

sponsoring?

the SucceSS OF All Our eMPlOYeeS.«<br />

Havasi: As a company committed to<br />

sustainable security, we also recognise<br />

our responsibility to society, and<br />

regularly support a broad portfolio<br />

of initiatives. Our main focus is on<br />

cultural and social initiatives, in<br />

sports we limit ourselves to recreational<br />

sports, such as the Vienna City<br />

Marathon. In the area of culture, the<br />

VBW theatre company (Vereinigte<br />

Bühnen Wien) and St. Margarethen<br />

Opera Festival are some of our partners,<br />

and we also support the Festival<br />

der Bezirke festival and the Long<br />

Night of the Churches (Lange Nacht<br />

der Kirchen) regularly. Providing support<br />

for social causes, however, is<br />

particularly important to us. Highlights<br />

in this area include, for example,<br />

the Safety Tour for children and<br />

the Caritas nursing care campaign,<br />

which we are co-financing. A project<br />

started with the “Second Savings<br />

Bank” (Zweite Sparkasse) provides<br />

low-cost or, in some cases, free insurance<br />

for people in a precarious<br />

financial situation who have special<br />

needs in this area. This is a matter of<br />

particular concern to us. We feel it is<br />

important to be a long-term, reliable<br />

partner in all of these projects, and to<br />

provide long-lasting support over the<br />

long term.<br />

Let us finish with a look into the future.<br />

What are your expectations and most<br />

important plans for financial year<br />

2011?<br />

Lasshofer: As mentioned previously,<br />

we are planning a product innovation<br />

initiative for 2011. The overall aim of<br />

the initiative is to achieve new quality<br />

for our products. This has two main<br />

dimensions. First, we aim to remain a<br />

reliable partner in all long-term insurance<br />

areas, such as retirement pen-<br />

sions and nursing care provisions,<br />

and continuously develop new products<br />

to provide long-term security in<br />

this area. On the other hand, life is<br />

becoming ever faster, and needs are<br />

becoming more short-term. We are<br />

also reacting flexibly to these developments,<br />

and are planning a series<br />

of innovations for retirement pensions,<br />

motor vehicles and nursing<br />

care in 2011 that are a perfect match<br />

for these new needs. We will also, of<br />

course, combine this with further<br />

training and advanced training for our<br />

advisors. They need to have detailed<br />

knowledge of the products and customer<br />

needs, and be able to see the<br />

bigger picture.<br />

In terms of figures, we will naturally<br />

be aiming for sustainable growth.<br />

This applies in particular to the nonlife<br />

area, where natural catastrophes,<br />

rising criminality, and the economic<br />

crisis have increased people’s security<br />

needs, leading to an upward<br />

trend. In addition, we also see potential<br />

in nursing care provisions. In<br />

overall terms, we have a good basis<br />

for further increasing our volume of<br />

business.<br />

Thank you for the interview.<br />

»We tAKe Our SOciAl<br />

reSPOnSiBilitY<br />

VerY SeriOuSlY.«<br />

Judit Havasi<br />

interVieW<br />

ANNUAL REPORT 2010 | <strong>Wiener</strong> StädtiSche 17

<strong>Wiener</strong> StädtiSche MAnAging BOArd<br />

18 ANNUAL REPORT 2010 | <strong>Wiener</strong> StädtiSche<br />

Judit hAVASi<br />

Member of the Managing Board<br />

Areas of responsibility:<br />

human resources and<br />

development, company law,<br />

sponsoring, life insurance,<br />

casualty insurance, health<br />

insurance, personal<br />

insurance service centre<br />

erich leiSS<br />

Member of the Managing Board<br />

Areas of responsibility:<br />

Property insurance, general liability<br />

insurance and legal expenses<br />

insurance, private and commercial<br />

business, motor vehicle insurance,<br />

property insurance service centre,<br />

special damages, legal expenses<br />

claims, business organisation,<br />

iT management and provider<br />

management

chriStine dOrnAuS<br />

Member of the Managing Board<br />

Areas of responsibility:<br />

Securities and funds, equity<br />

investment management and<br />

loans, real estate and real<br />

estate-related equity investments,<br />

finance and accounting,<br />

collections service centre<br />

rOBert lASShOFer<br />

general Manager, cEO<br />

Areas of responsibility:<br />

Media and public relations,<br />

internal communications<br />

marketing, advertising, central<br />

sales management, primary<br />

distribution, secondary distribution,<br />

Erste Bank Sparkasse group<br />

partnership, provincial<br />

head offices<br />

Peter höFinger<br />

Member of the Managing Board<br />

Areas of responsibility:<br />

corporate and large customer<br />

business, reinsurance

OVerVieW<br />

A<br />

cOMPAnY & StrAtegY<br />

Number 1 in Austria 26<br />

The Vienna insurance group<br />

clear objectives and strategy<br />

