- Page 1 and 2: CalWORKs Policy Handbook San Bernar

- Page 3 and 4: INTERIM INSTRUCTION NOTICE #13-021,

- Page 5 and 6: INTERIM INSTRUCTION NOTICE #13-019,

- Page 7 and 8: INTERIM INSTRUCTION NOTICE #13-007,

- Page 9 and 10: Interim Instruction Notice #13-007,

- Page 11 and 12: INTERIM INSTRUCTION NOTICE #13-005,

- Page 13 and 14: County of San Bernardino Human Serv

- Page 15 and 16: C-IV Implementation: Phase One Intr

- Page 17 and 18: C-IV Implementation: Phase One, Con

- Page 19 and 20: C-IV Implementation: Phase One, Con

- Page 21 and 22: C-IV Implementation: Phase One, Con

- Page 23 and 24: Reporting Requirements Introduction

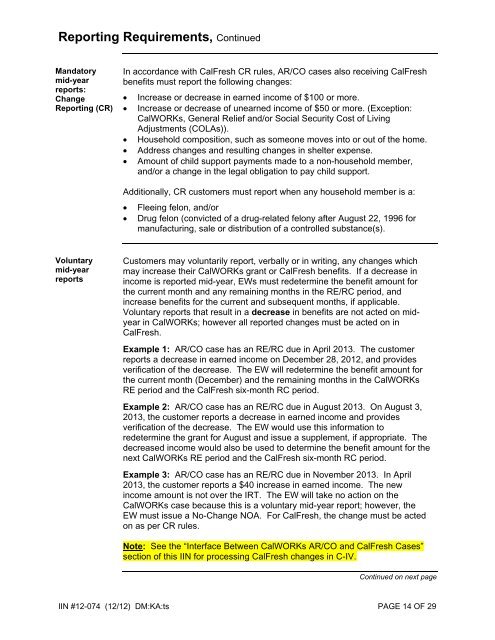

- Page 25: Reporting Requirements, Continued M

- Page 29 and 30: Income Budgeting Prospective budget

- Page 31 and 32: Income Budgeting, Continued Income

- Page 33 and 34: Income Budgeting, Continued Excess

- Page 35 and 36: Interface Between CalWORKs AR/CO an

- Page 37 and 38: Case Movement Case movement between

- Page 39 and 40: Case Movement, Continued Time Limit

- Page 41 and 42: Conversion, Continued Forms The fol

- Page 43 and 44: INTERIM INSTRUCTION NOTICE #12-057,

- Page 45 and 46: Login Authorized users that have be

- Page 47 and 48: To perform a match search, type in

- Page 49 and 50: POP Tracking Sheet EW Name EW File

- Page 51 and 52: INTERIM INSTRUCTION NOTICE #12-053,

- Page 53 and 54: INTERIM INSTRUCTION NOTICE #12-053,

- Page 55 and 56: INTERIM INSTRUCTION NOTICE #12-053,

- Page 57 and 58: INTERIM INSTRUCTION NOTICE #12-053,

- Page 59 and 60: County of San Bernardino Human Serv

- Page 61 and 62: INTERIM INSTRUCTION NOTICE #12-036,

- Page 63 and 64: INTERIM INSTRUCTION NOTICE #12-036,

- Page 65 and 66: INTERIM INSTRUCTION NOTICE #12-021,

- Page 67 and 68: Table of Contents CalWORKs POLICY H

- Page 69 and 70: Table of Contents, Continued Divers

- Page 71 and 72: INTERIM INSTRUCTION NOTICE #13-025,

- Page 73 and 74: INTERIM INSTRUCTION NOTICE #13-025,

- Page 75 and 76: INTERIM INSTRUCTION NOTICE #12-062,

- Page 77 and 78:

County of San Bernardino Human Serv

- Page 79 and 80:

INTERIM INSTRUCTION NOTICE #12-049

- Page 81 and 82:

Overview Application/Re-Evaluation/

- Page 83 and 84:

Application Overview Introduction T

- Page 85 and 86:

Application Overview, Continued Sta

- Page 87 and 88:

Application Overview, Continued The

- Page 89 and 90:

Advance Eligibility Determination P

- Page 91 and 92:

Advance Eligibility Determination P

- Page 93 and 94:

Advance Eligibility Determination P

- Page 95 and 96:

C4Yourself e-Application, Continued

- Page 97 and 98:

Obtaining and Evaluating Evidence I

- Page 99 and 100:

Application Processing Time Frames,

- Page 101 and 102:

CalWORKs Denial - Medi-Cal Applicat

- Page 103 and 104:

Rescind of Denial Introduction Ther

- Page 105 and 106:

Social Security Number (SSN), Conti

- Page 107 and 108:

Beginning Date of Aid (BDA) for New

- Page 109 and 110:

Immediate Need (IN) Introduction Im

- Page 111 and 112:

Immediate Need (IN), Continued IN p

- Page 113 and 114:

Immediate Need (IN), Continued IN t

- Page 115 and 116:

Restoration of Eligibility and Bene

- Page 117 and 118:

Restoration of Eligibility and Bene

- Page 119 and 120:

Restoration of Eligibility and Bene

- Page 121 and 122:

Restoration of Eligibility and Bene

- Page 123 and 124:

Restoration of Eligibility and Bene

- Page 125 and 126:

Foster Care (FC) - Miller vs. Youak

- Page 127 and 128:

Foster Care (FC) - Miller vs. Youak

- Page 129 and 130:

Dependents/Wards of the Court, Cont

- Page 131 and 132:

Extended CalWORKs for Young Adults

- Page 133 and 134:

Extended CalWORKs for Young Adults,

- Page 135 and 136:

Extended CalWORKs for Young Adults,

- Page 137 and 138:

Re-Evaluations (REs): Basic Informa

- Page 139 and 140:

Re-Evaluation (RE) Procedure, Conti

- Page 141 and 142:

Setting Re-Evaluation (RE) Dates In

- Page 143 and 144:

Setting Re-Evaluation (RE) Dates, C

- Page 145 and 146:

Add Person Introduction This sectio

- Page 147 and 148:

Beginning Date of Aid (BDA) for Add

- Page 149 and 150:

Beginning Date of Aid (BDA) Example

- Page 151 and 152:

Beginning Date of Aid (BDA) Example

- Page 153 and 154:

Beginning Date of Aid (BDA) Chart,

- Page 155 and 156:

Add Person Results in Ineligibility

- Page 157 and 158:

Add Person Results in Ineligibility

- Page 159 and 160:

Add Person Results in Ineligibility

- Page 161 and 162:

Rules for Newborns, Continued Newbo

- Page 163 and 164:

Unborn/Pregnancy Special Needs (PSN

- Page 165 and 166:

Change of Payee Introduction This s

- Page 167 and 168:

