bs 08 mam - Educomp Solutions Ltd.

bs 08 mam - Educomp Solutions Ltd.

bs 08 mam - Educomp Solutions Ltd.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

The deferred tax asset is recognized and carried forward only to the extent that there is a reasonable<br />

/ virtual certainty that sufficient future taxable income will be available against which such deferred tax<br />

asset will be realized.<br />

(xiv) Provision, Contingent Liabilities and Contingent Assets<br />

Provisions involving su<strong>bs</strong>tantial degree of estimation in measurement are recognized when there is a<br />

present obligation as a result of past events and it is probable that there will be an outflow of<br />

resources. Contingent Liabilities are not recognized but are disclosed in the notes. Contingent Assets<br />

are neither recognized nor disclosed in the financial statements.<br />

(xv) Earning per share<br />

Basic Earnings per share are calculated by dividing the net profit or loss for the year attributable to<br />

equity shareholders after tax (and including post tax effect of any extra-ordinary item) by the weighted<br />

average number of equity shares outstanding during the year. The weighted average number of<br />

equity shares outstanding during the period, are adjusted for events of bonus issue to existing<br />

shareholders.<br />

For the purpose of calculating diluted earning per share, the net profits or loss attributable to equity<br />

shareholders and the weighted average number of shares outstanding are adjusted for the effects of<br />

all dilutive potential equity shares, if any.<br />

(xvi) Cash Flow Statement<br />

Cash flows are reported using the indirect method, whereby net profits before tax is adjusted for the<br />

effect of transaction of non-cash nature and any deferrals or accruals of past or future cash receipts<br />

or payments. The cash flows from regular revenue generating, investing and financing activities are<br />

segregated.<br />

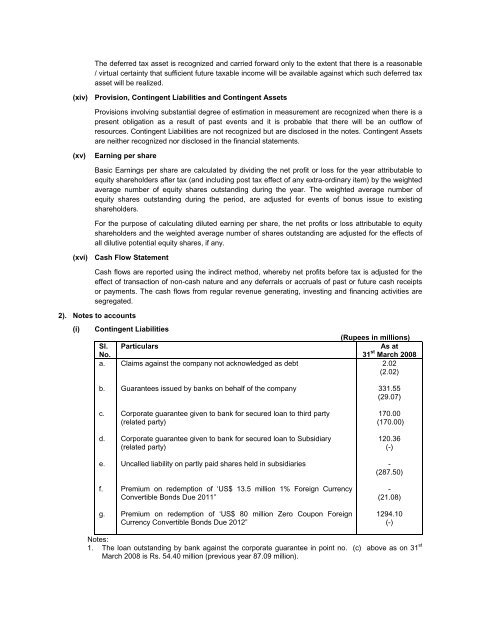

2). Notes to accounts<br />

(i) Contingent Liabilities<br />

Sl.<br />

No.<br />

Particulars<br />

(Rupees in millions)<br />

As at<br />

31 st March 20<strong>08</strong><br />

a. Claims against the company not acknowledged as debt<br />

2.02<br />

(2.02)<br />

b.<br />

c.<br />

d.<br />

e.<br />

f.<br />

g.<br />

Guarantees issued by banks on behalf of the company<br />

Corporate guarantee given to bank for secured loan to third party<br />

(related party)<br />

Corporate guarantee given to bank for secured loan to Su<strong>bs</strong>idiary<br />

(related party)<br />

Uncalled liability on partly paid shares held in su<strong>bs</strong>idiaries<br />

Premium on redemption of ‘US$ 13.5 million 1% Foreign Currency<br />

Convertible Bonds Due 2011”<br />

Premium on redemption of ‘US$ 80 million Zero Coupon Foreign<br />

Currency Convertible Bonds Due 2012”<br />

331.55<br />

(29.07)<br />

170.00<br />

(170.00)<br />

120.36<br />

(-)<br />

-<br />

(287.50)<br />

-<br />

(21.<strong>08</strong>)<br />

1294.10<br />

(-)<br />

Notes:<br />

1. The loan outstanding by bank against the corporate guarantee in point no. (c) above as on 31 st<br />

March 20<strong>08</strong> is Rs. 54.40 million (previous year 87.09 million).