Leadership in current insurance topics and innovation<br />

Professionalism and reliability<br />

28<br />

30<br />

32<br />

34 B<br />

Employees as a key factor in success<br />

Success can be shared<br />

36<br />

38 MAJOr tOPicS 2010<br />

20 ANNUAL REPORT 2010 | <strong>Wiener</strong> StädtiSche<br />

The new <strong>Wiener</strong> <strong>Städtische</strong> 40<br />

Expansion of the service centres 41<br />

Negative effects of natural catastrophes 42<br />

Attention on retirement provisions 44<br />

Product and service initiatives 48<br />

Advertising does well 52

c<br />

MAnAgeMent rePOrt 2010<br />

Business development in 2010 54<br />

Risk report 59<br />

Outlook for 2011 61<br />

Proposal on the distribution of profits 63<br />

d<br />

AnnuAl FinAnciAl StAteMentS 2010<br />

Balance sheet 66<br />

income statement 74<br />

Notes to the financial statements 81<br />

Auditor’s report 104<br />

Supervisory Board report 106<br />

declaration by the Managing Board 108<br />

SerVice<br />

State advisory boards 109<br />

Provincial head offices 112<br />

contact information and addresses 113<br />

glossary 123<br />

ANNUAL REPORT 2010 | <strong>Wiener</strong> StädtiSche 21

KeY FigureS FOr <strong>Wiener</strong> StädtiSche VerSicherung Ag<br />

in million eur 2010<br />

gross premiums written 2,432.8<br />

Property/casualty 1,046.5<br />

Life 1,058.5<br />

health 327.8<br />

Financial result 388.4<br />

Profit from ordinary activity 187.6<br />

total capital assets 12,510.6<br />

capital assets 10,286.6<br />

capital assets of unit- and index-linked life insurance 2,234.0<br />

underwriting provisions<br />

(excluding unit- and index-linked life insurance) 8,294.9<br />

underwriting provisions of unit- and<br />

index-linked life insurance 2,141.4<br />

equity capital 881.7<br />

number of employees 3,497<br />

internal 1,546<br />

External (including trainees) 1,951<br />

22 ANNUAL REPORT 2010 | <strong>Wiener</strong> StädtiSche

Life 43.5%<br />

cOMPAnY & StrAtegY | MAJOR TOPicS 2010 | MANAgEMENT REPORT 2010 | ANNUAL FiNANciAL STATEMENTS 2010<br />

PreMiuMS BY SegMentS inSurAnce clAiMS BY SegMentS<br />

reSult FrOM OrdinArY BuSineSS BY SegMentS<br />

Property/casualty<br />

65.7%<br />

health 13.5%<br />

Property/casualty<br />

43.0%<br />

Life 21.7%<br />

health 12.6%<br />

Life 53.6%<br />

* incl. costs of claims processing<br />

Others 1.3%<br />

Real estate 2.7%<br />

Loans 13.0<br />

Ownership<br />

interests 17.1%<br />

health 13.8%<br />

Structure OF inVeStMentS*<br />

* Balance of investments excluding unit-linked and index-linked life<br />

insurance was EUR 10,286.60 mn as at 31 december 2010<br />

Property/casualty<br />

32.6%<br />

Securities 65.9%<br />

ANNUAL REPORT 2010 | <strong>Wiener</strong> StädtiSche 23<br />

A

<strong>Wiener</strong> StädtiSche VerSicherung Ag<br />

AuStriA’S tighteSt SAFetY net<br />

24 ANNUAL REPORT 2010 | <strong>Wiener</strong> StädtiSche<br />

Bregenz<br />

Dornbirn<br />

FELDKIRCH<br />

Bludenz<br />

Vienna location<br />

Ottakring<br />

Office "Vorsorge"<br />

Reutte<br />

Imst<br />

Landstraße<br />

Floridsdorf<br />

Telfs<br />

Donaustadt<br />

HEADQUARTERS<br />

PROVINCIAL HEAD OFFICE<br />

Liesing<br />

Landeck<br />

INNSBRUCK<br />

Wörgl<br />

Schwaz<br />

Kufstein<br />

Zell / See<br />

Lienz<br />

Braunau/Inn<br />

Mattighofen<br />

Seekirchen<br />

SALZBURG<br />

Hallein<br />

Bischofshofen<br />

St. Johann/Pongau<br />

Bad Gastein<br />

Hermagor

Grieskirchen<br />

Ried/Innkreis<br />

Vöcklabruck<br />

Abtenau<br />

Schärding<br />

Mondsee<br />

Schörfling<br />

Bad Ischl<br />

Tamsweg<br />

Spittal/Drau<br />

Rohrbach<br />

Wels<br />

Vorchdorf<br />

Gmunden<br />

Scharnstein<br />

Villach<br />

Bad Leonfelden<br />

Eferding<br />

Leonding<br />

Bad Aussee<br />

Liezen<br />

Gröbming<br />

Traun<br />

Feldkirchen<br />

Steyr<br />

Kirchdorf/Krems<br />

LINZ<br />

Kremsmünster<br />

Windischgarsten<br />

Judenburg<br />

Murau<br />

St. Veit/Glan<br />

KLAGENFURT<br />

Freistadt<br />

Ferlach<br />

Völkermarkt<br />

Gmünd<br />

Kindberg<br />

Kapfenberg<br />

Zwettl<br />

Gratkorn<br />

Voitsberg<br />

Waidhofen/Thaya<br />

Bruck/Mur<br />

Gföhl<br />

Mürzzuschlag<br />

Deutschlandsberg Bad Radkersburg<br />

Leibnitz<br />

Hartberg<br />

Weiz<br />

Horn<br />

Krems<br />

Hollabrunn<br />

Gleisdorf<br />

Feldbach<br />

Fürstenfeld<br />

Stockerau<br />

Zistersdorf<br />

Korneuburg<br />

Gänserndorf<br />

Perg<br />

Herzogenburg<br />

Melk<br />

Amstetten ST. PÖLTEN<br />

Tulln<br />

Klosterneuburg<br />

Vienna (see<br />

Groß Enzersdorf<br />

map on left)<br />

Neulengbach<br />

Bruck/Leitha<br />

Mödling<br />

Schwechat<br />

Scheibbs<br />

Baden<br />

Neusiedl/See<br />

Waidhofen/Ybbs<br />

Lilienfeld<br />

Wr. Neustadt EISENSTADT<br />

Mattersburg<br />

Ternitz<br />

Leoben<br />

Knittelfeld<br />

Wolfsberg<br />

cOMPAnY & StrAtegY | MAJOR TOPicS 2010 | MANAgEMENT REPORT 2010 | ANNUAL FiNANciAL STATEMENTS 2010<br />

