Key figures - Schulthess Group

Key figures - Schulthess Group

Key figures - Schulthess Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

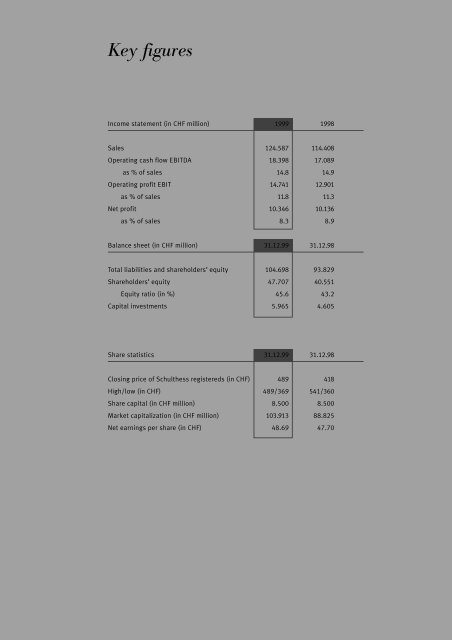

<strong>Key</strong> <strong>figures</strong><br />

Income statement (in CHF million) 1999 1998<br />

Sales 124.587 114.408<br />

Operating cash flow EBITDA 18.398 17.089<br />

as % of sales 14.8 14.9<br />

Operating profit EBIT 14.741 12.901<br />

as % of sales 11.8 11.3<br />

Net profit 10.346 10.136<br />

as % of sales 8.3 8.9<br />

Balance sheet (in CHF million) 31.12.99 31.12.98<br />

Total liabilities and shareholders’ equity 104.698 93.829<br />

Shareholders’ equity 47.707 40.551<br />

Equity ratio (in %) 45.6 43.2<br />

Capital investments 5.965 4.605<br />

Share statistics 31.12.99 31.12.98<br />

Closing price of <strong>Schulthess</strong> registereds (in CHF) 489 418<br />

High/low (in CHF) 489/369 541/360<br />

Share capital (in CHF million) 8.500 8.500<br />

Market capitalization (in CHF million) 103.913 88.825<br />

Net earnings per share (in CHF) 48.69 47.70

Household<br />

washing machine<br />

Household washing machine for<br />

multiple-dwelling houses<br />

The <strong>Schulthess</strong> <strong>Group</strong>: an overview<br />

The <strong>Schulthess</strong> <strong>Group</strong> is a leading Swiss manufacturer<br />

of washing machines and dryers. It is active in the household,<br />

small business and commercial sectors. In the<br />

household sector, which has the greatest volume and<br />

turnover, washing machines and dryers are produced<br />

for owner-occupied properties (single-family houses<br />

and condominium apartments). The semi-professional<br />

appliances are intended for multiple-dwelling houses<br />

and for small businesses. The commercial sector is<br />

directed towards the manufacturing and marketing of<br />

washing extractors, dryers and mangles for hotels,<br />

homes and hospitals.<br />

The <strong>Schulthess</strong> <strong>Group</strong> consists of <strong>Schulthess</strong> Maschinen<br />

AG, Merker AG, Novelan AG, Querop Handels AG<br />

and <strong>Schulthess</strong> Maschinen GmbH, Austria. In China,<br />

the <strong>Schulthess</strong> <strong>Group</strong> has a 25 per cent holding in a<br />

joint-venture company.<br />

For commercial use<br />

Washing machine<br />

for semi-professional<br />

applications

Dear Shareholders,<br />

The <strong>Schulthess</strong> <strong>Group</strong>’s business year 1999, though encouraging<br />

with regard to the economic result, has not fulfilled<br />

our expectations in all respects.<br />

It is certain that the business development last year confirmed<br />

the correctness of the corporate strategy adopted by<br />

the <strong>Schulthess</strong> <strong>Group</strong>. In this it seeks on the one hand a<br />

marked expansion of the export share in the semi-professional<br />

and professional market sectors, on the other hand<br />

growth by carefully targeted acquisitions. The <strong>Group</strong>’s<br />

strong market position in the Swiss home market is to be<br />

maintained and expanded.<br />

The business result 1999 reflects this development to a<br />

large degree. Whereas the overall turnover in the Swiss<br />

market stagnated, the export share of sales grew further<br />

thanks to new co-operation agreements and marketing<br />

partners. One major event in the business year was the<br />

takeover of Novelan AG, Dällikon. This acquisition contributed<br />

considerably to the growth in the <strong>Group</strong>’s sales.<br />

Thanks to progress in productivity, the operating profit<br />

increased yet again. The <strong>Schulthess</strong> <strong>Group</strong>’s sales profitability<br />

achieved a high value with 8,3% compared with<br />

other companies in the branch.<br />

2<br />

As a public company, in its shareholders’ interest the<br />

<strong>Schulthess</strong> <strong>Group</strong> wants to implement the defined medium<br />

to long-term target requirements – an averaged annual<br />

growth of approx. 10% and an EBIT margin of approx. 12%.<br />

The <strong>Schulthess</strong> <strong>Group</strong> achieved this objective almost<br />

completely in 1999. We are confident for the new business<br />

year that we will achieve a further marked step in growth in<br />

export thanks to new products and the co-operation<br />

agreements made in the export sector.<br />

In the period under review, the stock market rewarded the<br />

potential of the <strong>Schulthess</strong> registered share with a rise in<br />

price from CHF 418.– (as at the end of Dec. 98) to CHF 489.–<br />

(as at the end of Dec. 99). <strong>Schulthess</strong> is and remains a<br />

reliable, profitable and interesting investment.<br />

With the end of the business year, I am handing over the<br />

chairmanship of the <strong>Schulthess</strong> <strong>Group</strong> to Mr Rudolf Kägi.<br />

The long-standing Operating Manager and Delegate of the<br />

Board is the guarantee for a modern corporate policy and<br />

the necessary continuity in management. I wish him a<br />

continued sure hand and the necessary portion of luck. I<br />

shall remain linked with the company as a board member<br />

and am looking forward to being able to continue to<br />

accompany the company further in this position. I would like<br />

to thank all those who supported and advised me in my<br />

function up to now at the head of the <strong>Schulthess</strong> <strong>Group</strong>.<br />

Paul O. Rutz<br />

Chairman of the Board<br />

(until December 31, 1999)

High profitability,<br />

growth in turnover by acquisition<br />

Overview of the development as a whole<br />

The <strong>Schulthess</strong> <strong>Group</strong> has completed the business year 1999<br />

with a good result once again, whereby, however, the growth<br />

targets that had been aimed for were not fully achieved in<br />

all sectors. In the sense of the <strong>Group</strong>’s growth strategy, on<br />

