bs 08 mam - Educomp Solutions Ltd.

bs 08 mam - Educomp Solutions Ltd.

bs 08 mam - Educomp Solutions Ltd.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

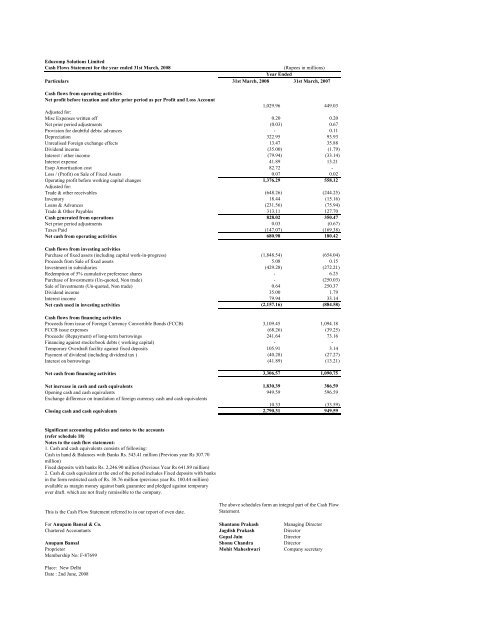

<strong>Educomp</strong> <strong>Solutions</strong> Limited<br />

Cash Flows Statement for the year ended 31st March, 20<strong>08</strong> (Rupees in millions)<br />

Year Ended<br />

Particulars 31st March, 20<strong>08</strong> 31st March, 2007<br />

Cash flows from operating activities<br />

Net profit before taxation and after prior period as per Profit and Loss Account<br />

1,029.96<br />

Adjusted for:<br />

Misc Expenses written off 0.20<br />

Net prior period adjustments (0.03)<br />

Provision for doubtful debts/ advances -<br />

Depreciation 322.95<br />

Unrealised Foreign exchange effects 13.47<br />

Dividend income (35.00)<br />

Interest / other income (79.94)<br />

Interest expense 41.89<br />

Esop Amortisation cost 82.72<br />

Loss / (Profit) on Sale of Fixed Assets 0.07<br />

Operating profit before working capital changes<br />

Adjusted for:<br />

1,376.29<br />

Trade & other receivables (648.26)<br />

Inventory 18.44<br />

Loans & Advances (231.56)<br />

Trade & Other Payables 313.11<br />

Cash generated from operations 828.02<br />

Net prior period adjustments 0.03<br />

Taxes Paid (147.07)<br />

Net cash from operating activities 680.98<br />

Cash flows from investing activities<br />

Purchase of fixed assets (including capital work-in-progress) (1,848.54)<br />

Proceeds from Sale of fixed assets 5.<strong>08</strong><br />

Investment in su<strong>bs</strong>idiaries (429.28)<br />

Redemption of 5% cumulative preference shares -<br />

Purchase of Investments (Un-quoted, Non trade) -<br />

Sale of Investments (Un-quoted, Non trade) 0.64<br />

Dividend income 35.00<br />

Interest income 79.94<br />

Net cash used in investing activities (2,157.16)<br />

Cash flows from financing activities<br />

Proceeds from issue of Foreign Currency Convertible Bonds (FCCB) 3,109.45<br />

FCCB issue expenses (68.26)<br />

Proceeds/ (Repayment) of long-term borrowings 241.64<br />

Financing against stocks/book debts ( working capital) -<br />

Temporary Overdraft facility against fixed deposits 105.91<br />

Payment of dividend (including dividend tax ) (40.28)<br />

Interest on borrowings (41.89)<br />

Net cash from financing activities 3,306.57<br />

Net increase in cash and cash equivalents 1,830.39<br />

Opening cash and cash equivalents 949.59<br />

Exchange difference on translation of foreign currency cash and cash equivalents<br />

10.33<br />

Closing cash and cash equivalents 2,790.31<br />

Significant accounting policies and notes to the accounts<br />

(refer schedule 18)<br />

Notes to the cash flow statement:<br />

1. Cash and cash equivalents consists of following:<br />

Cash in hand & Balances with Banks Rs. 543.41 million (Previous year Rs 307.70<br />

million)<br />

Fixed deposits with banks Rs. 2,246.90 million (Previous Year Rs 641.89 million)<br />

2. Cash & cash equivalent at the end of the period includes Fixed deposits with banks<br />

in the form restricted cash of Rs. 38.76 million (previous year Rs. 100.44 million)<br />

available as margin money against bank guarantee and pledged against temporary<br />

over draft. which are not freely remissible to the company.<br />

This is the Cash Flow Statement referred to in our report of even date.<br />

449.03<br />

0.20<br />

0.67<br />

0.11<br />

93.93<br />

35.88<br />

(1.79)<br />

(33.14)<br />

13.21<br />

-<br />

0.02<br />

558.12<br />

(244.25)<br />

(15.16)<br />

(75.94)<br />

127.70<br />

350.47<br />

(0.67)<br />

(169.38)<br />

180.42<br />

(654.04)<br />

0.15<br />

(272.21)<br />

6.25<br />

(250.03)<br />

250.37<br />

1.79<br />

33.14<br />

(884.58)<br />

1,094.18<br />

(39.25)<br />

73.16<br />

-<br />

3.14<br />

(27.27)<br />

(13.21)<br />

1,090.75<br />

386.59<br />

596.59<br />

(33.59)<br />

949.59<br />

The above schedules form an integral part of the Cash Flow<br />

Statement.<br />

For Anupam Bansal & Co. Shantanu Prakash Managing Director<br />

Chartered Accountants Jagdish Prakash Director<br />

Gopal Jain Director<br />

Anupam Bansal Shonu Chandra Director<br />

Proprietor Mohit Maheshwari Company secretary<br />

Membership No: F-87699<br />

Place: New Delhi<br />

Date : 2nd June, 20<strong>08</strong>