GRAZ<br />

Retz<br />

Neunkirchen<br />

Aspang<br />

Jennersdorf<br />

Wolkersdorf<br />

Oberwart<br />

Güssing<br />

Laa/Thaya<br />

Poysdorf<br />

Mistelbach<br />

Oberpullendorf<br />

headquarters/Provincial head offices<br />

Branch offices<br />

A

For a remarkable 186 years, <strong>Wiener</strong> <strong>Städtische</strong> has been the reliable<br />

partner for its customers, a manager for their problems today, and the<br />

provisions they make for the future. Experience, competence, financial<br />

strength and innovation are the pillars of our economic success.<br />

»MArKet leAder<br />

thAnKS tO the<br />

truSt OF<br />

1.3 MilliOn<br />

cuStOMerS«<br />

26 ANNUAL REPORT 2010 | <strong>Wiener</strong> StädtiSche<br />

<strong>Wiener</strong> <strong>Städtische</strong> is the largest single<br />

company in the international Vienna Insurance<br />

Group (VIG), with registered office in<br />

Vienna. <strong>Wiener</strong> <strong>Städtische</strong> is an independent<br />

company that concentrates fully on<br />

activities in the Austrian market and the<br />

branch offices in Italy and Slovenia<br />

Leading market position<br />

The confidence of 1.3 million customers,<br />

a total premium volume of approximately<br />

EUR 2.4 billion in 2010, and a market share<br />

of 14.5% make <strong>Wiener</strong> <strong>Städtische</strong> the largest<br />

insurance company in Austria. Its customers<br />

benefit from its experience, pro-<br />

factbox<br />

> largest insurance company in Austria,<br />

with a market share of 14.5% and<br />

1.3 million customers<br />

> nation-wide service provided by nine<br />

provincial head offices, approximately<br />

140 business offices, and 3,500<br />

employees, including 2,000 advisors<br />

> Financial strength provided by good<br />

capital resources and integration into<br />

the Vienna insurance group<br />

nuMBer 1 in AuStriA<br />

fessional employees and innovative range<br />

of products. The Company operates in all<br />

insurance classes and offers customers security<br />

in many areas of life.<br />

Important for the economy<br />

In addition, <strong>Wiener</strong> <strong>Städtische</strong> plays a<br />

major role in maintaining Austria’s attractiveness<br />

as a business centre, not only as<br />

a major employer, but also as one of the<br />

most important investors in the country.<br />

Sustainable investments and equity investments,<br />

and support in the social and<br />

cultural areas are deeply anchored in our<br />

business strategy.<br />

<strong>Wiener</strong> <strong>Städtische</strong> also makes a major contribution<br />

to the stability and growth of the<br />

Austrian economy by being a reliable partner<br />

for industry and large customers. <strong>Wiener</strong><br />

<strong>Städtische</strong> is one of the most important<br />

real estate investors in Austria. The investment<br />

portfolio is supplemented with real<br />

estate in order to offer customers sustainability<br />

and a high level of security.<br />

An insurance partner in all classes<br />

<strong>Wiener</strong> <strong>Städtische</strong> operates in the property/casualty,<br />

life and health insurance areas,<br />

and offers innovative custom-tailored<br />

solutions for private, commercial and corporate<br />

customers. Everything is based on<br />

the needs of the market and customers –<br />

in the future, <strong>Wiener</strong> <strong>Städtische</strong> will continue<br />

to offer products that provide stability<br />

and security in the future, as well as flexibility<br />

and convertibility.

Proximity to customers and<br />

service orientation<br />

Close to 3,500 employees, including more<br />

than 2,000 advisors, in nine provincial<br />

head offices and approximately 140 business<br />

offices provide personal service tailored<br />

to individual needs throughout all of<br />

Austria. Use of this regional approach and<br />

strong nation-wide customer service will<br />

continue to be one of the most important<br />

pillars of <strong>Wiener</strong> <strong>Städtische</strong>’s success. It<br />

guarantees proximity to customers, rapid<br />

claims settlement, and personal, comprehensive<br />

service.<br />

Attractive multi-channel distribution<br />

Our field staff, brokers, agents, and approximately<br />

140 business offices represent<br />

<strong>Wiener</strong> <strong>Städtische</strong>’s sales strength. Our<br />

salaried field staff are our strongest channel<br />

for private sales, and sales to small and<br />

medium-sized business. In 2008, a new<br />

institutional distribution option, banking<br />

distribution, was added to the previous<br />

successful channels of distribution.<br />

The cooperation with the Erste Bank<br />

Sparkasse Group helps to develop insurance<br />

solutions for capital accumulation<br />

using competitive forms of investment.<br />

The cooperation is also being steadily expanded,<br />

with the goal of positioning these<br />

two distribution channels as professional<br />

and reliable partners for both banking and<br />

insurance products.<br />

Stability and security<br />

As a result of choosing targeted investments<br />

in highly secure projects known<br />

to have good capital resources, <strong>Wiener</strong><br />

<strong>Städtische</strong> is excellently positioned and financially<br />

strong, even in times of economic<br />

tension. The broad positioning of <strong>Wiener</strong><br />

<strong>Städtische</strong>‘s parent company, the Vienna<br />

cOMPAnY & StrAtegY | MAJOR TOPicS 2010 | MANAgEMENT REPORT 2010 | ANNUAL FiNANciAL STATEMENTS 2010<br />

