QUARTERLY REPORT Quarter 2 of 2012 - Холдинг МРСК

QUARTERLY REPORT Quarter 2 of 2012 - Холдинг МРСК

QUARTERLY REPORT Quarter 2 of 2012 - Холдинг МРСК

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

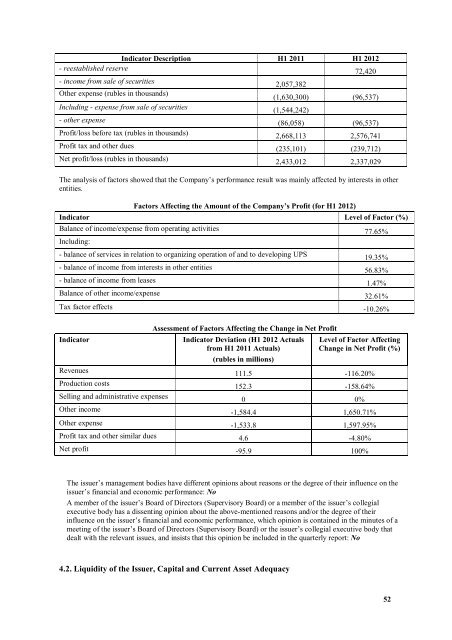

Indicator Description H1 2011 H1 <strong>2012</strong><br />

- reestablished reserve 72,420<br />

- income from sale <strong>of</strong> securities 2,057,382<br />

Other expense (rubles in thousands)<br />

(1,630,300) (96,537)<br />

Including - expense from sale <strong>of</strong> securities (1,544,242)<br />

- other expense (86,058) (96,537)<br />

Pr<strong>of</strong>it/loss before tax (rubles in thousands) 2,668,113 2,576,741<br />

Pr<strong>of</strong>it tax and other dues (235,101) (239,712)<br />

Net pr<strong>of</strong>it/loss (rubles in thousands) 2,433,012 2,337,029<br />

The analysis <strong>of</strong> factors showed that the Company’s performance result was mainly affected by interests in other<br />

entities.<br />

Factors Affecting the Amount <strong>of</strong> the Company’s Pr<strong>of</strong>it (for H1 <strong>2012</strong>)<br />

Indicator Level <strong>of</strong> Factor (%)<br />

Balance <strong>of</strong> income/expense from operating activities 77.65%<br />

Including:<br />

- balance <strong>of</strong> services in relation to organizing operation <strong>of</strong> and to developing UPS 19.35%<br />

- balance <strong>of</strong> income from interests in other entities 56.83%<br />

- balance <strong>of</strong> income from leases 1.47%<br />

Balance <strong>of</strong> other income/expense 32.61%<br />

Tax factor effects -10.26%<br />

Assessment <strong>of</strong> Factors Affecting the Change in Net Pr<strong>of</strong>it<br />

Indicator Indicator Deviation (H1 <strong>2012</strong> Actuals<br />

from H1 2011 Actuals)<br />

(rubles in millions)<br />

Level <strong>of</strong> Factor Affecting<br />

Change in Net Pr<strong>of</strong>it (%)<br />

Revenues 111.5 -116.20%<br />

Production costs 152.3 -158.64%<br />

Selling and administrative expenses 0 0%<br />

Other income -1,584.4 1,650.71%<br />

Other expense -1,533.8 1,597.95%<br />

Pr<strong>of</strong>it tax and other similar dues 4.6 -4.80%<br />

Net pr<strong>of</strong>it -95.9 100%<br />

The issuer’s management bodies have different opinions about reasons or the degree <strong>of</strong> their influence on the<br />

issuer’s financial and economic performance: No<br />

A member <strong>of</strong> the issuer’s Board <strong>of</strong> Directors (Supervisory Board) or a member <strong>of</strong> the issuer’s collegial<br />

executive body has a dissenting opinion about the above-mentioned reasons and/or the degree <strong>of</strong> their<br />

influence on the issuer’s financial and economic performance, which opinion is contained in the minutes <strong>of</strong> a<br />

meeting <strong>of</strong> the issuer’s Board <strong>of</strong> Directors (Supervisory Board) or the issuer’s collegial executive body that<br />

dealt with the relevant issues, and insists that this opinion be included in the quarterly report: No<br />

4.2. Liquidity <strong>of</strong> the Issuer, Capital and Current Asset Adequacy<br />

52