July 1, 1999 Novelan AG, Dällikon was taken over and<br />

integrated into the <strong>Schulthess</strong> <strong>Group</strong>. Further progress was<br />

made in the course of the year in export with marketing and<br />

service operations being agreed with various strong partners<br />

in the European area. In the important Swiss home market,<br />

the market position was maintained over a long period with<br />

a difficult environment and with a saturated market.<br />

The production and expansion of the market of Wuxi Little<br />

Swan-<strong>Schulthess</strong> Washing Machinery Co. Ltd., our joint-venture<br />

company in China, made a belated start in the year under<br />

review on account of problems with the production of<br />

parts. Despite this rather slow start, the management of the<br />

Chinese partner company is confident that it will be able to<br />

considerably increase the production and sales <strong>figures</strong> in<br />

the coming period.<br />

Further progress in productivity in production at the Wolfhausen<br />

headquarters thanks to considerable investments in<br />

new equipment there have contributed decisively to the<br />

good result.<br />

4<br />

The strategy:<br />

Growth by our own efforts and through acquisitions<br />

The overall development of the <strong>Schulthess</strong> <strong>Group</strong> in the<br />

business year 1999 confirms the Board in its corporate strategy.<br />

Because growth in saturated Switzerland where the<br />

<strong>Group</strong> companies, taken as a whole, are maintainings strong<br />

market position, is becoming increasingly difficult to achieve,<br />

in export we are pursuing a strategy which is aimed at activating<br />

additional markets with niche products.<br />

We also consider it sensible to achieve further growth by<br />

acquisitions, if sensible synergies will result from this for<br />

our corporate group and at the same time a strengthening of<br />

our position can be attained. Whereas in the home market<br />

all the company’s products groups, e.g. appliances for one’s<br />

own home, for multi-dwelling houses and semi-professional<br />

applications, as well as machines for the professional laundry<br />

trade, are marketed, in export, in view of the aforementioned<br />

“niche-oriented” policy, efforts are concentrated on<br />

semi-professional professional products.<br />

The acquisition of Novelan AG, Dällikon also took place then<br />

at the middle of the year within the scope of our growth<br />

strategy. The company has three fields of activity, namely<br />

sales and after-sales service for<br />

• large household appliances<br />

• heat technology<br />

• air-conditioning/ventilation<br />

With its interesting after-sales service sector, it also corresponds<br />

with the growing importance of the service section of<br />

the economy. With this acquisition, the <strong>Schulthess</strong> <strong>Group</strong><br />

has considerably expanded the customer basis in the business<br />

with real estate companies so important for Switzerland<br />

(e.g. property management companies and building cooperatives),<br />

general contractors and architects. Novelan AG<br />

was gradually integrated in the second half of 1999. The<br />

<strong>Group</strong>’s sales growth is also a result above all of this acquisition.

Important cornerstones for future successes were laid in<br />

export. Thus in the United Kingdom, France, Scandinavia<br />

and Holland, new, strong national marketing partners with a<br />

considerable sales potential were acquired. In this connection,<br />

<strong>Schulthess</strong> products are not only marketed under their<br />

own label, but also within the scope of private label partnerships.<br />

As some of these partnerships were only made in the<br />

course of the business year, they can only have a full effect<br />

on sales in the course of the year 2000.<br />

Growth targets partially reached, profitability targets for the<br />

most part achieved<br />

In 1999, the <strong>Schulthess</strong> <strong>Group</strong> reached its profitability targets<br />

for the most part, but not its growth targets in all<br />

sectors. The business result (EBIT and profit) reflects the<br />

company’s good productivity and profitability. The reported<br />

growth is mainly attributable to the consolidation of Novelan<br />

(July–December 1999). The difficult situation for many<br />

months in the home market, the delay in the introduction of<br />

the new commercial range and the time taken to reach agreements<br />

in the export sector have slowed down the development<br />

of sales. The Board is, however, confident that it will<br />

further expand sales growth in the new business year with<br />

appropriate measures.<br />

Outlook<br />

In 2000, the <strong>Schulthess</strong> <strong>Group</strong> will place its main emphasis<br />

on further stepping up its growth strategy. The Board and<br />

Management are reckoning with a sales growth of 10–12%<br />

and a yield on sales of over 8%. The expansion of export<br />

sales is to be continued systematically. Interest is concentrated<br />

here on the consolidation of existing partnerships, the<br />

search for new marketing partners and on covering the whole<br />

European area with <strong>Schulthess</strong> agencies.<br />

In the acquisition sector, the <strong>Schulthess</strong> <strong>Group</strong> is looking for<br />

suitable new partners at home and abroad. What is decisive<br />

for such takeover operations are the partner companies’<br />

compatibility with the <strong>Group</strong>’s corporate strategy, the economic<br />

basis, the potential for the future and the synergies<br />

which can be achieved in the market.<br />

5<br />

Sales<br />

(in CHF million)<br />

140<br />

120<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0<br />

1995<br />

112.4<br />

EBITDA<br />

(in CHF million)<br />

20<br />

15<br />

10<br />

5<br />

0<br />

1995<br />

7.9<br />

1996<br />

116.3<br />

1996<br />

11.0<br />

1997<br />

117.0<br />

1997<br />

12.7<br />

1998<br />

114.4<br />

1998<br />

17.1<br />

1999<br />

124.6<br />

1999<br />

18.4

EBIT<br />

(in CHF million)<br />

15<br />

12<br />

9<br />

6<br />

3<br />

0<br />

1995<br />

3.9<br />

1996<br />

6.5<br />

Consolidated profit<br />

(in CHF million)<br />

12<br />

10<br />

8<br />

6<br />

4<br />

2<br />

0<br />

1995<br />

2.0<br />

1996<br />

3.7<br />

1997<br />

8.6<br />

1997<br />

5.5<br />

1998<br />

12.9<br />

1998<br />

10.1<br />

1999<br />

14.7<br />

1999<br />

10.3<br />

Non-operating income of know-how transfer<br />

as part of joint venture (1,8 CHF million)<br />

6<br />

In the Swiss home market, the <strong>Schulthess</strong> <strong>Group</strong> is striving<br />

towards a further consolidation and improvement in its market<br />

position and sales.<br />

Additional points of focus of the <strong>Schulthess</strong> <strong>Group</strong> lie in the<br />

product sector and in further modernization steps in production.<br />

The completion of the renewal of the commercial<br />

washing machine series and the enlargement of the largemargin<br />

Spirit topline line by new models and their introduction<br />

are at the centre of the range policy. In production,<br />

further notable investments are planned, especially in the<br />

manufacture of commercial machines.<br />

Thanks<br />

The overall result of the <strong>Schulthess</strong> <strong>Group</strong> is for the most<br />

part encouraging. The prospects with respect to the <strong>Group</strong>’s<br />

further development are promising. A motivated team of<br />

qualified employees has carried out this work and is confidently<br />

facing the future challenges.<br />

The Board is aware of its employees’ great performance and<br />

thanks them all for their untiring commitment, for their contribution<br />

towards the result and their positive attitude towards<br />

the company.<br />

We would like to thank you, our shareholders, for your confidence<br />

and loyalty towards the <strong>Schulthess</strong> <strong>Group</strong>. We are<br />

confident that we will be able to report on positive events,<br />

results and developments in the new business year too.<br />

Rudolf Kägi<br />

Chief Executive Officer<br />

(since January 1, 2000 also Chairman of the Board)

