Review

Review

Review

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

E.Investment policy in the recent year, main reasons for income or<br />

loss, improvement plan, and investment plan in the coming one year<br />

The company carries out investments according to article 36 and 37 of the Financial Holding Company Law, the<br />

assessment of investment returns rate, and joint-marketing benefi ts among subsidiaries, in the hope of augmenting the<br />

returns on equity. In response to the demand of clients for assets accumulation and wealth-management planning, the<br />

company will inevitably expand its business scope, on top of providing comprehensive professional fi nancial services.<br />

Looking ahead, in the face of acute competition and a fast-changing fi nancial environment, the company will continue,<br />

via own or external growth, expanding the scale and market shares in the operations of banking, securities, insurance,<br />

investment fi nance, commercial paper/bond, and other fi nancial sectors, as well as overseas deployment, in order to<br />

tap the businesses of clients in various sections, strengthen competitive edge, and expand profi t sources.<br />

F. Assessment of risk management in the recent year and as of<br />

the date for the publication of the annual report by analyzing<br />

consolidated fi nancial and business status<br />

a. Risk-management framework and policy of the fi nancial holding<br />

company and subsidiaries<br />

To cope with its comprehensive business scope, the company needs effi cient identifi cation, assessment, consolidation,<br />

and management of risks, in addition to properly allocating capital to various business units. The company manages<br />

risks via a procedure closely associated with its risk-management policy, organizational framework, risk assessment,<br />

and business activities. According to overall risk-management planning, the fi nancial holding company has instituted<br />

independent risk-management organizations, with their frameworks listed below:<br />

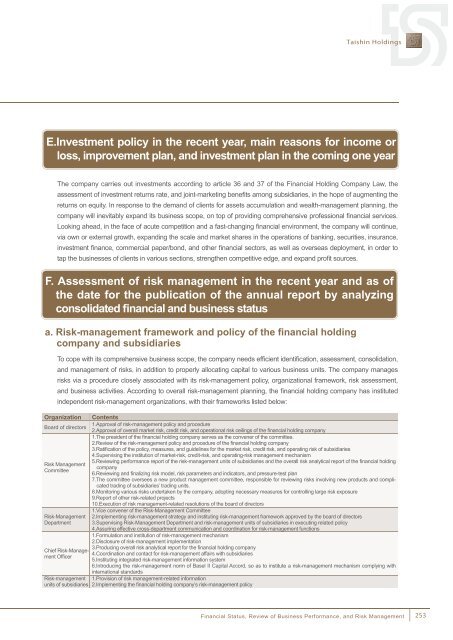

Organization Contents<br />

1.Approval of risk-management policy and procedure<br />

Board of directors<br />

2.Approval of overall market risk, credit risk, and operational risk ceilings of the fi nancial holding company<br />

1.The president of the fi nancial holding company serves as the convener of the committee.<br />

2.<strong>Review</strong> of the risk-management policy and procedure of the fi nancial holding company<br />

3.Ratifi cation of the policy, measures, and guidelines for the market risk, credit risk, and operating risk of subsidiaries<br />

4.Supervising the institution of market-risk, credit-risk, and operating-risk management mechanism<br />

5.<strong>Review</strong>ing performance report of the risk-management units of subsidiaries and the overall risk analytical report of the fi nancial holding<br />

Risk Management<br />

company<br />

Committee<br />

6.<strong>Review</strong>ing and fi nalizing risk model, risk parameters and indicators, and pressure-test plan<br />

7.The committee oversees a new product management committee, responsible for reviewing risks involving new products and complicated<br />

trading of subsidiaries’ trading units.<br />

8.Monitoring various risks undertaken by the company, adopting necessary measures for controlling large risk exposure<br />

9.Report of other risk-related projects<br />

10.Execution of risk management-related resolutions of the board of directors<br />

1.Vice convener of the Risk-Management Committee<br />

Risk-Management 2.Implementing risk-management strategy and instituting risk-management framework approved by the board of directors<br />

Department 3.Supervising Risk-Management Department and risk-management units of subsidiaries in executing related policy<br />

4.Assuring effective cross-department communication and coordination for risk-management functions<br />

1.Formulation and institution of risk-management mechanism<br />

2.Disclosure of risk-management implementation<br />

3.Producing overall risk analytical report for the fi nancial holding company<br />

Chief Risk-Manage-<br />

4.Coordination and contact for risk-management affairs with subsidiaries<br />

ment Offi cer<br />

5.Instituting integrated risk-management information system<br />

6.Introducing the risk-management norm of Basel II Capital Accord, so as to institute a risk-management mechanism complying with<br />

international standards<br />

Risk-management 1.Provision of risk management-related information<br />

units of subsidiaries 2.Implementing the fi nancial holding company’s risk-management policy<br />

Financial Status, <strong>Review</strong> of Business Performance, and Risk Management<br />

253