Reverse Logistics - Logistics Quarterly

Reverse Logistics - Logistics Quarterly

Reverse Logistics - Logistics Quarterly

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

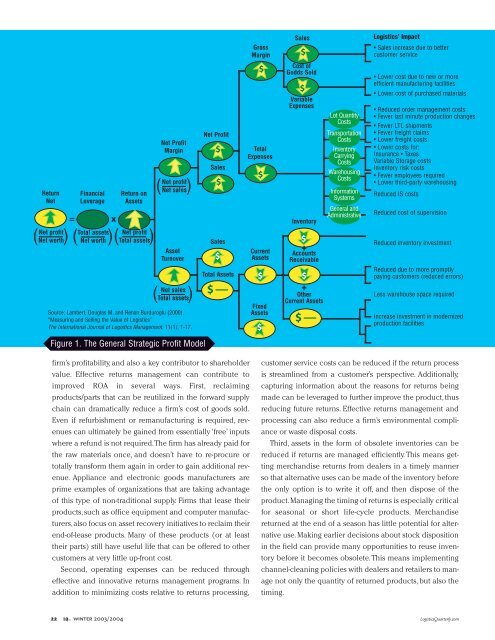

Return<br />

Net<br />

Net profit ( Net worth)<br />

=<br />

Financial<br />

Leverage<br />

x<br />

Total assets ( Net worth)<br />

firm’s profitability, and also a key contributor to shareholder<br />

value. Effective returns management can contribute to<br />

improved ROA in several ways. First, reclaiming<br />

products/parts that can be reutilized in the forward supply<br />

chain can dramatically reduce a firm’s cost of goods sold.<br />

Even if refurbishment or remanufacturing is required, revenues<br />

can ultimately be gained from essentially ‘free’ inputs<br />

where a refund is not required.The firm has already paid for<br />

the raw materials once, and doesn’t have to re-procure or<br />

totally transform them again in order to gain additional revenue.<br />

Appliance and electronic goods manufacturers are<br />

prime examples of organizations that are taking advantage<br />

of this type of non-traditional supply. Firms that lease their<br />

products, such as office equipment and computer manufacturers,also<br />

focus on asset recovery initiatives to reclaim their<br />

end-of-lease products. Many of these products (or at least<br />

their parts) still have useful life that can be offered to other<br />

customers at very little up-front cost.<br />

Second, operating expenses can be reduced through<br />

effective and innovative returns management programs. In<br />

addition to minimizing costs relative to returns processing,<br />

22 LQ winter 2003/2004<br />

Return on<br />

Assets<br />

Net profit ( Total assets)<br />

Net Profit<br />

Margin<br />

Net profit ( Net sales)<br />

Asset<br />

Turnover<br />

Net sales ( Total assets)<br />

Source: Lambert, Douglas M. and Renan Burduroglu (2000).<br />

“Measuring and Selling the Value of <strong>Logistics</strong>”<br />

The International Journal of <strong>Logistics</strong> Management, 11(1), 1-17.<br />

Figure 1. The General Strategic Profit Model<br />

Net Profit<br />

$<br />

Sales<br />

$<br />

Sales<br />

$<br />

Total Assets<br />

$–<br />

Gross<br />

Margin<br />

$<br />

Total<br />

Expenses<br />

$<br />

Current<br />

Assets<br />

$<br />

Fixed<br />

Assets<br />

$<br />

Sales<br />

$<br />

Cost of<br />

Godds Sold<br />

$<br />

Variable<br />

Expenses<br />

Inventory<br />

$<br />

+<br />

Accounts<br />

Receivable<br />

$<br />

+<br />

Other<br />

Current Assets<br />

$–<br />

Lot Quantity<br />

Costs<br />

Transportation<br />

Costs<br />

Inventory<br />

Carrying<br />

Costs<br />

Warehousing<br />

Costs<br />

Information<br />

Systems<br />

General and<br />

Administrative<br />

<strong>Logistics</strong>’ Impact<br />

• Sales increase due to better<br />

customer service<br />

• Lower cost due to new or more<br />

efficient manufacturing facilities<br />

• Lower cost of purchased materials<br />

• Reduced order management costs<br />

• Fewer last minute production changes<br />

• Fewer LTL shipments<br />

• Fewer freight claims<br />

• Lower freight costs<br />

• Lower costs for:<br />

Insurance • Taxes<br />

Variable Storage costs<br />

Inventory risk costs<br />

• Fewer employees required<br />

• Lower third-party warehousing<br />

Reduced IS costs<br />

Reduced cost of supervision<br />

Reduced inventory investment<br />

Reduced due to more promptly<br />

paying customers (reduced errors)<br />

Less warehouse space required<br />

Increase investment in modernized<br />

production facilities<br />

customer service costs can be reduced if the return process<br />

is streamlined from a customer’s perspective. Additionally,<br />

capturing information about the reasons for returns being<br />

made can be leveraged to further improve the product, thus<br />

reducing future returns. Effective returns management and<br />

processing can also reduce a firm’s environmental compliance<br />

or waste disposal costs.<br />

Third, assets in the form of obsolete inventories can be<br />

reduced if returns are managed efficiently. This means getting<br />

merchandise returns from dealers in a timely manner<br />

so that alternative uses can be made of the inventory before<br />

the only option is to write it off, and then dispose of the<br />

product.Managing the timing of returns is especially critical<br />

for seasonal or short life-cycle products. Merchandise<br />

returned at the end of a season has little potential for alternative<br />

use. Making earlier decisions about stock disposition<br />

in the field can provide many opportunities to reuse inventory<br />

before it becomes obsolete.This means implementing<br />

channel-cleaning policies with dealers and retailers to manage<br />

not only the quantity of returned products, but also the<br />

timing.<br />

<strong>Logistics</strong><strong>Quarterly</strong>.com