Overview Domestic Abuse Introductio

- Page 169 and 170:

Domestic Abuse: Program Information

- Page 171 and 172:

Domestic Abuse: Program Information

- Page 173 and 174:

Safe At Home Program Introduction T

- Page 175 and 176:

Service Providers Introduction This

- Page 177 and 178:

Basic Diversion Information Introdu

- Page 179 and 180:

Basic Diversion Information, Contin

- Page 181 and 182:

The Diversion Process Introduction

- Page 183 and 184:

Making the Diversion Decision: A Co

- Page 185 and 186:

Issuing Diversion: The Process Intr

- Page 187 and 188:

Diversion Issued via Warrant/EBT In

- Page 189 and 190:

Secondary Diversion Introduction Th

- Page 191 and 192:

The Impact of Diversion on Time Lim

- Page 193 and 194:

When a Diversion Recipient Reapplie

- Page 195 and 196:

Overview Statewide Finger Imaging S

- Page 197 and 198:

Statewide Finger Imaging System (SF

- Page 199 and 200:

Statewide Finger Imaging System (SF

- Page 201 and 202:

Statewide Finger Imaging System (SF

- Page 203 and 204:

Statewide Finger Imaging System (SF

- Page 205 and 206:

Statewide Finger Imaging System (SF

- Page 207 and 208:

Table of Contents CalWORKs POLICY H

- Page 209 and 210:

Overview Deprivation Introduction D

- Page 211 and 212:

Death Deprivation Introduction This

- Page 213 and 214:

Incapacity Deprivation, Continued D

- Page 215 and 216:

Unemployment Deprivation Introducti

- Page 217 and 218:

Unemployment Deprivation, Continued

- Page 219 and 220:

Absence Deprivation, Continued Exam

- Page 221 and 222:

Absence Deprivation for Unborns and

- Page 223 and 224:

Overview Child Support Requirements

- Page 225 and 226:

Child Support Requirements, Continu

- Page 227 and 228:

Child Support Good Cause Procedures

- Page 229 and 230:

Child Support Good Cause Procedures

- Page 231 and 232:

Child Support Non-Cooperation Intro

- Page 233 and 234:

Child Support Non-Cooperation, Cont

- Page 235 and 236:

Child Support Voluntary Declaration

- Page 237 and 238:

Child Support Unmarried Father (UMF

- Page 239 and 240:

Child Support Services Referral Pro

- Page 241 and 242:

Child Support Services Referral Pro

- Page 243 and 244:

Child Support Services Referral Pro

- Page 245 and 246:

Overview Assistance Unit/Responsibl

- Page 247 and 248:

Caretaker Relatives: Required Relat

- Page 249 and 250:

Proof of Relationship Introduction

- Page 251 and 252:

Care and Control of a Child Introdu

- Page 253 and 254:

Nonparent Caretaker Relatives: Need

- Page 255 and 256:

Overview Assistance Unit Introducti

- Page 257 and 258:

Assistance Unit Basics, Continued M

- Page 259 and 260:

Assistance Unit (AU) Members Introd

- Page 261 and 262:

Assistance Unit (AU) Members, Conti

- Page 263 and 264:

Non-AU Members Introduction Non-AU

- Page 265 and 266:

Excluded Members Introduction Exclu

- Page 267 and 268:

Non-persons Introduction Non-person

- Page 269 and 270:

Non-persons, Continued Wraparound T

- Page 271 and 272:

California Registered Domestic Part

- Page 273 and 274:

Overview Temporary Absence Introduc

- Page 275 and 276:

Temporary Absence: Exceptions to th

- Page 277 and 278:

Examples of Temporary Absence Intro

- Page 279 and 280:

Table of Contents CalWORKs POLICY H

- Page 281 and 282:

Table of Contents, Continued The Ca

- Page 283 and 284:

Transition Process Overview This se

- Page 285 and 286:

Case Management Vendors Overview Th

- Page 287 and 288:

The Cal-Learn Program Overview This

- Page 289 and 290:

The Cal-Learn Program, Continued Ca

- Page 291 and 292:

Cal-Learn Registration Overview Thi

- Page 293 and 294:

Cal-Learn Participation Overview Th

- Page 295 and 296:

Cal-Learn Participation, Continued

- Page 297 and 298:

Cal-Learn Supportive Services, Cont

- Page 299 and 300:

Cal-Learn Supportive Services, Cont

- Page 301 and 302:

Cal-Learn Supportive Services, Cont

- Page 303 and 304:

Cal-Learn Supportive Services, Cont

- Page 305 and 306:

Cal-Learn Supportive Services, Cont

- Page 307 and 308:

Bonuses and Penalties Overview This

- Page 309 and 310:

Bonuses and Penalties, Continued Au

- Page 311 and 312:

Bonuses and Penalties, Continued Ho

- Page 313 and 314:

Ending Cal-Learn Participation, Con

- Page 315 and 316:

INTERIM INSTRUCTION NOTICE #12-037,

- Page 317 and 318:

INTERIM INSTRUCTION NOTICE #11-032

- Page 319 and 320:

INTERIM INSTRUCTION NOTICE #11-032

- Page 321 and 322:

INTERIM INSTRUCTION NOTICE #11-032

- Page 323 and 324:

Overview, Continued Contents (conti

- Page 325 and 326:

Proof of Child’s Age Introduction

- Page 327 and 328:

Verifying a Child’s Age Introduct

- Page 329 and 330:

Eligibility Requirements: 18 Year-O

- Page 331 and 332:

18 Year-Olds with Disabilities, Con

- Page 333 and 334:

18 Year-Olds with Disabilities, Con

- Page 335 and 336:

Maximum Family Grant (MFG): Overvie

- Page 337 and 338:

MFG: Applying the MFG Rule and Exem

- Page 339 and 340:

MFG Determinations - Examples of Fa

- Page 341 and 342:

MFG: Eligibility Requirements Intro

- Page 343 and 344:

MFG Child Only AU Introduction This

- Page 345 and 346:

Immunizations Introduction This sec

- Page 347 and 348:

Verification of Immunization: The F

- Page 349 and 350:

Verification of Immunization: Ongoi

- Page 351 and 352:

Imposing the Immunization Penalty I

- Page 353 and 354:

School Attendance: Overview and Def

- Page 355 and 356:

School Attendance: Rules Introducti

- Page 357 and 358:

School Attendance: Verification Int

- Page 359 and 360:

School Attendance: Penalty Introduc

- Page 361 and 362:

School Attendance: Imposing the Pen

- Page 363 and 364:

Minor Parents Introduction This sec

- Page 365 and 366:

Forms: Minor Parent in an Acceptabl

- Page 367 and 368:

Exemptions from the Acceptable Livi

- Page 369 and 370:

Minors Living Independently Introdu

- Page 371 and 372:

Children and Family Services (CFS)

- Page 373 and 374:

Summary: Examples of Required Forms

- Page 375 and 376:

Completing Casework after the CFS R

- Page 377 and 378:

When the Second Parent of the Minor

- Page 379 and 380:

Teens Turning 18 Years Old - Seamle

- Page 381 and 382:

Teens Turning 18 Years Old - Seamle

- Page 383 and 384:

Teens Turning 18 Years Old - Seamle

- Page 385 and 386:

The Cal-Learn Program Introduction

- Page 387 and 388:

The Cal-Learn Program, Continued Wh

- Page 389 and 390:

Cal-Learn Referral Procedures Intro

- Page 391 and 392:

Cal-Learn Registration Introduction

- Page 393 and 394:

Beginning Cal-Learn Participation,

- Page 395 and 396:

Cal-Learn Supportive Services Intro

- Page 397 and 398:

Cal-Learn Supportive Services, Cont

- Page 399 and 400:

Cal-Learn Supportive Services, Cont

- Page 401 and 402:

Cal-Learn Supportive Services, Cont

- Page 403 and 404:

Cal-Learn Supportive Services, Cont

- Page 405 and 406:

Cal-Learn Supportive Services, Cont

- Page 407 and 408:

Cal-Learn Bonuses and Penalties, Co

- Page 409 and 410:

Cal-Learn Penalty Introduction This

- Page 411 and 412:

Ending Cal-Learn Participation Intr

- Page 413 and 414:

Overview Residency Introduction Thi

- Page 415 and 416:

Basic Residency Requirements, Conti

- Page 417 and 418:

When Families Move, Continued How e

- Page 419 and 420:

Absence from California, Continued

- Page 421 and 422:

Contacting Other Counties or States

- Page 423 and 424:

Contacting Other Counties or States

- Page 425 and 426:

Establishing a Mailing Address Intr

- Page 427 and 428:

Homecall and Special Investigation

- Page 429 and 430:

Table of Contents CalWORKs POLICY H

- Page 431 and 432:

Table of Contents, Continued Jay Tr

- Page 433 and 434:

Citizens Introduction Most recipien

- Page 435 and 436:

Notes about the HS 623 (E/S) Proces

- Page 437 and 438:

Federal Deficit Reduction Act Intro

- Page 439 and 440:

Federal Deficit Reduction Act, Cont

- Page 441 and 442:

Federal Deficit Reduction Act, Cont

- Page 443 and 444:

Federal Deficit Reduction Act, Cont

- Page 445 and 446:

Child Citizenship Act of 2000, Cont

- Page 447 and 448:

Noncitizen Eligibility Identifying

- Page 449 and 450:

Noncitizen Status Verification Requ

- Page 451 and 452:

Funding the CalWORKs Grant Noncitiz

- Page 453 and 454:

S/O Exception: Veterans or Active D

- Page 455 and 456:

Combining Work Quarters Sharing cou

- Page 457 and 458:

Non-countable Work Quarters Quarter

- Page 459 and 460:

How the SSA Calculates Quarters Int

- Page 461 and 462:

S/O Exception: Cuban and Haitian Im

- Page 463 and 464:

S/O Exception: Withheld Deportation

- Page 465 and 466:

Afghan and Iraqi Special Immigrants

- Page 467 and 468:

Afghan and Iraqi Special Immigrants

- Page 469 and 470:

Noncitizens: Aid Categories and MED

- Page 471 and 472:

Identifying Refugees How to identif

- Page 473 and 474:

RCA for Unaccompanied Minor Refugee

- Page 475 and 476:

RCA: Refugees Not Linked to CalWORK

- Page 477 and 478:

Refugee Help from Other Agencies Ru

- Page 479 and 480:

Voluntary Agency (VOLAG) List Names

- Page 481 and 482:

Sponsored Noncitizens - Overview, C

- Page 483 and 484:

Sponsored Noncitizens - Determining

- Page 485 and 486:

Sponsored Noncitizens - Determining

- Page 487 and 488:

Sponsored Noncitizens - Exemptions

- Page 489 and 490:

Battered Noncitizens Overview Certa

- Page 491 and 492:

Noncitizen Victims of Human Traffic

- Page 493 and 494:

Noncitizen Victims of Human Traffic

- Page 495 and 496:

Noncitizen Victims of Human Traffic

- Page 497 and 498:

Noncitizen Child Victims of Human T

- Page 499 and 500:

Ineligible Noncitizens Ineligibilit

- Page 501 and 502:

Table of Contents CalWORKs POLICY H

- Page 503 and 504:

INTERIM INSTRUCTION NOTICE #12-075

- Page 505 and 506:

Young Child Exemptions (YCEs) Intro

- Page 507 and 508:

Young Child Exemptions (YCEs), Cont

- Page 509 and 510:

Reengagement Requirements, Continue

- Page 511 and 512:

Reengagement Requirements, Continue

- Page 513 and 514:

Young Child Exemption (YCE) Reengag

- Page 515 and 516:

WTW 2 - WTW Plan Activity Assignmen

- Page 517 and 518:

WTW 24-Month Time Clock, Continued

- Page 519 and 520:

WTW 24-Month Time Clock, Continued

- Page 521 and 522:

WTW 24-Month Time Clock, Continued

- Page 523 and 524:

Exempt Volunteers Introduction This

- Page 525 and 526:

Exemption Welfare-To-Work (WTW) 24-

- Page 527 and 528:

Overview Work Requirements Introduc

- Page 529 and 530:

Overview of Programs Introduction T

- Page 531 and 532:

Welfare-to-Work (WTW) Participation

- Page 533 and 534:

Welfare-to-Work (WTW) Participation

- Page 535 and 536:

Exemption Reasons Introduction This

- Page 537 and 538:

Exemption Reasons, Continued Exempt

- Page 539 and 540:

Exemption Reasons, Continued Care o

- Page 541 and 542:

Introduction to the Work Participat

- Page 543 and 544:

Initiating Participation Introducti

- Page 545 and 546:

Acting on Changes During Participat

- Page 547 and 548:

Sanctions, Continued Who is sanctio

- Page 549 and 550:

Sanction Procedures, Continued Sanc

- Page 551 and 552:

Other Actions Related to Sanctions

- Page 553 and 554:

Other Actions Related to Sanctions,

- Page 555 and 556:

Cooperation After a Sanction, Conti

- Page 557 and 558:

CIMC Registration Procedures Introd

- Page 559 and 560:

Table of Contents CalWORKs POLICY H

- Page 561 and 562:

Basic Resources Introduction This s

- Page 563 and 564:

Basic Resources, Continued Recordin

- Page 565 and 566:

Identifying Resources, Continued Ex

- Page 567 and 568:

Resource Table, Continued Resource

- Page 569 and 570:

Eligibility Determination Process I

- Page 571 and 572:

Motor Vehicle Value Determination,

- Page 573 and 574:

Motor Vehicle Value Determination,

- Page 575 and 576:

Real Estate Value Determination Int

- Page 577 and 578:

Lien Process Introduction If the cu

- Page 579 and 580:

Lien Process, Continued Lien proced

- Page 581 and 582:

Restricted Accounts Introduction Th

- Page 583 and 584:

Restricted Accounts, Continued Veri

- Page 585 and 586:

Retirement/Educational Accounts Int

- Page 587 and 588:

Overview Income Introduction Income

- Page 589 and 590:

Definitions and Terms, Continued In

- Page 591 and 592:

Income Treatment and Verification C

- Page 593 and 594:

Income Treatment and Verification C

- Page 595 and 596:

Income Treatment and Verification C

- Page 597 and 598:

Income Treatment and Verification C

- Page 599 and 600:

Income Treatment and Verification C

- Page 601 and 602:

Income Treatment and Verification C

- Page 603 and 604:

Availability of Child Support Incom

- Page 605 and 606:

Potentially Available Income County

- Page 607 and 608:

Potentially Available Income, Conti

- Page 609 and 610:

Veteran’s Affairs (VA) Benefits,

- Page 611 and 612:

Reasonably Anticipated Income, Cont

- Page 613 and 614:

Examples - Reasonably Anticipated I

- Page 615 and 616:

Earned Income Basics Gross pay or g

- Page 617 and 618:

Paid Work Experience (WEX) Introduc

- Page 619 and 620:

Self-employment, Continued Identify

- Page 621 and 622:

Roomer/Boarder and Self-employment

- Page 623 and 624:

Self-employment as a Child Care Pro

- Page 625 and 626:

Income In-Kind (IIK) Definition Inc

- Page 627 and 628:

Income In-Kind (IIK), Continued Nee

- Page 629 and 630:

Unrelated Adult Male (UAM), Continu

- Page 631 and 632:

Income from Property Income from pr

- Page 633 and 634:

Unemployment Insurance Benefits (UI

- Page 635 and 636:

Pensions Treatment of pension incom

- Page 637 and 638:

General Payroll Information and Exa

- Page 639 and 640:

General Payroll Information and Exa

- Page 641 and 642:

General Payroll Information and Exa

- Page 643 and 644:

General Payroll Information and Exa

- Page 645 and 646:

Table of Contents, Continued SECTIO

- Page 647 and 648:

Overview Reporting Introduction Thi

- Page 649 and 650:

Definitions and Terms Overview This

- Page 651 and 652:

Overview Section 2 Reporting Requir

- Page 653 and 654:

Quarterly Report (QR 7), Continued

- Page 655 and 656:

Overview Section 3 Quarterly Report

- Page 657 and 658:

Quarterly Report - The process Intr

- Page 659 and 660:

Other Required Forms Introduction T

- Page 661 and 662:

QR 7 Completeness Criteria Introduc

- Page 663 and 664:

QR 7 Completeness Criteria, Continu

- Page 665 and 666:

QR 7 - Request to Stop Benefits Int

- Page 667 and 668:

QR 7 Completeness - Part 1, Continu

- Page 669 and 670:

QR 7 Completeness - Part 2 Introduc

- Page 671 and 672:

QR 7 Completeness - Income Verifica

- Page 673 and 674:

QR 7 Completeness - Address Change

- Page 675 and 676:

Overview Section 5 Processing a Com

- Page 677 and 678:

Processing an Incomplete QR 7 Intro

- Page 679 and 680:

Processing an Incomplete QR 7, Cont

- Page 681 and 682:

Examples of a Complete QR 7 Introdu

- Page 683 and 684:

Examples of an Incomplete QR 7 Intr

- Page 685 and 686:

Good Cause Introduction A customer

- Page 687 and 688:

Overview Section 6 Mandatory Mid-qu

- Page 689 and 690:

Income Reporting Threshold (IRT) In

- Page 691 and 692:

Income Reporting Threshold (IRT), C

- Page 693 and 694:

Drug Felony Convictions, Fleeing Fe

- Page 695 and 696:

Reduction in ABAWD Work Hours Intro

- Page 697 and 698:

Voluntary Mid-quarter Reports Intro

- Page 699 and 700:

Changes in Income, Continued Requir

- Page 701 and 702:

Changes in Assistance Unit (AU)/Hou

- Page 703 and 704:

Overview Section 8 Annual Reporting

- Page 705 and 706:

Reporting Requirements, Continued M

- Page 707 and 708:

Reporting Requirements, Continued V

- Page 709 and 710:

Case Transition Introduction Under

- Page 711 and 712:

Table of Contents CalWORKs POLICY H

- Page 713 and 714:

Overview Special Needs Introduction

- Page 715 and 716:

Pregnancy Special Needs (PSN) - Bas

- Page 717 and 718:

Determining PSN Payment Time Frames

- Page 719 and 720:

PSN Examples Introduction This sect

- Page 721 and 722:

Overview Section 2 Recurring Specia

- Page 723 and 724:

Recurring Special Needs - Basics, C

- Page 725 and 726:

Determining Recurring Special Needs

- Page 727 and 728:

Overview Section 3 Nonrecurring Spe

- Page 729 and 730:

Nonrecurring Special Needs - Paymen

- Page 731 and 732:

Overview Section 4 Homeless Assista

- Page 733 and 734:

Homeless Assistance - Basics Introd

- Page 735 and 736:

Homeless Assistance - Basics, Conti

- Page 737 and 738:

Determining Homelessness - Examples

- Page 739 and 740:

Determining Homelessness - Examples

- Page 741 and 742:

Homeless Assistance Payment Indicat

- Page 743 and 744:

Once-in-a-lifetime, Continued Requi

- Page 745 and 746:

Temporary Homeless Assistance, Cont

- Page 747 and 748:

Homeless Management Information Sys

- Page 749 and 750:

Homeless Management Information Sys

- Page 751 and 752:

Permanent Homeless Assistance, Cont

- Page 753 and 754:

Permanent Homeless Assistance - Arr

- Page 755 and 756:

Permanent Homeless Assistance - Arr

- Page 757 and 758:

Permanent Homeless Assistance - Arr

- Page 759 and 760:

Permanent Homeless Assistance - Hou

- Page 761 and 762:

Permanent Homeless Assistance - Uti

- Page 763 and 764:

Homeless Assistance Overpayments In

- Page 765 and 766:

Returned Homeless Assistance Warran

- Page 767 and 768:

Table of Contents, Continued MBSAC

- Page 769 and 770:

Overview Budgeting Introduction All

- Page 771 and 772:

Minimum Basic Standard of Adequate

- Page 773 and 774:

Exempt MAP Eligibility Introduction

- Page 775 and 776:

Exempt MAP Eligibility Determinatio

- Page 777 and 778:

MAP Change - When to Make Change in

- Page 779 and 780:

MAP Change - Examples Introduction

- Page 781 and 782:

MAP Change - Examples, Continued Ex

- Page 783 and 784:

Overview Budgeting Reasonably Antic

- Page 785 and 786:

Reasonably Anticipated Income, Cont

- Page 787 and 788:

Income Averaging Introduction Once

- Page 789 and 790:

Income Averaging, Continued Income

- Page 791 and 792:

Stable Income Introduction Income i

- Page 793 and 794:

Fluctuating Income Introduction Inc

- Page 795 and 796:

Fluctuating Income, Continued Estim

- Page 797 and 798:

Fluctuating Income, Continued Examp

- Page 799 and 800:

Financial Eligibility Introduction

- Page 801 and 802:

Applicant Financial Eligibility Tes

- Page 803 and 804:

Recipient Financial Eligibility Tes

- Page 805 and 806:

MBSAC and MAP Chart, Continued MBSA

- Page 807 and 808:

MBSAC and MAP Chart, Continued MBSA

- Page 809 and 810:

Mandatory Mid-quarter Changes Intro

- Page 811 and 812:

Income Reporting Threshold (IRT), C

- Page 813 and 814:

Drug Felony Convictions, Fleeing Fe

- Page 815 and 816:

County-initiated Mid-quarter Action

- Page 817 and 818:

Budgeting County-initiated Changes,

- Page 819 and 820:

Budgeting County-initiated Changes

- Page 821 and 822:

Voluntary Mid-quarter Changes Intro

- Page 823 and 824:

Voluntary Mid-quarter Changes in In

- Page 825 and 826:

Voluntary Mid-quarter Changes in In

- Page 827 and 828:

Examples - Voluntary Mid-quarter Ch

- Page 829 and 830:

Examples - Voluntary Mid-quarter Ch

- Page 831 and 832:

Intake Mid-quarter Report Examples

- Page 833 and 834:

Changes in Family Composition, Cont

- Page 835 and 836:

Examples - Changes in Family Compos

- Page 837 and 838:

Medi-Cal Eligibility for Add Person

- Page 839 and 840:

Examples - Mid-quarter Request for

- Page 841 and 842:

Examples - Mid-quarter Request for

- Page 843 and 844:

Third Party Information Known to th

- Page 845 and 846:

Examples - Third Party Information,

- Page 847 and 848:

Treatment of Multiple Mid-quarter C

- Page 849 and 850:

Examples - Multiple Mid-quarter Cha

- Page 851 and 852:

Examples - Budgeting Multiple Mid-q

- Page 853 and 854:

Examples - Budgeting Multiple Mid-q

- Page 855 and 856:

Annual Reporting, Income Budgeting

- Page 857 and 858:

Annual Reporting, Income Budgeting,

- Page 859 and 860:

Annual Reporting, Income Budgeting,

- Page 861 and 862:

Interface Between CalWORKs AR/CO an

- Page 863 and 864:

Interface Between CalWORKs AR/CO an

- Page 865 and 866:

Overview and Definitions Policy The

- Page 867 and 868:

Overview and Definitions, Continued

- Page 869 and 870:

Overpayment Identification and Resp

- Page 871 and 872:

Overpayment Examples Introduction T

- Page 873 and 874:

Overpayment Examples, Continued Exa

- Page 875 and 876:

Overpayment Procedures Overview An

- Page 877 and 878:

Overpayment Procedures, Continued A

- Page 879 and 880:

Methods of Overpayment Recoupment I

- Page 881 and 882:

Methods of Overpayment Recoupment,

- Page 883 and 884:

Underpayments Introduction Underpay

- Page 885 and 886:

Table of Contents, Continued Electr

- Page 887 and 888:

Overview Electronic Benefit Transfe

- Page 889 and 890:

Electronic Benefit Transfer: Genera

- Page 891 and 892:

Electronic Benefit Transfer: Genera

- Page 893 and 894:

Terms and Definitions, Continued Te

- Page 895 and 896:

Intake Process Introduction This se

- Page 897 and 898:

EBT Host-to-Host EBT Host-to- Host

- Page 899 and 900:

Cash Withdrawal at an Automated Tel

- Page 901 and 902:

Elimination of Electronic Benefit T

- Page 903 and 904:

Electronic Benefit Transfer (EBT) C

- Page 905 and 906:

Card Problems Introduction This sec

- Page 907 and 908:

Returned Electronic Benefit Transfe

- Page 909 and 910:

Electronic Benefit Transfer (EBT) C

- Page 911 and 912:

Payee Changes, Continued Continuati

- Page 913 and 914:

Designating an Electronic Benefit T

- Page 915 and 916:

Electronic Benefit Transfer (EBT) P

- Page 917 and 918:

Electronic Benefit Transfer (EBT) P

- Page 919 and 920:

Electronic Benefit Transfer (EBT) I

- Page 921 and 922:

Dormant Accounts Introduction This

- Page 923 and 924:

Expunged Accounts Introduction This

- Page 925 and 926:

Overview Direct Deposit Introductio

- Page 927 and 928:

Direct Deposit: Definitions Definit

- Page 929 and 930:

Direct Deposit: What to tell the Cu

- Page 931 and 932:

Direct Deposit: Process Signing up

- Page 933 and 934:

Rejected Deposits Rejected EFT depo

- Page 935 and 936:

Verifying Direct Deposit Identifyin

- Page 937 and 938:

Direct Deposit: Miscellaneous Funds

- Page 939 and 940:

Direct Deposit: Miscellaneous, Cont

- Page 941 and 942:

RESERVED FOR FUTURE USE CWPHB #4641

- Page 943 and 944:

RESERVED FOR FUTURE USE CWPHB #4641

- Page 945 and 946:

Stop Payments Overview There are ti

- Page 947 and 948:

Stop Payments, Continued Exception

- Page 949 and 950:

Counter Warrants and Priority Mail-

- Page 951 and 952:

Returned Warrants Returned warrants

- Page 953 and 954:

Warrant Pick-up, Continued Procedur

- Page 955 and 956:

Emergency Grocery Assistance Introd

- Page 957 and 958:

Overview Discontinuance Introductio

- Page 959 and 960:

Notice of Action (NOA) Introduction

- Page 961 and 962:

Waiver of 10-day Notice Requirement

- Page 963 and 964:

Customer Requests Discontinuance, C

- Page 965 and 966:

Change of Payee Introduction A chan

- Page 967 and 968:

Foster Care Placement Introduction

- Page 969 and 970:

Sanctions, Continued Sanction and p

- Page 971 and 972:

Inter-County Transfers (ICTs)-Out,

- Page 973 and 974:

Post-benefits and Referrals Introdu

- Page 975 and 976:

Table of Contents CalWORKs POLICY H

- Page 977 and 978:

Overview Medi-Cal Introduction All

- Page 979 and 980:

Continuing Medi-Cal Aid Codes Intro

- Page 981 and 982:

Post Medi-Cal Aid Code 38, Continue

- Page 983 and 984:

Refugee Medical Assistance (RMA) In

- Page 985 and 986:

Transitional Medi-Cal (TMC) Introdu

- Page 987 and 988:

Post Medi-Cal Aid Code 54 - Four Mo

- Page 989 and 990:

Companion Cases Introduction A Medi

- Page 991 and 992:

Qualified Medicare Beneficiaries (Q

- Page 993 and 994:

Accelerated Enrollment (AE) for Chi

- Page 995 and 996:

Deemed Eligible (DE) Infants Introd

- Page 997 and 998:

Deemed Eligible (DE) Infants, Conti

- Page 999 and 1000:

Exception Eligible Report - Deemed

- Page 1001 and 1002:

California Children Services, Conti

- Page 1003 and 1004:

Methods of Medi-Cal Card Issuance I

- Page 1005 and 1006:

Letters of Authorization (LOA) Intr

- Page 1007 and 1008:

Retroactive Medi-Cal Introduction T

- Page 1009 and 1010:

Add Persons - Quarterly Reporting I

- Page 1011 and 1012:

Overview Court Orders Background Th

- Page 1013 and 1014:

Andreyeva v Anderson Overview Andre

- Page 1015 and 1016:

Quilla Beverly v Anderson Overview

- Page 1017 and 1018:

Nickols v Saenz, Continued Determin

- Page 1019 and 1020:

Kehrer v Saenz Overview The Kehrer

- Page 1021 and 1022:

Table of Contents, Continued State

- Page 1023 and 1024:

Program Integrity Division (PID) Ov

- Page 1025 and 1026:

Terms and Definitions, Continued Cl

- Page 1027 and 1028:

Terms and Definitions, Continued Pr

- Page 1029 and 1030:

PID - Fraud Investigation Unit (FIU

- Page 1031 and 1032:

Finding Discrepancies, Continued Re

- Page 1033 and 1034:

Resolving Discrepancies, Continued

- Page 1035 and 1036:

Fraud Detection, Continued Fraud is

- Page 1037 and 1038:

Homecall Referrals Procedures Intro

- Page 1039 and 1040:

Income and Eligibility Verification

- Page 1041 and 1042:

Customer Failure to Cooperate with

- Page 1043 and 1044:

Quality Control (QC) Overview Quali

- Page 1045 and 1046:

Customer Failure to Cooperate with

- Page 1047 and 1048:

PID - Appeals Unit Overview The App

- Page 1049 and 1050:

State Hearings Overview The Appeals

- Page 1051 and 1052:

Complaints Overview The Appeals Uni

- Page 1053 and 1054:

Intentional Program Violations (IPV

- Page 1055 and 1056:

Intentional Program Violations (IPV

- Page 1057 and 1058:

Intentional Program Violations (IPV

- Page 1059 and 1060:

Intentional Program Violations (IPV

- Page 1061 and 1062:

Intentional Program Violations (IPV

- Page 1063 and 1064:

Fleeing Felons and Probation/Parole

- Page 1065 and 1066:

Felony Drug Conviction, Continued E

- Page 1067 and 1068:

Table of Contents CalWORKs POLICY H

- Page 1069 and 1070:

Overview Chapter 18 Time Limits Int

- Page 1071 and 1072:

Definitions Definitions Listed belo

- Page 1073 and 1074:

TANF and CalWORKs Clocks Introducti

- Page 1075 and 1076:

TANF and CalWORKs Clocks, Continued

- Page 1077 and 1078:

TANF and CalWORKs Clocks, Continued

- Page 1079 and 1080:

Who is Tracked Introduction In Cali

- Page 1081 and 1082:

Who is Tracked, Continued Aid code

- Page 1083 and 1084:

CalWORKs Safety Net Program, Contin

- Page 1085 and 1086:

RESERVED FOR FUTURE USE CWPHB #4613

- Page 1087 and 1088:

RESERVED FOR FUTURE USE CWPHB #4613

- Page 1089 and 1090:

What is Tracked Overview This secti

- Page 1091 and 1092:

What is Tracked, Continued Diversio

- Page 1093 and 1094:

What is Tracked, Continued Other co

- Page 1095 and 1096:

Changes in Work Registration and Ex

- Page 1097 and 1098:

TANF Exemptions and Extenders Intro

- Page 1099 and 1100:

CalWORKs Exemptions and Extenders,

- Page 1101 and 1102:

Overview Section 3 Reviewing Time O

- Page 1103 and 1104:

Time On Aid Reviews, Continued Time

- Page 1105 and 1106:

Time On Aid (TOA) Notices Overview

- Page 1107 and 1108:

Time On Aid (TOA) Notices, Continue

- Page 1109 and 1110:

Eligibility Worker Time Limit Revie

- Page 1111 and 1112:

Time Limit Exemption Request Introd

- Page 1113 and 1114:

Exemption Request Determination, Co

- Page 1115 and 1116:

TANF Exemptions Introduction The TA

- Page 1117 and 1118:

TANF Exemptions, Continued Living i

- Page 1119 and 1120:

TANF Exemptions, Continued Living i

- Page 1121 and 1122:

Work Registration and Exception Cod

- Page 1123 and 1124:

Overview Section 7 Time Limits Info

- Page 1125 and 1126:

Basics of Time On Aid Reviews, Cont

- Page 1127 and 1128:

Time Limit Review Actions, Continue

- Page 1129 and 1130:

Obtaining Information to Complete T

- Page 1131 and 1132:

Obtaining Information to Complete T

- Page 1133 and 1134:

Time On Aid Review: Intake/Add Pers

- Page 1135 and 1136:

Time On Aid Review: Intake/Add Pers

- Page 1137 and 1138:

Time On Aid Review: Re-Evaluation (

- Page 1139 and 1140:

Time On Aid (TOA) Review: CalWORKs

- Page 1141 and 1142:

Time On Aid (TOA) Review: CalWORKs

- Page 1143 and 1144:

Recording Database Information, Con

- Page 1145 and 1146:

Recording Database Information, Con

- Page 1147 and 1148:

Recording Database Information, Con

- Page 1149 and 1150:

Identifying Extenders, Continued Be

- Page 1151 and 1152:

CalWORKs: Action On Timing Out Intr

- Page 1153 and 1154:

CalWORKs: Action On Timing Out, Con

- Page 1155 and 1156:

Table of Contents CalWORKs POLICY H

- Page 1157 and 1158:

Regionalized Grants Regionalized Gr

- Page 1159 and 1160:

Region 1 MAP, MBSAC, and IIK Charts

- Page 1161 and 1162:

Aid Codes Introduction This section

- Page 1163 and 1164:

Aid Codes, Continued Safety Net aid

- Page 1165 and 1166:

Aid Codes, Continued Diversion clai

- Page 1167 and 1168:

"What's New" For your reference, yo

- Page 1169 and 1170:

SAN BERNARDINO COUNTY HUMAN SERVICE

- Page 1171 and 1172:

SAN BERNARDINO COUNTY HUMAN SERVICE

- Page 1173 and 1174:

SAN BERNARDINO COUNTY HUMAN SERVICE

- Page 1175 and 1176:

SAN BERNARDINO COUNTY HUMAN SERVICE

- Page 1177 and 1178:

SAN BERNARDINO COUNTY HUMAN SERVICE

- Page 1179 and 1180:

SAN BERNARDINO COUNTY HUMAN SERVICE

- Page 1181 and 1182:

SAN BERNARDINO COUNTY HUMAN SERVICE

- Page 1183 and 1184:

SAN BERNARDINO COUNTY HUMAN SERVICE

- Page 1185 and 1186:

SAN BERNARDINO COUNTY HUMAN SERVICE

- Page 1187 and 1188:

SAN BERNARDINO COUNTY HUMAN SERVICE

- Page 1189 and 1190:

SAN BERNARDINO COUNTY HUMAN SERVICE

- Page 1191 and 1192:

SAN BERNARDINO COUNTY HUMAN SERVICE

- Page 1193 and 1194:

SAN BERNARDINO COUNTY HUMAN SERVICE

- Page 1195 and 1196:

CalWORKs Policy Handbook Letter #46

- Page 1197 and 1198:

SAN BERNARDINO COUNTY HUMAN SERVICE

- Page 1199 and 1200:

SAN BERNARDINO COUNTY HUMAN SERVICE

- Page 1201 and 1202:

SAN BERNARDINO COUNTY HUMAN SERVICE

- Page 1203 and 1204:

SAN BERNARDINO COUNTY HUMAN SERVICE

- Page 1205 and 1206:

SAN BERNARDINO COUNTY HUMAN SERVICE

- Page 1207 and 1208:

SAN BERNARDINO COUNTY HUMAN SERVICE

- Page 1209 and 1210:

SAN BERNARDINO COUNTY HUMAN SERVICE

- Page 1211 and 1212:

SAN BERNARDINO COUNTY HUMAN SERVICE

- Page 1213 and 1214:

SAN BERNARDINO COUNTY HUMAN SERVICE

- Page 1215 and 1216:

SAN BERNARDINO COUNTY HUMAN SERVICE

- Page 1217 and 1218:

SAN BERNARDINO COUNTY HUMAN SERVICE

- Page 1219 and 1220:

SAN BERNARDINO COUNTY HUMAN SERVICE

- Page 1221 and 1222:

SAN BERNARDINO COUNTY HUMAN SERVICE

- Page 1223 and 1224:

CalWORKs Policy Handbook Letter #46

- Page 1225 and 1226:

CalWORKs Policy Handbook Letter #46

- Page 1227 and 1228:

Chapter 19- Charts, Tables and List

- Page 1229 and 1230:

CalWORKs Policy Handbook Letter #46

- Page 1231 and 1232:

SAN BERNARDINO COUNTY HUMAN SERVICE

- Page 1233 and 1234:

CALWORKS POLICY HANDBOOK LETTER #46

- Page 1235 and 1236:

SAN BERNARDINO COUNTY HUMAN SERVICE

- Page 1237 and 1238:

SAN BERNARDINO COUNTY HUMAN SERVICE

- Page 1239 and 1240:

SAN BERNARDINO COUNTY HUMAN SERVICE

- Page 1241 and 1242:

SAN BERNARDINO COUNTY HUMAN SERVICE

- Page 1243 and 1244:

SAN BERNARDINO COUNTY HUMAN SERVICE

- Page 1245 and 1246:

SAN BERNARDINO COUNTY HUMAN SERVICE

- Page 1247 and 1248:

SAN BERNARDINO COUNTY HUMAN SERVICE

- Page 1249 and 1250:

SAN BERNARDINO COUNTY HUMAN SERVICE

- Page 1251 and 1252:

SAN BERNARDINO COUNTY HUMAN SERVICE

- Page 1253 and 1254:

CalWORKs Policy Handbook Letter #45

- Page 1255 and 1256:

Chapter 19 - Charts, Tables and Lis

- Page 1257 and 1258:

CalWORKs Policy Handbook Letter #45

- Page 1259 and 1260:

CalWORKs Policy Handbook Letter #45

- Page 1261 and 1262:

CalWORKs Policy Handbook Letter #45

- Page 1263 and 1264:

SAN BERNARDINO COUNTY HUMAN SERVICE

- Page 1265 and 1266:

SAN BERNARDINO COUNTY HUMAN SERVICE

- Page 1267 and 1268:

SAN BERNARDINO COUNTY HUMAN SERVICE

- Page 1269 and 1270:

SAN BERNARDINO COUNTY HUMAN SERVICE

- Page 1271 and 1272:

SAN BERNARDINO COUNTY HUMAN SERVICE

- Page 1273 and 1274:

SAN BERNARDINO COUNTY HUMAN SERVICE

- Page 1275 and 1276:

SAN BERNARDINO COUNTY HUMAN SERVICE

- Page 1277 and 1278:

SAN BERNARDINO COUNTY HUMAN SERVICE

- Page 1279 and 1280:

SAN BERNARDINO COUNTY HUMAN SERVICE

- Page 1281 and 1282:

SAN BERNARDINO COUNTY HUMAN SERVICE

- Page 1283 and 1284:

SAN BERNARDINO COUNTY HUMAN SERVICE

- Page 1285 and 1286:

SAN BERNARDINO COUNTY HUMAN SERVICE

- Page 1287 and 1288:

SAN BERNARDINO COUNTY HUMAN SERVICE

- Page 1289 and 1290:

SAN BERNARDINO COUNTY HUMAN SERVICE

- Page 1291 and 1292:

SAN BERNARDINO COUNTY HUMAN SERVICE

- Page 1293 and 1294:

SAN BERNARDINO COUNTY HUMAN SERVICE

- Page 1295 and 1296:

CalWORKs Policy Handbook #4554, Con

- Page 1297 and 1298:

SAN BERNARDINO COUNTY HUMAN SERVICE

- Page 1299 and 1300:

CHAPTER 13 - Benefit Issuance, Cont

- Page 1301 and 1302:

SAN BERNARDINO COUNTY HUMAN SERVICE

- Page 1303 and 1304:

SAN BERNARDINO COUNTY HUMAN SERVICE

- Page 1305 and 1306:

SAN BERNARDINO COUNTY HUMAN SERVICE

- Page 1307 and 1308:

SAN BERNARDINO COUNTY HUMAN SERVICE

- Page 1309 and 1310:

SAN BERNARDINO COUNTY HUMAN SERVICE

- Page 1311 and 1312:

SAN BERNARDINO COUNTY HUMAN SERVICE

- Page 1313 and 1314:

SAN BERNARDINO COUNTY HUMAN SERVICE

- Page 1315 and 1316:

SAN BERNARDINO COUNTY HUMAN SERVICE

- Page 1317 and 1318:

SAN BERNARDINO COUNTY HUMAN SERVICE

- Page 1319 and 1320:

SAN BERNARDINO COUNTY HUMAN SERVICE

- Page 1321 and 1322:

SAN BERNARDINO COUNTY HUMAN SERVICE

- Page 1323 and 1324:

SAN BERNARDINO COUNTY HUMAN SERVICE

- Page 1325 and 1326:

SAN BERNARDINO COUNTY HUMAN SERVICE

- Page 1327 and 1328:

SAN BERNARDINO COUNTY HUMAN SERVICE

- Page 1329 and 1330:

SAN BERNARDINO COUNTY HUMAN SERVICE

- Page 1331 and 1332:

CalWORKs Policy Handbook Letter #45

- Page 1333 and 1334:

SAN BERNARDINO COUNTY HUMAN SERVICE

- Page 1335 and 1336:

SAN BERNARDINO COUNTY HUMAN SERVICE

- Page 1337 and 1338:

SAN BERNARDINO COUNTY HUMAN SERVICE

- Page 1339 and 1340:

SAN BERNARDINO COUNTY HUMAN SERVICE

- Page 1341 and 1342:

SAN BERNARDINO COUNTY HUMAN SERVICE

- Page 1343 and 1344:

SAN BERNARDINO COUNTY HUMAN SERVICE

- Page 1345 and 1346:

SAN BERNARDINO COUNTY HUMAN SERVICE

- Page 1347 and 1348:

SAN BERNARDINO COUNTY HUMAN SERVICE

- Page 1349 and 1350:

SAN BERNARDINO COUNTY HUMAN SERVICE

- Page 1351 and 1352:

SAN BERNARDINO COUNTY HUMAN SERVICE

- Page 1353 and 1354:

SAN BERNARDINO COUNTY HUMAN SERVICE

- Page 1355 and 1356:

SAN BERNARDINO COUNTY HUMAN SERVICE

- Page 1357 and 1358:

SAN BERNARDINO COUNTY HUMAN SERVICE

- Page 1359 and 1360:

SAN BERNARDINO COUNTY HUMAN SERVICE

- Page 1361 and 1362:

SAN BERNARDINO COUNTY HUMAN SERVICE

- Page 1363 and 1364:

SAN BERNARDINO COUNTY HUMAN SERVICE

- Page 1365 and 1366:

CalWORKs Policy Handbook #4450, Con

- Page 1367 and 1368:

SAN BERNARDINO COUNTY HUMAN SERVICE

- Page 1369 and 1370:

SAN BERNARDINO COUNTY HUMAN SERVICE

- Page 1371 and 1372:

SAN BERNARDINO COUNTY HUMAN SERVICE

- Page 1373 and 1374:

SAN BERNARDINO COUNTY HUMAN SERVICE

- Page 1375 and 1376:

SAN BERNARDINO COUNTY HUMAN SERVICE

- Page 1377 and 1378:

CHAPTER 19 - Charts, Tables and Lis

- Page 1379 and 1380:

SAN BERNARDINO COUNTY HUMAN SERVICE

- Page 1381 and 1382:

SAN BERNARDINO COUNTY HUMAN SERVICE

- Page 1383 and 1384:

SAN BERNARDINO COUNTY HUMAN SERVICE

- Page 1385 and 1386:

SAN BERNARDINO COUNTY HUMAN SERVICE

- Page 1387 and 1388:

SAN BERNARDINO COUNTY HUMAN SERVICE

- Page 1389 and 1390:

SAN BERNARDINO COUNTY HUMAN SERVICE

- Page 1391 and 1392:

Chapter 4 - Children and Eligibilit

- Page 1393 and 1394:

SAN BERNARDINO COUNTY HUMAN SERVICE

- Page 1395 and 1396:

SAN BERNARDINO COUNTY HUMAN SERVICE

- Page 1397 and 1398:

SAN BERNARDINO COUNTY HUMAN SERVICE

- Page 1399 and 1400:

SAN BERNARDINO COUNTY HUMAN SERVICE

- Page 1401 and 1402:

CALWORKS POLICY HANDBOOK LETTER #44

- Page 1403 and 1404:

SAN BERNARDINO COUNTY HUMAN SERVICE

- Page 1405 and 1406:

SAN BERNARDINO COUNTY HUMAN SERVICE

- Page 1407 and 1408:

SAN BERNARDINO COUNTY HUMAN SERVICE

- Page 1409 and 1410:

Chapter 7 - Work Requirements, Cont

- Page 1411 and 1412:

SAN BERNARDINO COUNTY HUMAN SERVICE

- Page 1413 and 1414:

SAN BERNARDINO COUNTY HUMAN SERVICE

- Page 1415 and 1416:

SAN BERNARDINO COUNTY HUMAN SERVICE

- Page 1417 and 1418:

Chapter 3 - Assistance Unit/Respons

- Page 1419 and 1420:

SAN BERNARDINO COUNTY HUMAN SERVICE

- Page 1421 and 1422:

SAN BERNARDINO COUNTY HUMAN SERVICE

- Page 1423 and 1424:

SAN BERNARDINO COUNTY HUMAN SERVICE

- Page 1425 and 1426:

SAN BERNARDINO COUNTY HUMAN SERVICE

- Page 1427 and 1428:

CalWORKs POLICY HANDBOOK LETTER #44

- Page 1429 and 1430:

SAN BERNARDINO COUNTY HUMAN SERVICE

- Page 1431 and 1432:

CalWORKs POLICY HANDBOOK LETTER #44

- Page 1433 and 1434:

SAN BERNARDINO COUNTY HUMAN SERVICE

- Page 1435 and 1436:

SAN BERNARDINO COUNTY HUMAN SERVICE

- Page 1437 and 1438:

CalWORKs Policy Handbook, Continued

- Page 1439 and 1440:

CalWORKs Policy Handbook, Continued

- Page 1441 and 1442:

SAN BERNARDINO COUNTY HUMAN SERVICE

- Page 1443:

IIN's We are publishing all active