Financial review <strong>Schulthess</strong> <strong>Group</strong><br />

Consolidated balance sheet<br />

in CHF 1,000 note 31.12.99 31.12.98<br />

Assets<br />

Cash and cash equivalents 4,945 6,843<br />

Marketable securities 3,359 2,405<br />

Trade accounts receivable, net 3.1 23,712 18,486<br />

Inventories 3.2 25,253 22,818<br />

Prepaid expenses 629 607<br />

Current assets 57,898 51,159<br />

Property and plant 36,173 34,041<br />

Equipment and vehicles 34,126 30,132<br />

Intangible assets and goodwill 2,278 866<br />

Financial investments 2,306 2,306<br />

Accumulated depreciation –28,083 –24,675<br />

Fixed assets 3.3 46,800 42,670<br />

Total assets 104,698 93,829<br />

Liabilities and shareholders’ equity<br />

Bank overdrafts 7,467 6,375<br />

Trade accounts payable 6,048 5,405<br />

Other current liabilities 2,610 1,351<br />

Accrued expenses 3.4 10,636 9,054<br />

Short-term liabilities 26,761 22,185<br />

Long-term debt 3.5 8,468 9,547<br />

Provisions 3.6 6,446 6,417<br />

Deferred income taxes 3.7 15,316 15,129<br />

Long-term liabilities 30,230 31,093<br />

Share capital 8,500 8,500<br />

Retained earnings and reserves 39,207 32,051<br />

Shareholders’ equity 3.8 47,707 40,551<br />

Total liabilities and shareholders’ equity 104,698 93,829<br />

8

Consolidated income statement<br />

in CHF 1,000 note 1999 1998<br />

Income from sales and services 4.1 124,587 114,408<br />

Revenue deduction 4,604 4,455<br />

Net income 119,983 109,953<br />

Cost of material 42,504 38,754<br />

Gross profit 77,479 71,199<br />

Personnel 36,589 34,191<br />

Rent 1,224 1,076<br />

Other operating expenses 4.2 21,268 18,843<br />

Operating cash flow EBITDA 18,398 17,089<br />

Depreciation of fixed assets 3,602 4,188<br />

Depreciation of goodwill 55 0<br />

Operating profit EBIT 14,741 12,901<br />

Financial income 4.3 418 461<br />

Financial expenses 4.4 –854 –1,287<br />

Financial income and expenses, net –436 –826<br />

Non-operating income 4.5 212 1,907<br />

Non-operating expenses 4.6 –6 –181<br />

Non-operating income and expenses, net 206 1,726<br />

Profit before taxes 14,511 13,801<br />

Taxes 4.7 4,165 3,665<br />

Net profit 10,346 10,136<br />

9

Consolidated cash flow statement<br />

in CHF 1,000 note 1999 1998<br />

Income from sales and services 4.1 124,587 114,408<br />

Revenue deduction 4,604 4,455<br />

Cost of material 42,504 38,754<br />

Personnel, rent and other operating expenses 59,081 54,110<br />

Operating cash flow EBITDA 18,398 17,089<br />

Financial income and expenses, net –436 –826<br />

Non-operating income and expenses, net 206 1,726<br />

Taxes –4,165 –3,665<br />

Change in marketable securities –954 –1,302<br />

Change in trade accounts receivable and prepaid expenses –1,857 891<br />

Change in inventories 784 –1,995<br />

Change in liabilities and provisions 266 –502<br />

Cash flow from operating activities 12,242 11,416<br />

Investing in property and plant 3.3 –292 –149<br />

Investing in equipment and vehicles 3.3 –3,245 –2,027<br />

Investing in intangible assets 3.3 –312 –173<br />

Investing in financial investments 3.3 0 –2,256<br />

Changes in <strong>Group</strong> companies –2,116 0<br />

Cash flow from investing activities –5,965 –4,605<br />

Increase in Bank loans 1,500 0<br />

Increase in loans 0 0<br />

Repayment of Bank loans –1,440 –4,120<br />

Repayment of loans –6,139 –1,347<br />

Share capital and reserves paid in 3.8 0 11,474<br />

Dividends paid –3,188 0<br />

Cash flow from financing activities –9,267 6,007<br />

Cash and Bank overdrafts, net at the beginning of year 468 –12,350<br />

Increase/Decrease in cash and Bank overdrafts, net –2,990 12,818<br />

Cash and Bank overdrafts, net at the end of year –2,522 468<br />

Fund composition:<br />

Cash and cash equivalents 4,945 6,843<br />

Less Bank overdrafts –7,467 –6,375<br />

Cash and Bank overdrafts, net –2,522 468<br />

10

Notes to the consolidated financial statements<br />

1 Consolidation principles<br />

1.1 General<br />

The consolidated financial statements of the <strong>Schulthess</strong> <strong>Group</strong> are based on uniform consolidation and valuation principles<br />

applicable for all the <strong>Group</strong> companies and have been prepared in accordance with the Swiss Accounting and Reporting<br />

Recommendations (ARR).<br />

1.2 Closing date<br />

The closing date of <strong>Schulthess</strong> <strong>Group</strong> Ltd., all its subsidiary companies and also the consolidated financial statements is<br />

December 31.<br />

1.3 Consolidated group<br />

As of December 31, <strong>Schulthess</strong> <strong>Group</strong> AG held the following investments:<br />

Company Nominal capital Percentage held<br />

1999 1998<br />

<strong>Schulthess</strong> Maschinen AG, Bubikon ZH CHF 1,500,000.00 100% 100%<br />

Merker AG, Baden-Dättwil AG CHF 500,000.00 100% 100%<br />

Novelan AG, Dällikon ZH CHF 1,250,000.00 100% –<br />

Querop Handels AG, Root LU CHF 1,000,000.00 100% 100%<br />

Querop Lager AG, Root LU CHF 50,000.00 100% 100%<br />

Wamatec SA, Lamone TICHF 100,000.00 100% 100%<br />

<strong>Schulthess</strong> Maschinen GmbH, A-Vienna ATS 4,000,000.00 100% 100%<br />

Wuxi Little Swan-<strong>Schulthess</strong> Washing<br />

Machinery Co. Ltd., Wuxi (China)<br />

USD 6,000,000.00 25% 25%<br />

1.4 Method of consolidation<br />

Companies in which <strong>Schulthess</strong> <strong>Group</strong> directly or indirectly holds an interest of more than 50% are fully consolidated.<br />

Companies in which an interest of 20–50% is held are shown in the balance sheet commensurate with the <strong>Group</strong>’s share of<br />

equity (equity method). Equity interests of less than 20% are shown at the lower of acquisition cost of equity value.<br />

The capital is consolidated according to the Anglo-Saxon purchase method.<br />

1.5 Intercompany transactions<br />

All assets and liabilities and intercompany transactions between <strong>Group</strong> companies (incl. dividends paid) are eliminated.<br />

Profits on intercompany deliveries of goods are of a negligible amount and therefore not eliminated in the consolidated<br />

financial statements.<br />

The goodwill paid at the time of the purchase of the companies was charged directly to the <strong>Group</strong>'s reserves until 1.1.95. In<br />

the years 1995 to 1998, no new holdings were purchased. From 1.1.99, the residual amount between the purchase price and<br />

the equity capital (goodwill) will be entered on the assets side and written down at a flat rate over a period of a maximum of<br />

10 years.<br />

11

1.6 Translation of foreign companies<br />

The reporting currency is the Swiss Franc (CHF). Annual accounts of foreign subsidiaries are prepared in their local currency.<br />

All balance sheet items (except shareholders’ equity) are translated into Swiss Francs (CHF) at the exchange rates applicable<br />

at the balance sheet date. Differences arising on translation are taken directly to sharesholders’ equity without affecting net<br />

profit.<br />

Income statement items are translated into Swiss Francs (CHF) at the average exchange rates during the particular reporting<br />

period. Exchange differences arising from operations are included in net profit.<br />

The following rate was used for the translation of foreign currencies:<br />

Balance sheet rates Income statement rates<br />

Year-end-rates Average rates<br />

1999 1998 1999 1998<br />

100 ATS 11.55 11.50 11.63 11.71<br />

2 Valuation principles<br />

2.1 General<br />

The annual accounts of the individual companies on which the consolidation was based were prepared using historical cost<br />

values (except plant and property to estimated market values) according to uniform <strong>Group</strong> accounting principles. The<br />

accounting principles remained unchanged as compared with the previous year.<br />

2.2 Current assets<br />

Inventories are valued at the most recent acquisition costs, the accumulated manufacturing costs, or at the lower market<br />

value (lower of cost or market principle).<br />

In the case of receivables, allowance is made for recognizable individual risks by valuation provisions.<br />

2.3 Fixed assets<br />

The valuation of property and plant is based on market values. Expert appraisals were commissioned to assess the market<br />

values.<br />

Equipment and vehicles are valued at acquisition or construction cost. Equipment and vehicles are depreciated on a straightline<br />

basis over their expected useful lives from the month of acquisition onwards.<br />

