Quarterly Report 3/2008 (PDF, 308 KB) - Munich Re

Quarterly Report 3/2008 (PDF, 308 KB) - Munich Re

Quarterly Report 3/2008 (PDF, 308 KB) - Munich Re

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Interim management report Business experience<br />

6 <strong>Munich</strong> <strong>Re</strong> Group <strong>Quarterly</strong> <strong><strong>Re</strong>port</strong> 3/<strong>2008</strong><br />

Business experience<br />

from 1 January to 30 September <strong>2008</strong><br />

<strong>Re</strong>insurance<br />

– Satisfactory treaty renewals at 1 July <strong>2008</strong><br />

– High cost burden of €1.2bn from major losses for January to September;<br />

combined ratio of 100.2%<br />

– Investment result of €3.0bn marked by financial market crisis<br />

– <strong>Re</strong>sult of €2.0bn for the first three quarters<br />

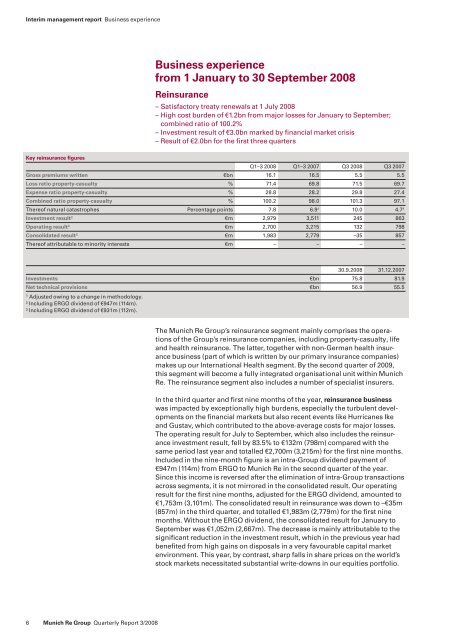

Key reinsurance fi gures<br />

Q1–3 <strong>2008</strong> Q1–3 2007 Q3 <strong>2008</strong> Q3 2007<br />

Gross premiums written €bn 16.1 16.5 5.5 5.5<br />

Loss ratio property-casualty % 71.4 69.8 71.5 69.7<br />

Expense ratio property-casualty % 28.8 28.2 29.8 27.4<br />

Combined ratio property-casualty % 100.2 98.0 101.3 97.1<br />

Thereof natural catastrophes Percentage points 7.8 6.9¹ 10.0 4.7¹<br />

Investment result² €m 2,979 3,511 245 863<br />

Operating result² €m 2,700 3,215 132 798<br />

Consolidated result³ €m 1,983 2,779 –35 857<br />

Thereof attributable to minority interests €m – – – –<br />

30.9.<strong>2008</strong> 31.12.2007<br />

Investments €bn 75.8 81.9<br />

Net technical provisions<br />

1 Adjusted owing to a change in methodology.<br />

² Including ERGO dividend of €947m (114m).<br />

³ Including ERGO dividend of €931m (112m).<br />

€bn 56.9 55.5<br />

The <strong>Munich</strong> <strong>Re</strong> Group’s reinsurance segment mainly comprises the operations<br />

of the Group’s reinsurance companies, including property-casualty, life<br />

and health reinsurance. The latter, together with non-German health insurance<br />

business (part of which is written by our primary insurance companies)<br />

makes up our International Health segment. By the second quarter of 2009,<br />

this segment will become a fully integrated organisational unit within <strong>Munich</strong><br />

<strong>Re</strong>. The reinsurance segment also includes a number of specialist insurers.<br />

In the third quarter and first nine months of the year, reinsurance business<br />

was impacted by exceptionally high burdens, especially the turbulent developments<br />

on the financial markets but also recent events like Hurricanes Ike<br />

and Gustav, which contributed to the above-average costs for major losses.<br />

The operating result for July to September, which also includes the reinsurance<br />

investment result, fell by 83.5% to €132m (798m) compared with the<br />

same period last year and totalled €2,700m (3,215m) for the first nine months.<br />

Included in the nine-month figure is an intra-Group dividend payment of<br />

€947m (114m) from ERGO to <strong>Munich</strong> <strong>Re</strong> in the second quarter of the year.<br />

Since this income is reversed after the elimination of intra-Group transactions<br />

across segments, it is not mirrored in the consolidated result. Our operating<br />

result for the first nine months, adjusted for the ERGO dividend, amounted to<br />

€1,753m (3,101m). The consolidated result in reinsurance was down to –€35m<br />

(857m) in the third quarter, and totalled €1,983m (2,779m) for the first nine<br />

months. Without the ERGO dividend, the consolidated result for January to<br />

September was €1,052m (2,667m). The decrease is mainly attributable to the<br />

significant reduction in the investment result, which in the previous year had<br />

benefited from high gains on disposals in a very favourable capital market<br />

environment. This year, by contrast, sharp falls in share prices on the world’s<br />

stock markets necessitated substantial write-downs in our equities portfolio.