Insurance Group, provides additional stability.<br />

VIG’s top listing on the Vienna Stock<br />

Exchange and its success in the CEE region<br />

generate significant added value for<br />

Austria as a financial centre.<br />

Due to the events that occurred in financial<br />

markets in recent years, the European<br />

Union intends to change its capital requirements<br />

(Solvency II). <strong>Wiener</strong> <strong>Städtische</strong> is<br />

already well positioned in terms of its riskaware<br />

culture and risk management for implementing<br />

these rules.<br />

ANNUAL REPORT 2010 | <strong>Wiener</strong> StädtiSche 27<br />

A

28 ANNUAL REPORT 2010 | <strong>Wiener</strong> StädtiSche<br />

The Vienna insurance group (Vig) is a listed international<br />

insurance group with its registered office in Vienna. With a<br />

premium volume in excess of EUR 8 billion and approximately<br />

25,000 employees, Vig is one of the largest players in the<br />

insurance market of central and Eastern Europe.<br />

»MOre StABilitY<br />

And SecuritY<br />

thrOugh integrAtiOn<br />

in An internAtiOnAl<br />

grOuP«<br />

the ViennA inSurAnce grOuP<br />

VIG’s insurance companies offer their<br />

customers high-quality products and<br />

services in the life and non-life areas.<br />

Shares of the Vienna Insurance Group<br />

are listed on the Vienna and Prague<br />

stock exchanges.<br />

VIG’s focused and systematic strategy for<br />

expanding into the CEE region enabled it to<br />

make the leap from being a national insurance<br />

company to an international group of<br />

approximately 50 insurance companies in<br />

24 countries. Standing for financial stability,<br />

VIG is able to offer customers, shareholders,<br />

partners and employees a high<br />

level of security. This is also underscored<br />

by the A+ rating, with a stable outlook,<br />

given to it by the well-known rating agency<br />

Standard & Poor’s.<br />

The CEE growth region<br />

In 1990, VIG was the first Western insurance<br />

company to move into Central and Eastern<br />

Europe – a region that today already accounts<br />

for around 50% of total group premiums.<br />

The Group has group companies<br />

operating in this region in Albania, Belarus,<br />

Bulgaria, Croatia, the Czech Republic, Estonia,<br />

Georgia, Hungary, Latvia, Lithuania,<br />

Macedonia, Montenegro, Poland, Romania,<br />

Russia, Serbia, Slovakia, Turkey and<br />

Ukraine. There is also a <strong>Wiener</strong> <strong>Städtische</strong><br />

branch office in Slovenia. VIG is therefore<br />

optimally positioned to participate in the<br />

CEE region’s rising standard of living and<br />

hence in its rising need for insurance.<br />

VIG is also represented in Germany, Liechtenstein<br />

and Italy.<br />

Core market: Austria<br />

Austria is a key market for the Group; it is<br />

here that the expansion began. The excellent<br />

positioning of VIG’s three Austrian<br />

companies, <strong>Wiener</strong> <strong>Städtische</strong> Versicherung,<br />

Donau Versicherung and Sparkasse Versicherung,<br />

makes it the market leader in<br />

Austria.<br />

Corporate structure redesigned<br />

In 2010, as part of a restructuring, <strong>Wiener</strong><br />

<strong>Städtische</strong>’s operating business in Austria<br />

was separated from the international holding<br />

company activities. As a result, VIG now<br />

focuses on management responsibilities<br />

for the Group. The transparent structures<br />

and processes created within the Group<br />

have enabled management to become<br />

more efficient.<br />

All of the Group companies have strong<br />

regional roots, and can also build on VIG’s<br />

strong international background. The restructuring<br />

provides them with a common<br />

umbrella and a strong, unifying identity that<br />

extends beyond their individual markets.<br />

Full range of products offered<br />

VIG has more than 185 years of experience<br />

in the insurance business. Committed customer<br />

advisors, innovative products, excellent<br />

service, and optimal customer access<br />

through multi-channel distribution were

MAnY BrAndS,<br />

One grOuP<br />

and are the cornerstones of the company’s<br />

successful development. VIG also uses a<br />

multi-brand strategy to take advantage of<br />

the power of the proven brands rich in tradition<br />

in every country.<br />

The Group companies in Austria have offered<br />

innovative insurance solutions tailored<br />

to customer needs for many years in<br />

both the life and the non-life areas. In Central<br />

and Eastern Europe, the rising standard<br />

of living has led to an increased need<br />

for insurance. While motor vehicle insurance<br />

and household/homeowner policies<br />

were initially in strongest demand, today<br />

retirement provisions, savings and investment<br />

products in the form of life insurance<br />

policies are enjoying rising popularity.<br />

VIG Re was founded to be the Group’s inhouse<br />

reinsurance company. Its location in<br />

the Czech Republic underscores the significance<br />

of the CEE region as a growth<br />

market.<br />

The Erste Group – a strong partner<br />

In 2008, a reciprocal sales and distribution<br />

agreement was signed with the Erste Group<br />

in Austria and Central and Eastern Europe.<br />

Using a multi-channel distribution approach,<br />

the Erste Group distributes VIG insurance<br />

products, while VIG companies<br />

offer banking products in return. Both VIG<br />

and the Erste Group are professional and<br />

reliable points of contact for banking and<br />

insurance products alike.<br />

cOMPAnY & StrAtegY | MAJOR TOPicS 2010 | MANAgEMENT REPORT 2010 | ANNUAL FiNANciAL STATEMENTS 2010<br />

Employees ensure success<br />

VIG offers the best possible advice and excellent<br />

service for its comprehensive range<br />

of products. Group employees therefore<br />

play a very important role in the Company’s<br />

success. Use of a regional approach means<br />

they are always close to the customer and<br />

in touch with the needs of the market.<br />

Further information on VIG is available at<br />

www.vig.com and in its group management<br />

report.<br />

ANNUAL REPORT 2010 | <strong>Wiener</strong> StädtiSche 29<br />

A

30 ANNUAL REPORT 2010 | <strong>Wiener</strong> StädtiSche<br />

cleAr OBJectiVeS And StrAtegY<br />

Excellent advisors and service, trend-setting products, and<br />

its regional approach and international background have made<br />

<strong>Wiener</strong> <strong>Städtische</strong> the clear number 1 in the Austrian market.<br />

And the company’s goal will continue to be maintaining and<br />

expanding its leadership position in the market.<br />

»FOur KeY StrAtegic<br />

PillArS FOr eXPAnding<br />

Our MArKet<br />

leAderShiP«<br />

OBJectiVeS FOr 2011<br />

In 2010 the Austrian market showed clear<br />

signs of recovering again following the end<br />

of the financial crisis. Premium volume in<br />

the Austrian insurance market as a whole<br />

rose by 2%. Significant growth was recorded<br />

in all classes, especially life insurance<br />

and health insurance, but also property/<br />

casualty insurance.<br />

Maintain and expand the<br />

number 1 position<br />

<strong>Wiener</strong> <strong>Städtische</strong>‘s market share of 14.5%<br />

