QUARTERLY REPORT Quarter 2 of 2012 - Холдинг МРСК

QUARTERLY REPORT Quarter 2 of 2012 - Холдинг МРСК

QUARTERLY REPORT Quarter 2 of 2012 - Холдинг МРСК

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Changes in indicators describing the issuer’s liquidity calculated on the basis <strong>of</strong> its accounting (financial)<br />

statements<br />

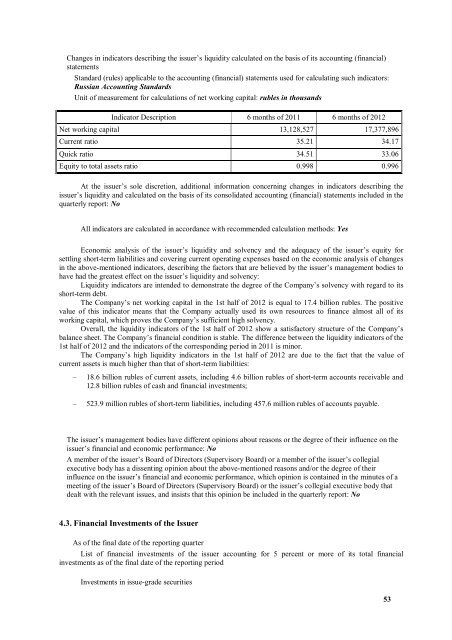

Standard (rules) applicable to the accounting (financial) statements used for calculating such indicators:<br />

Russian Accounting Standards<br />

Unit <strong>of</strong> measurement for calculations <strong>of</strong> net working capital: rubles in thousands<br />

Indicator Description 6 months <strong>of</strong> 2011 6 months <strong>of</strong> <strong>2012</strong><br />

Net working capital 13,128,527 17,377,896<br />

Current ratio 35.21 34.17<br />

Quick ratio 34.51 33.06<br />

Equity to total assets ratio 0.998 0.996<br />

At the issuer’s sole discretion, additional information concerning changes in indicators describing the<br />

issuer’s liquidity and calculated on the basis <strong>of</strong> its consolidated accounting (financial) statements included in the<br />

quarterly report: No<br />

All indicators are calculated in accordance with recommended calculation methods: Yes<br />

Economic analysis <strong>of</strong> the issuer’s liquidity and solvency and the adequacy <strong>of</strong> the issuer’s equity for<br />

settling short-term liabilities and covering current operating expenses based on the economic analysis <strong>of</strong> changes<br />

in the above-mentioned indicators, describing the factors that are believed by the issuer’s management bodies to<br />

have had the greatest effect on the issuer’s liquidity and solvency:<br />

Liquidity indicators are intended to demonstrate the degree <strong>of</strong> the Company’s solvency with regard to its<br />

short-term debt.<br />

The Company’s net working capital in the 1st half <strong>of</strong> <strong>2012</strong> is equal to 17.4 billion rubles. The positive<br />

value <strong>of</strong> this indicator means that the Company actually used its own resources to finance almost all <strong>of</strong> its<br />

working capital, which proves the Company’s sufficient high solvency.<br />

Overall, the liquidity indicators <strong>of</strong> the 1st half <strong>of</strong> <strong>2012</strong> show a satisfactory structure <strong>of</strong> the Company’s<br />

balance sheet. The Company’s financial condition is stable. The difference between the liquidity indicators <strong>of</strong> the<br />

1st half <strong>of</strong> <strong>2012</strong> and the indicators <strong>of</strong> the corresponding period in 2011 is minor.<br />

The Company’s high liquidity indicators in the 1st half <strong>of</strong> <strong>2012</strong> are due to the fact that the value <strong>of</strong><br />

current assets is much higher than that <strong>of</strong> short-term liabilities:<br />

– 18.6 billion rubles <strong>of</strong> current assets, including 4.6 billion rubles <strong>of</strong> short-term accounts receivable and<br />

12.8 billion rubles <strong>of</strong> cash and financial investments;<br />

– 523.9 million rubles <strong>of</strong> short-term liabilities, including 457.6 million rubles <strong>of</strong> accounts payable.<br />

The issuer’s management bodies have different opinions about reasons or the degree <strong>of</strong> their influence on the<br />

issuer’s financial and economic performance: No<br />

A member <strong>of</strong> the issuer’s Board <strong>of</strong> Directors (Supervisory Board) or a member <strong>of</strong> the issuer’s collegial<br />

executive body has a dissenting opinion about the above-mentioned reasons and/or the degree <strong>of</strong> their<br />

influence on the issuer’s financial and economic performance, which opinion is contained in the minutes <strong>of</strong> a<br />

meeting <strong>of</strong> the issuer’s Board <strong>of</strong> Directors (Supervisory Board) or the issuer’s collegial executive body that<br />

dealt with the relevant issues, and insists that this opinion be included in the quarterly report: No<br />

4.3. Financial Investments <strong>of</strong> the Issuer<br />

As <strong>of</strong> the final date <strong>of</strong> the reporting quarter<br />

List <strong>of</strong> financial investments <strong>of</strong> the issuer accounting for 5 percent or more <strong>of</strong> its total financial<br />

investments as <strong>of</strong> the final date <strong>of</strong> the reporting period<br />

Investments in issue-grade securities<br />

53