bs 08 mam - Educomp Solutions Ltd.

bs 08 mam - Educomp Solutions Ltd.

bs 08 mam - Educomp Solutions Ltd.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

(b) Pursuant to shareholder resolution dated 13 th September 2007, the Company introduced “<strong>Educomp</strong><br />

Employees Stock Option Scheme 2007” which provides for the issue of 200,000 equity shares to<br />

employees of the company and its su<strong>bs</strong>idiaries. The option vesting period was initially for seven<br />

years from the date of award of option to employees at an exercise price approved by the<br />

remuneration committee.. However the vesting period was increased to ten years as per the<br />

shareholders approval dated 11 th February, 20<strong>08</strong>.Till date 82210 Stock options have been granted.<br />

All the above options are planned to be settled in equity at the time of exercise and have maximum<br />

period of 10 years from the date of respective grants.<br />

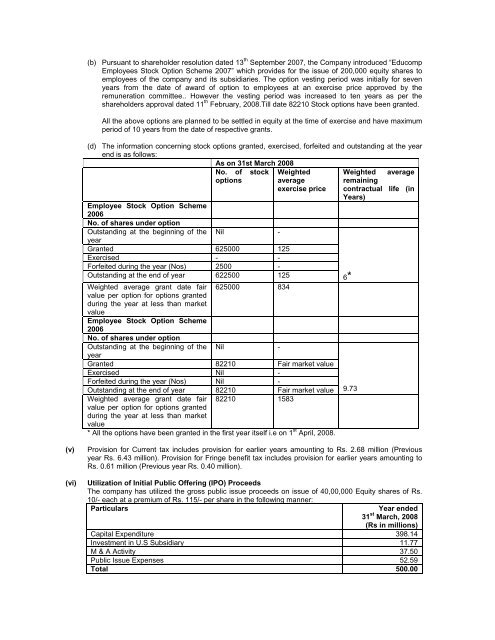

(d) The information concerning stock options granted, exercised, forfeited and outstanding at the year<br />

end is as follows:<br />

Employee Stock Option Scheme<br />

2006<br />

No. of shares under option<br />

Outstanding at the beginning of the<br />

year<br />

As on 31st March 20<strong>08</strong><br />

No. of stock<br />

options<br />

Nil -<br />

Granted 625000 125<br />

Exercised - -<br />

Forfeited during the year (Nos) 2500 -<br />

Outstanding at the end of year 622500 125<br />

Weighted average grant date fair 625000<br />

value per option for options granted<br />

during the year at less than market<br />

834<br />

value<br />

Employee Stock Option Scheme<br />

2006<br />

No. of shares under option<br />

Outstanding at the beginning of the<br />

year<br />

Nil -<br />

Weighted<br />

average<br />

exercise price<br />

Granted 82210 Fair market value<br />

Exercised Nil -<br />

Forfeited during the year (Nos) Nil -<br />

Outstanding at the end of year 82210 Fair market value<br />

Weighted average grant date fair 82210<br />

value per option for options granted<br />

during the year at less than market<br />

value<br />

1583<br />

* All the options have been granted in the first year itself i.e on 1 st April, 20<strong>08</strong>.<br />

Weighted average<br />

remaining<br />

contractual life (in<br />

Years)<br />

(v) Provision for Current tax includes provision for earlier years amounting to Rs. 2.68 million (Previous<br />

year Rs. 6.43 million). Provision for Fringe benefit tax includes provision for earlier years amounting to<br />

Rs. 0.61 million (Previous year Rs. 0.40 million).<br />

(vi) Utilization of Initial Public Offering (IPO) Proceeds<br />

The company has utilized the gross public issue proceeds on issue of 40,00,000 Equity shares of Rs.<br />

10/- each at a premium of Rs. 115/- per share in the following manner:<br />

Particulars Year ended<br />

31 st March, 20<strong>08</strong><br />

(Rs in millions)<br />

Capital Expenditure 398.14<br />

Investment in U.S Su<strong>bs</strong>idiary 11.77<br />

M & A Activity 37.50<br />

Public Issue Expenses 52.59<br />

Total 500.00<br />

6*<br />

9.73