and premium volume of EUR 2.4 billion<br />

made it the clear number 1 in the Austrian<br />

market. The Company recorded growth at<br />

a rate that was significantly better than the<br />

market average, and even recorded an increase<br />

in premiums of more than 5%. This<br />

growth was primarily due to good performance<br />

in the life insurance class. <strong>Wiener</strong><br />

<strong>Städtische</strong> will continue to focus on life<br />

insurance and motor vehicle insurance in<br />

2011.<br />

Improvement in result from ordinary<br />

activities<br />

Targeted increases in premium volume<br />

and further administrative optimisation of<br />

services and synergies will be used to continuously<br />

improve our combined ratio and<br />

result from ordinary activities.<br />

StrAtegY FOr 2011<br />

<strong>Wiener</strong> <strong>Städtische</strong> is basing its strategy<br />

on four key pillars to achieve its ambitious<br />

goals: innovation, the best possible advisors<br />

and service, continuous employee development,<br />

and expansion of the partnership<br />

with the Erste Bank Sparkasse Group.<br />

In all cases, the central focus is on the customer<br />

and their concerns.<br />

- Innovation: Optimisation, simplification,<br />

personalisation and tailoring products to<br />

customer needs are the challenges related<br />

to products.<br />

- Best possible advisors and service:<br />

Customer satisfaction and, therefore,<br />

the length of customer relationships are<br />

continuously increased by continuous improvements<br />

in service.<br />

- Continuous employee development:<br />

<strong>Wiener</strong> <strong>Städtische</strong> employees primarily<br />

manage customer problems. The majority<br />

of our employees provide advisory services.<br />

Continuous employee development and<br />

training of young advisors ensure continuing<br />

success in personal advisory services.<br />

- Expansion of the partnership with the<br />

Erste Bank Sparkasse Group: Both companies<br />

have customer potential that has<br />

not yet been fully exploited. The partnership,<br />

which permits customers to obtain<br />

advice on a full range of financial and insurance<br />

concerns, will be further expanded<br />

and intensified.

cOMPAnY & StrAtegY | MAJOR TOPicS 2010 | MANAgEMENT REPORT 2010 | ANNUAL FiNANciAL STATEMENTS 2010<br />

ANNUAL REPORT 2010 | <strong>Wiener</strong> StädtiSche 31<br />

A

32 ANNUAL REPORT 2010 | <strong>Wiener</strong> StädtiSche<br />

<strong>Wiener</strong> <strong>Städtische</strong> is currently the market leader in Austria.<br />

This success is due to early attention to important insurance-<br />

related topics, continuous development of new products and<br />

improvement of proven products, as well as customer-friendly<br />

and service-oriented advisory and distribution systems.<br />

»... neW PrOductS<br />

thAt Are OFten<br />

FAr AheAd OF<br />

their tiMe«<br />

leAderShiP And innOVAtiOn<br />

A long tradition<br />

During <strong>Wiener</strong> <strong>Städtische</strong>’s long and successful<br />

history, management and employees<br />

repeatedly changed the focus of<br />

insurance product development in Austria<br />

in order to react optimally to changes in<br />

customer needs.<br />

The Company started with non-life insurance,<br />

soon followed by the life insurance<br />

class. Today, private customers can obtain<br />

insurance products in all of the important<br />

subcategories, from retirement provisions,<br />

residential, mobility, vacation and health<br />

products all the way to attractive, innovative<br />

special solutions, such as insurance<br />

for students.<br />

<strong>Wiener</strong> <strong>Städtische</strong> is the reliable partner<br />

for all business customers’ needs, from<br />

company pensions to business insurance<br />

and liability insurance. Integration in the<br />

Vienna Insurance Group enables business<br />

customers to receive the same comprehensive<br />

service they are used to from <strong>Wiener</strong><br />

<strong>Städtische</strong> in all CEE countries where<br />

the Group is represented.<br />

Product innovation<br />

<strong>Wiener</strong> <strong>Städtische</strong> still continues to provide<br />

customers with new products that are<br />

often far ahead of their time. For example,<br />

retirement pensions were already offered<br />

in the 1960s, long before it became<br />

a general topic of interest. Today, nursing<br />

care provisions are also in the centre of at-<br />

tention. <strong>Wiener</strong> <strong>Städtische</strong> offered its first<br />

insurance solution for nursing care provisions<br />

as early as in 1995, in association<br />

with a retirement pension product.<br />

In 2003, <strong>Wiener</strong> <strong>Städtische</strong> became the<br />

first insurance company in Austria to offer<br />

a government-sponsored pension plan,<br />

thereby starting a trend throughout the<br />

Austrian insurance market. Today, more<br />

than one million Austrians use a product<br />

of this kind, and approximately one in five<br />

are insured with <strong>Wiener</strong> <strong>Städtische</strong>. This<br />

makes <strong>Wiener</strong> <strong>Städtische</strong> the clear market<br />

leader in this area.<br />

Alternative drive technologies will play an<br />

increasingly important role in the future. In<br />

2006, <strong>Wiener</strong> <strong>Städtische</strong> became the first<br />

Austrian insurance company to promote<br />

the sale of environmentally friendly vehicles<br />

by offering a premium discount. Today,<br />

every second customer already benefits<br />

in this way by insuring a low-emission<br />

vehicle.<br />

In the area of property insurance, <strong>Wiener</strong><br />

<strong>Städtische</strong> was the first to expand catastrophic<br />

protection in homeowner insurance<br />

and increasing the amount insured<br />

for natural hazards. Due to climate change,<br />

this topic will also play an increasingly important<br />

role in the future.<br />

Students and customers with little money<br />

often cannot afford comprehensive insur-

ance coverage. <strong>Wiener</strong> <strong>Städtische</strong> therefore<br />

offers special low-budget insurance<br />

solutions. Customer well-being is our number<br />

1 priority.<br />

Further information on specific products<br />

and changes in 2010 is available on page<br />

48 and on the Internet at www.wienerstaedtische.at<br />

Optimal service<br />

Optimal advice and service is the way to<br />

reach customers with innovative products.<br />

This is why <strong>Wiener</strong> <strong>Städtische</strong> has always<br />

relied on a regional approach and multichannel<br />

distribution. Close contact with<br />

customers gives sales employees a direct<br />

understanding of customer needs, and<br />

this information flows directly into product<br />

development.<br />

New media are also being increasingly<br />

used to further improve service. Whether<br />

it is apps for smartphones or tablet PCs, or<br />

online portals for claims reporting, <strong>Wiener</strong><br />

<strong>Städtische</strong> is service-oriented, innovative,<br />

and on the pulse of the times.<br />

Multi-channel distribution with our partners<br />

offers optimal advice and access for<br />

every customer.<br />

Also a trendsetting investor<br />

In addition to playing a leading role in its<br />

core business, the insurance industry,<br />

<strong>Wiener</strong> <strong>Städtische</strong> is also an established financial<br />

partner, and has made new, trendsetting<br />

investments.<br />

In 1990, <strong>Wiener</strong> <strong>Städtische</strong> was one of the<br />

first to dare to cross the border to enter<br />

Central and Eastern Europe. Many Austrian<br />

companies followed. The CEE region<br />

is still one of the most important, fastest<br />

growing economic areas for the Austrian<br />

economy today. VIG generates a substantial<br />

portion of its profits there and continues<br />

to steadily expand its position as one<br />

of the market leaders in the region.<br />

cOMPAnY & StrAtegY | MAJOR TOPicS 2010 | MANAgEMENT REPORT 2010 | ANNUAL FiNANciAL STATEMENTS 2010<br />

