Quarterly Report 3/2008 (PDF, 308 KB) - Munich Re

Quarterly Report 3/2008 (PDF, 308 KB) - Munich Re

Quarterly Report 3/2008 (PDF, 308 KB) - Munich Re

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

1 After elimination of intra-Group transactions across segments.<br />

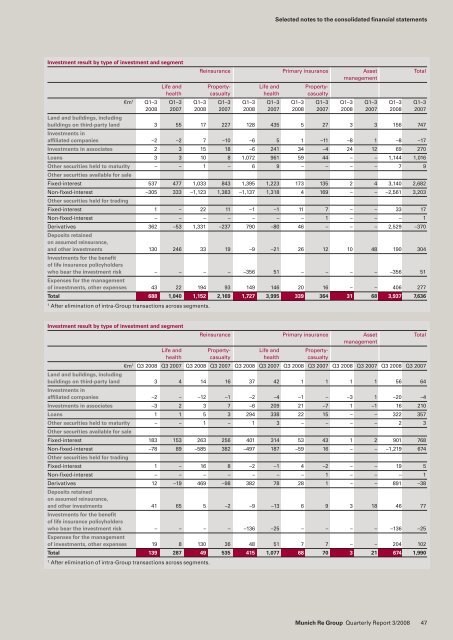

Investment result by type of investment and segment<br />

1 After elimination of intra-Group transactions across segments.<br />

Selected notes to the consolidated financial statements<br />

Investment result by type of investment and segment<br />

<strong>Re</strong>insurance Primary insurance Asset<br />

management<br />

Total<br />

Life and Property- Life and Propertyhealth<br />

casualty health casualty<br />

€m1 Q1–3 Q1–3 Q1–3 Q1–3 Q1–3 Q1–3 Q1–3 Q1–3 Q1–3 Q1–3 Q1–3 Q1–3<br />

<strong>2008</strong> 2007 <strong>2008</strong> 2007 <strong>2008</strong> 2007 <strong>2008</strong> 2007 <strong>2008</strong> 2007 <strong>2008</strong> 2007<br />

Land and buildings, including<br />

buildings on third-party land<br />

Investments in<br />

3 55 17 227 128 435 5 27 3 3 156 747<br />

affi liated companies –2 –2 7 –10 –6 5 1 –11 –8 1 –8 –17<br />

Investments in associates 2 3 15 18 –6 241 34 –4 24 12 69 270<br />

Loans 3 3 10 8 1,072 961 59 44 – – 1,144 1,016<br />

Other securities held to maturity<br />

Other securities available for sale<br />

– – 1 – 6 9 – – – – 7 9<br />

Fixed-interest 537 477 1,033 843 1,395 1,223 173 135 2 4 3,140 2,682<br />

Non-fi xed-interest<br />

Other securities held for trading<br />

–305 333 –1,123 1,383 –1,137 1,318 4 169 – – –2,561 3,203<br />

Fixed-interest 1 – 22 11 –1 –1 11 7 – – 33 17<br />

Non-fi xed-interest – – – – – – – 1 – – – 1<br />

Derivatives<br />

Deposits retained<br />

on assumed reinsurance,<br />

362 –53 1,331 –237 790 –80 46 – – – 2,529 –370<br />

and other investments<br />

Investments for the benefi t<br />

of life insurance policyholders<br />

130 246 33 19 –9 –21 26 12 10 48 190 304<br />

who bear the investment risk<br />

Expenses for the management<br />

– – – – –356 51 – – – – –356 51<br />

of investments, other expenses 43 22 194 93 149 146 20 16 – – 406 277<br />

Total 688 1,040 1,152 2,169 1,727 3,995 339 364 31 68 3,937 7,636<br />

<strong>Re</strong>insurance Primary insurance Asset Total<br />

management<br />

Life and Property- Life and Propertyhealth<br />

casualty health casualty<br />

€m 1 Q3 <strong>2008</strong> Q3 2007 Q3 <strong>2008</strong> Q3 2007 Q3 <strong>2008</strong> Q3 2007 Q3 <strong>2008</strong> Q3 2007 Q3 <strong>2008</strong> Q3 2007 Q3 <strong>2008</strong> Q3 2007<br />

Land and buildings, including<br />

buildings on third-party land<br />

Investments in<br />

3 4 14 16 37 42 1 1 1 1 56 64<br />

affi liated companies –2 – –12 –1 –2 –4 –1 – –3 1 –20 –4<br />

Investments in associates –3 2 3 7 –6 209 21 –7 1 –1 16 210<br />

Loans 1 1 5 3 294 338 22 15 – – 322 357<br />

Other securities held to maturity<br />

Other securities available for sale<br />

– – 1 – 1 3 – – – – 2 3<br />

Fixed-interest 183 153 263 256 401 314 53 43 1 2 901 768<br />

Non-fi xed-interest<br />

Other securities held for trading<br />

–78 89 –585 382 –497 187 –59 16 – – –1,219 674<br />

Fixed-interest 1 – 16 8 –2 –1 4 –2 – – 19 5<br />

Non-fi xed-interest – – – – – – – 1 – – – 1<br />

Derivatives<br />

Deposits retained<br />

on assumed reinsurance,<br />

12 –19 469 –98 382 78 28 1 – – 891 –38<br />

and other investments<br />

Investments for the benefi t<br />

of life insurance policyholders<br />

41 65 5 –2 –9 –13 6 9 3 18 46 77<br />

who bear the investment risk<br />

Expenses for the management<br />

– – – – –136 –25 – – – – –136 –25<br />

of investments, other expenses 19 8 130 36 48 51 7 7 – – 204 102<br />

Total 139 287 49 535 415 1,077 68 70 3 21 674 1,990<br />

<strong>Munich</strong> <strong>Re</strong> Group <strong>Quarterly</strong> <strong><strong>Re</strong>port</strong> 3/<strong>2008</strong><br />

47