Annual Report (PDF) - Feintool

Annual Report (PDF) - Feintool

Annual Report (PDF) - Feintool

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

46<br />

<strong>Report</strong> and Proposal of the Board<br />

<strong>Report</strong><br />

In the reporting period, <strong>Feintool</strong> International Holding took up both direct and indirect<br />

participations in new companies. As of October 1, 1999 it acquired 100% of the shares in<br />

Heinrich Schmid Maschinen- und Werkzeugbau AG in Jona, Switzerland. This was followed<br />

by the establishment of Mühlemann Holding AG in Biberist, into which <strong>Feintool</strong> International<br />

Holding incorporated its stakes in Mühlemann AG in Biberist and Mühlemann U.S. Operations,<br />

Inc. in Antioch, Tennessee. On January 1, 2000, all of the shares in IMA Automation GmbH<br />

and in mhk Montagekomponenten Vertriebs-GmbH in Amberg, Germany, were transferred to<br />

BalTec Holding AG, a subsidiary of <strong>Feintool</strong> International Holding. In line with previous practice,<br />

<strong>Feintool</strong> International Holding took over the patents and brand rights for the business of<br />

IMA Automation GmbH and mhk Montagekomponenten Vertriebs-GmbH. It will license the<br />

rights it has acquired to its subsidiaries. Finally, Limatec AG in Grenchen was integrated<br />

into Baltec Holding AG as of April 1, 2000.<br />

These transactions had an impact on the balance sheet of <strong>Feintool</strong> International Holding.<br />

The book value of the investments rose from CHF 98.3 m to CHF 122.0 m. Long-term loans<br />

granted to subsidiaries went up from CHF 17.3 m to CHF 52.9 m. A convertible bond worth<br />

CHF 62.6 m was issued in February 2000 to finance the acquisition projects.<br />

In the second financial year after being quoted on the stock exchange, <strong>Feintool</strong> International<br />

Holding upped its earnings by 37.8% to CHF 30.7 m. This increase is due to higher income<br />

from dividends and licenses as well as currency gains on the sale of treasury stock.<br />

In addition, <strong>Feintool</strong> International Holding used its cash in the form of loans to subsidiaries,<br />

which resulted in substantial interest income.<br />

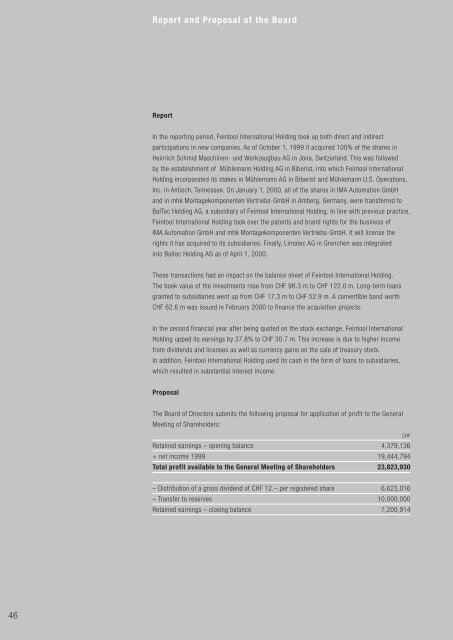

Proposal<br />

The Board of Directors submits the following proposal for application of profit to the General<br />

Meeting of Shareholders:<br />

Retained earnings – opening balance 4,379,136<br />

+ net income 1999 19,444,794<br />

Total profit available to the General Meeting of Shareholders 23,823,930<br />

– Distribution of a gross dividend of CHF 12.– per registered share 6,623,016<br />

– Transfer to reserves 10,000,000<br />

Retained earnings – closing balance 7,200,914<br />

CHF