A restructuring was performed in 2010, in<br />

which the business operations in Austria<br />

were separated from the international activities.<br />

The new structure allows <strong>Wiener</strong><br />

<strong>Städtische</strong> to concentrate on the Austrian<br />

insurance business, while VIG takes responsibility<br />

for holding company activities.<br />

The Group offers its subsidiaries an optimal<br />

operating framework and the opportunity<br />

to take advantage of common structures<br />

and synergies. The customer also benefits<br />

in the end, because more time is available<br />

for providing advice and service.<br />

»... <strong>Wiener</strong><br />

StädtiSche –<br />

SerVice-Oriented<br />

And innOVAtiVe,<br />

On the PulSe OF<br />

the tiMeS«<br />

ANNUAL REPORT 2010 | <strong>Wiener</strong> StädtiSche 33<br />

A

»2,000 AdViSOrS<br />

enSure PerFect<br />

SerVice«<br />

34 ANNUAL REPORT 2010 | <strong>Wiener</strong> StädtiSche<br />

PrOFeSSiOnAliSM And reliABilitY<br />

Achieving customer satisfaction and understanding<br />

customer concerns are important priorities for <strong>Wiener</strong><br />

<strong>Städtische</strong>. Providing optimal service and excellent<br />

advisors will ensure continued success in the increasingly<br />

competitive Austrian insurance market.<br />

The best possible service by professional<br />

employees<br />

High quality service and custom-tailored<br />

insurance solutions are key factors in <strong>Wiener</strong><br />

<strong>Städtische</strong>’s successful past. Customer<br />

satisfaction has been a priority for<br />

186 years. <strong>Wiener</strong> <strong>Städtische</strong>’s regional<br />

approach, professional advice and guaranteed<br />

availability at all times is made possible<br />

by nine provincial head offices, three<br />

service centres, approximately 140 business<br />

offices and more than 2,000 advisors.<br />

Optimal solutions<br />

Customer needs are changing, with the<br />

trend moving in the direction of more personalisation.<br />

Having professional advisors<br />

as field staff allows customer concerns<br />

and needs to be understood and appropriate<br />

solutions provided. Personal service<br />

also promotes customer loyalty when the<br />

advisor is a true “problem manager”. The<br />

experience in previous years indicates that<br />

customer service and personal advisors<br />

will continue to become more important in<br />

the future.<br />

New service channels<br />

In addition to the use of personal advisors<br />

as field staff, customers can, of course,<br />

also use service hotlines or email to contact<br />

<strong>Wiener</strong> <strong>Städtische</strong>. Many services are<br />

also available via new media.<br />

The Company’s new website offers customers<br />

many easy-to-use tools, such as on-<br />

line claims reporting and benefit claims,<br />

and extensive information on individual<br />

insurance topics. An app for direct claims<br />

reporting has been available for smartphones<br />

since 2010. The app also provides<br />

emergency checklists and important first<br />

aid measures.<br />

An SMS claims service keeps customers upto-date<br />

on the current status of their claims,<br />

and an SMS storm warning service is available<br />

free of charge for mobile phones.<br />

Strong partners<br />

In 2008, <strong>Wiener</strong> <strong>Städtische</strong> and the Erste<br />

Bank Sparkasse Group entered into a distribution<br />

agreement aimed at providing customers<br />

a single source of solutions for all<br />

their financial needs. In addition to proven<br />

insurance solutions, <strong>Wiener</strong> <strong>Städtische</strong>’s<br />

professional advisors also offer banking<br />

products to customers.<br />

Favourably priced account packages, loans<br />

and savings cards with attractive interest<br />

rates provide a complement to the range of<br />

products offered by <strong>Wiener</strong> <strong>Städtische</strong>. In<br />

return, insurance solutions were added to<br />

the range of products offered to customers<br />

by the Erste Bank Sparkasse Group. This is<br />

a win-win situation.

cOMPAnY & StrAtegY | MAJOR TOPicS 2010 | MANAgEMENT REPORT 2010 | ANNUAL FiNANciAL STATEMENTS 2010<br />

ANNUAL REPORT 2010 | <strong>Wiener</strong> StädtiSche 35<br />

A

36 ANNUAL REPORT 2010 | <strong>Wiener</strong> StädtiSche<br />

eMPlOYeeS AS A KeY FActOr in SucceSS<br />

in addition to optimal products, <strong>Wiener</strong> <strong>Städtische</strong> customers<br />

also rely greatly on our excellent service and personal advisors.<br />

Professional, committed employees play a central role in<br />

achieving our ambitious company objectives and making<br />

<strong>Wiener</strong> <strong>Städtische</strong> an outstanding company.<br />