12

3 Notes to the consolidated balance sheet<br />

3.1 Trade accounts receivable, net<br />

in CHF 1,000 31.12.99 31.12.98<br />

Trade accounts receivable 23,553 19,500<br />

Accounts receivable from non-consolidated companies 559 0<br />

Other receivables and prepayments 1,601 676<br />

Provision for doubtful accounts –2,001 –1,690<br />

Total 23,712 18,486<br />

3.2 Inventories<br />

in CHF 1,000 31.12.99 31.12.98<br />

Raw material 7,905 8,094<br />

Work in process 2,686 2,336<br />

Finished products 7,626 5,370<br />

Products for services 11,439 11,037<br />

Provision for obsolete inventories –4,403 –4,019<br />

Total 25,253 22,818<br />

14

3.3 Fixed assets<br />

in CHF 1,000 Property Equipment Intangible<br />

and and assets and Financial<br />

plant vehicles goodwill investments Total<br />

Net book value as of January 1, 1998 28,684 11,836 236 50 40,806<br />

Gross book value as of January 1, 1998 32,445 28,847 693 50 62,035<br />

Revaluation of property and plant 1,447 0 0 0 1 447<br />

Additions 649 2,077 173 2,256 5,155<br />

Disposals –500 –792 0 0 –1 292<br />

Gross book value as of December 31, 1998 34,041 30,132 866 2,306 67,345<br />

Accumulated depreciation as of January 1, 1998 3,761 17,011 457 0 21,229<br />

Additions 1,342 2,725 121 0 4,188<br />

Disposals 0 742 0 0 742<br />

Accumulated depreciation as of December 31, 1998 5,103 18,994 578 0 24,675<br />

Net book value as of December 31, 1998/1.1.99 28,938 11,138 28 8 2,306 42,670<br />

Gross book value as of January 1, 1999 34,041 30,132 866 2,306 67,345<br />

Revaluation of property and plant 0 0 0 0 0<br />

Additions 292 3,500 312 0 4,104<br />

Additions from changes in <strong>Group</strong> companies 0 –1,234 0 0 –1,234<br />

Disposals 1,840 1,728 1,100 0 4,668<br />

Gross book value as of December 31, 1999 36,173 34,126 2,278 2,306 74,883<br />

Accumulated depreciation as of January 1, 1999 5,103 18,994 578 0 24,675<br />

Additions 444 3,046 112 0 3,602<br />

Additions from changes in <strong>Group</strong> companies 0 –979 0 0 –979<br />

Disposals 0 730 55 0 785<br />

Accumulated depreciation as of December 31, 1999 5,547 21,791 745 0 28,083<br />

Net book value as of December 31, 1999 30,626 12,335 1,533 2,306 46,800<br />

Capitalized intangible assets comprise mainly lincenses for clients in the ironing machine lining segment, amortized over a<br />

periode of five years.<br />

3.4 Accrued expenses<br />

in CHF 1,000 31.12.99 31.12.98<br />

Income from services concerning next year 8,409 6,923<br />

Revenue deduction 715 671<br />

Personnel 831 629<br />

Ta x e s 0 70<br />

Others 681 761<br />

Total 10,636 9,054<br />

15

3.5 Long-term debt<br />

in CHF 1,000 31.12.99 31.12.98<br />

Bank loans 1,300 2,600<br />

Mortgages 4,460 3,100<br />

Loans from staff pension funds 2,708 3,847<br />

Total 8,468 9,547<br />

3.6 Provisions<br />

in CHF 1,000 31.12.99 31.12.98<br />

Warranties, guarantees 2,310 2,600<br />

Taxes 3,868 3,399<br />

Other operating provisions 268 418<br />

Total 6,446 6,417<br />

3.7 Deferred income taxes<br />

Deferred taxes are provided for at the normal local tax rates.<br />

3.8 Shareholders’ equity<br />

in CHF 1,000 Share Translation Capital Retained Total<br />

capital differences reserves earnings<br />

Value as of January 1, 1998 2,700 2 2,867 12,043 17,612<br />

Revaluation 1,331 1,331<br />

Increase of share capital (Going public) 1,000 10,474 11,474<br />

Capital increase according to 652 d CO 4,800 –4,800 0<br />

Net profit 10,136 10,136<br />

Translation differences –2 –2<br />

Value as of December 31, 1998 8,500 0 9,872 22,179 40,551<br />

Value as of January 1, 1999 8,500 0 9,872 22,179 40,551<br />

Revaluation 0<br />

Net profit 10,346 10,346<br />

Dividends paid –3,188 –3,188<br />

Translation differences –2 –2<br />

Value as of December 31, 1999 8,500 -2 9,872 29,337 47,707<br />

16

4 Notes to the consolidated income statement<br />

4.1 Segmental information<br />

in CHF 1,000 1999 1998<br />

Household 106,270 94,512<br />

Industrial 18,317 19,896<br />

Total 124,587 114,408<br />

Exports 9,531 8,454<br />

Exports as % of total sales 7,65 7,39<br />

The Household segment offers products and services for single- and multi-family buildings (and small businesses).<br />

The Industrial segment generates sales with products and services for hotels, restaurants, hospitals, homes, etc.<br />

4.2 Other operating expenses<br />

in CHF 1,000 1999 1998<br />

Administration expenses 6,408 6,386<br />

Advertising expenses 6,989 5,479<br />

Other expenses 7,871 6,978<br />

Total 21,268 18,843<br />

4.3 Financial income<br />

in CHF 1,000 1999 1998<br />

Interests 243 261<br />

Unrealized profit of exchange 175 200<br />

Total 418 461<br />

4.4 Financial expenses<br />

in CHF 1,000 1999 1998<br />

Bank interest 626 949<br />

Loan interest 228 338<br />

Total 854 1,287<br />

17

4.5 Non-operating income<br />

in CHF 1,000 1999 1998<br />

Income of know-how transfer as part of joint venture 120 1,805<br />

Sales of non-current assets 21 10<br />

Others 71 92<br />

Total 212 1,907<br />

4.6 Non-operating expenses<br />

in CHF 1,000 1999 1998<br />

Others 6 181<br />

Total 6 181<br />

4.7 Taxes<br />

in CHF 1,000 1999 1998<br />

Current taxes 4,142 3,702<br />

Deferred taxes 23 –37<br />

Total 4,165 3,665<br />

18

5 Further information as required under Art. 663 b CO<br />

in CHF 1,000 1999 1998<br />

Fire insurance value of property, plant and equipment<br />

Property and plant 36,889 34,867<br />

Equipment 35,675 32,268<br />

Models<br />

Pledged assets under reservation of ownership<br />

Pledged real estate<br />

3,000 3,000<br />

Stated value 30,626 28,938<br />

Charge 12,600 14,600<br />

Drawn on<br />

Joint and several guarantees for third-party liabilities<br />

9,629 7,942<br />

Joint and several guarantees issued<br />

Leasing liabilities not stated<br />

26 26<br />

Leasing installments not due 7 61<br />

of which due in 1999 0 54<br />

of which due in 2000<br />

Liabilities in respect of pension funds<br />

7 7<br />

Short-term liabilities in respect of pension funds 223 221<br />

Loans in respect of pension funds<br />

Net release of taxed undisclosed reserves<br />

2,708 3,646<br />

Release of employer contribution reserves, insurance fund 0 192<br />

Release of employer contribution reserves, staff welfare foundation 0 146<br />

Total 0 338<br />

Own shares<br />

in number of shares<br />

Value as of January 1 3,334 0<br />

Purchase of 1,666 shares 1,666 3,334<br />

Value as of December 31 5,000 3,334<br />

in CHF<br />

Value as of January 1 1,102,269 0<br />

Purchase of 1,666 shares 806,118 1,102,269<br />

Value as of December 31 1,908,387 1,102,269<br />

Major shareholders under Art. 663 c CO<br />

See page 36.<br />

19

Report of the group auditors to the General Meeting of <strong>Schulthess</strong> <strong>Group</strong> AG, Wolfhausen<br />

