bs 08 mam - Educomp Solutions Ltd.

bs 08 mam - Educomp Solutions Ltd.

bs 08 mam - Educomp Solutions Ltd.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

(Rupees in millions)<br />

Particulars As on<br />

31 st March 20<strong>08</strong><br />

As on<br />

31 st March 2007<br />

Not later than 1 year 40.66 9.48<br />

Later than 1 year but not later than 5 years 83.67 30.84<br />

Later than 5 years - 3.81<br />

Total 124.33 44.13<br />

c. Assets given on lease:<br />

i) General description of lease terms:<br />

a) Assets are given on lease over a period of 2 to 3 years<br />

b) Lease rentals are charged on the basis of agreed terms.<br />

ii) The company has given office space on sub lease. The future minimum Sublease payment<br />

expected to be received as on March 31, 20<strong>08</strong> Rs. 12.11 million (previous year Rs 16.88).<br />

Other Income includes income from operating lease of Rs. 5.52 million (previous year Rs. 3.82<br />

million) under lease and hire income.<br />

(x) Deferred tax liability<br />

As per Accounting Standard (AS-22) on “Accounting for Taxes on Income “ Issued by Institute of<br />

Chartered Accountants of India (ICAI), the Deferred tax Liability (DTL) as at 31 st March 20<strong>08</strong> comprises<br />

of the following:<br />

(Rupees in millions)<br />

Particulars 31 st March 31<br />

20<strong>08</strong><br />

st March<br />

a) Deferred Tax Liability<br />

2007<br />

-Depreciation<br />

b) Deferred Tax Assets<br />

217.65 60.62<br />

-Expenses allowable on payment basis 4.73 3.05<br />

-Provisions for doubtful debts and advances 0.23 0.23<br />

-Expenses allowable as per section 40 of the Income Tax<br />

Act, 1961<br />

- 0.35<br />

Deferred Tax Liability (Net) 212.69 56.99<br />

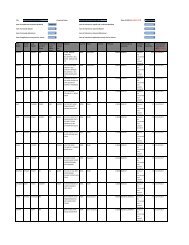

(xi) Related party Disclosures:<br />

As per Accounting Standard 18, issued by the Institute of Chartered Accountants of India, the<br />

disclosures of transactions with related parties as defined in Accounting Standard are given as below:<br />

i) List of related parties with whom transactions have taken place & relationships:<br />

S. No. Name of Related Party Relationship<br />

1<br />

2<br />

3<br />

4<br />

5<br />

6<br />

7<br />

8<br />

9<br />

10<br />

11<br />

12<br />

13<br />

14<br />

15<br />

16<br />

<strong>Educomp</strong> Learning Private Limited<br />

Wheitstone Productions Private Limited<br />

Edumatics Corporation, USA<br />

<strong>Educomp</strong> Infrastructure Private Limited<br />

<strong>Educomp</strong> School Management Limited<br />

<strong>Educomp</strong> Professional Education Limited<br />

<strong>Educomp</strong> Software Limited<br />

<strong>Educomp</strong> Asia Pacific Pte. <strong>Ltd</strong>.<br />

Threebrix E-services Pvt. <strong>Ltd</strong>.<br />

Authrorgen Technologies Pvt. <strong>Ltd</strong>.<br />

<strong>Educomp</strong> Infrastructure Services Pvt. <strong>Ltd</strong>.<br />

AsknLearn Pte <strong>Ltd</strong>.<br />

Wiz Learn Pte <strong>Ltd</strong>.<br />

Pave Education Pte <strong>Ltd</strong>.<br />

Singapore learning.Com Pte <strong>Ltd</strong>.<br />

Shikhya <strong>Solutions</strong> Inc.<br />

Su<strong>bs</strong>idiary Companies<br />

(Direct & Indirect holding)