Over the course of its 186-year history,<br />

<strong>Wiener</strong> <strong>Städtische</strong> has become the largest<br />

employer in the Austrian insurance industry,<br />

with a current total of 3,500 employees,<br />

including more than 2,000 customer<br />

advisors. A special work environment has<br />

been created around the core values of<br />

fairness and mutual respect.<br />

Education and advanced training<br />

Well-trained trainees are the professional<br />

advisors of tomorrow. <strong>Wiener</strong> <strong>Städtische</strong> is<br />

already educating a third of the trainees in<br />

the entire insurance industry. In addition,<br />

the Company also began a trainee initiative<br />

in 2010. More than 100 young career entrants<br />

were already hired in the first year,<br />

and another 100 youth trainee positions<br />

will be offered starting in the autumn of<br />

2011.<br />

The Company‘s human resources policy<br />

also contains other key elements in addition<br />

to training and advanced training.<br />

Potential analyses across the Group form<br />

the basis for a targeted, needs-oriented<br />

development programme that conveys<br />

technical knowledge and Company values.<br />

Joint training events allow a continuous exchange<br />

of best practices between all employees.<br />

Human resources development<br />

<strong>Wiener</strong> <strong>Städtische</strong> has a three-level management<br />

training programme that provides<br />

targeted training in internal, custom

tailored courses for the different target<br />

groups: future/young executives, department<br />

heads, and group leaders. The goal<br />

of the programme is to further increase<br />

management quality by teaching modern<br />

management concepts and developing a<br />

shared management philosophy within the<br />

Company. The executives identify themselves<br />

with their role and network with<br />

each other. Young employees benefit from<br />

the knowledge and experience of their older<br />

colleagues. Attention is consciously paid<br />

to mixing ages in structures and teams to<br />

allow a continuous exchange of experience<br />

and knowledge transmission.<br />

This programme makes an important contribution<br />

to the professional and personal<br />

development of <strong>Wiener</strong> <strong>Städtische</strong>‘s executive<br />

employees, and ensures the longterm<br />

success of the Company.<br />

Employee ideas and experience also contribute<br />

to the development of new <strong>Wiener</strong><br />

<strong>Städtische</strong> products and services and further<br />

development of existing products and<br />

services. A variety of internal company<br />

competitions provides a good incentive to<br />

become actively involved.<br />

Gender equality<br />

<strong>Wiener</strong> <strong>Städtische</strong> views equal treatment<br />

of men and women as a key objective at all<br />

levels. Two women and mothers in a fivemember<br />

Managing Board, and 35% women<br />

in middle management provide impressive<br />

proof of this. <strong>Wiener</strong> <strong>Städtische</strong> feels<br />

that the corporate income transparency<br />

amendment that entered into force on 1<br />

March 2011 provides another good contribution<br />

to equal treatment. There are also<br />

other initiatives, such as “Daughters’ Day”<br />

and a variety of other measures for creating<br />

a balance between career and family.<br />

In 1974, <strong>Wiener</strong> <strong>Städtische</strong> became one<br />

of the first employers in Austria to provide<br />

company day-care facilities. Today, 105<br />

employee children are looked after in these<br />

facilities. The Company also offers flexible<br />

cOMPAnY & StrAtegY | MAJOR TOPicS 2010 | MANAgEMENT REPORT 2010 | ANNUAL FiNANciAL STATEMENTS 2010<br />

working time and work organisation models<br />

for its employees. One pleasing result of<br />

this is that 90% of all employees return after<br />

maternity leave. <strong>Wiener</strong> <strong>Städtische</strong> has<br />

been one of the most family-friendly, women-friendly<br />

companies in Austria for years,<br />

and has received many awards in this area.<br />

Equal treatment is, of course, also reflected<br />

in terms of migration. Multilingual skills are<br />

an important factor for customer information<br />

at <strong>Wiener</strong> <strong>Städtische</strong> and are actively<br />

promoted. English is already a minimum<br />

requirement in all areas.<br />

For years now, the Company has taken the<br />

view that people with certain disabilities<br />

can perform their work just as efficiently<br />

as people with no disabilities. <strong>Wiener</strong><br />

<strong>Städtische</strong> therefore provided positions for<br />

96 employees with disabilities in 2010, a<br />

number considerably higher than the statutory<br />

requirement.<br />

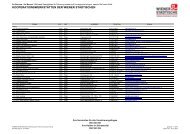

Employment statistics as at<br />

31 December 2010<br />

number of employees<br />

2009<br />

as at<br />

31.12.<br />

2010<br />

as at<br />

31.12. change<br />

Administration 1,526 1,546 20<br />

headquarters 873 1,030 157<br />

Provincial head offices<br />

(+ branch offices)<br />

653 516 -137<br />

distribution 1,884 1,802 -82<br />

Field sales<br />

representatives<br />

1,654 1,598 -56<br />

Organisational<br />

employees<br />

230 204 -26<br />

trainees 149 149 0<br />

total 3,559 3,497 -62<br />

- 62 fewer employees, the decline is mainly due to natural turnover without replacement<br />

and combining of duties during the structural reorganisation of the company<br />

- The number of office employees rose by 20 to 1,546 in 2010 due to reassignment<br />

of authority when the company was separated from the group<br />

- Of the 1,546 office employees, 593 were men and 953 women<br />

- 96 employees with disabilities<br />

»Our eMPlOYeeS –<br />

the BASiS OF Our<br />

SucceSS«<br />

ANNUAL REPORT 2010 | <strong>Wiener</strong> StädtiSche 37<br />

A

38 ANNUAL REPORT 2010 | <strong>Wiener</strong> StädtiSche<br />

As the largest insurance company in Austria, <strong>Wiener</strong> <strong>Städtische</strong><br />

is aware of its responsibility to society. it therefore provides<br />

a wide range of programmes and targeted support for<br />

social causes, culture and the arts, sports, and the area<br />

of child and youth development.<br />

factbox<br />

<strong>Wiener</strong> <strong>Städtische</strong>’s<br />

most important sponsoring areas:<br />

SucceSS cAn Be ShAred<br />

> Social involvement: cooperation with<br />

the “Second Savings Bank” (Zweiter<br />

Sparkasse), the “Bank for People without<br />

a Bank”, and a number of types of<br />

ooperation with many aid organisations.<br />

> children and youth: many support<br />

projects, such as the children Safety<br />

Olympics, the Zoom children‘s<br />

Museum, and cooperation with the<br />

Kinderfreunde organisation.<br />

> culture & the arts: <strong>Wiener</strong> <strong>Städtische</strong><br />

supports many cultural projects, theatre<br />

productions, and film and music<br />

festivals.<br />

> Sports & exercise: sponsoring of<br />

Austrian sports associations and<br />

major events, such as the Vienna city<br />

Marathon and Business run.<br />

People form the core of <strong>Wiener</strong> <strong>Städtische</strong>.<br />