As auditors of the group, we have audited the consolidated financial statements (balance sheet, income statement and<br />

notes) of <strong>Schulthess</strong> <strong>Group</strong> AG for the year ended December 31, 1999.<br />

These consolidated financial statements are the responsibility of the Board of Directors. Our responsibility is to express an<br />

opinion on these consolidated financial statements based on our audit. We confirm that we meet the legal requirements<br />

concerning professional qualification and independence.<br />

Our audit was conducted in accordance with auditing standards promulgated by the profession, which require that an audit<br />

be planned and performed to obtain reasonable assurance about whether the consolidated financial statements are free<br />

from material misstatement. We have examined on a test basis evidence supporting the amounts and disclosures in the<br />

consolidated financial statements. We have also assessed the accounting principles used, significant estimates made and<br />

the overall consolidated financial statement presentation. We believe that our audit provides a reasonable basis for our<br />

opinion.<br />

In our opinion, the consolidated financial statements give a true and fair view of the financial position, the results of<br />

operations and the cash flows in accordance with the Accounting and Reporting Recommendations (ARR) and comply with<br />

the law and the accounting provisions as contained in the Listing Rules of the Swiss Exchange.<br />

We recommend that the consolidated financial statements submitted to you be approved.<br />

PricewaterhouseCoopers AG<br />

PETERHANS René MIGLIARETTI Silvio<br />

Zurich, March 7, 2000<br />

20

Financial review <strong>Schulthess</strong> <strong>Group</strong> AG<br />

21

Balance sheet<br />

in CHF 31.12.99 31.12.98<br />

Assets<br />

Cash 1,708,145 3,844,063<br />

Marketable securities 1,908,387 1,130,543<br />

Accounts receivable from <strong>Group</strong> companies 1,500,000 20,000<br />

Other receivables 547,257 700,551<br />

Prepaid expenses 152,000 19,000<br />

Current assets 5,815,789 5,714,157<br />

Financial investments 35,794,001 33,494,001<br />

Fixed assets 35,794,001 33,494,001<br />

Total assets 41,609,790 39,208,158<br />

Liabilities and shareholders’ equity<br />

Accounts payable to <strong>Group</strong> companies 0 0<br />

Accrued expenses 50,000 124,805<br />

Provisions 2,728,800 1,607,500<br />

Loans from <strong>Group</strong> companies 0 0<br />

Liabilities 2,778,800 1,732,305<br />

Share capital 8,500,000 8,500,000<br />

Reserve for own shares 1,908,387 1,102,269<br />

Reserves 21,565,679 22,071,797<br />

Retained earnings: 6,856,924 5,801,787<br />

Carried forward from previous year 2,314,287 3,544,932<br />

Net profit 4,542,637 2,256,855<br />

Shareholders’ equity 38,830,990 37,475,853<br />

Total liabilities and shareholders’ equity 41,609,790 39,208,158<br />

22

Income statement<br />

in CHF 1999 1998<br />

Management fees 900,000 900,000<br />

Income of know-how transfer as part of joint venture 120,000 1,804,800<br />

Income on holdings 6,000,000 2,000,000<br />

Financial income 98,920 85,431<br />

Total income 7,118,920 4,790,231<br />

Financial expenses 41,063 190,604<br />

Depreciation 1,200,000 1,000,000<br />

Other operating expenses 1,102,443 780,395<br />

Taxes 232,777 562,377<br />

Total expenses 2,576,283 2,533,376<br />

Net profit 4,542,637 2,256,855<br />

23

Notes to the financial statements 1999<br />

Major holdings<br />

Company Nominal capital Percentage held<br />

24<br />

1999 1998<br />

<strong>Schulthess</strong> Maschinen AG, Bubikon ZH CHF 1,500,000 100% 100%<br />

Merker AG, Baden-Dättwil AG CHF 500,000 100% 100%<br />

Novelan Ltd., Dällikon ZH CHF 1,250,000 100% 0%<br />

Querop Handels AG, Root LU CHF 1,000,000 100% 100%<br />

Querop Lager AG, Root LU CHF 50,000 100% 100%<br />

Wamatec SA, Lamone TI CHF 100,000 100% 100%<br />

<strong>Schulthess</strong> Maschinen GmbH, A-Vienna ATS 4,000,000 100% 100%<br />

Wuxi Little Swan-<strong>Schulthess</strong> Washing<br />

Machinery Co. Ltd., Wuxi (China)<br />

USD 6,000,000 25% 25%<br />

Own shares<br />

in number of shares 1999 1998<br />

Value as of January 1 3,334 0<br />

Purchase of 1,666 shares 1,666 3,334<br />

Value as of December 31 5,000 3,334<br />

in CHF<br />

Value as of January 1 1,102,269 0<br />

Purchase of 1,666 shares 806,118 1,102,269<br />

Value as of December 31 1,908,387 1,102,269<br />

Major shareholders<br />

See page 36.<br />

Proposed allocation of retained earnings<br />

Proposal of the Board of Directors<br />

in CHF 1999 1998<br />

Carried forward from previous year 2,314,287 3,544,932<br />

Net profit 4,542,637 2,256,855<br />

Retained earnings 6,856,924 5,801,787<br />

Dividends (CHF 16.– per share) 3,400,000 3,187,500<br />

Allocation to the reserve 300,000 300,000<br />

Carried forward to next year 3,156,924 2,314,287

Report of the statutory auditors to the General Meeting of <strong>Schulthess</strong> <strong>Group</strong> AG, Wolfhausen<br />

As statutory auditors, we have audited the accounting records and the financial statements (balance sheet, income<br />

statement and notes) of <strong>Schulthess</strong> <strong>Group</strong> AG for the year ended December 31, 1999.<br />

These financial statements are the responsibility of the Board of Directors. Our responsibility is to express an opinion on<br />

these financial statements based on our audit. We confirm that we meet the legal requirements concerning professional<br />

qualification and independence.<br />

Our audit was conducted in accordance with auditing standards promulgated by the profession, which require that an audit<br />

be planned and performed to obtain reasonable assurance about whether the financial statements are free from material<br />

misstatement. We have examined on a test basis evidence supporting the amounts and disclosures in the financial<br />

statements. We have also assessed the accounting principles used, significant estimates made and the overall financial<br />

statement presentation. We believe that our audit provides a reasonable basis for our opinion.<br />

In our opinion, the accounting records and financial statements and the proposed appropriation of available earnings comply<br />

with the law and the company’s articles of incorporation.<br />

We recommend that the financial statements submitted to you be approved.<br />

PricewaterhouseCoopers AG<br />

PETERHANS René MIGLIARETTI Silvio<br />

Zurich, March 7, 2000<br />

25

Corporate philosophy<br />

1. Concentration on own strong points and openness for<br />

new opportunities<br />

The <strong>Schulthess</strong> <strong>Group</strong> has been manufacturing washing machines<br />

for almost a century. It has nowadays a high degree<br />

of competence in the development, manufacture and<br />

marketing of washing machines and dryers for the<br />

household and for semi-professional applications, as well as<br />

of machines for commercial laundries. The company wants<br />

to continue to concentrate on its core competence, but to<br />

keep its options open for suitable new activities on the<br />

basis of market developments and market opportunities in<br />

its main markets.<br />

2. Growth strategy<br />

The <strong>Schulthess</strong> <strong>Group</strong> professes its faith in a strategy of<br />

growth. In this it follows both the path of internal growth<br />

(particularly through the expansion of export activities) and<br />

the opportunity of a growth through acquisitions or through<br />

diversification into new fields of activities. The involvement<br />

by the <strong>Schulthess</strong> <strong>Group</strong> in China, the Wuxi Little Swan-<br />

