Quarterly Report 3/2008 (PDF, 308 KB) - Munich Re

Quarterly Report 3/2008 (PDF, 308 KB) - Munich Re

Quarterly Report 3/2008 (PDF, 308 KB) - Munich Re

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

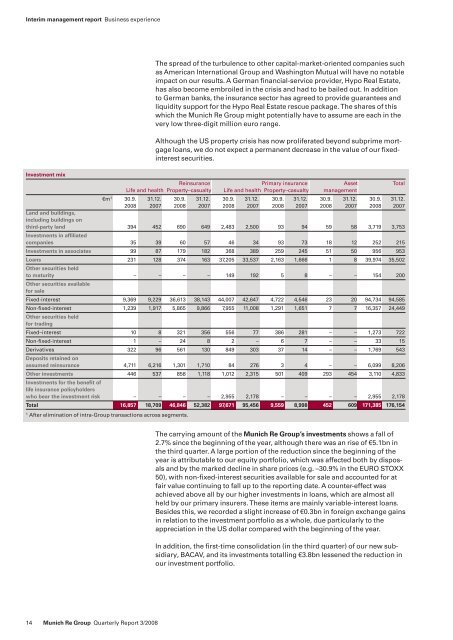

Interim management report Business experience<br />

Investment mix<br />

1 After elimination of intra-Group transactions across segments.<br />

14 <strong>Munich</strong> <strong>Re</strong> Group <strong>Quarterly</strong> <strong><strong>Re</strong>port</strong> 3/<strong>2008</strong><br />

The spread of the turbulence to other capital-market-oriented companies such<br />

as American International Group and Washington Mutual will have no notable<br />

impact on our results. A German financial-service provider, Hypo <strong>Re</strong>al Estate,<br />

has also become embroiled in the crisis and had to be bailed out. In addition<br />

to German banks, the insurance sector has agreed to provide guarantees and<br />

liquidity support for the Hypo <strong>Re</strong>al Estate rescue package. The shares of this<br />

which the <strong>Munich</strong> <strong>Re</strong> Group might potentially have to assume are each in the<br />

very low three-digit million euro range.<br />

Although the US property crisis has now proliferated beyond subprime mortgage<br />

loans, we do not expect a permanent decrease in the value of our fixedinterest<br />

securities.<br />

<strong>Re</strong>insurance Primary insurance Asset Total<br />

Life and health Property–casualty Life and health Property–casualty management<br />

€m1 30.9. 31.12. 30.9. 31.12. 30.9. 31.12. 30.9. 31.12. 30.9. 31.12. 30.9. 31.12.<br />

<strong>2008</strong> 2007 <strong>2008</strong> 2007 <strong>2008</strong> 2007 <strong>2008</strong> 2007 <strong>2008</strong> 2007 <strong>2008</strong> 2007<br />

Land and buildings,<br />

including buildings on<br />

third-party land<br />

Investments in affi liated<br />

394 452 690 649 2,483 2,500 93 94 59 58 3,719 3,753<br />

companies 35 39 60 57 46 34 93 73 18 12 252 215<br />

Investments in associates 99 87 179 182 368 389 259 245 51 50 956 953<br />

Loans<br />

Other securities held<br />

231 128 374 163 37,205 33,537 2,163 1,666 1 8 39,974 35,502<br />

to maturity<br />

Other securities available<br />

for sale<br />

– – – – 149 192 5 8 – – 154 200<br />

Fixed-interest 9,369 9,229 36,613 38,143 44,007 42,647 4,722 4,546 23 20 94,734 94,585<br />

Non-fi xed-interest<br />

Other securities held<br />

for trading<br />

1,239 1,917 5,865 9,866 7,955 11,008 1,291 1,651 7 7 16,357 24,449<br />

Fixed–interest 10 8 321 356 556 77 386 281 – – 1,273 722<br />

Non-fi xed-interest 1 – 24 8 2 – 6 7 – – 33 15<br />

Derivatives<br />

Deposits retained on<br />

322 96 561 130 849 303 37 14 – – 1,769 543<br />

assumed reinsurance 4,711 6,216 1,301 1,710 84 276 3 4 – – 6,099 8,206<br />

Other investments<br />

Investments for the benefi t of<br />

life insurance policyholders<br />

446 537 858 1,118 1,012 2,315 501 409 293 454 3,110 4,833<br />

who bear the investment risk – – – – 2,955 2,178 – – – – 2,955 2,178<br />

Total 16,857 18,709 46,846 52,382 97,671 95,456 9,559 8,998 452 609 171,385 176,154<br />

The carrying amount of the <strong>Munich</strong> <strong>Re</strong> Group’s investments shows a fall of<br />

2.7% since the beginning of the year, although there was an rise of €5.1bn in<br />

the third quarter. A large portion of the reduction since the beginning of the<br />

year is attributable to our equity portfolio, which was affected both by disposals<br />

and by the marked decline in share prices (e.g. –30.9% in the EURO STOXX<br />

50), with non-fixed-interest securities available for sale and accounted for at<br />

fair value continuing to fall up to the reporting date. A counter-effect was<br />

achieved above all by our higher investments in loans, which are almost all<br />

held by our primary insurers. These items are mainly variable-interest loans.<br />

Besides this, we recorded a slight increase of €0.3bn in foreign exchange gains<br />

in relation to the investment portfolio as a whole, due particularly to the<br />

appreciation in the US dollar compared with the beginning of the year.<br />

In addition, the first-time consolidation (in the third quarter) of our new subsidiary,<br />

BACAV, and its investments totalling €3.8bn lessened the reduction in<br />

our investment portfolio.