Respectful and fair treatment of customers,<br />

as well as employees, ensures the sustained,<br />

long-term success of the Company.<br />

This success can be shared.<br />

<strong>Wiener</strong> <strong>Städtische</strong> has made it a goal to provide<br />

support as a partner to many social,<br />

sports, cultural and forward-looking initiatives.<br />

People and sustainability are always a<br />

priority. <strong>Wiener</strong> <strong>Städtische</strong> receives support<br />

in many areas from its principal shareholder<br />

WIENER STÄDTISCHE Wechselseitiger Versicherungsverein<br />

- Vermögensverwaltung -<br />

Vienna Insurance Group.<br />

Social initiatives<br />

Social involvement is especially important<br />

to the Company, and is deeply anchored in<br />

its business philosophy.<br />

People in need are in particular need of support<br />

– <strong>Wiener</strong> <strong>Städtische</strong> was the first Austrian<br />

insurance company to address the<br />

topic of micro-insurance. In cooperation<br />

with the “Second Savings Bank” (Zweite<br />

Sparkasse), these people are offered very<br />

low-cost or free banking and insurance<br />

services.<br />

The number of people requiring nursing<br />

care is rising rapidly in Austria. <strong>Wiener</strong><br />

<strong>Städtische</strong> therefore supports initiatives in<br />

the area of nursing care and works together<br />

as a partner with aid organisations such<br />

as Caritas, Hilfswerk, Volkshilfe and the Red

Cross throughout Austria to provide nursing<br />

care to those who require it.<br />

Arts and culture<br />

<strong>Wiener</strong> <strong>Städtische</strong> actively promotes the<br />

development and diversity of the cultural<br />

sector in Austria by providing personalities<br />

of the cultural scene with additional opportunities<br />

and freedom for artistic development.<br />

The VBW theatre company (Vereinigten<br />

Bühnen Wien), St. Margarethen Opera<br />

Festival, Bregenz Festival, Viennale, Danube<br />

Island Festival and the “Long Night of<br />

the Churches” (Lange Nacht der Kirchen)<br />

are only a few examples of the many different<br />

organisations receiving support from<br />

<strong>Wiener</strong> <strong>Städtische</strong>.<br />

As part of the “RINGTURM.KUNST” exhibition,<br />

<strong>Wiener</strong> <strong>Städtische</strong> presented more<br />

than one hundred selected works from its<br />

collection in the Leopold Museum from 21<br />

October 2010 to 14 March 2011. This is the<br />

first time that a broad cross-section of the<br />

<strong>Wiener</strong> <strong>Städtische</strong> collection, which focuses<br />

on paintings and graphic art from 1945 to the<br />

present, has been presented to the public.<br />

Children, youth and families<br />

Sports activities, projects on the topic of<br />

security or in the cultural area, and support<br />

for children and youth are of particular<br />

importance to <strong>Wiener</strong> <strong>Städtische</strong>. <strong>Wiener</strong><br />

<strong>Städtische</strong> has worked with the Kinder-<br />

freunde organisation for many years, and<br />

provides support for the Zoom Children’s<br />

cOMPAnY & StrAtegY | MAJOR TOPicS 2010 | MANAgEMENT REPORT 2010 | ANNUAL FiNANciAL STATEMENTS 2010<br />

Museum, and the Safety Tour, which gives<br />

children across Austria an understanding of<br />

safety.<br />

Sports<br />

Whether the Business Run, Wachau Marathon,<br />

Vienna City Marathon or the Vienna<br />

Street Soccer, Street Basketball and Beach<br />

Volleyball Championships (Käfigmeisterschaften),<br />

sports are important for maintaining<br />

good health. <strong>Wiener</strong> <strong>Städtische</strong> provides<br />

support for public sports events that<br />

allow as many people as possible to participate<br />

and achieve their personal best.<br />

The environment<br />

Small ideas can have a great effect. The<br />

scale of the company can often turn small<br />

changes into big effects. Changes that are<br />

almost insignificant for a single person, such<br />

as printing on both sides of a sheet of paper,<br />

instead of using two pages, produce big effects<br />

when applied by 3,500 employees.<br />

<strong>Wiener</strong> <strong>Städtische</strong> attempts to actively integrate<br />

environmental protection as a part of<br />

the everyday work environment and create a<br />

strong sense of environmental awareness in<br />

the office. In 2006, <strong>Wiener</strong> <strong>Städtische</strong> became<br />

the first programme partner for the<br />

Austrian Ministry of Life’s klima:aktiv climate<br />

initiative.<br />

Detailed information on <strong>Wiener</strong> <strong>Städtische</strong>’s<br />

many activities in the area of Corporate<br />

Social Responsibility are available at<br />

www.wienerstaedtische.at.<br />

ANNUAL REPORT 2010 | <strong>Wiener</strong> StädtiSche 39<br />

A

»FULL CONCENTRA-<br />

TION ON AUSTRIA«<br />

40 ANNUAL REPORT 2010 | WIENER STÄDTISCHE<br />

WIENER STÄDTISCHE NEW<br />

Welcome to the future!<br />

<strong>Wiener</strong> <strong>Städtische</strong> is a wholly-owned subsidiary of<br />

the Vienna Insurance Group and number 1 in the<br />

Austrian insurance market.<br />

A look back explains the way to the new<br />

company structure: Over the last two decades<br />

<strong>Wiener</strong> <strong>Städtische</strong> has developed<br />

from a successful local insurance company<br />

to a group operating internationally. Against<br />

this background, <strong>Wiener</strong> <strong>Städtische</strong> was<br />

responsible for a variety of control tasks in<br />

addition to the insurance business operations.<br />

factbox<br />

> New corporate structure of <strong>Wiener</strong><br />

<strong>Städtische</strong> legally binding since<br />

3 August 2010.<br />

> The Managing Board of <strong>Wiener</strong><br />

<strong>Städtische</strong> is composed as followed:<br />

Robert LASSHOFER, CEO<br />