<strong>Schulthess</strong> Machinery Co. Ltd. joint venture which produces<br />

washing extractors, dryers and mangles for the rapidly<br />

growing Chinese commercial market and for further southeast<br />

Asiatic countries is to be consistently expanded.<br />

3. Niche strategy<br />

The <strong>Schulthess</strong> <strong>Group</strong> pursues a niche strategy, concentrating<br />

on markets which have a considerable potential but are<br />

uninteresting for competitors with large production capacities.<br />

It canvasses these markets with innovative products.<br />

One example for this is the Spirit topline generation for the<br />

semi-professional markets, such as, for instance, the multidwelling<br />

house, launderettes, small commercial businesses,<br />

etc. The <strong>Schulthess</strong> products for the household and the<br />

commercial machines for hotels, homes and hospitals may<br />

justifiably be included among the niche products.<br />

4. Comprehensive solutions<br />

The <strong>Schulthess</strong> <strong>Group</strong> is active in the development, production<br />

and marketing of washing machines, dryers and<br />

laundry machines. However, the markets increasingly expect<br />

26<br />

comprehensive solutions including the products and<br />

appropriate services. <strong>Schulthess</strong> will therefore expand<br />

its range of services (such as the services offered by the<br />

after-sales service organisations, the subscription services<br />

or the full service in dealings with real estate companies)<br />

to deal specifically with this.<br />

5. Quality<br />

The main focus of the work of all employees in the<br />

<strong>Schulthess</strong> <strong>Group</strong> companies and sectors is the endeavour<br />

to achieve high quality. It is seen not only as the<br />

proverbial <strong>Schulthess</strong> product quality, but is considered<br />

as the maxim for acting for the work of each individual.<br />

The company will therefore also implement certification<br />

in quality management in accordance with ISO 9001.<br />

6. Consistent environmental protection<br />

Within the scope of its overall activity the <strong>Schulthess</strong><br />

<strong>Group</strong> makes an active contribution towards environmental<br />

protection. Both the production and disposal<br />

processes, as well as its products, of course, comply<br />

with the latest ecological requirements. By fulfilling ISO<br />

norm 14001, the <strong>Schulthess</strong> <strong>Group</strong> wants to prove the<br />

high quality of its environmental management.<br />

7. Clear declaration of loyalty to Switzerland<br />

The <strong>Schulthess</strong> <strong>Group</strong> declares its loyalty to the production<br />

location Switzerland because here it can count on<br />

more than averagely motivated, flexible and willing employees.<br />

In addition, it profits from the high level of<br />

education which is decisive for the excellent quality of<br />

products and services.<br />

8. On course for profit<br />

Over the past few years, the <strong>Schulthess</strong> <strong>Group</strong> has continuously<br />

increased the profit. With its growth and niche<br />

strategy, its active utilisation of synergies and the launching<br />

of new products, it wants to increase profitability<br />

even further and create additional added value for its<br />

employees and shareholders.

Production philosophy<br />

<strong>Schulthess</strong> endeavours to achieve the greatest possible<br />

flexibility, productivity, quality and readiness for delivery in<br />

keeping with the market in its production of washing<br />

machines and dryers.<br />

Thanks to just-in-time production, <strong>Schulthess</strong> is in a position<br />

to meet these requirements optimally. Goods are produced<br />

on principle only to order. The sequences and working<br />

times in production are in accordance with the orders<br />

received. The production of parts in the island principle<br />

manufactures those components which are directly required<br />

in each case to meet orders. Accordingly, the finished product<br />

stores are limited to products which are directly awaiting<br />

delivery. The stocks of material for production are also<br />

kept to a minimum.<br />

A further prerequisite for the greatest possible productivity<br />

is the “same part” philosophy. The objective is to employ<br />

the same components in as many products as possible.<br />

<strong>Schulthess</strong> products are designed on a modular basis in a<br />

construction kit form. This system is not only of importance<br />

for economic viability, but also considerably simplifies the<br />

whole after-sales service work.<br />

Products<br />

The <strong>Schulthess</strong> <strong>Group</strong> develops, manufactures and sells<br />

washing machines and dryers for three customer segments.<br />

The household segment, which is the largest in terms of<br />

both volume and sales, comprises washing machines and<br />

tumble-dryers for individual and shared used in single and<br />

28<br />

The manufacture of each individual product is, of course,<br />

accompanied by a comprehensive system of quality checks.<br />

<strong>Schulthess</strong> has delegated the responsibility for quality during<br />

the production process to the respective production<br />

islands so that quality faults can be prevented already in<br />

the part production. At the end of the chain, each appliance<br />

and each machine is subjected to an exact operating and<br />

final check.<br />

The level of training and the readiness for action of the employees<br />

at all levels are decisive for the high quality. With<br />

internal training courses, as well as with experience and<br />

co-ordination groups it is ensured that the <strong>Schulthess</strong> employees<br />

can fulfil their tasks in an optimum manner.<br />

<strong>Schulthess</strong> does its part for the new recruits with the annual<br />

training of a large number of commercial or technical apprentices.<br />

multi-family homes. The company’s medium-sized light<br />

commercial products are designed for use by small<br />

commercial operations. The industrial segment<br />

manufactures washer-extractors and dryers for hotels,<br />

residential homes and hospitals.

Washing machines Tumble-dryers<br />

Household Single homes 5 kg Spirit 5150 Spirit TC 5350 air condenser system<br />

Spirit 5060 Spirit TC 5300 air condenser system<br />

Spirit 5000 Spirit T 5250 air exhaust<br />

Spirit T 5200 air exhaust<br />

Trophy WL Trophy TC<br />

Multi-family homes 6 kg Spirit topline 6150 Spirit topline TC 6350 water<br />

condenser system<br />

Spirit topline T 6250 air exhaust<br />

5 kg Spirit topline 5650 Utilization of the 6-kg tumble-dryer<br />

Small commercial 6 kg Spirit topline 6150 Spirit topline TC 6350 water<br />

operations condenser system<br />

Spirit topline T 6250 air exhaust<br />

7.5 kg Spirit topline 7500<br />

9.0 kg Spirit topline 9000<br />

Washer-extractors Commercial dryers Mangles<br />

Industrial 10 kg WSI 100 TI 250 MS 20 / 100<br />

12.5 kg WSI 125 MS 30 / 140, MS 30 / 180<br />

15 kg WSI 150 TI 375 MS 50 / 180, MS 50 / 210<br />

20 kg WSI 200 TI 500 MS 60 / 180, MS 60 / 210<br />

25 kg WSI 250 M 350–2/2700, M 500–2/3000<br />

30 kg WSI 300 TI 750<br />

29

The <strong>Schulthess</strong> <strong>Group</strong>’s objectives<br />

1. Expansion of the strong market position in Switzerland<br />

• Expansion of the niche range Spirit topline by the washing machines 7500 and<br />

9000 and the laundry dryer 9000<br />

• Further rationalization measures and investments in production in order to<br />

implement automated manufacture in sheet metal machining<br />

• Enlargement of the after-sales services to include a Full Service organisation and a<br />

multi-brand service<br />

• Further expansion of the heating technology and air conditioning/ventilation sectors<br />

2. Opening up of further export markets with <strong>Schulthess</strong> agencies and private label<br />

co-operation agreements<br />

• Expansion of the network of <strong>Schulthess</strong> agencies, especially in Germany, Belgium,<br />

Italy and in Eastern European countries<br />

• Exploitation of further private label distribution partnerships, in particular in the<br />

European area<br />

3. External growth<br />

• Introduction of co-operation agreements with appropriate partner companies in the<br />

field of semi-professional and commercial laundry machines<br />

• Market launch of joint-venture products in European markets and overseas.<br />

