- Page 1 and 2: Faculty of Economics and Business A

- Page 3: Financing Unquoted High-Growth Comp

- Page 7 and 8: Acknowledgements This dissertation

- Page 9 and 10: calls. We know everything about eac

- Page 11 and 12: 1.4. Company Growth as a Complex Or

- Page 13 and 14: 3.5.3. Alternative Explanations for

- Page 15 and 16: List of Tables Chapter 1 Table 1.1

- Page 17 and 18: List of Figures Chapter 1 Figure 1.

- Page 19 and 20: De tweede studie gaat na hoe versch

- Page 21 and 22: Executive Summary High-growth compa

- Page 23 and 24: development as a whole. The process

- Page 25 and 26: The rest of this introduction is st

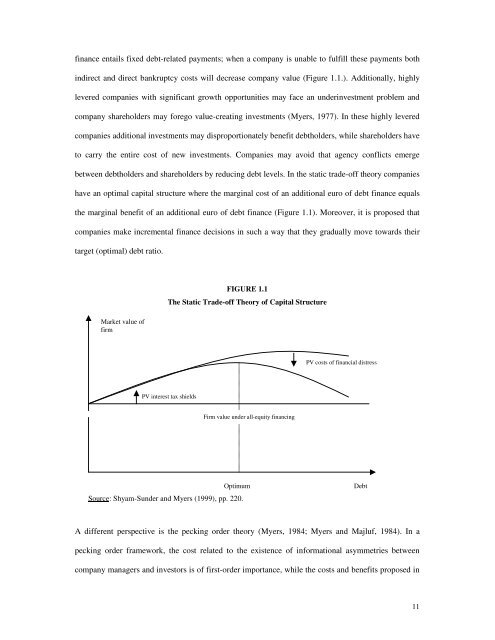

- Page 27 and 28: More significantly, finance scholar

- Page 29 and 30: Furthermore, in light of current fi

- Page 31 and 32: 1.2.1. Amount of Finance A first di

- Page 33: Empirical research confirms that co

- Page 37 and 38: track record, will heavily rely on

- Page 39 and 40: 1.2.4. Dynamics Companies have to m

- Page 41 and 42: focusing on the acquisition of vent

- Page 43 and 44: Moreover, historical finance decisi

- Page 45 and 46: I. TELEOLOGY FIGURE 1.3 Process Mod

- Page 47 and 48: 1.4.1. Growth Indicators, Growth Fo

- Page 49 and 50: TABLE 1.2 Overlap (%) between Diffe

- Page 51 and 52: Study 1: Incremental Finance Decisi

- Page 53 and 54: accessible for a limited number of

- Page 55 and 56: FIGURE 1.4 Early-Stage Entrepreneur

- Page 57 and 58: Overall, a low level of entrepreneu

- Page 59 and 60: timeframe of the study 3 . However,

- Page 61 and 62: are collect through the financial a

- Page 63 and 64: Two drawbacks of the Zephyr databas

- Page 65 and 66: accurately remembering finance even

- Page 67 and 68: experience of venture capital firms

- Page 69 and 70: founding. The increased professiona

- Page 71 and 72: investments internally and not to a

- Page 73 and 74: contribute to the acquisition of ot

- Page 75 and 76: constraints (Himmelberg and Peterse

- Page 77 and 78: 1.9. Structure of the Dissertation

- Page 79 and 80: Chandler G.N. and Hanks S.H. (1998)

- Page 81 and 82: Gregory B.T., Rutherford M.W., Oswa

- Page 83 and 84: Manigart S., De Waele K., Wright M.

- Page 85 and 86:

Van Auken H. (2001) “Financing sm

- Page 87 and 88:

2.1. Abstract This study examines i

- Page 89 and 90:

Companies do not continuously raise

- Page 91 and 92:

future expansion, financial distres

- Page 93 and 94:

Despite contradictory empirical fin

- Page 95 and 96:

lowers company value and in turn in

- Page 97 and 98:

Hypothesis 2: High-growth companies

- Page 99 and 100:

had to be for at least two years am

- Page 101 and 102:

2.4.2. Dependent Variables: Finance

- Page 103 and 104:

Percentage of firms using: TABLE 2.

