Review

Review

Review

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

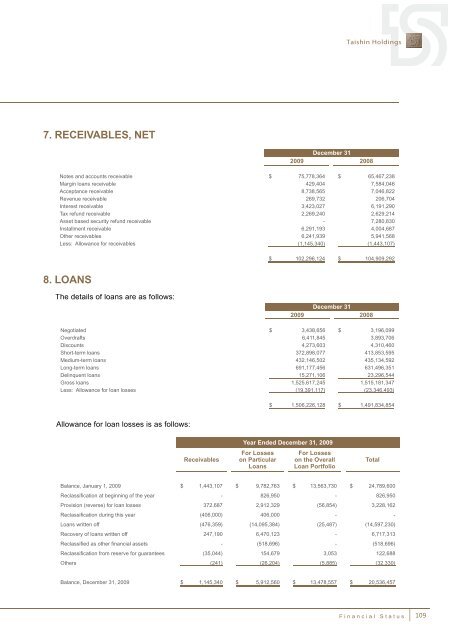

7. RECEIVABLES, NET<br />

December 31<br />

2009 2008<br />

Notes and accounts receivable $ 75,778,364 $ 65,467,238<br />

Margin loans receivable 429,404 7,584,046<br />

Acceptance receivable 8,738,565 7,046,822<br />

Revenue receivable 269,732 206,704<br />

Interest receivable 3,423,027 6,191,290<br />

Tax refund receivable 2,269,240 2,629,214<br />

Asset based security refund receivable - 7,280,830<br />

Installment receivable 6,291,193 4,004,687<br />

Other receivables 6,241,939 5,941,568<br />

Less: Allowance for receivables (1,145,340) (1,443,107)<br />

8. LOANS<br />

The details of loans are as follows:<br />

$ 102,296,124 $ 104,909,292<br />

December 31<br />

2009 2008<br />

Negotiated $ 3,438,656 $ 3,196,099<br />

Overdrafts 6,411,845 3,893,706<br />

Discounts 4,273,603 4,310,460<br />

Short-term loans 372,898,077 413,853,595<br />

Medium-term loans 432,146,502 435,134,592<br />

Long-term loans 691,177,456 631,496,351<br />

Delinquent loans 15,271,106 23,296,544<br />

Gross loans 1,525,617,245 1,515,181,347<br />

Less: Allowance for loan losses (19,391,117) (23,346,493)<br />

Allowance for loan losses is as follows:<br />

Receivables<br />

$ 1,506,226,128 $ 1,491,834,854<br />

Year Ended December 31, 2009<br />

For Losses<br />

on Particular<br />

Loans<br />

For Losses<br />

on the Overall<br />

Loan Portfolio<br />

Balance, January 1, 2009 $ 1,443,107 $ 9,782,763 $ 13,563,730 $ 24,789,600<br />

Reclassification at beginning of the year - 826,950 - 826,950<br />

Provision (reverse) for loan losses 372,687 2,912,329 (56,854) 3,228,162<br />

Reclassification during this year (406,000) 406,000 - -<br />

Loans written off (476,359) (14,095,384) (25,487) (14,597,230)<br />

Recovery of loans written off 247,190 6,470,123 - 6,717,313<br />

Reclassified as other financial assets - (518,696) - (518,696)<br />

Reclassification from reserve for guarantees (35,044) 154,679 3,053 122,688<br />

Others (241) (26,204) (5,885) (32,330)<br />

Balance, December 31, 2009 $ 1,145,340 $ 5,912,560 $ 13,478,557 $ 20,536,457<br />

Total<br />

Financial Status<br />

109