• Expansion of the range produced in China through new products.<br />

• Continuation of the acquisition policy adopted.<br />

30

<strong>Key</strong> <strong>figures</strong> at a glance<br />

1995–1999<br />

Income statement (in CHF million) 1999 1998 1997 1996 1995<br />

Sales 124.587 114.408 117.025 116.344 112.445<br />

Operating cash flow EBITDA 18.398 17.089 12.655 10.971 7.910<br />

as % of sales 14.8 14.9 10.8 9.4 7.0<br />

Operating profit EBIT 14.741 12.901 8.642 6.503 3.886<br />

as % of sales 11.8 11.3 7.4 5.6 3.5<br />

Net profit 10.346 10.136 5.481 3.672 2.017<br />

as % of sales 8.3 8.9 4.7 3.2 1.8<br />

Balance sheet (in CHF million) 1999 1998 1997 1996 1995<br />

Total liabilities and<br />

shareholders’ equity 104.698 93.829 83.982 88.685 92.049<br />

Shareholders’ equity 47.707 40.551 17.612 14.100 10.402<br />

Equity ratio (in %) 45.6 43.2 21.0 15.9 11.3<br />

Capital investments<br />

as % of operating cash flow<br />

5.965 4.605 5.871 4.079 3.328<br />

EBITDA 32.4 26.9 46.4 37.2 42.1<br />

Staff 1999 1998 1997 1996 1995<br />

Number of employees 480 448 471 522 538<br />

Sales per employee 259,556 255,375 248,461 222,881 209,006<br />

Gross profit per employee 161,415 158,926 149,928 132,703 125,569<br />

33

Information for investors<br />

Capital structure<br />

The share capital is CHF 8,500,000 and is divided into<br />

212,500 registered shares with a par value of CHF 40 each.<br />

Listing<br />

All <strong>Schulthess</strong> <strong>Group</strong> shares are listed on Swiss Exchange.<br />

Corporate financing<br />

Regular operating investments are to be financed from<br />

current cash flow, but as a rule this is not to involve the use<br />

of more than 50% of current cash flow.<br />

Distribution of profits<br />

The company has a profit-related dividend policy.<br />

Shareholding restrictions<br />

The percentage of voting rights held by each shareholder is<br />

limited to 5% of the total number of shares reported in the<br />

commercial register. An exception to this rule are so-called<br />

“grandfathers”, shareholders who held shares in the<br />

<strong>Schulthess</strong> <strong>Group</strong> prior to the initial public offering. Ownership<br />

of shares by foreign investors is not subject to any<br />

limitation.<br />

Opting out<br />

The company has neither opting-out nor opting up clause.<br />

36<br />

Major shareholders<br />

The following shareholders own more than 5% of the<br />

registered shares (31.12.99):<br />

Rudolf Kägi 11.52%<br />

Power Re. Ltd. 10.13 %<br />

Barbara Rutz 9.48%<br />

Other members of the Rutz family (total) 13.27%*<br />

Andrea Malär 5.75%<br />

* No individuals with more than 5%<br />

Stock option plan<br />

The company is planning to introduce a management<br />

incentive programme in the medium term.<br />

Remuneration of directors<br />

In 1999, members of the Board of Directors of <strong>Schulthess</strong><br />

<strong>Group</strong> AG together received a total of CHF 210,000 to defray<br />

their expenses.<br />

Investor Relations<br />

Max M. Müller<br />

Chief Financial Officer<br />

<strong>Schulthess</strong> <strong>Group</strong> AG<br />

Landstrasse 37<br />

CH-8633 Wolfhausen<br />

Switzerland<br />

Tel. ++41 (0)55 253 51 11<br />

Fax ++41 (0)55 253 54 80<br />

E-mail direktion@schulthess-group.com<br />

Coming events<br />

April 11, 2000: Annual General Meeting in Wolfhausen ZH,<br />

Switzerland<br />

August 8, 2000: Publication of 2000 Semi-Annual Report

Share statistics<br />

<strong>Schulthess</strong> registereds at CHF 40 nominal<br />

Security ID number: 253 887<br />

Number of shares<br />

31.12.1999<br />

212,500<br />

Closing price (in CHF) 489<br />

High/low (in CHF) 489/369<br />

Dividend (in CHF)* 16.00<br />

Share capital (in CHF million) 8.500<br />

Market capitalization (in CHF million) 103.913<br />

*Motion to be put to 2000 AGM<br />

<strong>Key</strong> <strong>figures</strong> per share<br />

Net earnings per share (in CHF)<br />

31.12.1999<br />

48.69<br />

Price/earning ratio 10.04<br />

EBITDA per share (in CHF) 86.58<br />

Price/EBITDA ratio 5.65<br />

Consolidated equity capital (in CHF million) 47.707<br />

Consolidated equity capital per share (in CHF) 224.50<br />

Price/equity ratio 2.18<br />

Return on equity (in %) 23.44<br />

37<br />

Comparative performance of <strong>Schulthess</strong> shares<br />

(up to February 2000)<br />

600<br />

550<br />

500<br />

450<br />

400<br />

350<br />

Jan. Feb. Mar. April<br />

May<br />

June<br />

July<br />

Sept.<br />

Further information<br />

You can find out the latest share price and further<br />

information on the company and its business performance<br />

at www.schulthess-group.com.<br />

Aug.<br />

Swiss Performance Index (SPI)<br />

<strong>Schulthess</strong> <strong>Group</strong><br />

Oct.<br />

Nov.<br />

Dec.<br />

Jan.<br />

Feb.

Board and Management<br />

<strong>Schulthess</strong><br />

Maschinen AG<br />

Wolfhausen<br />

Manager<br />

Rudolf Kägi<br />

Board<br />

Rudolf Kägi, Chairman/Delegate<br />

Dr. Peter R. Isler, Vice-chairman<br />

Attorney-at-law, partner in the Zurich law office<br />

Niederer Kraft & Frey, member of the board of<br />

Bank Leu AG, Industrieholding Cham AG and Kardex AG<br />

Prof. Dr. Christian Belz, member<br />

Professor of Marketing and Director of the Research<br />

Institute for Selling and Commerce at the University of<br />

St. Gallen (HSG), member of the board of Jelmoli Holding AG,<br />

Unilever (Switzerland) AG and WRH Walter Reist Holding AG<br />

Andrea Malär, member<br />

Management consultant<br />

Merker AG<br />

Baden-Dättwil<br />

Manager<br />

Hans-Jürg Schwendener<br />

Paul O. Rutz, member<br />

Chairman of the Board of Compagnie Grainière SA<br />

Board<br />

Chairman/Delegate<br />

Rudolf Kägi<br />

Vice-chairman<br />

Dr. Peter R. Isler<br />

Novelan AG<br />

Dällikon<br />

CEO<br />

Rudolf Kägi<br />

CFO<br />

Max M. Müller<br />

Manager<br />

Fritz W. Bischofberger<br />

40<br />

Members<br />

Prof. Dr. Christian Belz<br />

Andrea Malär<br />

Paul O. Rutz<br />

Querop Handels AG<br />

Baden-Dättwil<br />

Manager<br />

Roberto Persici<br />

Management<br />

Rudolf Kägi, DOB 1941<br />

Chief Executive Officer<br />

Max M. Müller, DOB 1962<br />

Chief Financial Officer<br />

<strong>Schulthess</strong><br />

Maschinen GmbH, Vienna<br />

Manager<br />

Heinz Cibulka

Milestones<br />

1999 Takeover of Novelan AG, Dällikon<br />

Commencement of production in the Wuxi Little Swan-<strong>Schulthess</strong> joint venture<br />