- Page 105 and 106:

Noteworthy is the high correlation

- Page 107 and 108:

Internal finance: TABLE 2.4 Variabl

- Page 109 and 110:

Internal finance: (EARNINGS/TOTAL A

- Page 111 and 112:

in the probability of raising exter

- Page 113 and 114:

Additional analyses on smaller sub-

- Page 115 and 116:

Our results are important for acade

- Page 117 and 118:

Barclay M.J., Smith Jr., C.W. and M

- Page 119 and 120:

Helwege J. and Liang N. (1996) “I

- Page 121 and 122:

Ou C. and Haynes G.W. (2006) “Acq

- Page 123 and 124:

Chapter 3: Seeking Experienced or L

- Page 125 and 126:

(Rindova, Williamson, Petkova and S

- Page 127 and 128:

higher growth paths both in employm

- Page 129 and 130:

The accumulated experience may not

- Page 131 and 132:

offer finance by venture capital in

- Page 133 and 134:

around three to five years (Zarutsk

- Page 135 and 136:

effects of this potential confound.

- Page 137 and 138:

It is conceptually convenient to de

- Page 139 and 140:

it indicates how the mean initial s

- Page 141 and 142:

The results of the unconditional an

- Page 143 and 144:

significant quadratic trend. In thi

- Page 145 and 146:

exhibit steeper growth curves both

- Page 147 and 148:

obustness of the positive relations

- Page 149 and 150:

employment and intangible assets ra

- Page 151 and 152:

3.6. Discussion and Conclusion Most

- Page 153 and 154:

suggest that venture capital firms

- Page 155 and 156:

Baum J.A.C., Calabrese T. and Silve

- Page 157 and 158:

Hoang H. and Rothaermel F.T. (2005)

- Page 159 and 160:

Peixoto J.L. (1987) “Hierarchical

- Page 161 and 162:

Appendix 1: Robustness Check In the

- Page 163 and 164:

Chapter 4: Early Differences and Pe

- Page 165 and 166:

financial resource mobilization fro

- Page 167 and 168:

processes that make it difficult fo

- Page 169 and 170:

Biotechnology, 2002). The biotechno

- Page 171 and 172:

Table 4.2 differentiates between hi

- Page 173 and 174:

to follow-up interviews, (4) financ

- Page 175 and 176:

informants had difficulties in accu

- Page 177 and 178:

for ventures to replicate the succe

- Page 179 and 180:

A good illustration is the differen

- Page 181 and 182:

corporate investor related to a big

- Page 183 and 184:

In contrast to the image portrayed

- Page 185 and 186:

4.5.2. Initial Differences in Growt

- Page 187 and 188:

TABLE 4.6 Local Search and the Impa

- Page 189 and 190:

investors related to the venture, a

- Page 191 and 192:

persist across time and suggest it

- Page 193 and 194:

performing biotechnology parent com

- Page 195 and 196:

“In our venture capital firm the

- Page 197 and 198:

Additionally, our cases illustrate

- Page 199 and 200:

(Gargiulo, 1993). He approached not

- Page 201 and 202:

that the availability and suitabili

- Page 203 and 204:

and Eisenhardt, 2008). In this cont

- Page 205 and 206:

ventures are often depicted as pass

- Page 207 and 208:

Eisenhardt K.M. (1989b) “Agency t

- Page 209 and 210:

Katila R., Rosenberger J.D. and Eis

- Page 211 and 212:

Sorenson O. and Stuart T.E. (2001)

- Page 213 and 214:

Chapter 5: Limitations, Avenues for

- Page 215 and 216:

and despite these low leverage rati

- Page 217 and 218:

Additionally, early investors may i

- Page 219 and 220:

5.2.1. Entrepreneurs By studying th

- Page 221 and 222:

investment strategy. Given the requ

- Page 223:

Lerner J. (1999) “The government