1998 Opening of the <strong>Schulthess</strong> <strong>Group</strong> to the public<br />

Founding of the joint venture with the Wuxi Little Swan Company (China)<br />

1997 Forming of the <strong>Schulthess</strong> <strong>Group</strong> AG as the holding for <strong>Schulthess</strong> companies<br />

1996 150 th anniversary and renaming of the Maschinenfabrik <strong>Schulthess</strong> AG<br />

into <strong>Schulthess</strong> Maschinen AG<br />

1995 Hiving off of the Maschinenfabrik Hildebrand AG, Asdorf<br />

1994 Introduction of flow production (just-in-time production)<br />

1994 Co-operation agreement with the German Böwe Passat GmbH company<br />

1991 Takeover of Merker AG, Baden<br />

1988/89 Formation of the <strong>Schulthess</strong> <strong>Group</strong> from the Maschinenfabrik <strong>Schulthess</strong> AG,<br />

Querop Handels AG and Hildebrand AG<br />

1988 Separation from the family shareholders group by a management buyout<br />

1987 Launch of the first washing machines with microprocessor control<br />

1951 Production of Europe's first household washing machines<br />

1949 Invention of punched-card controls for washing machines<br />

1943 Transformation of the former general partnership into joint-stock company<br />

1937 Move into factory buildings in Wolfhausen, Canton of Zurich<br />

1904 Manufacture of the first washing appliance<br />

1890 Takeover of Ornamentfabrik Künzli & Co. in Zurich<br />

1845 Founding of the Bauspenglerei Kaspar <strong>Schulthess</strong> in Zurich<br />

41

<strong>Schulthess</strong> <strong>Group</strong> companies<br />

<strong>Schulthess</strong> <strong>Group</strong> AG<br />

Landstrasse 37<br />

CH-8633 Wolfhausen<br />

Switzerland<br />

Tel. ++41 (0)55 253 51 11<br />

Fax ++41 (0)55 253 54 80<br />

E-mail direktion@schulthess-group.com<br />

www.schulthess-group.com<br />

<strong>Schulthess</strong> Maschinen AG<br />

Landstrasse 37<br />

CH-8633 Wolfhausen<br />

Switzerland<br />

Tel. ++41 (0)55 253 51 11<br />

Fax ++41 (0)55 253 54 70<br />

E-mail sales.ch@schulthess-maschinen.com<br />

www.schulthess-maschinen.com<br />

Merker AG<br />

Täfernstrasse 4<br />

CH-5405 Baden-Dättwil<br />

Switzerland<br />

Tel. ++41 (0)56 200 71 71<br />

Fax ++41 (0)56 200 72 22<br />

E-mail info@merker.ch<br />

www.merker.ch<br />

42<br />

Novelan AG<br />

Buchserstr. 31<br />

CH-8108 Dällikon<br />

Tel. ++41 (0)1 847 48 11<br />

Fax ++41 (0)1 847 48 10<br />

Querop Handels AG<br />

Täfernstrasse 4<br />

CH-5405 Baden-Dättwil<br />

Switzerland<br />

Tel. ++41 (0)56 200 73 73<br />

Fax ++41 (0)56 200 73 00<br />

<strong>Schulthess</strong> Maschinen GmbH Österreich<br />

Hetzendorferstr. 191<br />

A-1130 Vienna<br />

Austria<br />

Tel. ++43 (0)1 803 98 00 20<br />

Fax ++43 (0)1 803 98 00 30<br />

Wuxi Little Swan-<strong>Schulthess</strong> Washing Machinery Co. Ltd.<br />

67 Huiqian Road, Wuxi<br />

Jiangsu China 214035<br />

Tel. ++86 510 3704 003 2185<br />

Fax ++86 510 3703 143

<strong>Schulthess</strong> Maschinen AG<br />

<strong>Schulthess</strong> Maschinen AG, Wolfhausen, develops, produces<br />

and markets washing machines and dryers under<br />

its own name <strong>Schulthess</strong> for the household, small businesses<br />

and commerce. In addition, in co-operation with<br />

leading undertakings, such as Electrolux and Siemens,<br />

and export sales partners, it manufactures appliances<br />

in the semi-professional range. In the commercial sector,<br />

there are co-operation agreements with German<br />

companies for wet cleaning and commercial machines.<br />

The <strong>Schulthess</strong> Maschinen AG’s products are marketed<br />

in Switzerland and in European countries in direct sales<br />

and through the trade. The After Sales Service Switzerland<br />

organization operates from three regional aftersales<br />

service centres and five further branches.<br />

Merker AG<br />

Merker AG, located in Baden-Dättwil, trades in washing<br />

machines, dryers and dishwashers marketed under the<br />

Merker brand. They concentrate on direct sales to a<br />

professional clientele, such as property administrators,<br />

building co-operatives, general contractors or architects.<br />

Its washing machines and tumblers produced by<br />

<strong>Schulthess</strong> are used in multi-dwelling and single-family<br />

houses. Merker and <strong>Schulthess</strong> act jointly in after-sales<br />

service.<br />

Novelan AG<br />

The Novelan AG company, which has its head office in<br />

Dällikon (Canton of Zurich) and was acquired by the<br />

<strong>Schulthess</strong> <strong>Group</strong> in 1999, is active mainly in the<br />

marketing and servicing of large electrical appliances<br />

for the household (washing machines, tumblers, refrigerators<br />

and freezers). It supplies both a professional<br />

clientele in the real property sector and the trade. As a<br />

service company active nationwide, it makes its mark<br />

with a multi-brand policy. Further fields of activity of<br />

the company are heating technology and airconditioning/ventilation<br />

technology.<br />

Querop Handels AG<br />

The Querop Handels AG company domiciled in Baden-<br />

Dättwil supplies hypermarkets and the specialist trade<br />

in Switzerland with large electrical appliances for the<br />

household. It sells a part of its range under its own<br />

brand name Querop and as an importer represents<br />

well-known foreign makes, such as Ariston or Indesit<br />

from the Italian Merloni <strong>Group</strong>.<br />

<strong>Schulthess</strong> Maschinen GmbH Austria<br />

<strong>Schulthess</strong> Maschinen GmbH markets the washing<br />

machines, dryers and commercial machines produced<br />

in Switzerland in the large Austrian federal states (the<br />

other federal states are canvassed by its marketing<br />

partners). In particular it serves the semi-professional<br />

and professional laundry markets and it has an efficient<br />

after-sales service organization.<br />

Wuxi Little Swan-<strong>Schulthess</strong><br />

Washing Machinery Co. Ltd.<br />

Wuxi Little Swan-<strong>Schulthess</strong> Washing Machinery Co.<br />

Ltd. develops, produces and markets washing extractors<br />

and commercial dryers for the rapidly growing<br />

Chinese and adjoining Asian markets. It is 25 per cent<br />

owned by the <strong>Schulthess</strong> <strong>Group</strong>. The other 75 per cent<br />

of the share capital is held by Wuxi Little Swan, China’s<br />

leading household appliance manufacturer.

<strong>Schulthess</strong> <strong>Group</strong> AG<br />

Landstrasse 37<br />

CH-8633 Wolfhausen<br />

Tel. ++41 (0) 55 253 51 11<br />

Fax ++41 (0) 55 253 54 80<br />

e-mail direktion@schulthess-group.com<br />

www.schulthess-group.com<br />

Conception and editing:<br />

Wirz Investor Relations AG, Zurich<br />

Design and setting:<br />

Giger&Partner, Zurich<br />

Translation:<br />

bmp translations, Basle/Zurich<br />

Photos:<br />

Ursula Markus, Zurich<br />

<strong>Schulthess</strong> Maschinen AG<br />

Lithos and printing:<br />

Druckerei Feldegg AG, Zollikerberg<br />

This report also appears in English.<br />

3.2000.500.e